April 22, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, April 22nd, 2024.

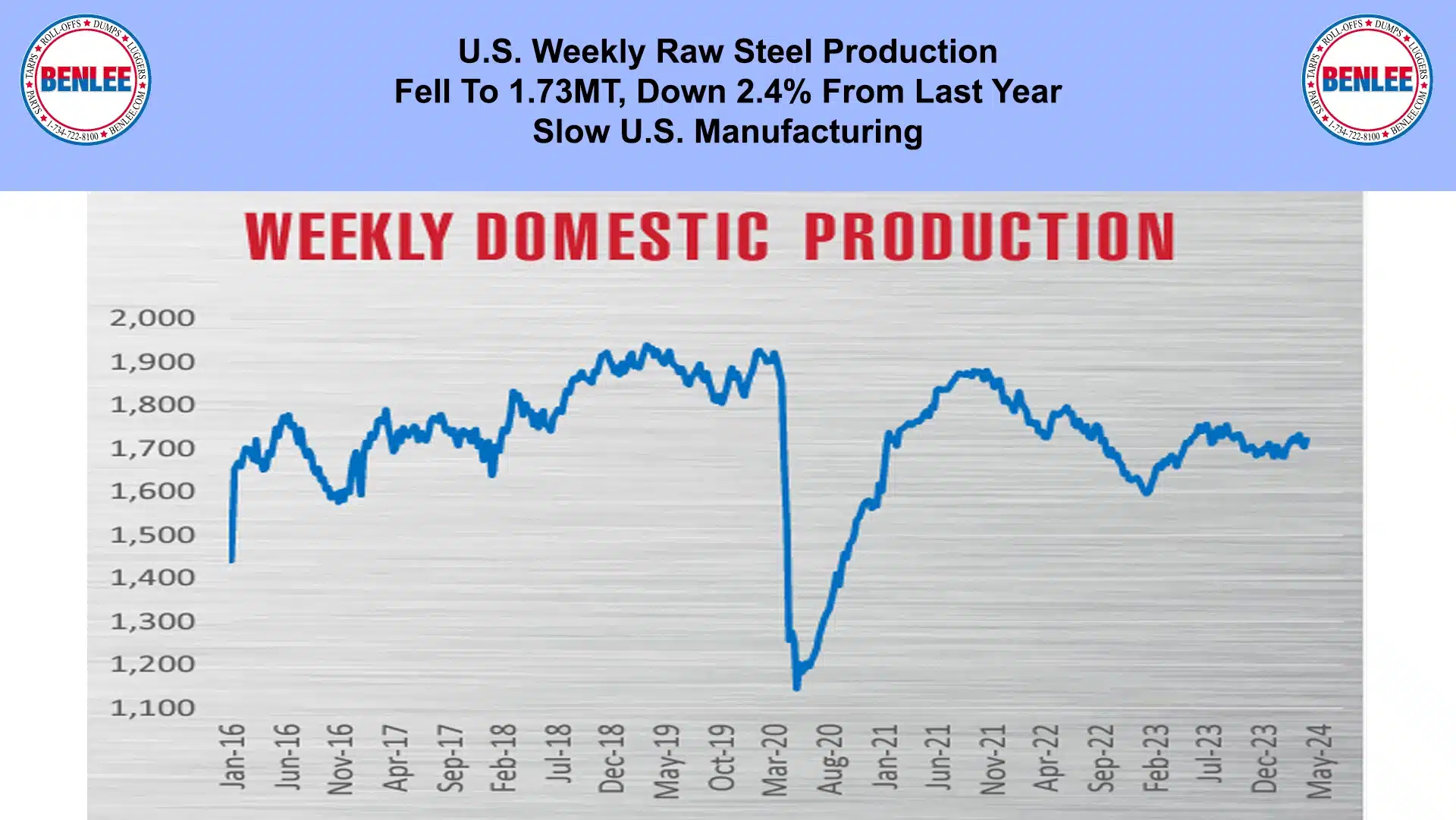

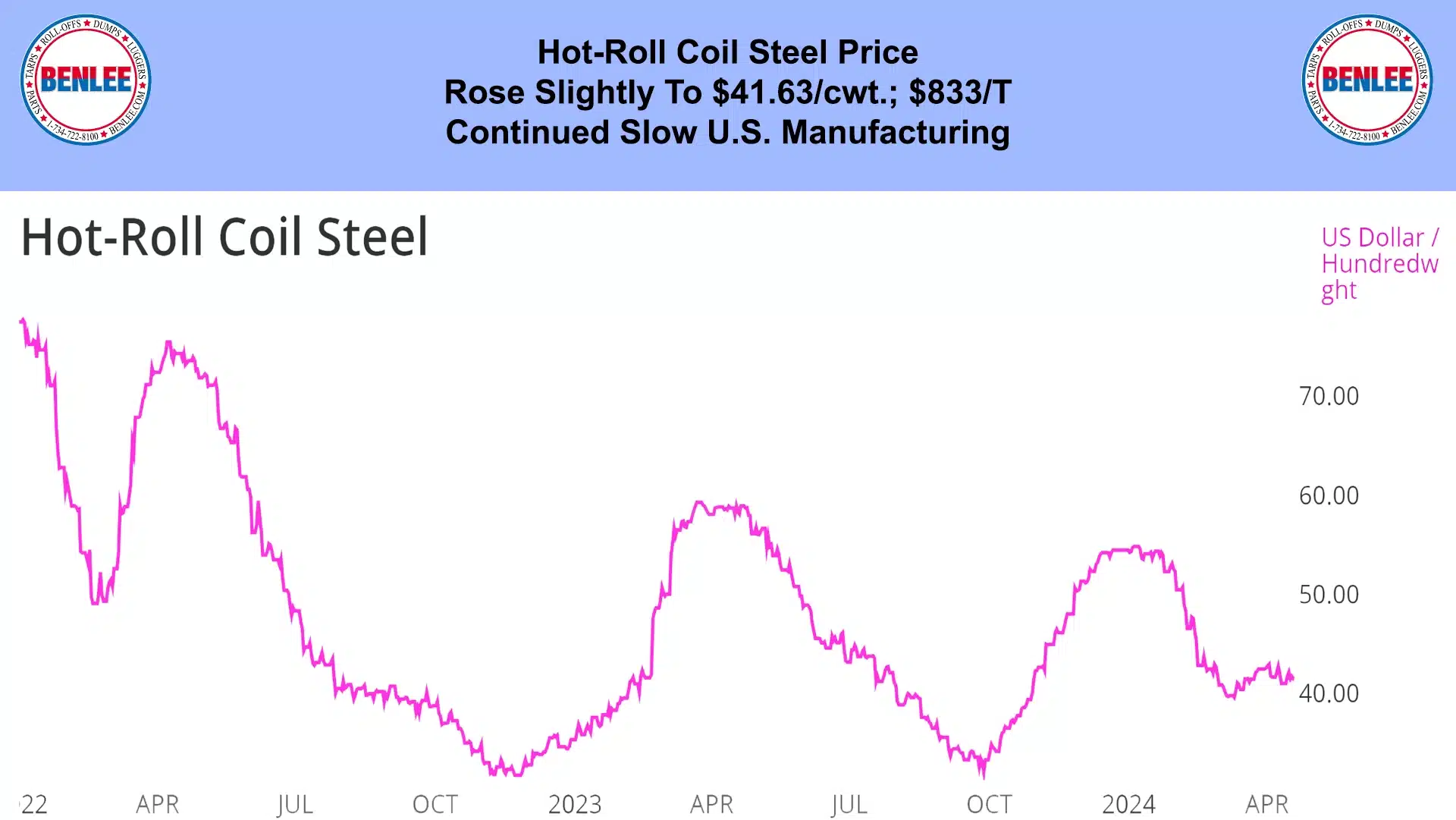

U.S. weekly raw steel production fell to 1.73MT, down 2.4% from last year on slow U.S. manufacturing.

