May 13, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, May 13th, 2024.

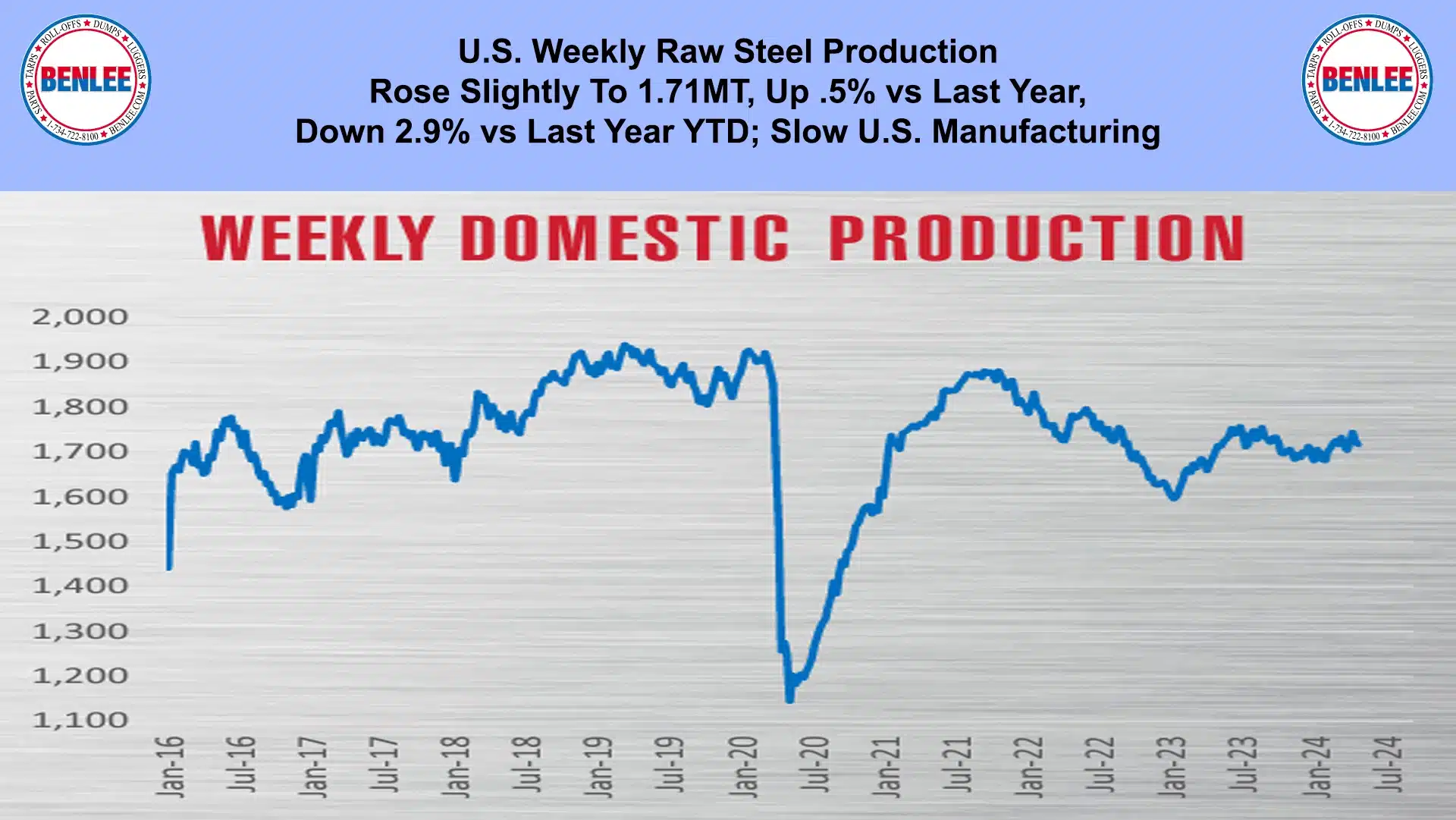

U.S. weekly raw steel production rose slightly to 1.71MT. It was up .5% from last year and down 2.9% vs last year YTD on slow U.S. manufacturing.

