June 3, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, June 3rd, 2024.

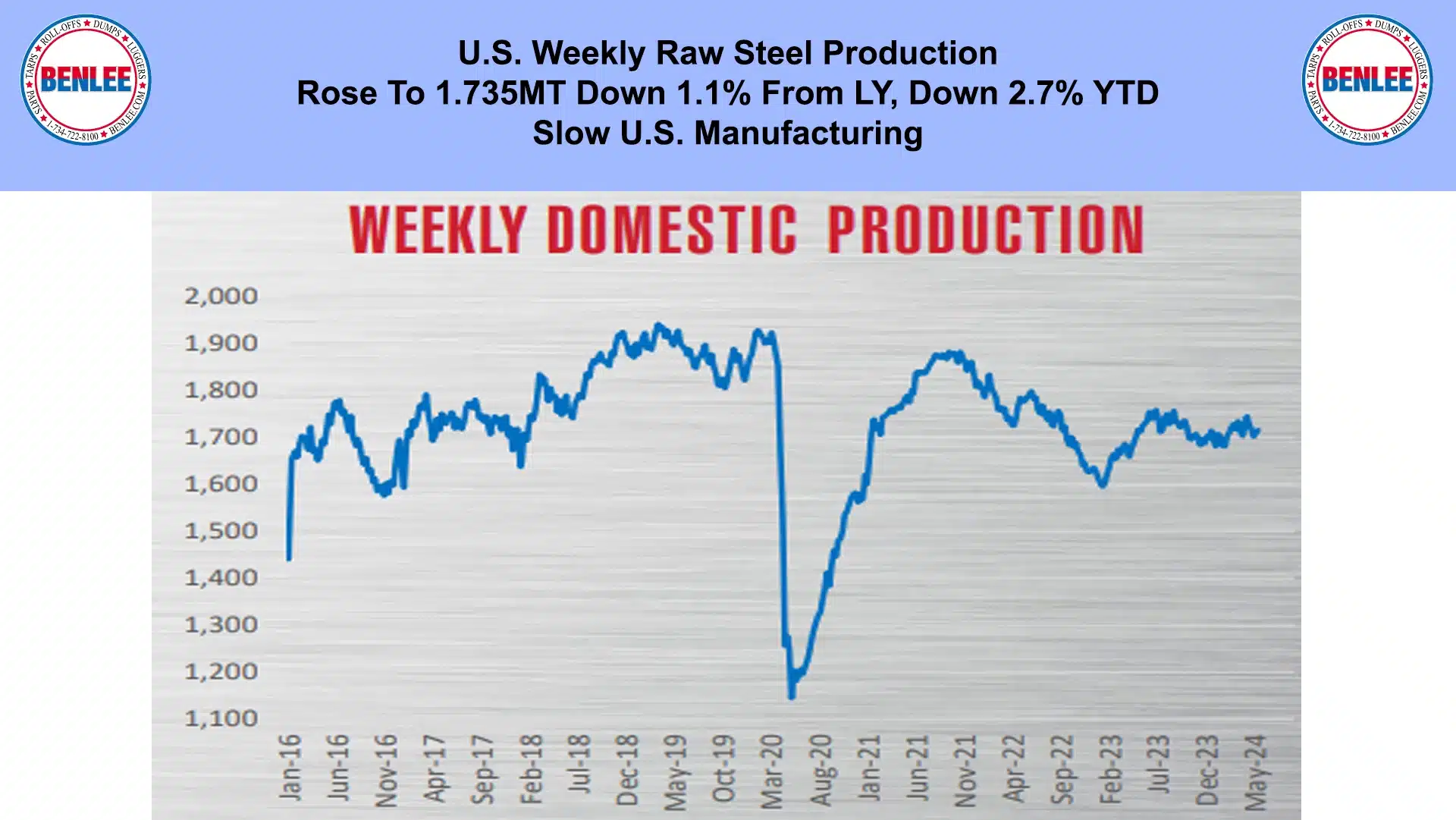

U.S. weekly raw steel production rose to 1.735MT down 1.1% from last year and down 2.7% YTD on slow U.S. manufacturing.