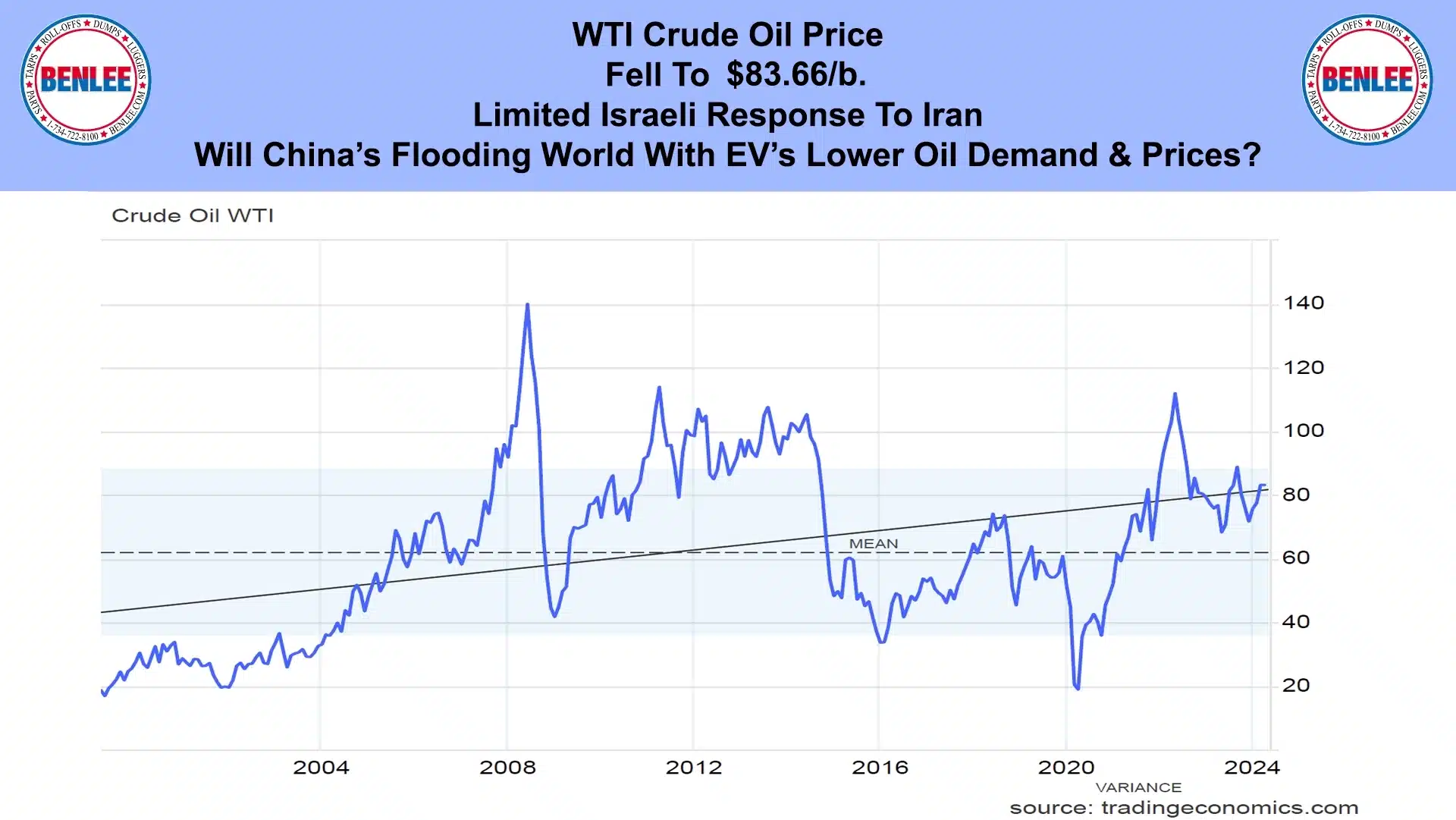

WTI crude oil price fell to $83.14/b., on the limited Israeli response to Iran. A question is will China’s flooding the world with Electric vehicles, lower oil demand and then, lower oil prices?

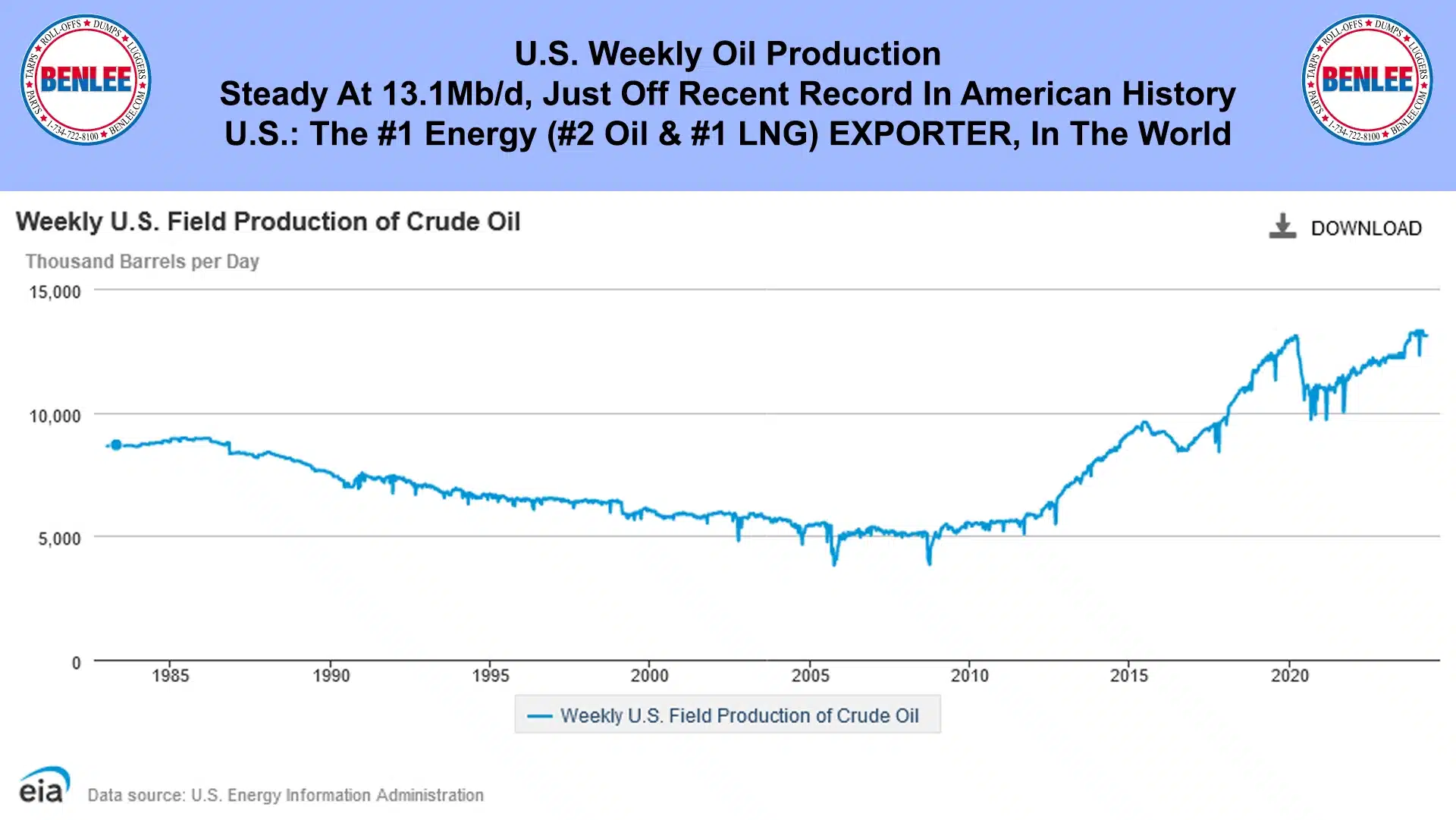

U.S. weekly crude oil production was steady at 13.1Mb/d., just off the recent record in American History. The U.S. is the #1 energy exporter in the world: oil, and LNG, liquified natural gas combined). I repeat the U.S. is the #1 energy exporter in the world.