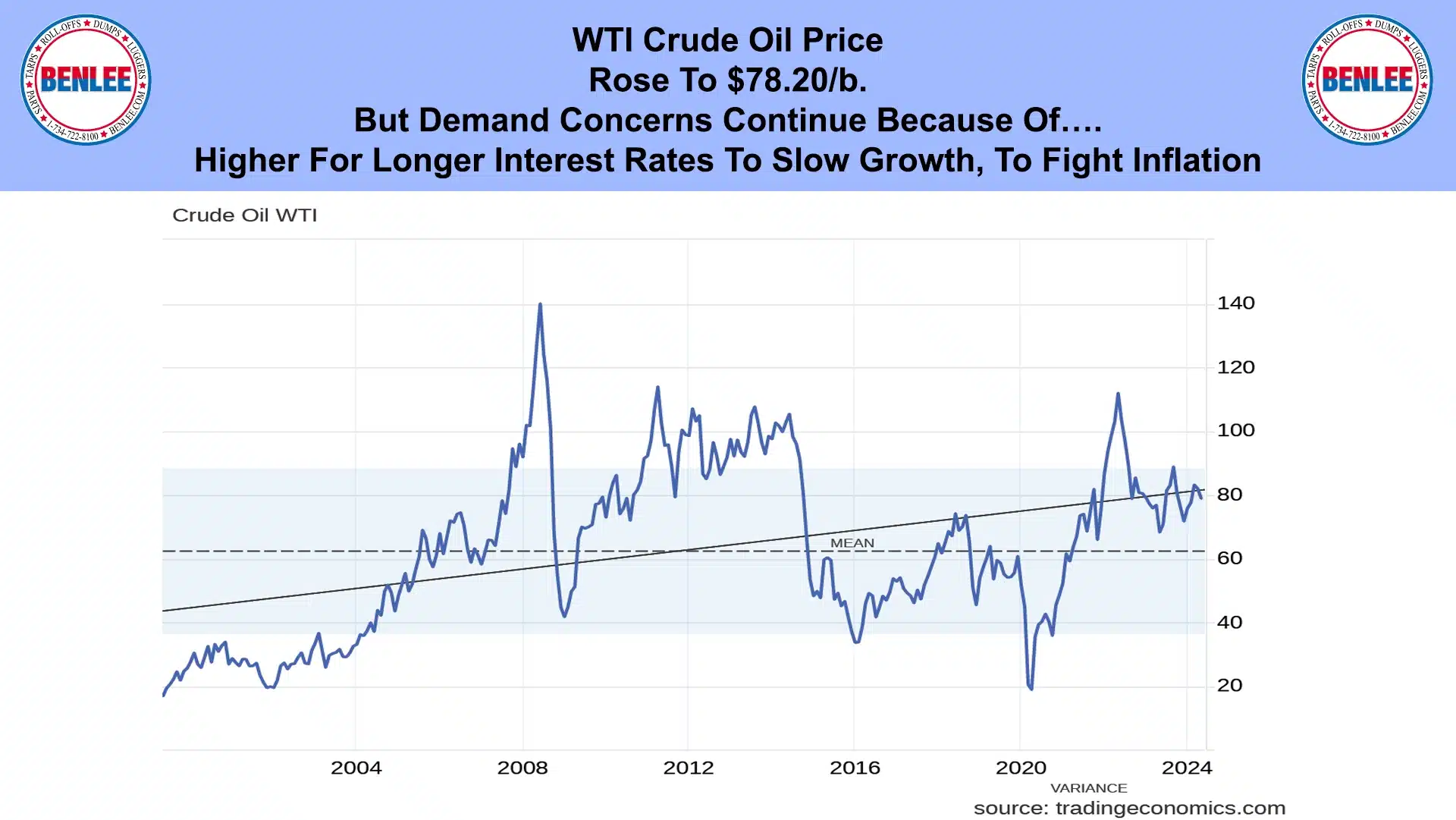

WTI crude oil price rose to $78.20/b, but demand concerns continue because of higher for longer interest rates to slow growth, to fight inflation.

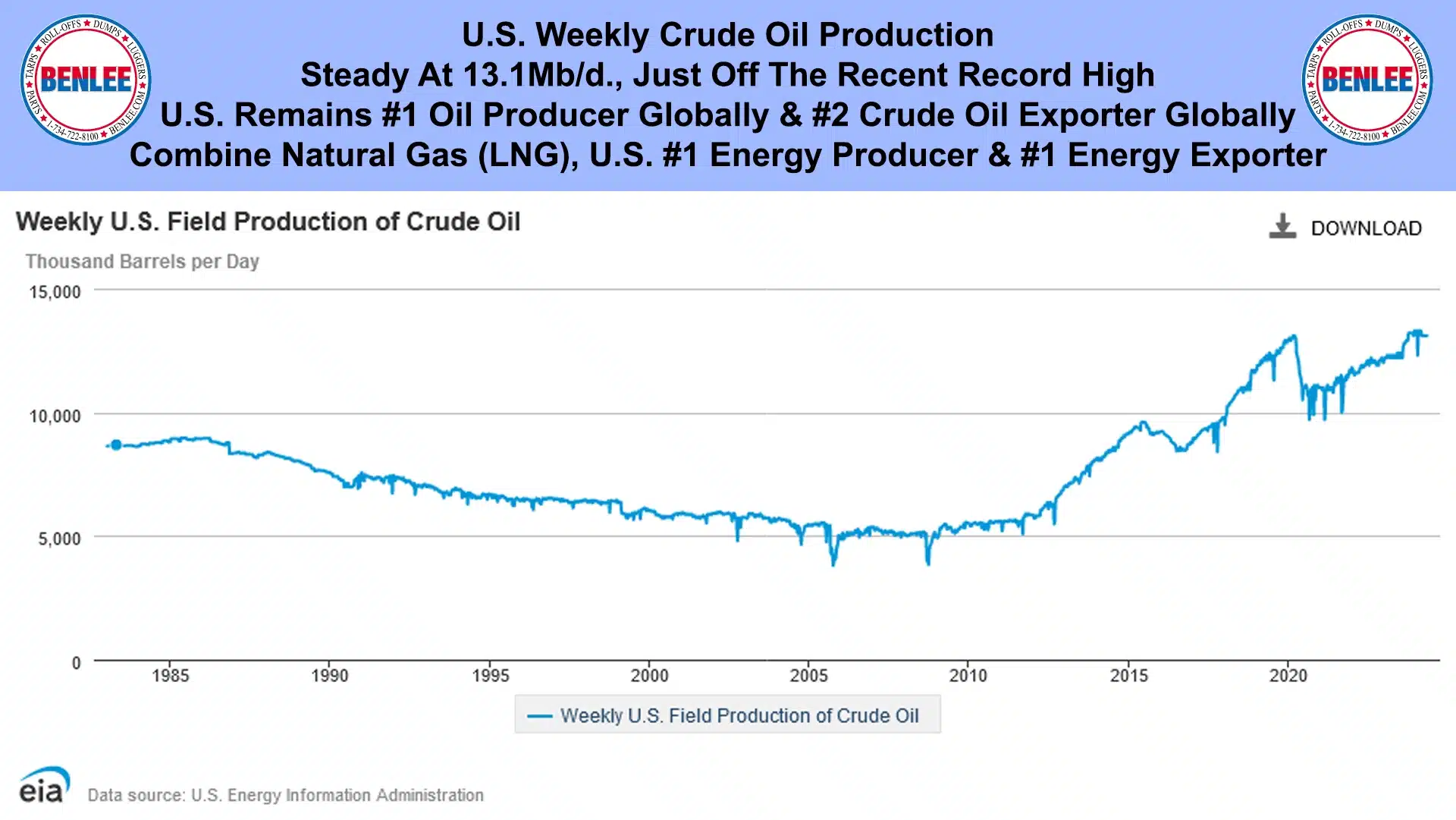

U.S. weekly crude oil production was steady at 13.1Mb/d. just off the recent record high. The U.S. remains the #1 oil producer globally and the #2 crude oil exporter globally. When crude oil is combined with natural gas, LNG, the U.S. is the #1 Energy Producer in the world and the #1 energy Exporter in the world. More than Saudi Arabia, more than Russia. We are the #1 Producer and #1 Exporter and exporting at or near record amounts of energy in history.