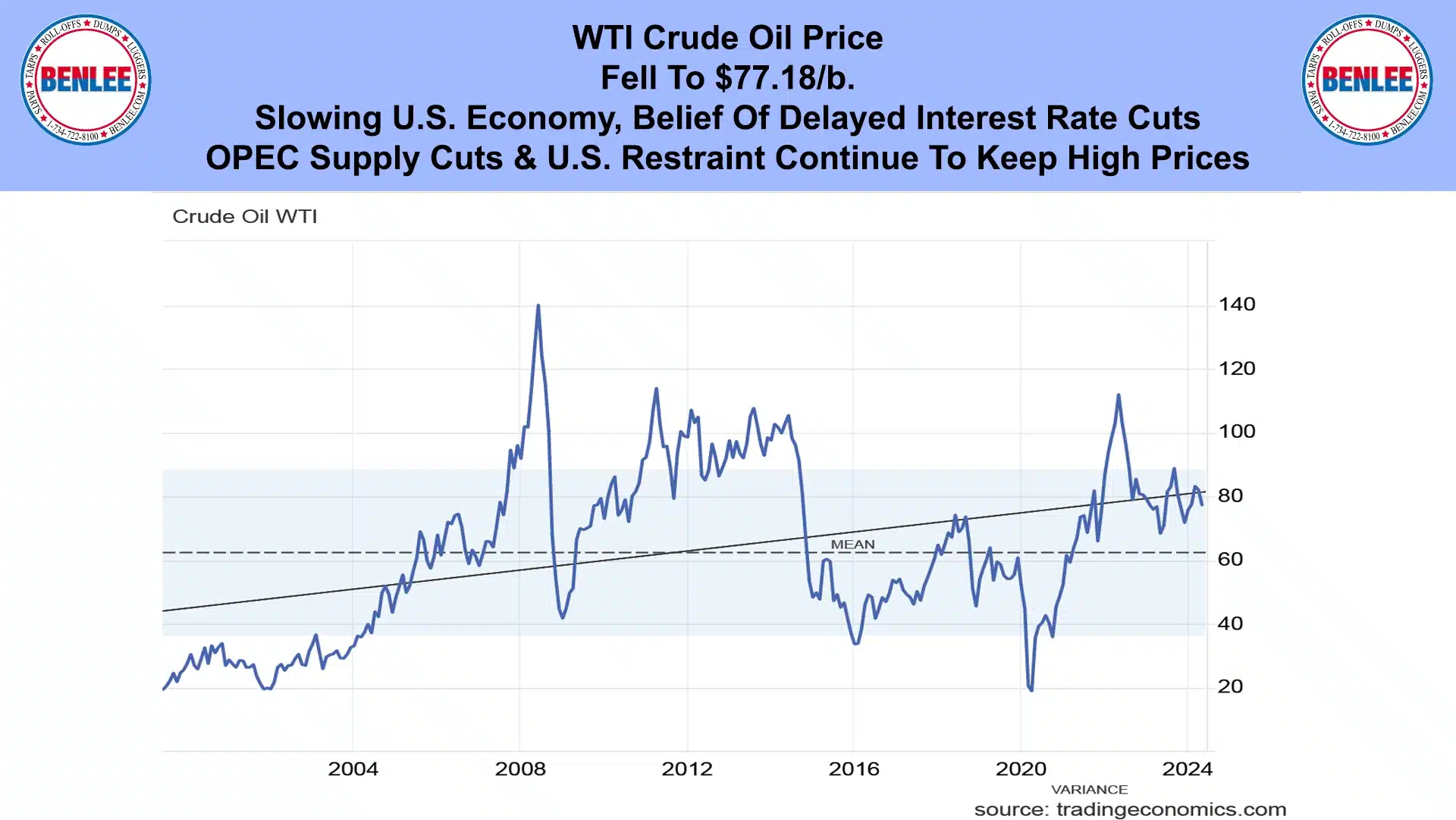

WTI crude oil price fell to $77.18/b., on the slowing U.S. economy and on the belief of delayed interest rate cuts. OPEC supply cuts and U.S. oil company constraints continue to keep prices high.

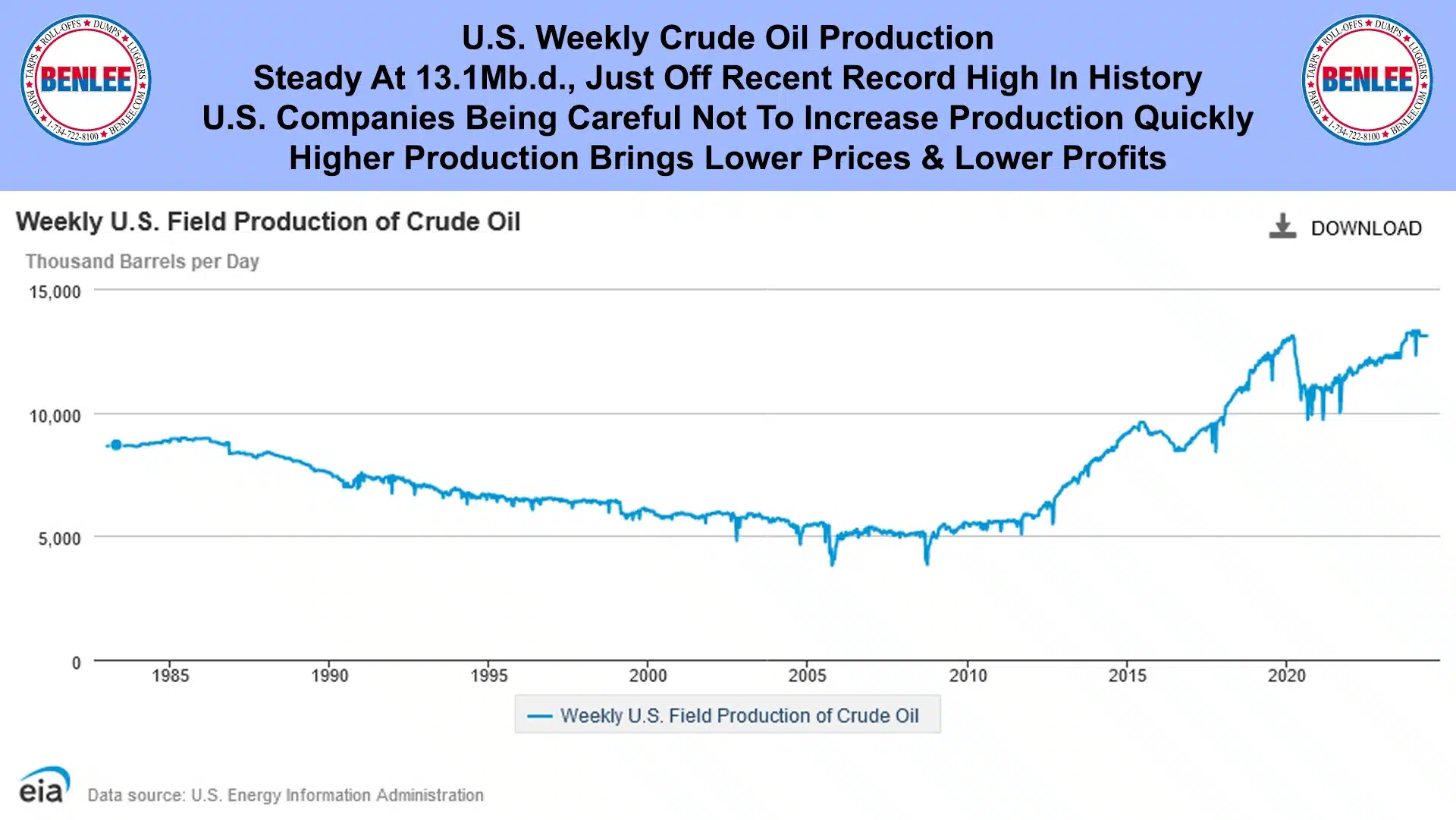

U.S. weekly crude oil production was steady at 13.1Mb/d. just off the recent record high in American history. U.S. oil companies are being careful not to increase production quickly. Higher production brings lower prices and lower profits.

