September 30, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, September 30th, 2024.

U.S. weekly raw steel production fell to 1.71MT up .9% from last year but down 1.6% YTD on slow U.S. manufacturing.

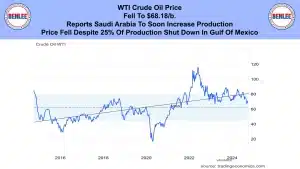

WTI crude oil price fell to $68.18/b. on reports of Saudia Arabia to soon increase production. The price fell despite 25% of production shut down in the Gulf Of Mexico.

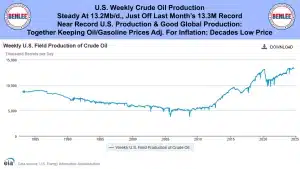

U.S. weekly crude oil production was steady to 13.2Mb/d., just off last month’s 13.3Mb/d record. The near record U.S. production and good global production together, is keeping oil and gasoline adjusted for inflation at a decades low price.

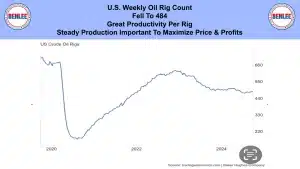

The U.S. weekly oil rig count fell to 484 on great productivity per rig. Steady production is important to maximize price and profits.

Scrap steel #1 HMS price was steady at $305/GT on a good balance of supply and demand.

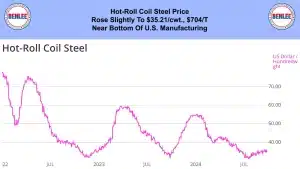

Hot-roll coil steel price rose slightly to $35.21/cwt., $704/T. We are near the bottom of U.S. manufacturing.

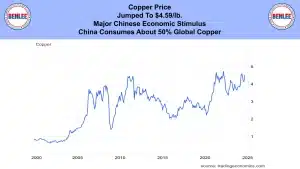

Copper price jumped to $4.59/lb., on major Chinese economic stimulus. China consumes about 50% of global copper.

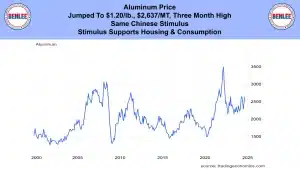

Aluminum price jumped to $1.20/lb., $2,637/MT. a three-month high on the same Chinese stimulus. The stimulus supports housing and consumption.

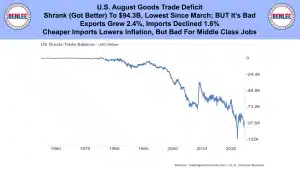

The U.S. August goods trade deficit shrank, as in got better to $94.3B the lowest since March, but it is bad. Exports grew at 2.4%, while imports declined 1.6%. Cheaper imports lower inflation, but is bad for middle class jobs.

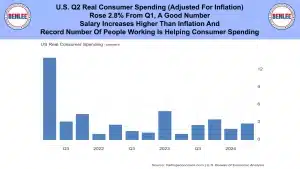

U.S. Q2 Real consumer spending adjusted for inflation. It rose 2.8% from Q1, a good number. Salary increases higher than inflation is helping consumers and the record number of people working is also helping spending.

U of M September consumer sentiment was revised higher to 70.1 a 5 month high. Current and future expectations are higher and inflation expectations were revised lower.

U.S. August personal consumption expenditure index, the Federal Reserve’s preferred measure of inflation. It fell to 2.2% vs last year and in the past three months was 1.7% annualized. Net prices are high, but salary increases are higher than the 2.2%.

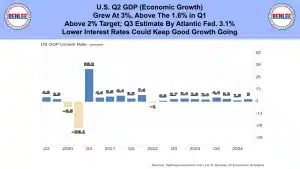

U.S. Q2 GDP, which is economic growth. The economy grew at 3%, above the 1.6% in Q1. Also, it was above the 2% target. The Q3 estimate by the Atlantic Federal Reserve is 3.1%. Lower interest rates could keep good growth going.

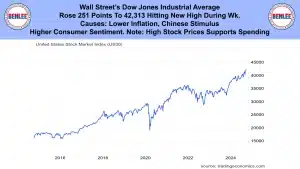

Wall Street’s Dow Jones Industrial Average rose 251 points to 42,313, hitting a new high during the week. Causes were lower inflation, Chinese Stimulus, and higher consumer sentiment. Note: high stock prices supports spending.

We were sorry to hear about the death of Billy Johnson, ReMA’s chief lobbyist. He will be missed.

This report by Greg Brown from is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.