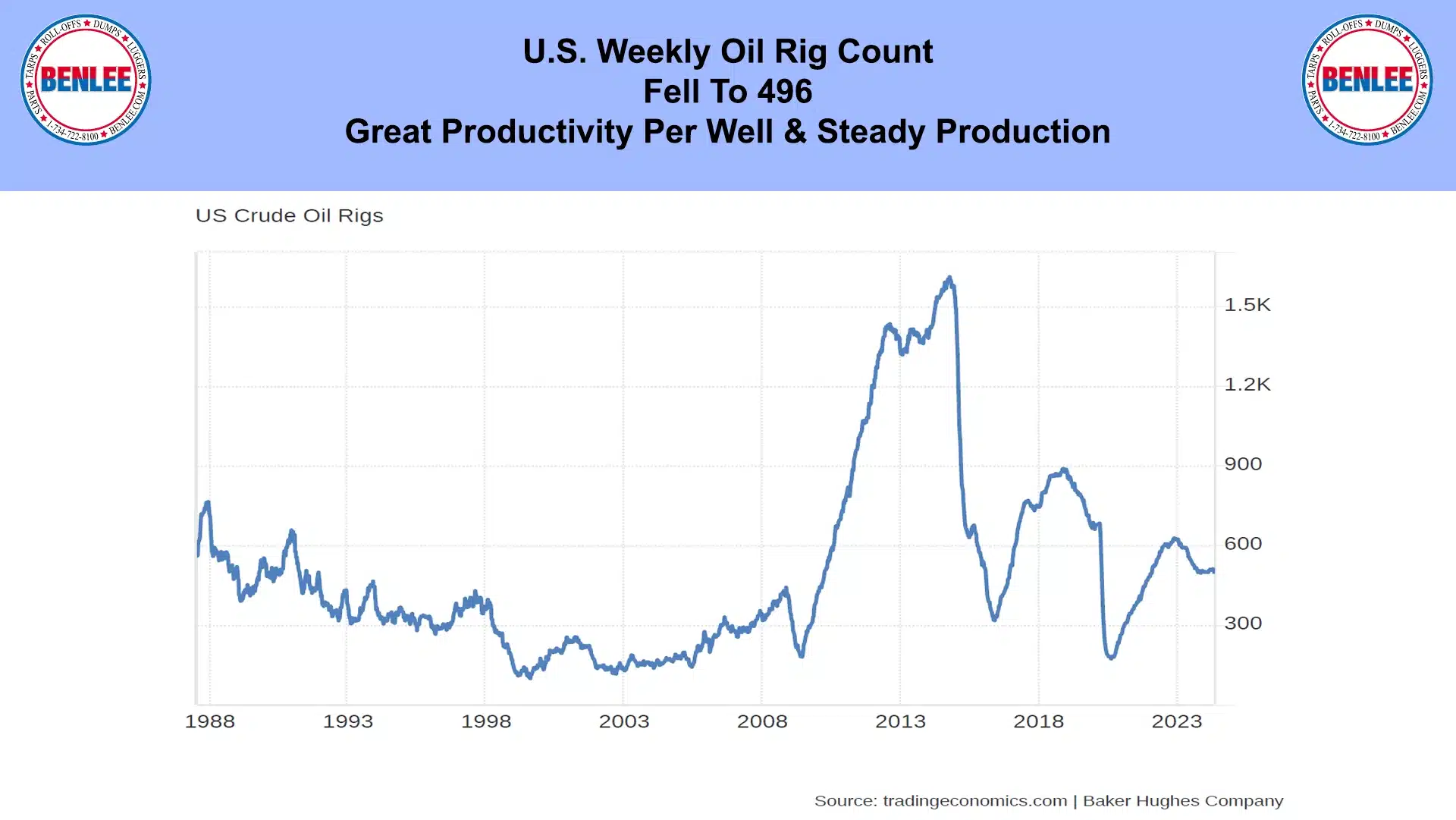

The U.S. weekly oil rig count fell to 496 on great productivity per well and steady production.

