June 10, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, June 10th, 2024.

U.S. weekly raw steel production rose slightly to 1.74MT, down .5% from last year and down 2.6% YTD on slow U.S. manufacturing.

WTI crude oil price fell to $75.38/b., on steady demand & good supply.

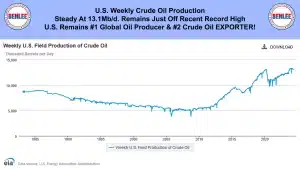

U.S. weekly crude oil production was steady at 13.1Mb/d. as it remains just off the recent record high. The U.S. remains the #1 global oil producer in the world and the #2 crude oil exporter. I repeat, we are the #1 oil producer in the world, and the #2 crude oil exported in the world.

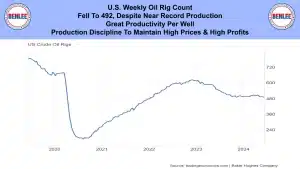

The U.S. weekly oil rig count fell to 492, despite near record production on great productivity per well. Also, on production discipline to maintain high prices and high profits.

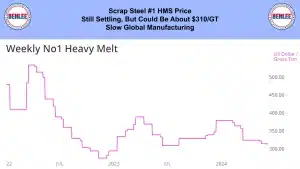

Scrap steel #1 HMS price is still settling, but could be about $310/GT on slow global manufacturing.

Hot-roll coil steel price fell to $36.58/cwt., $732/T, below the price of 2004, 20 years ago. This was on slow U.S. manufacturing and good supply.

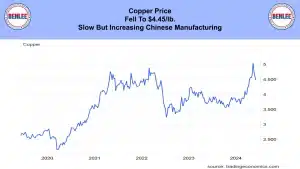

Copper price fell to $4.45/lb., on slow but increasing Chinese manufacturing.

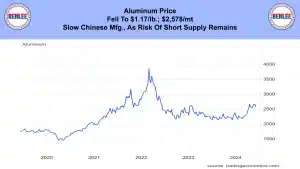

Aluminum price fell to $1.17/lb., $2,578/mt on slow Chinese manufacturing, but as the risk of short supply remains.

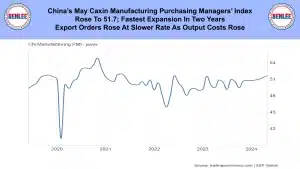

China’s May Caxin Manufacturing Purchasing Managers’ index rose to 51.7, the fastest expansion in two years. Export orders rose at a slower rate, as output costs rose.

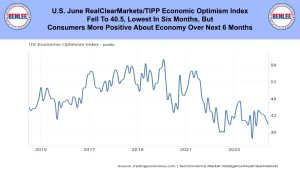

U.S. June Real Clear Markets TIPP Economic Optimism index fell to 40.5, the lowest in 6 months, but consumers were more positive about the economy over the next 6 months.

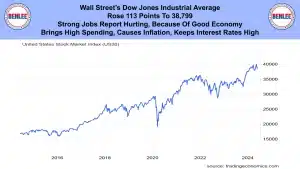

U.S. May new jobs report added 272,000 jobs, the most in 5 months and well above the 185,000 forecast. This is good news and bad news. The good news is more people are working and more people have more money, so they are buying more. This is bad in that it causes inflation.

U.S. May Average hourly earnings rose 4.1% vs the recent 2.7% inflation. When COVID first hit, inflation crashed and wages skyrocketed. It brought crazy high gains by workers. Inflation than rose and wage growth slowed, which hurt workers. Wages gains are now higher than inflation.

U.S. Total Non-Farm Payrolls, rose to 158.5M the most in American history and well above pre COVID’s 152.3M. The record number of people making record amount of money is driving the economy.

Wall Street’s Dow Jones Industrial Average rose 113 points to 38, 799. This was on the strong jobs report hurting because of the good economy. That as said, causes inflation that is keeping interest rates high.

This report by Greg Brown is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.