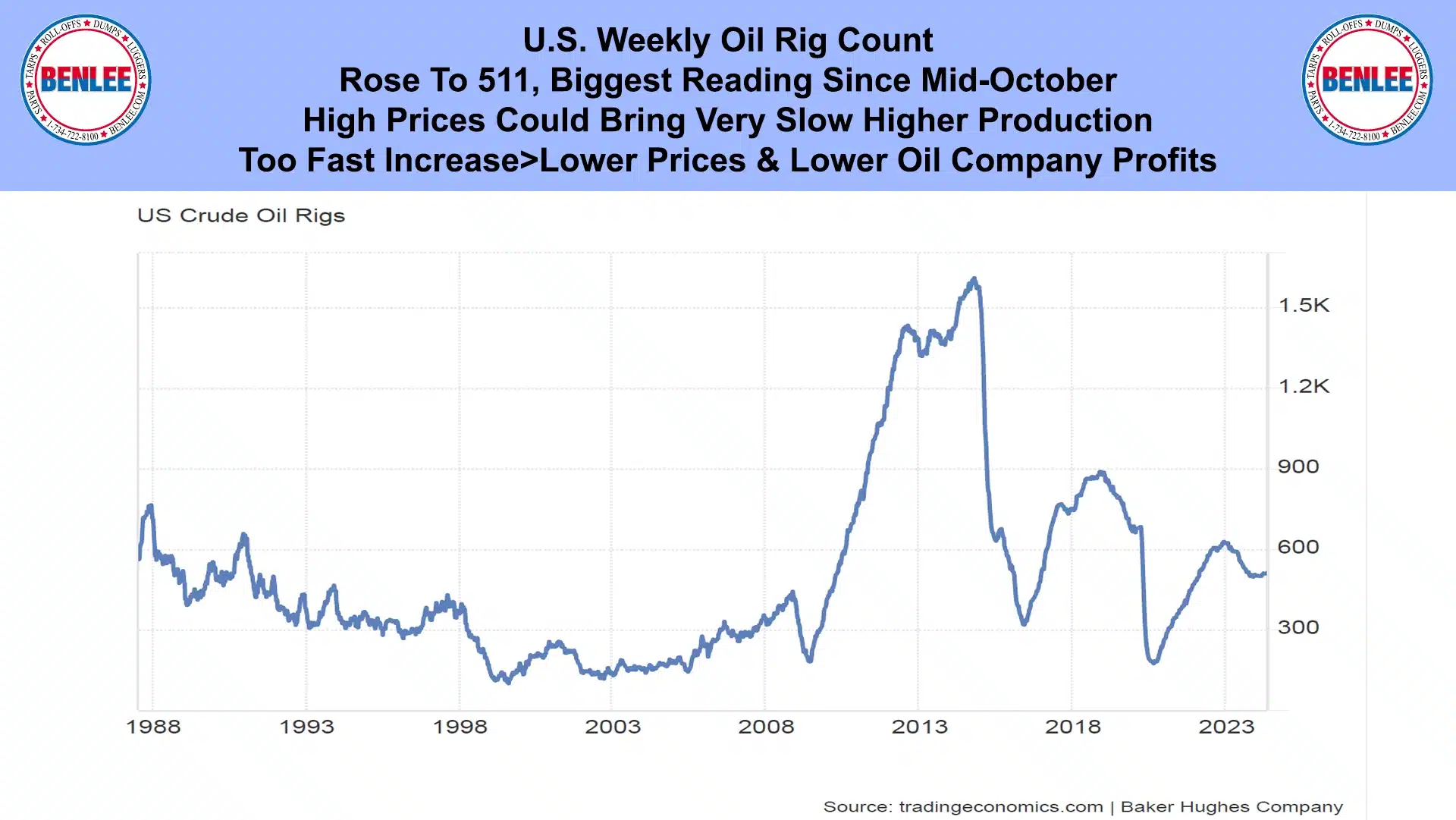

The U.S. weekly oil rig count rose to 511, the biggest reading since Mid-October. High prices could bring very slow higher production. Too fast of an increase would lower prices and lower oil company profits.