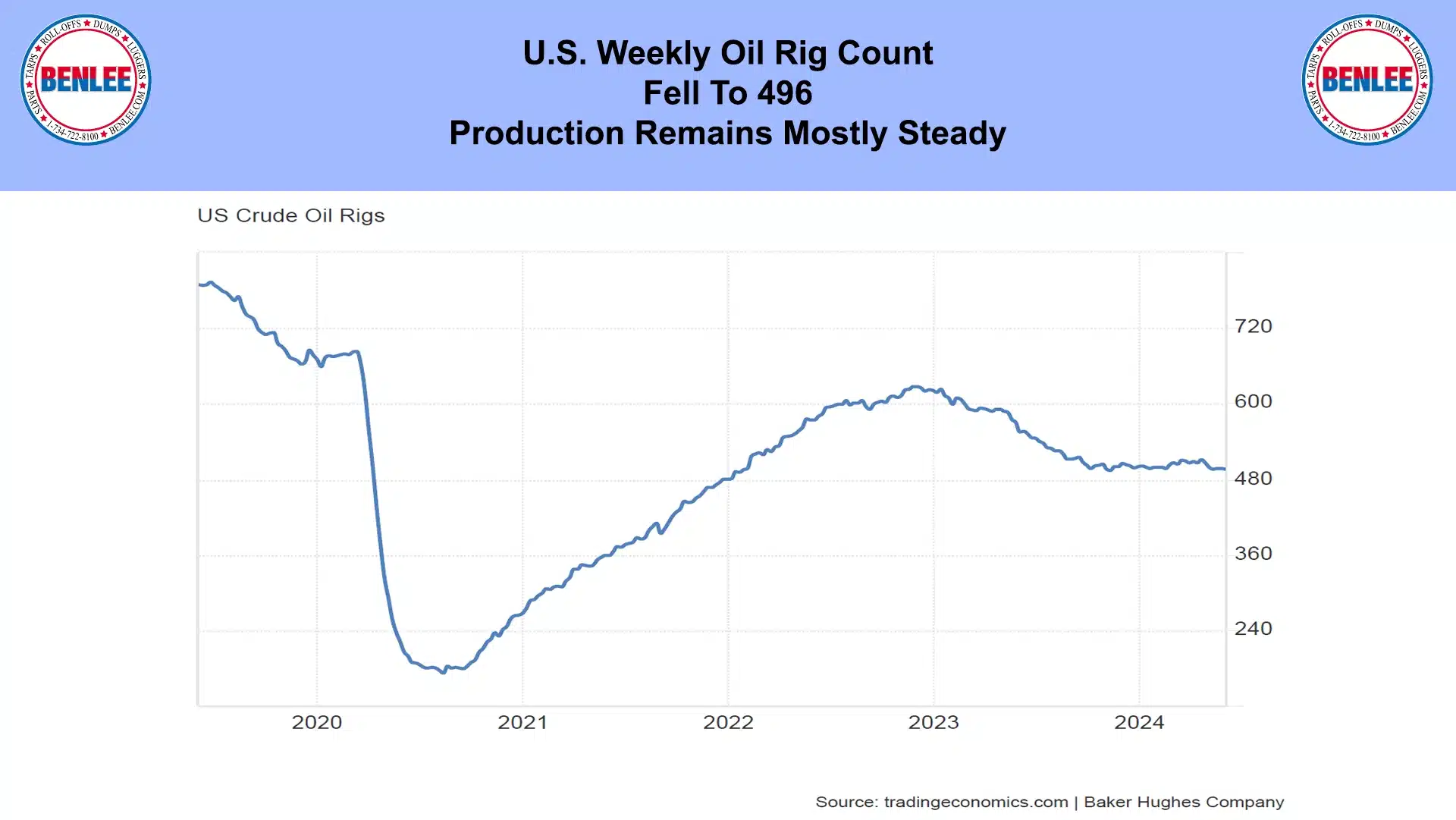

The U.S. weekly oil rig count fell to 496. Production remains mostly steady.

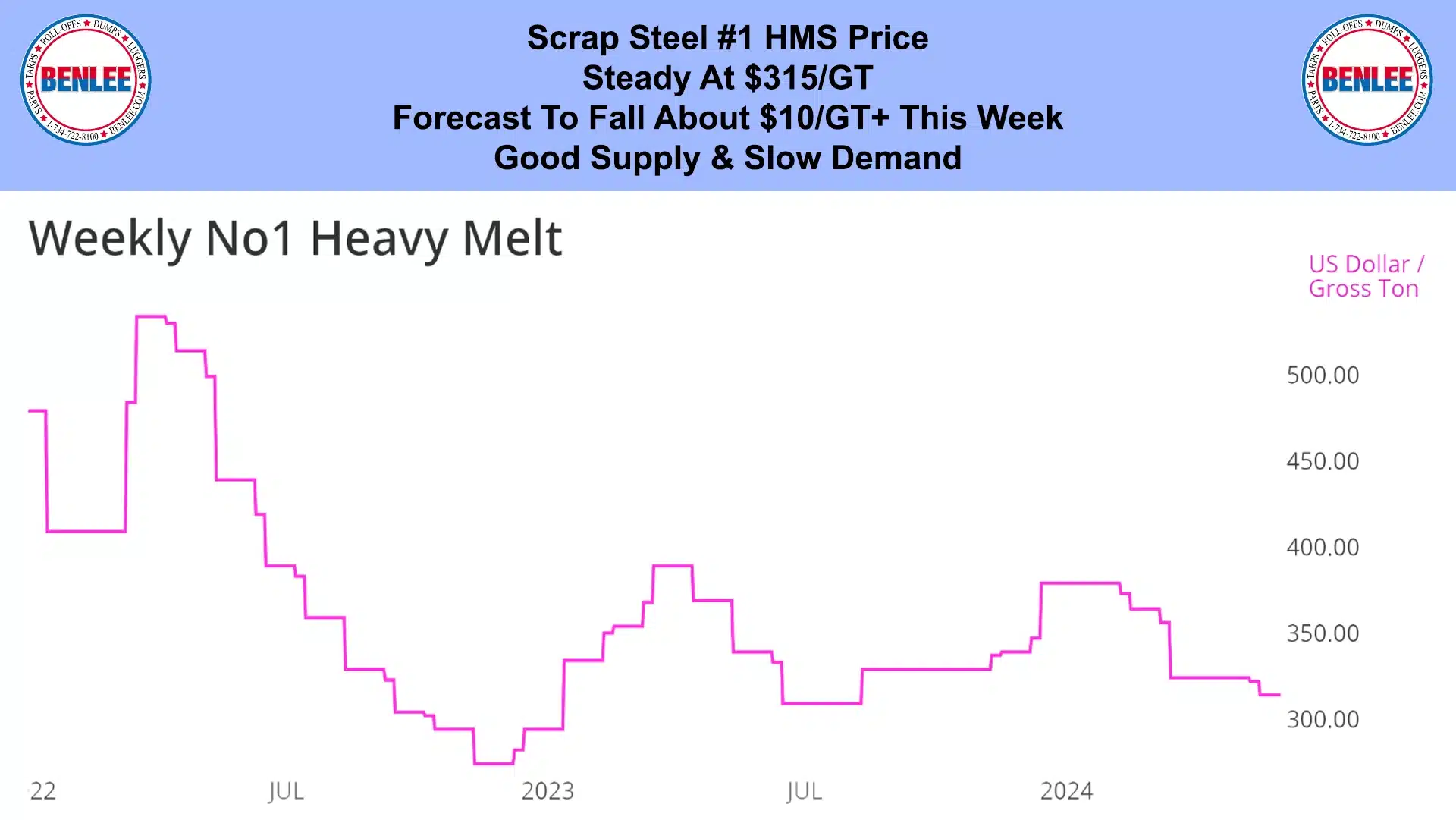

Scrap steel #1 HMS price was steady at $315/GT and is forecast to fall about $10+/GT this week. This was on good supply and slow demand.