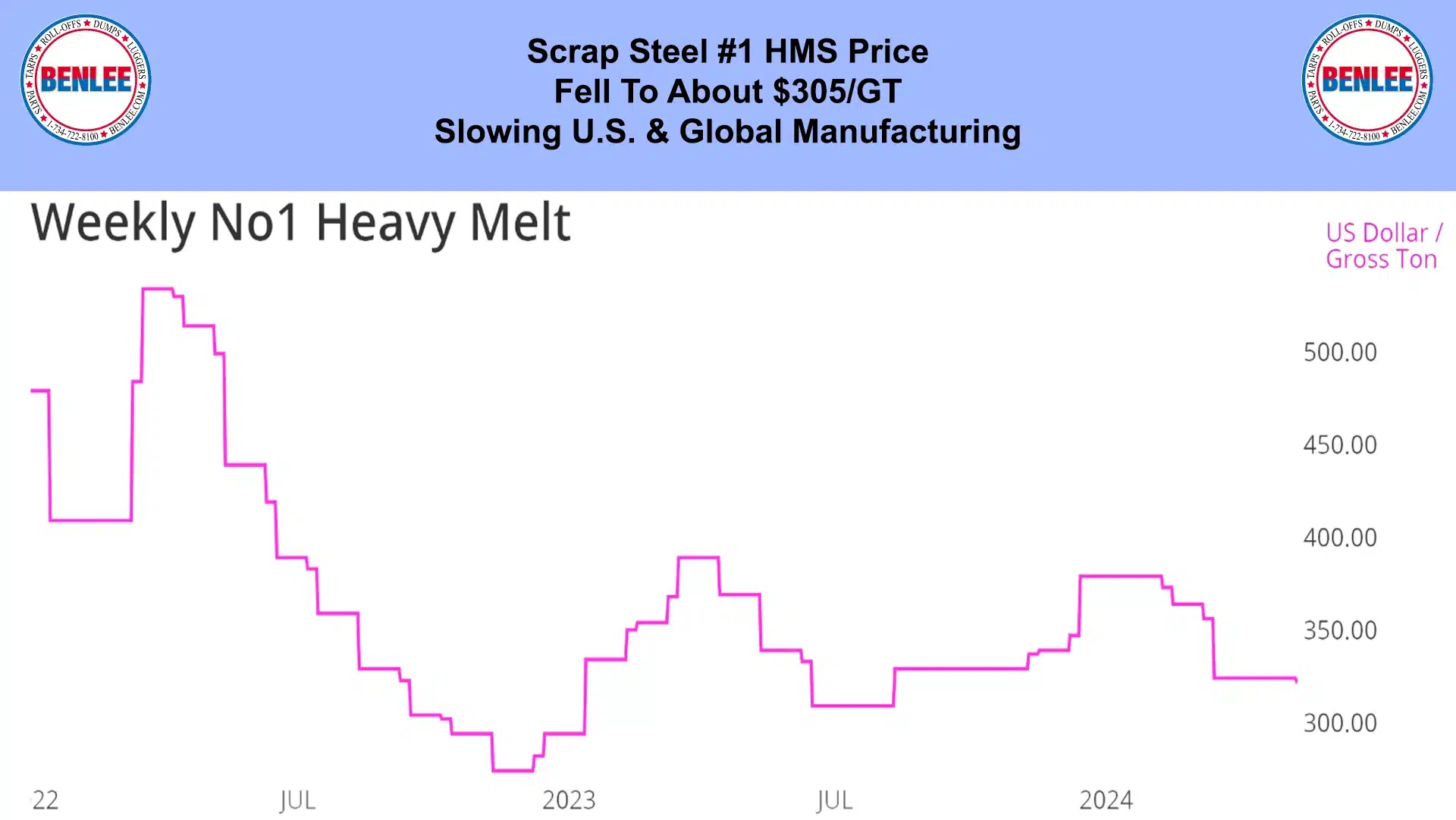

Scrap steel #1 HMS price fell to about $305/GT on slowing U.S. and global manufacturing.

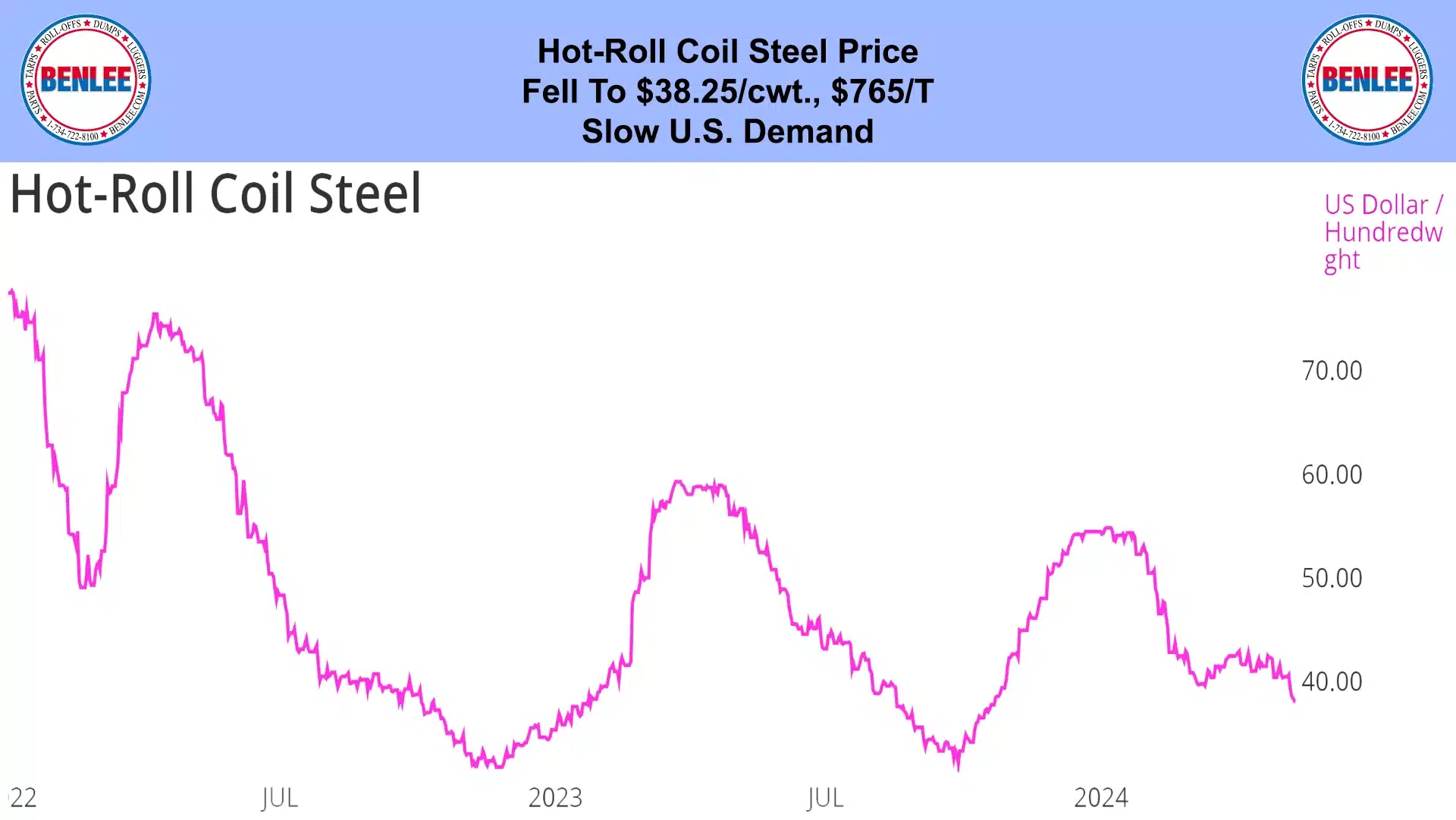

Hot-roll coil steel price fell to $38.25/cwt., $765/T on slow U.S. demand.