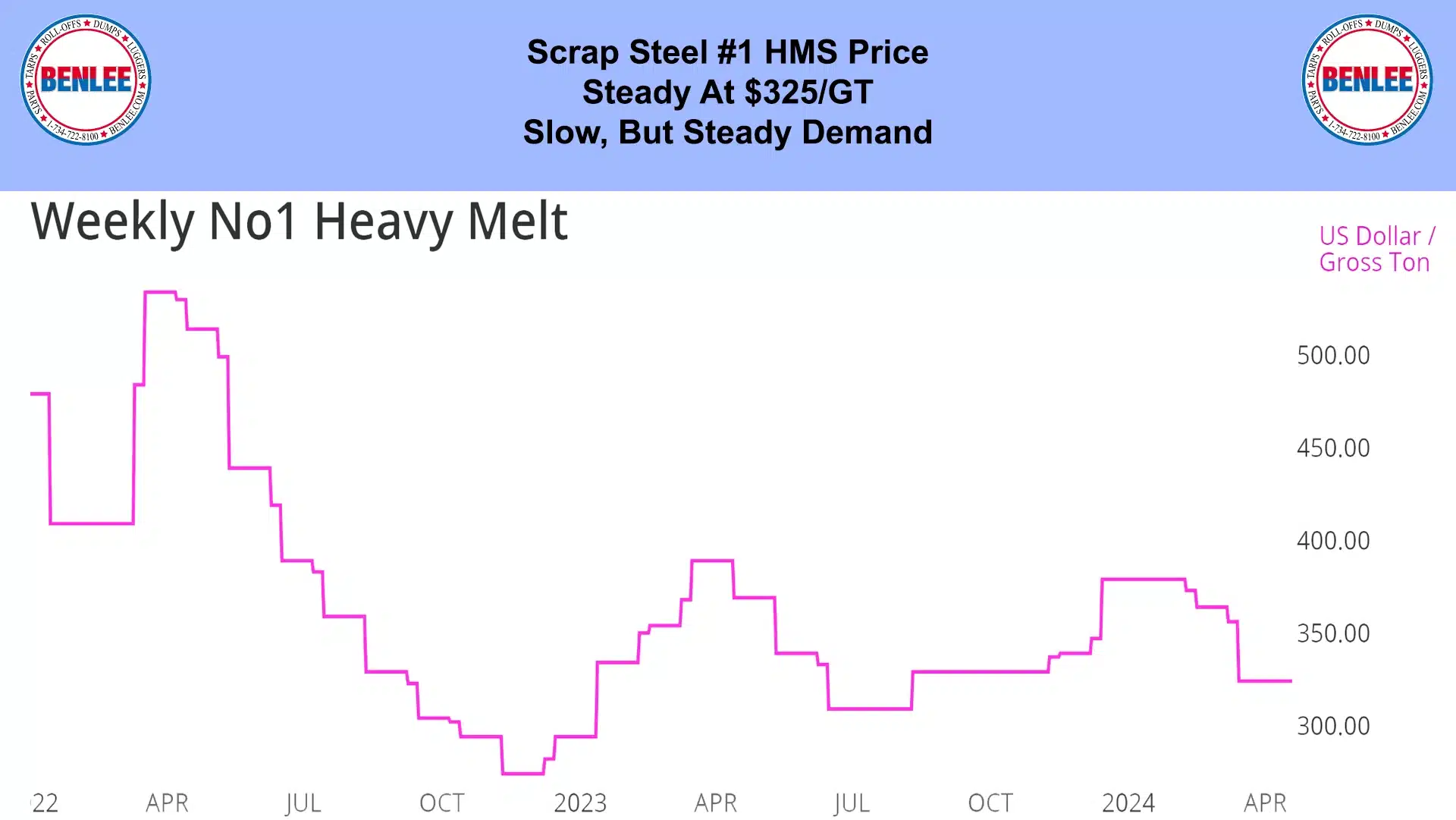

Scrap steel #1 HMS price was steady at $325/GT, on slow, but steady demand.

Hot-roll coil steel price rose slightly to $41.63/cwt., $833/T on continued slow U.S. manufacturing.

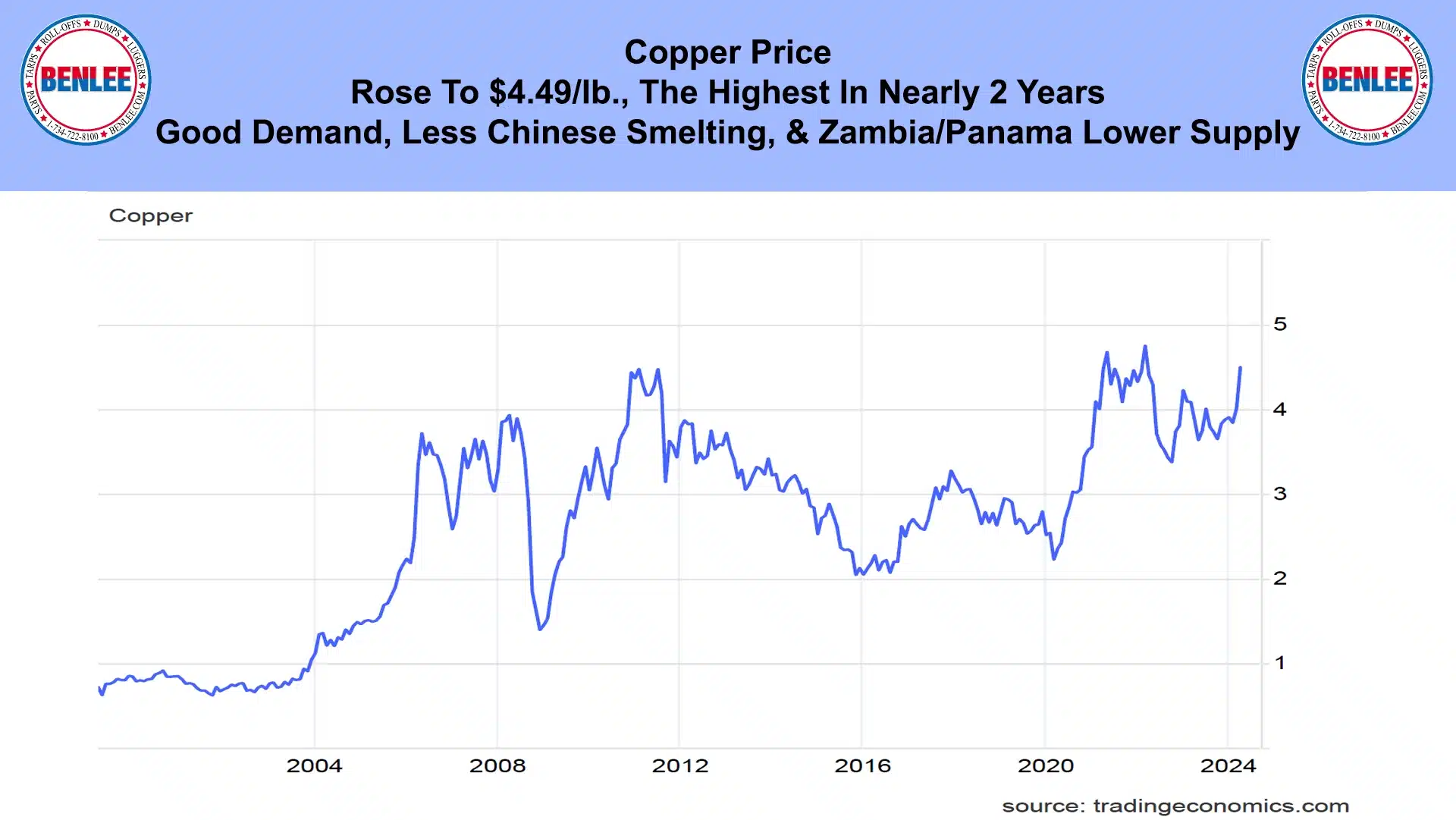

Copper price rose to $4.49/lb., the highest in nearly 2 years. This was on good demand, less Chinese smelting and Zambia and Panama lower supply.