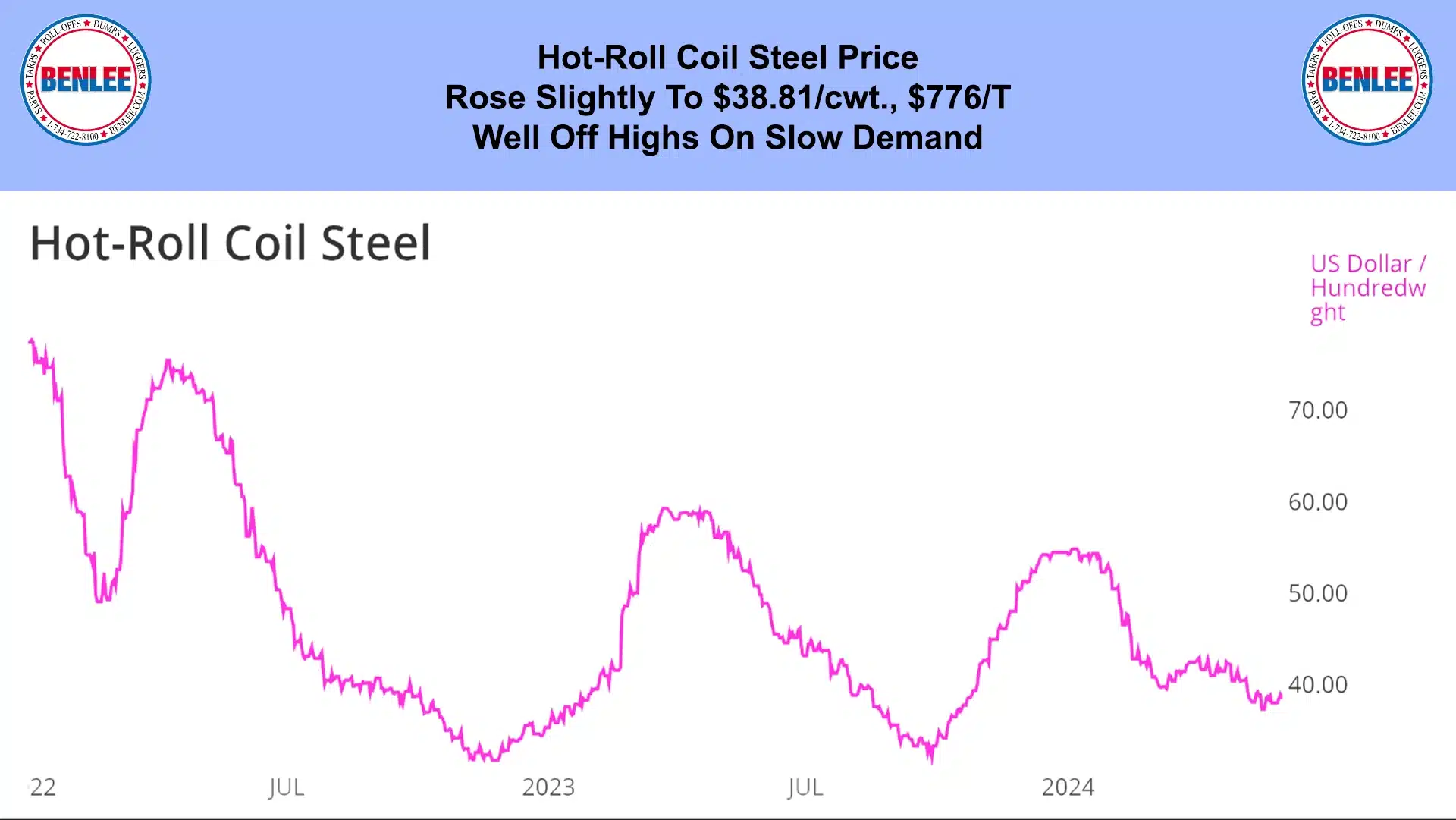

Hot-roll coil steel price rose slightly to $38.81/cwt., $776/T, well off their highs on slow demand.