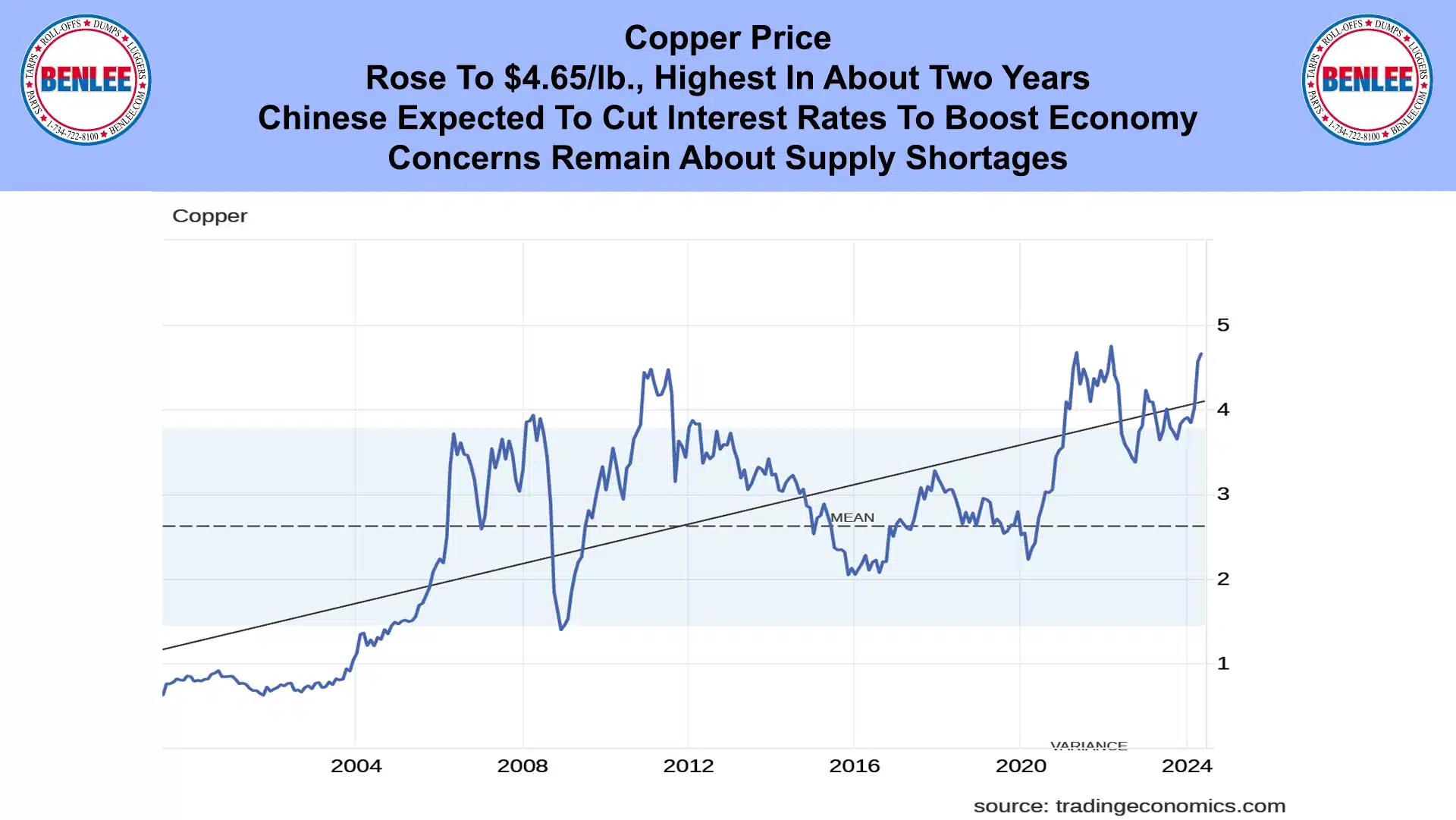

Copper price rose to $4.65/lb., the highest in about two years. The Chinese are expected to cut interest rates to boost the economy and concerns remain about supply shortages.

