August 26, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, August 26th, 2024.

U.S. weekly raw steel production rose slightly to 1.75MT, up .7% from last year, but down 2% year to date.

WTI crude oil price fell to $74.83/b. Adjusted for inflation, oil is below the price of 20 years ago. This was on the slower U.S. economy and lower Chinese demand. Huge electric vehicle sales in China is slowing oil demand.

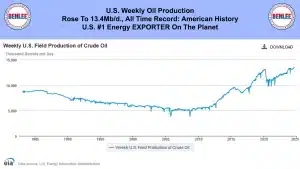

U.S. weekly crude oil production rose to 13.4Mb/d., the all-time record in American history. The U.S. remains the #1 energy exporter, yes exporter on the planet.

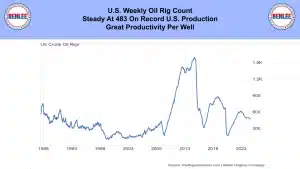

The U.S. weekly oil rig count was steady at 483 on record U.S. production and great productivity per well.

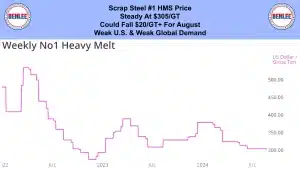

Scrap steel #1 HMS price was steady at $305/GT. Prices could fall $20/GT or more for August on weak U.S. & weak global demand.

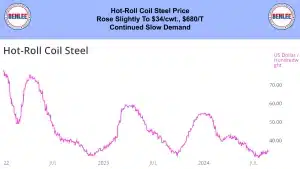

Hot-roll coil steel price rose slightly to $34/cwt., $680/T on continued slow demand.

Copper price rose to $4.20/lb. China’s exports eased, which could mean better Chinese demand.

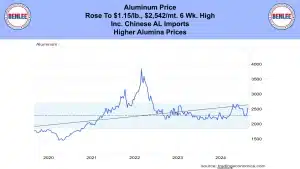

Aluminum price rose to $1.15/lb., $2,542/mt a 6 week high on increased Chinese aluminum imports and higher alumina prices.

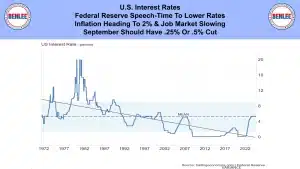

U.S. interest rates. The Federal Reserve Chairman gave a speech and said it was time to lower interest rates. He said this was due to inflation is heading to 2% and the job market is slowing. September should have a .25% or .5% rate cut.

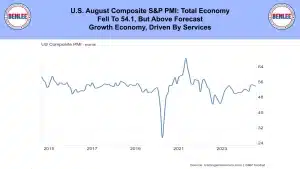

U.S. August composite S&P purchasing manager’s index for the total economy. It fell to 54.1, but above estimate. This confirms we are in a growth economy. Growth is being drive by services.

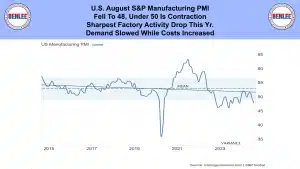

U.S. August S&P manufacturing purchasing managers index fell to 48, with under 50 being contraction. There was the sharpest factory activity drop this year. Demand slowed while costs increased.

U.S. July existing home sales rose to 3.95M annualized after a 4 month decline. High prices and high interest rates are hurting demand.

U.S. single and multi-unit home building permits rose to 1.41M annualized, the rate of the 1960s: 60+ years ago. As said, high prices and high interest rates are hurting demand.

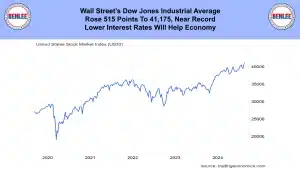

Wall Street’s Dow Jones Industrial Average rose a 515 points to 41,175 near the all-time record. Lower interest rates will help the economy.

This report by Greg Brown from is brought to you by BENLEE .

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.