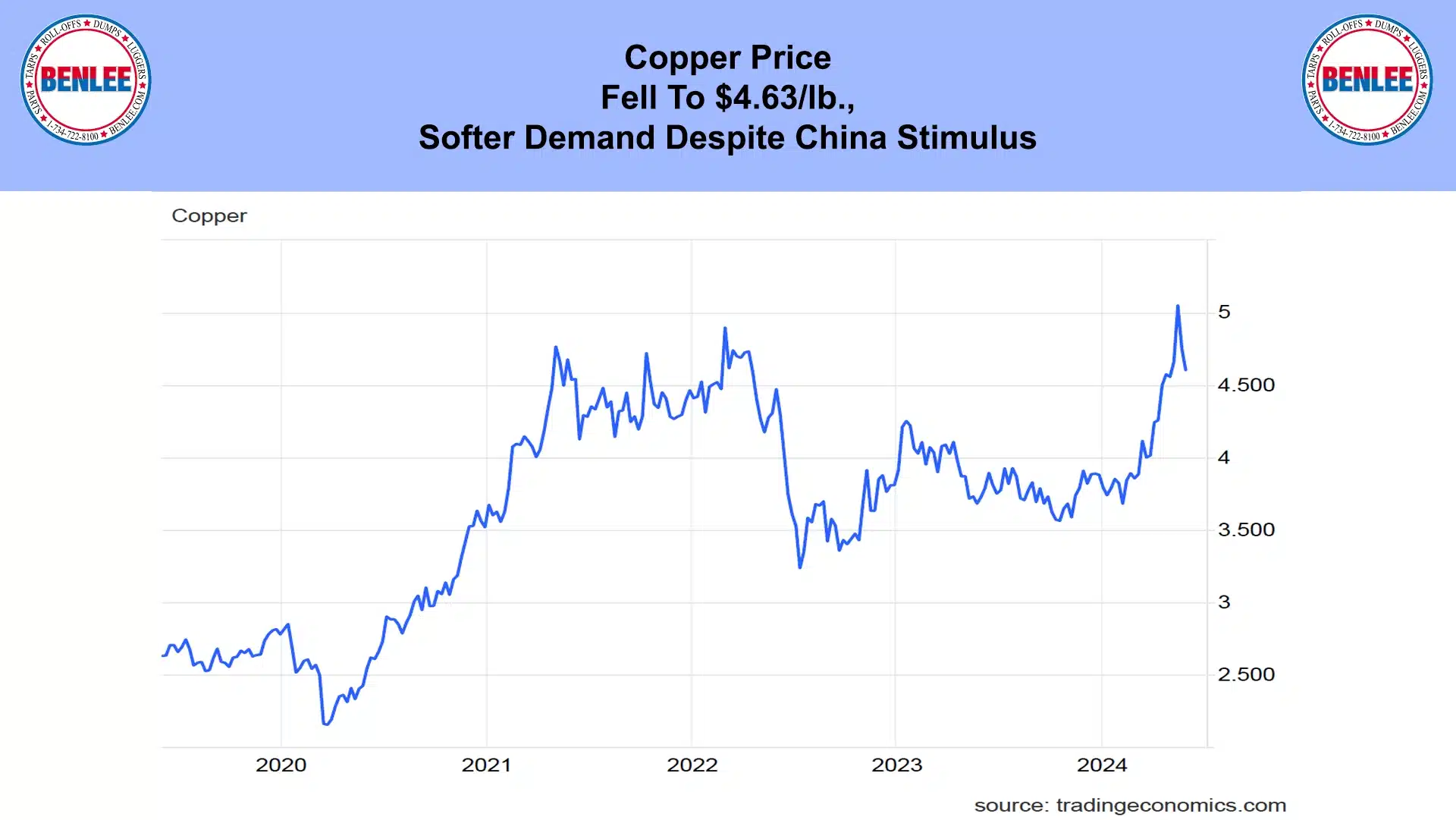

Copper price fell to $4.63/lb., on softer demand, despite China stimulus.

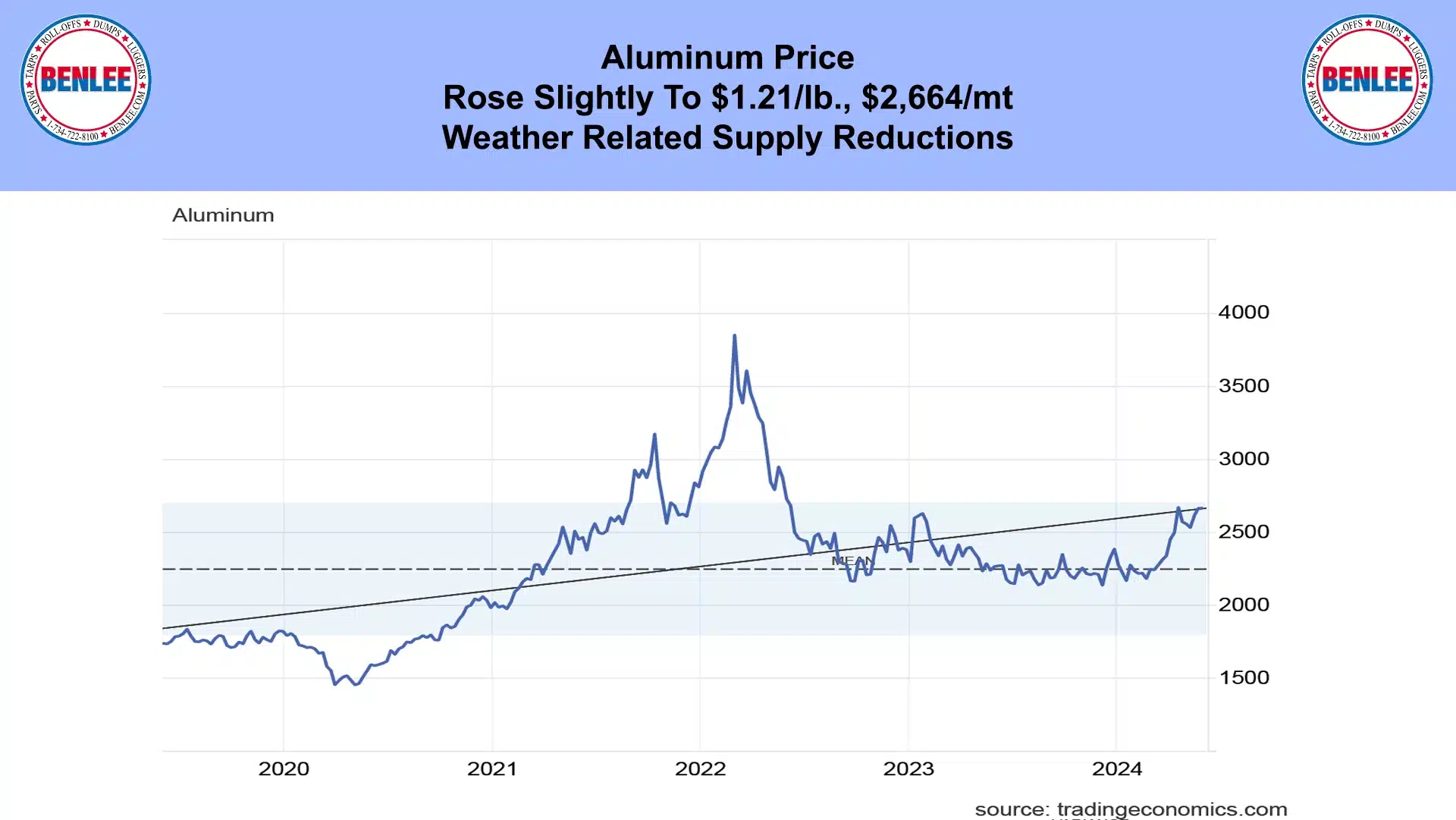

Aluminum price rose slightly to $1.21/lb., $2,664/mt., on weather related supply reductions.