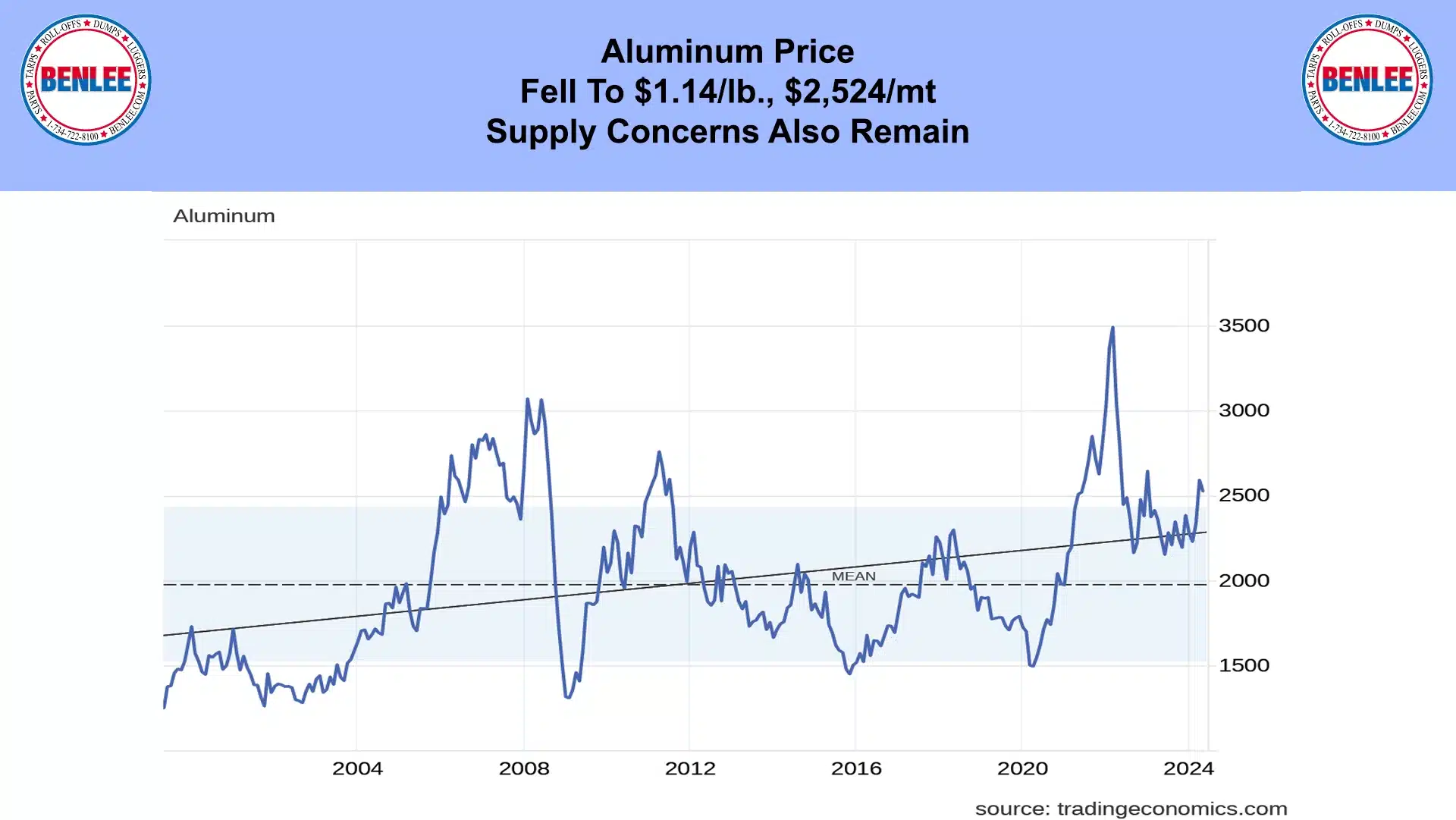

Aluminum price fell to $1.14/LB., $2,524/MT., as supply concerns also remain.

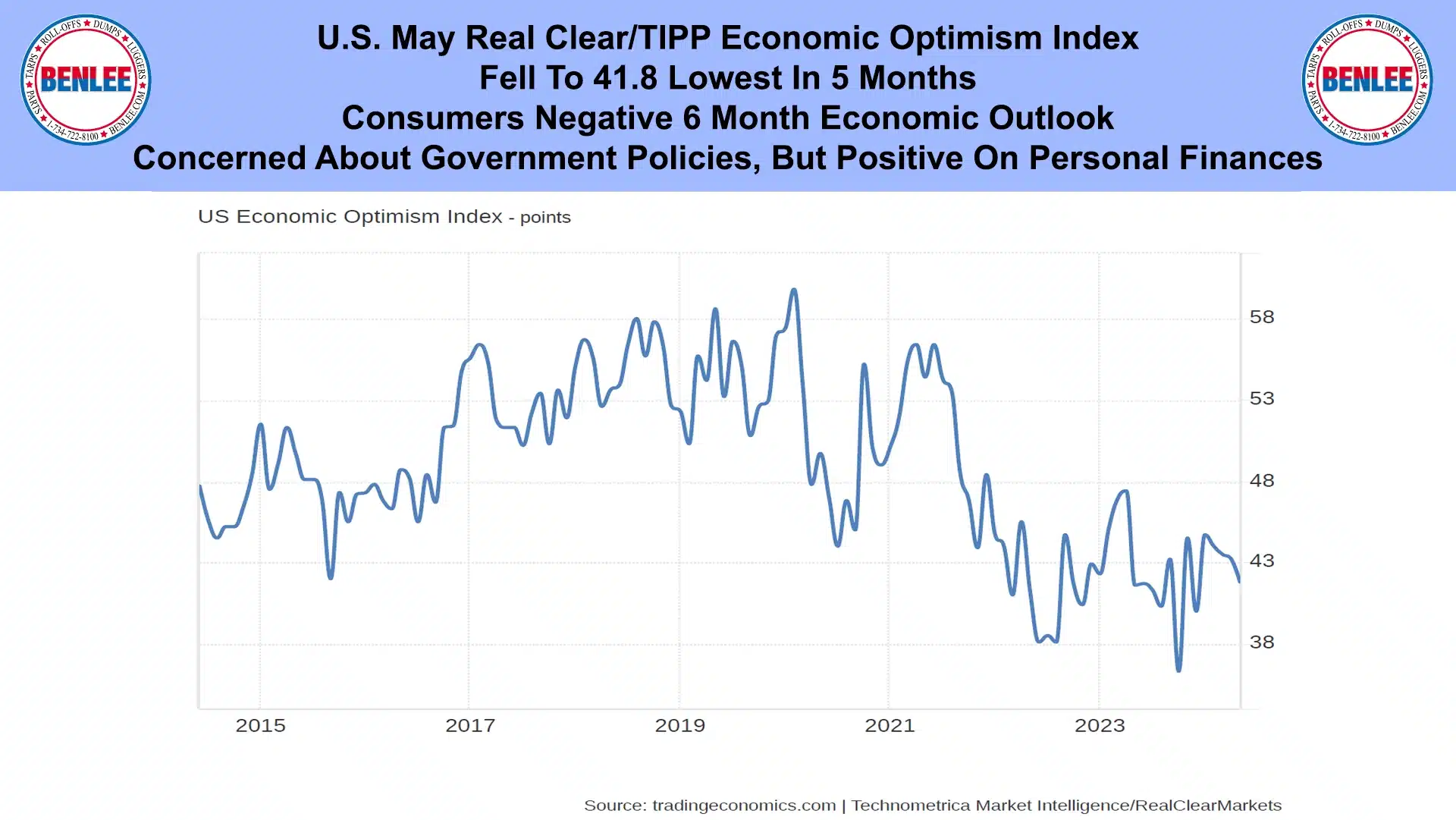

U.S. May Real Clear/TIPP Economic optimism index fell to 41.8, the lowest in 5 months. Consumers were negative about the 6 month economic outlook. They are also concerned about government policies, but positive on their personal finances.