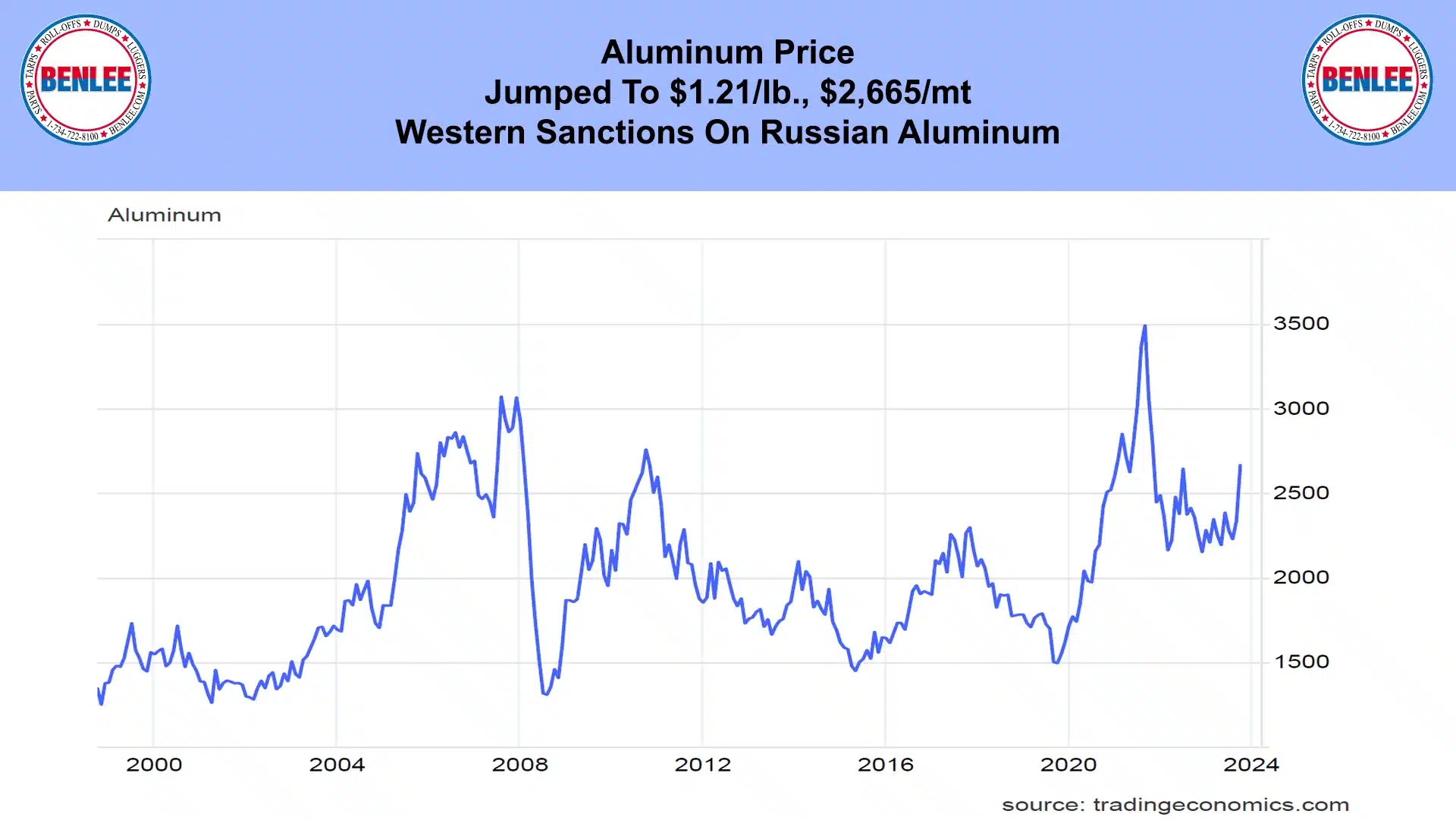

Aluminum price jumped to $1.21/lb., $2,665/mt on western sanctions on Russian aluminum.