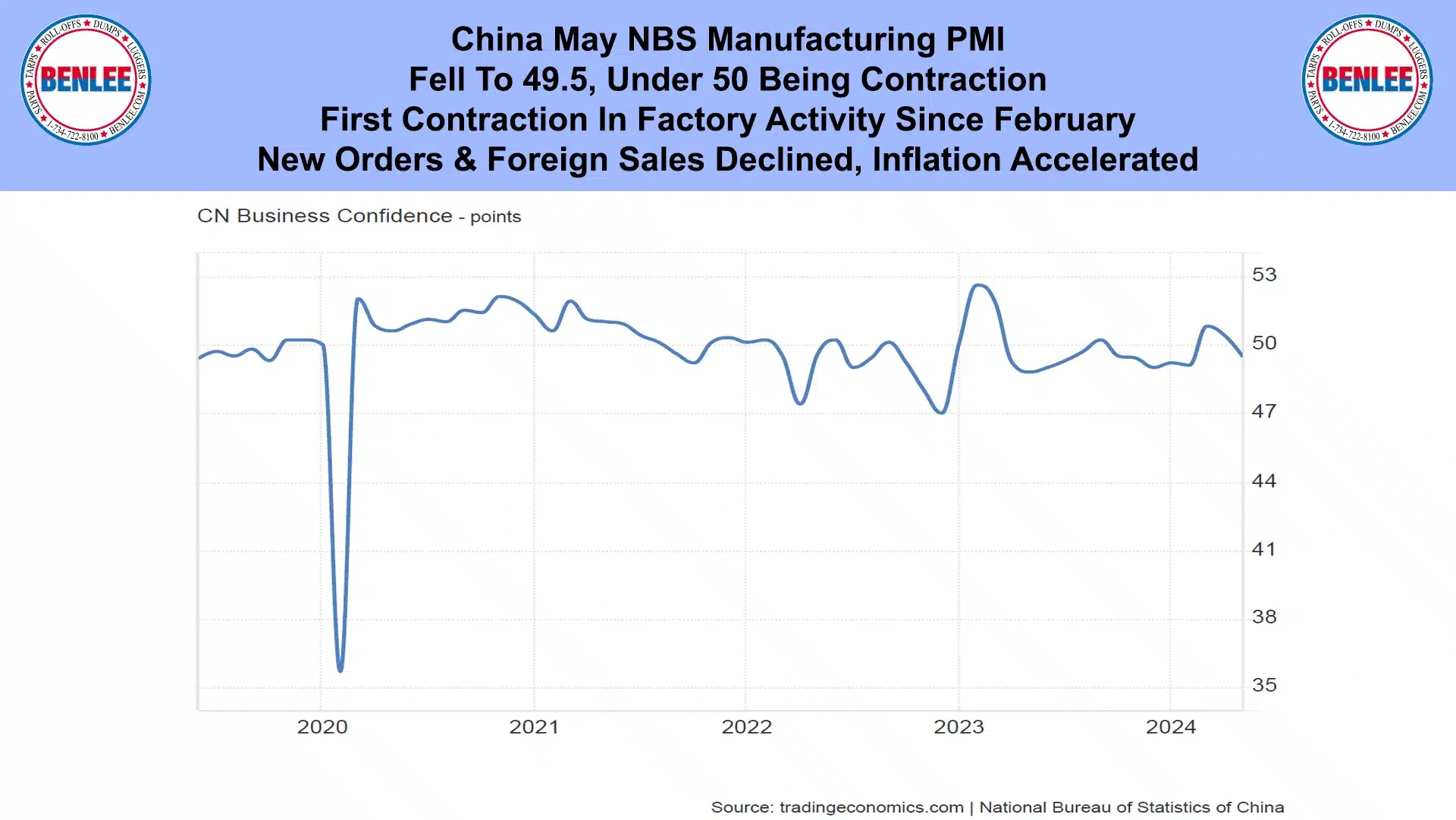

China May NBS Manufacturing PMI fell to 49.5, with under 50 being contraction. This was the first contraction in factory activity since February. New orders and foreign sales declined, as inflation accelerated.

U.S. Chicago area May Purchasing Managers index fell to 35.4, the sharpest contraction in activity since the COVID crash. High interest rates are slowing the economy so manufacturing is slowing. The Federal Reserve is causing this to reduce inflation.

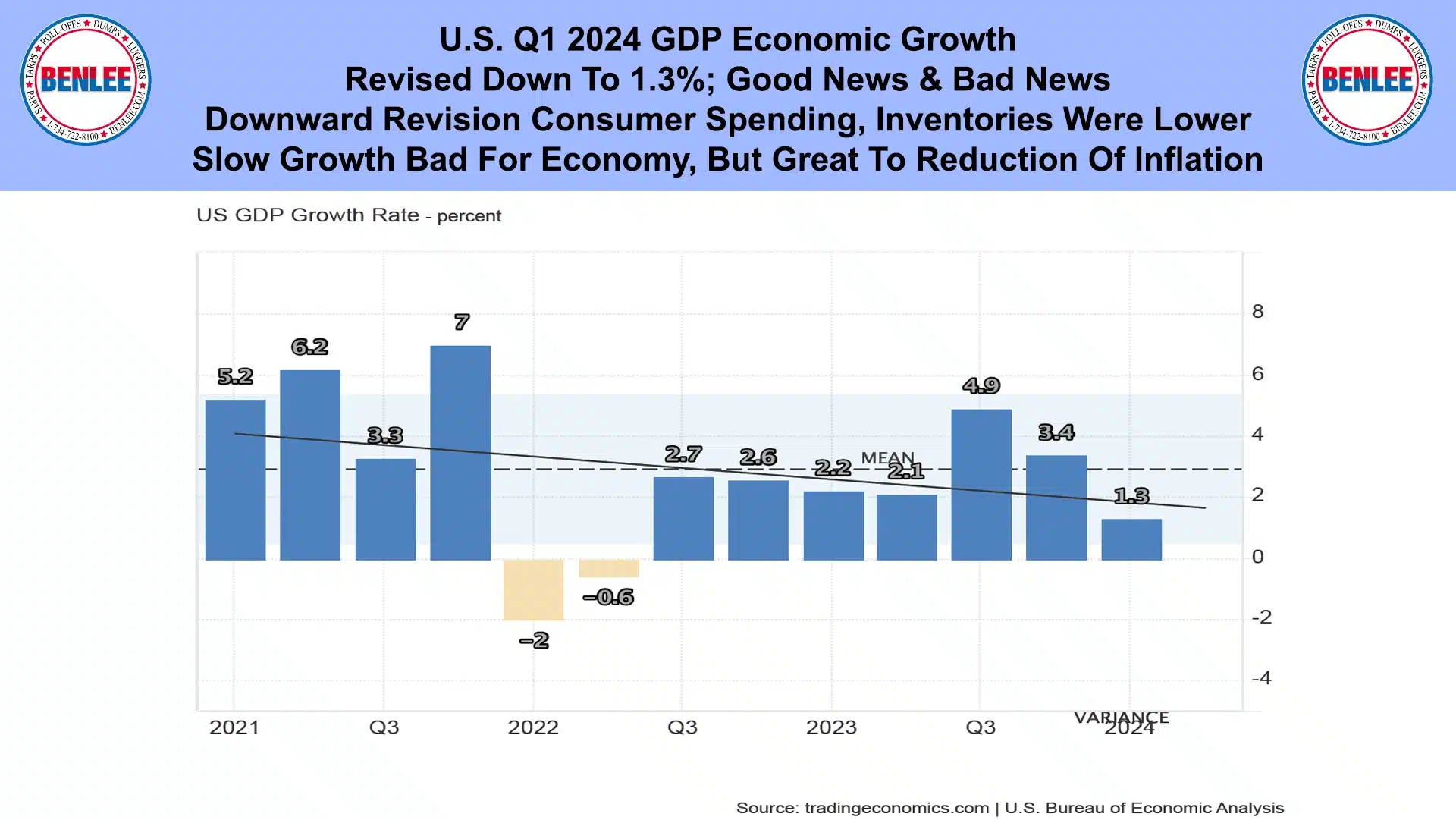

U.S. Q1 2024 GDP Economic Growth was revised down to 1.3%. This is good news and bad news. There was a downward revision of consumer spending and inventories were lower. The slow growth is bad for the economy, but great to reduce inflation.