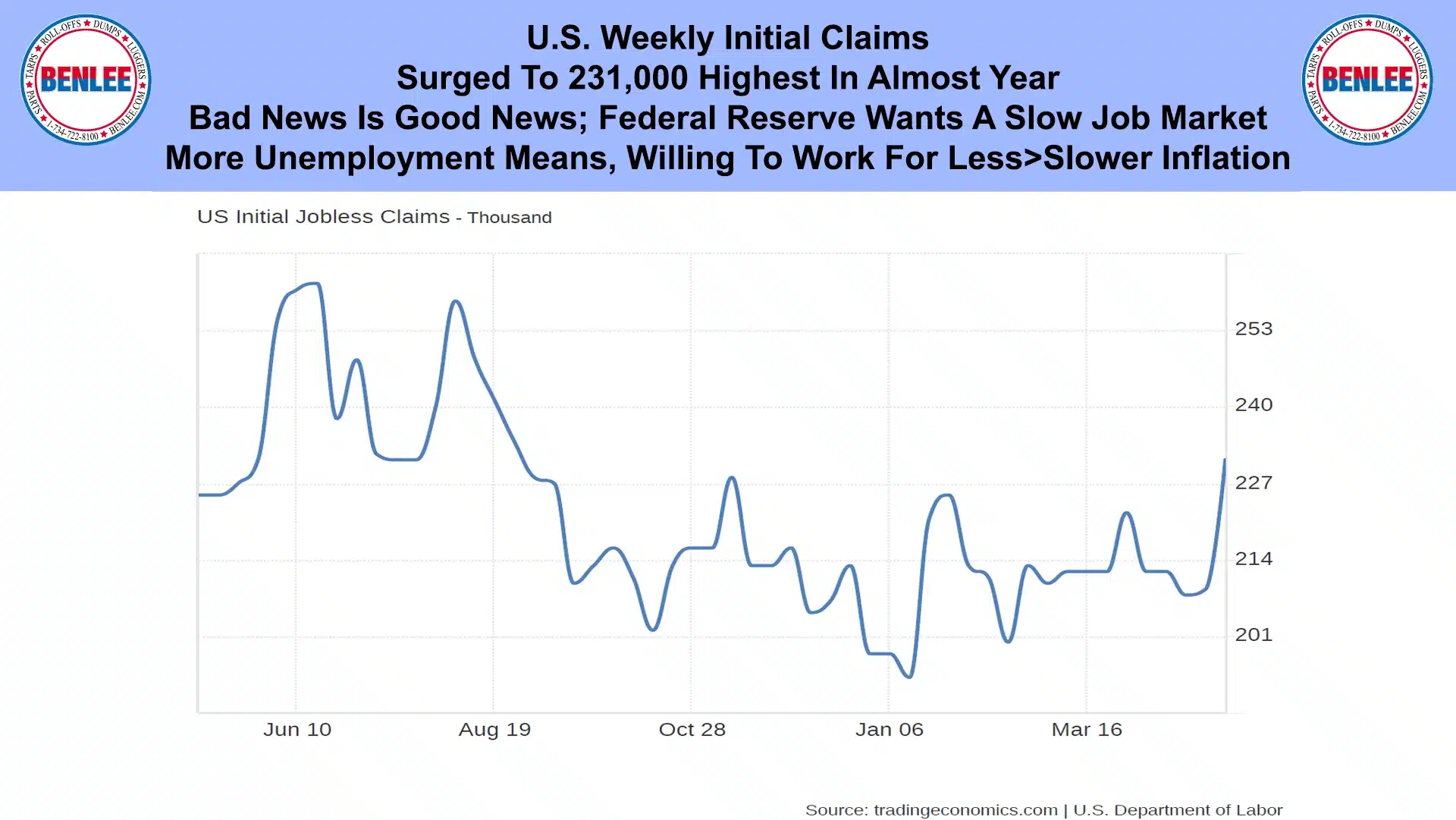

U.S. weekly initial jobless claims surged to 231,000 the highest in almost a year. This bad news is good news. The Federal Reserve wants a slow job market. More unemployment means people are willing to work for less, which brings slower inflation.