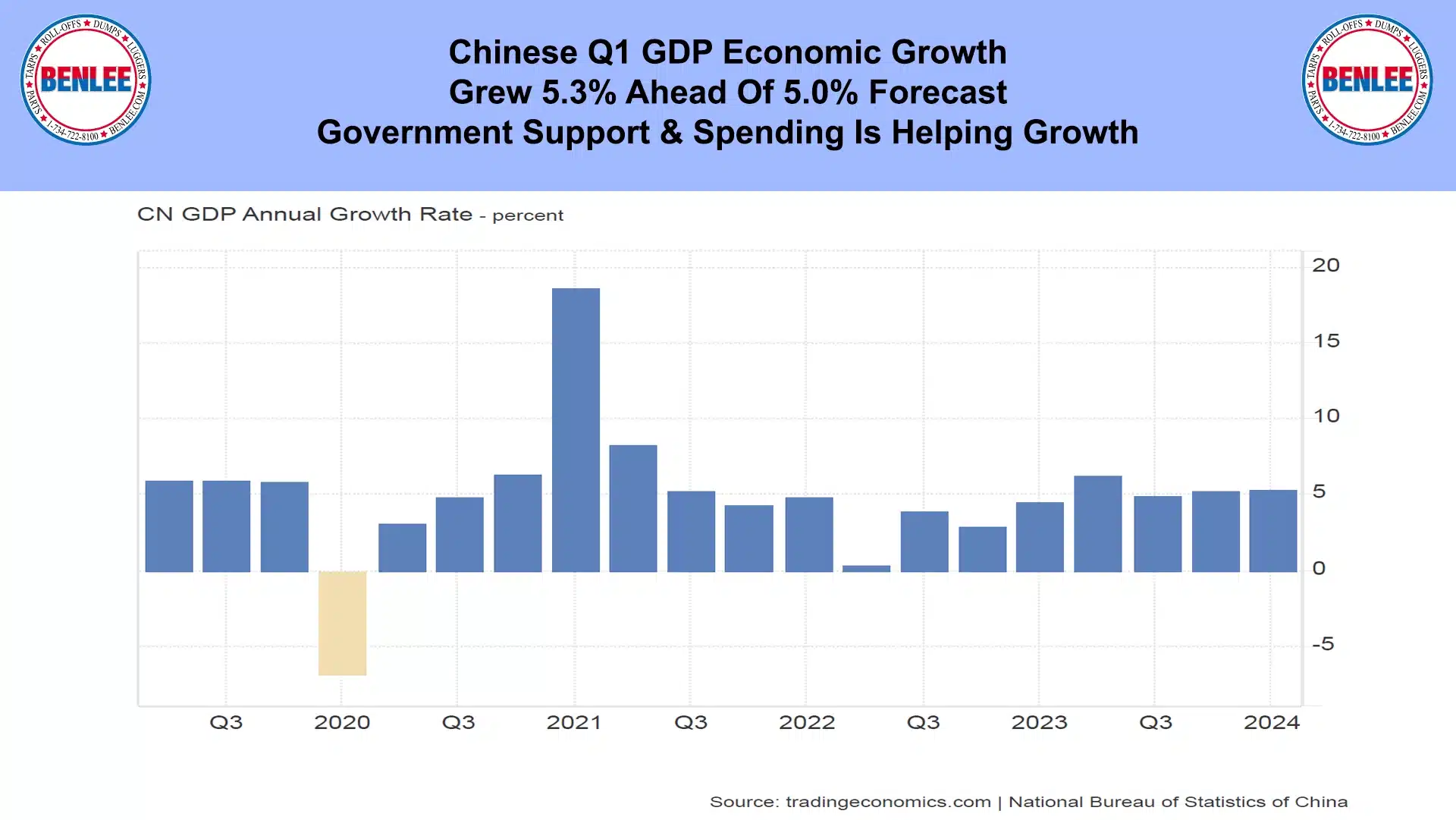

Chinese Q1 GDP, economic growth. It grew at 5.3%, which was ahead of the 5.0% forecast. Government support and spending is helping growth.