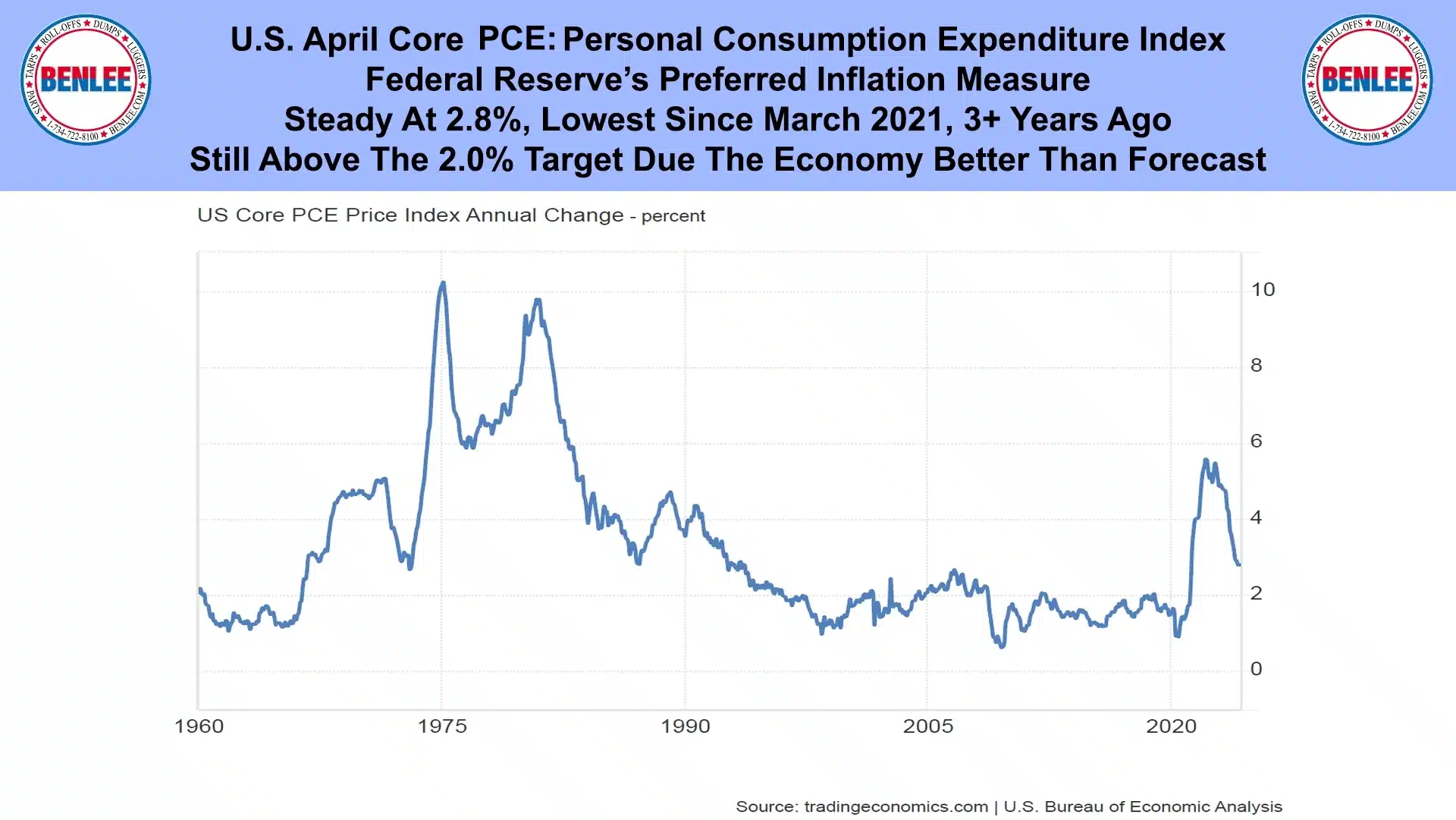

U.S. April Core PCE, Personal Consumption Expenditure index which is the Federal Reserve’s preferred inflation measure. It was steady at 2.8%, the lowest since March 2021, 3+ years ago. It is still above the 2% target though, due to the economy is better than forecast.