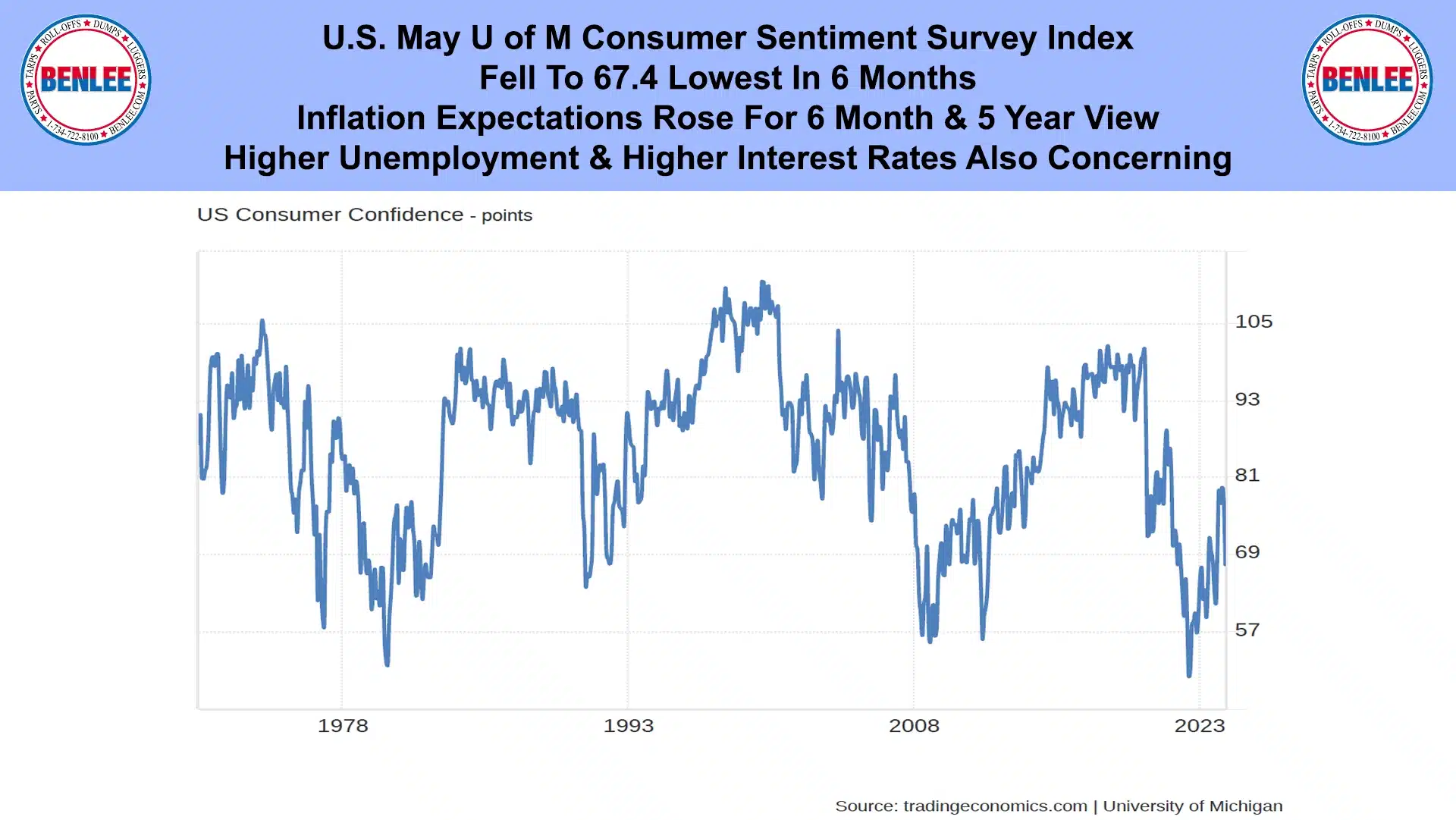

U.S. May U of M Consumer sentiment survey index fell to 67.4 the lowest in 6 months. This was as inflation expectations rose for the 6 month and 5 year view. Higher unemployment and higher interest rates are also concerning.

U.S. April average hourly earnings fell to 3.9%, but more than the 3.5% inflation. The high 3.9% is great for workers, but bad for inflation.

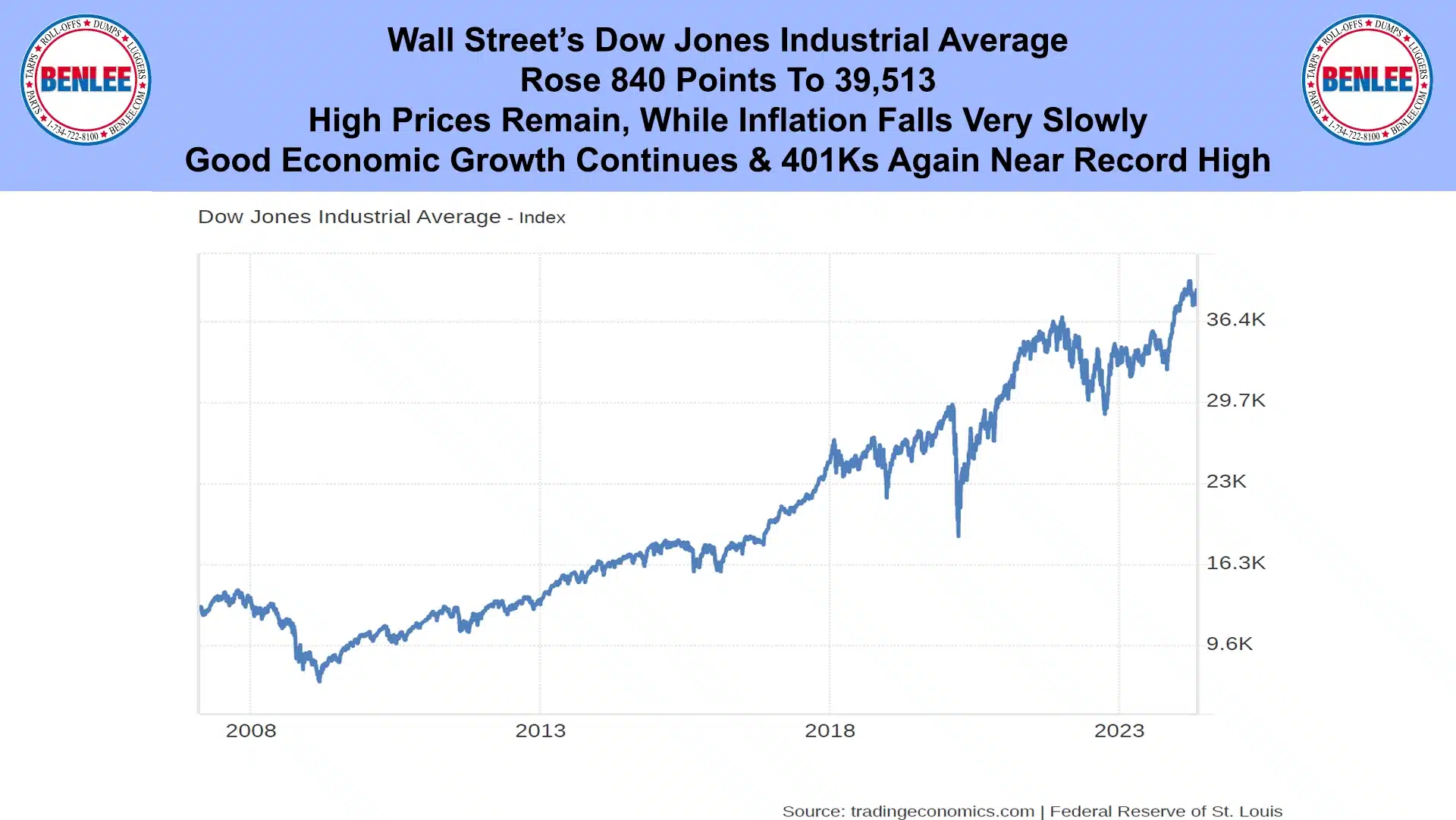

Wall Street’s Dow Jones industrial average rose 840 points to 39,513. High prices remain, while inflation falls very slowly. Good economic growth continues and 401ks are again near record highs.

This report by Greg Brown from is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.