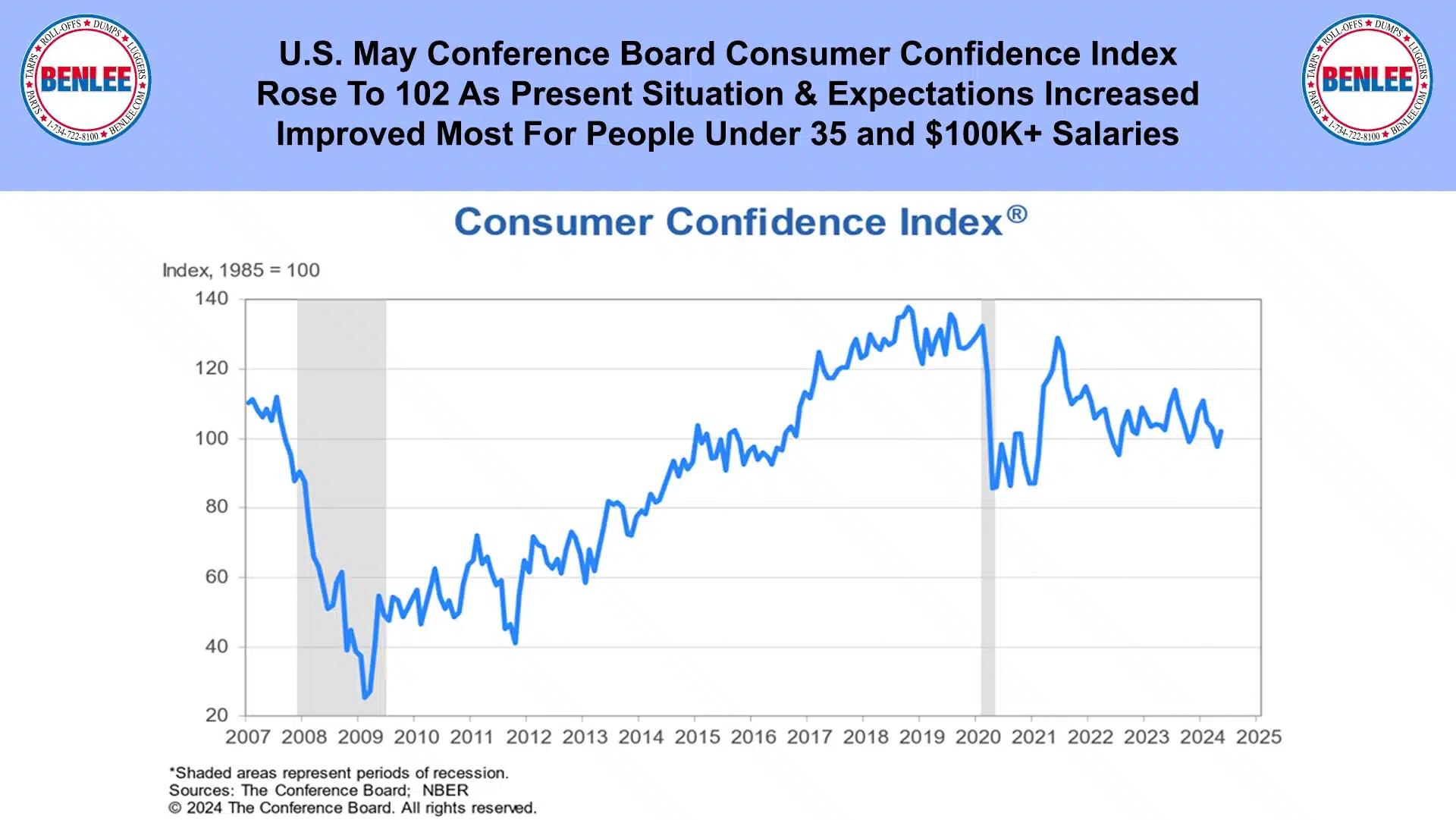

U.S. May Conference Board Consumer Confidence index rose to 102 as the present situation and expectations increased. The improvement was most for people under 35 and $100K+ salaries.

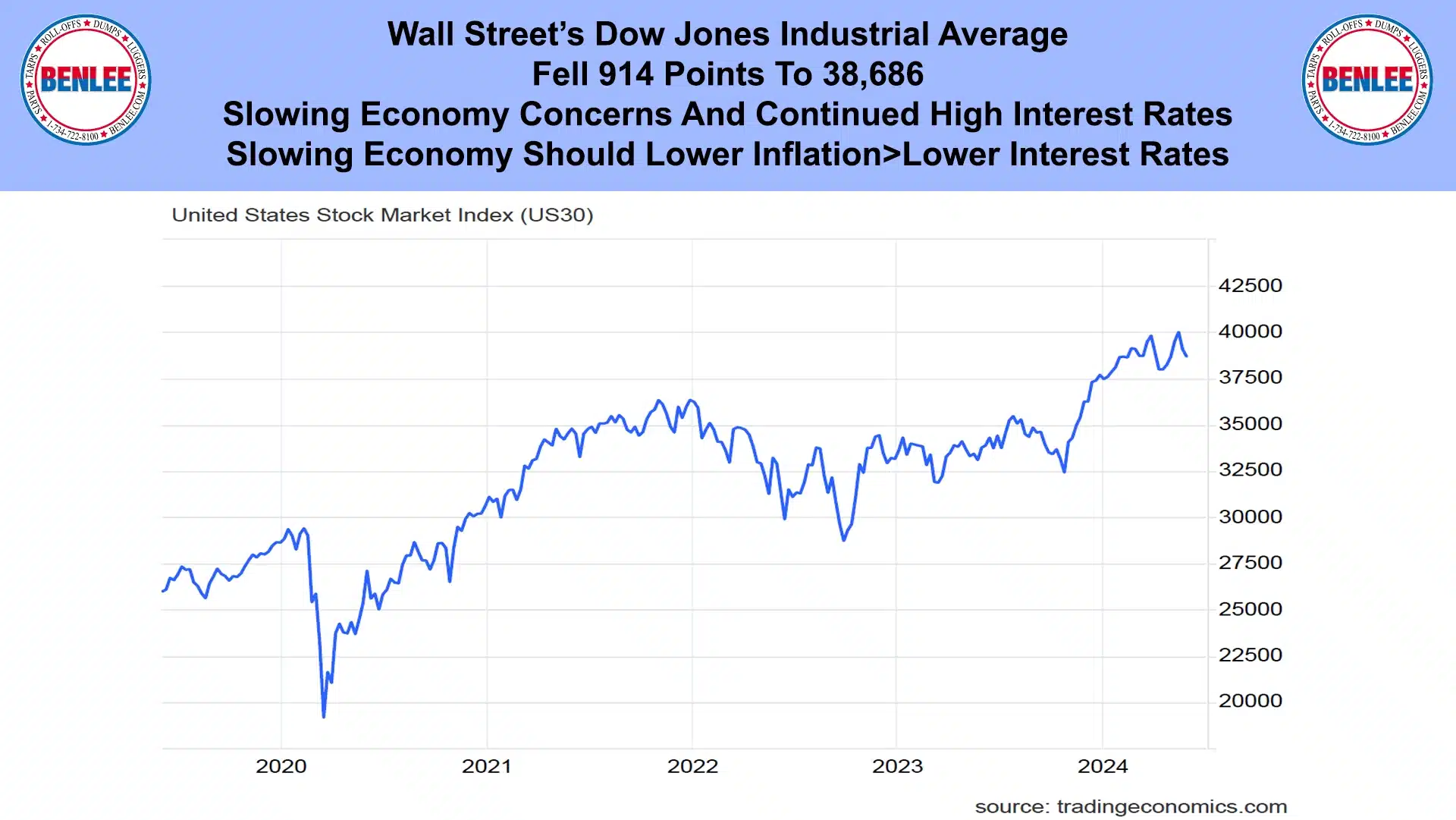

Wall Street’s Dow Jones Industrial Average fell 914 points to 38,686. This was on the slowing economy concerns and continued high interest rates. Importantly, the slowing economy should lower inflation, which will lower interest rates and help the economy.

This report by Greg Brown is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.