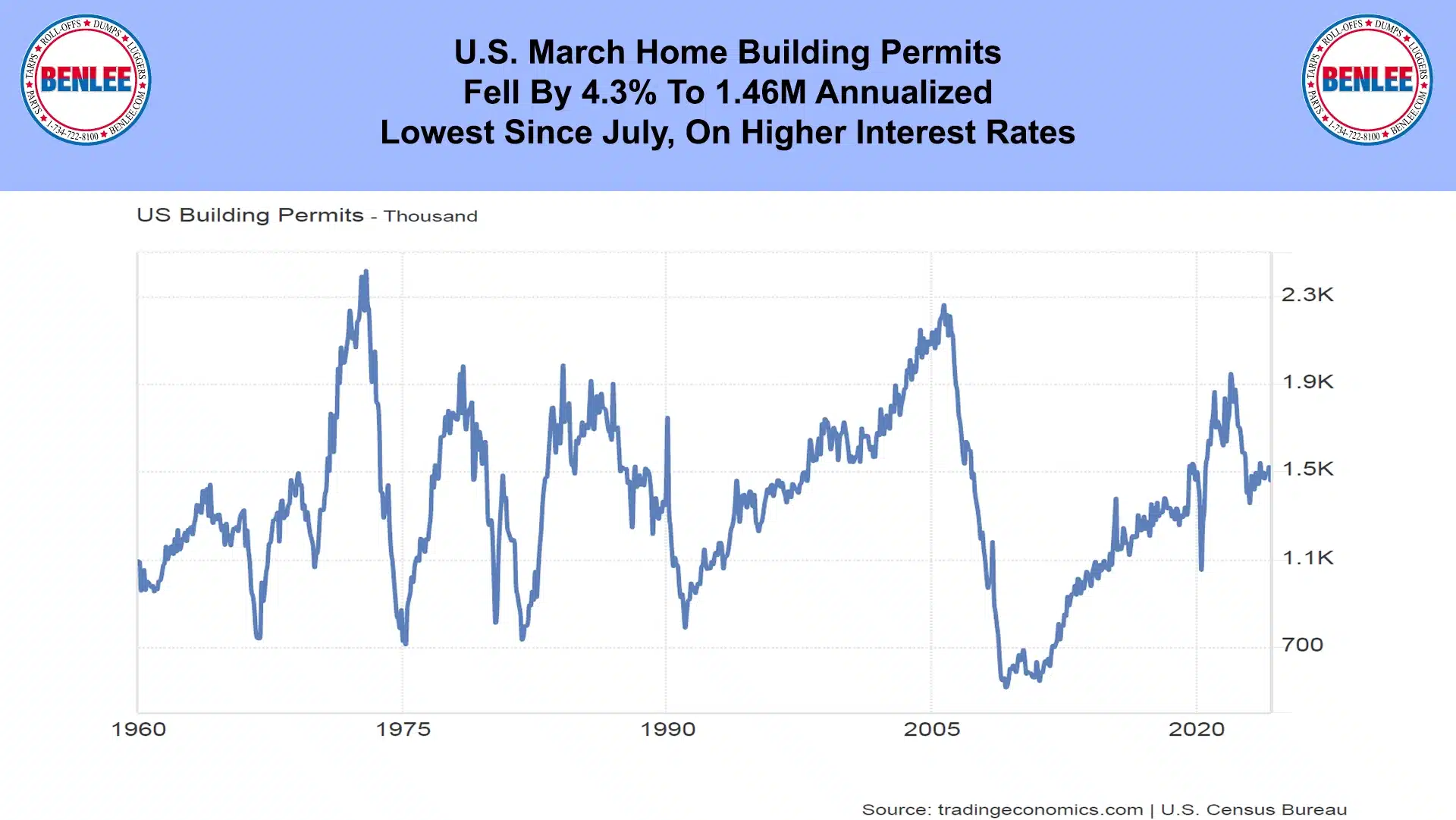

U.S. March home building permits fell by 4.3% to 1.46M annualized. This was the lowest since July on higher interest rates.

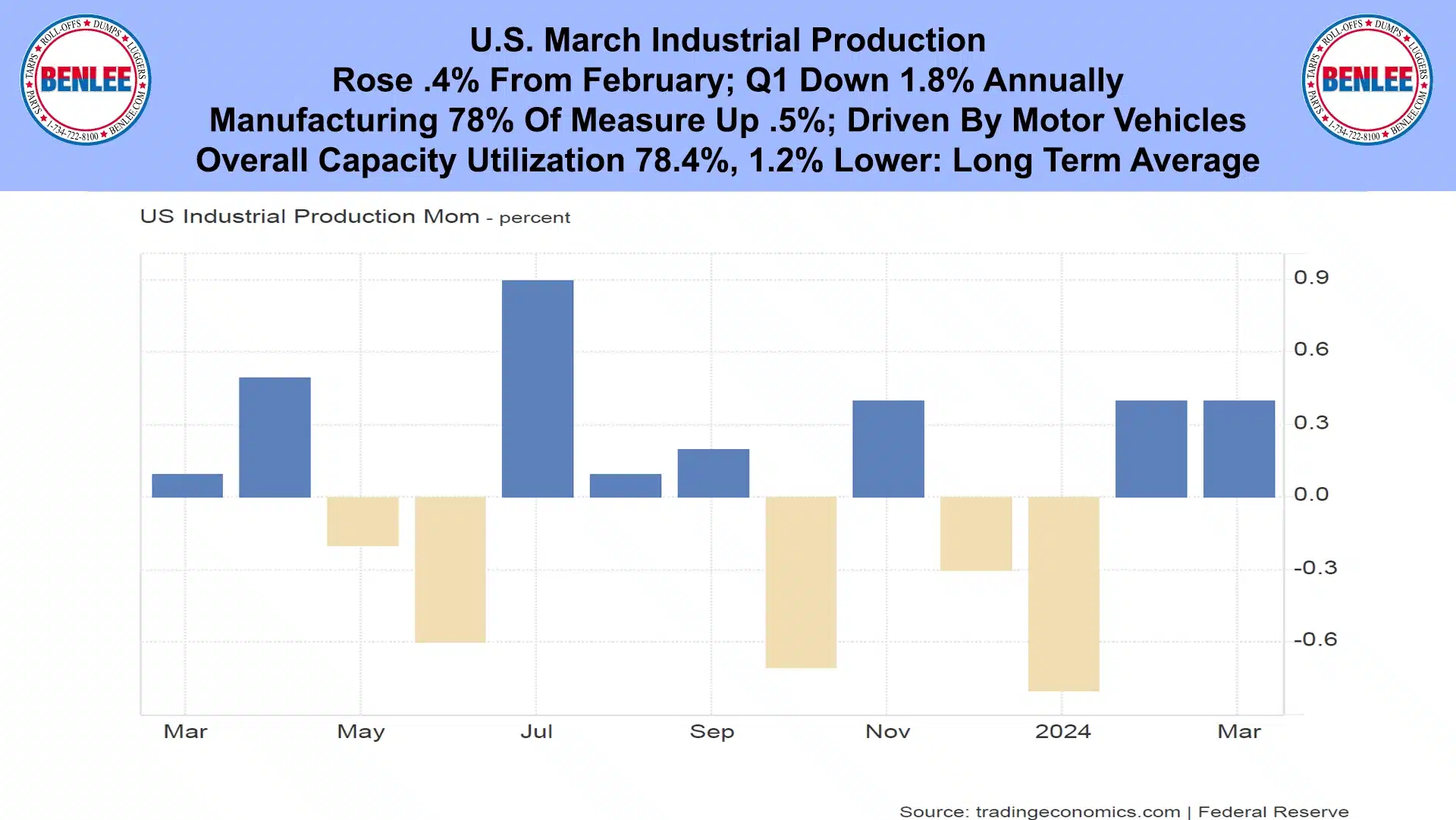

U.S. March industrial production rose .4% from February, with Q1 down 1.8% annually. Manufacturing is 78% of this measure and was up .5%, driven by motor vehicle production. Overall capacity utilization was 78.4%, 1.2% lower than the long term average.

U.S. March retail sales increased 4% vs last year on a 3.5% inflation. It was up a big .7% vs February as online stores were up 2.7% from February.

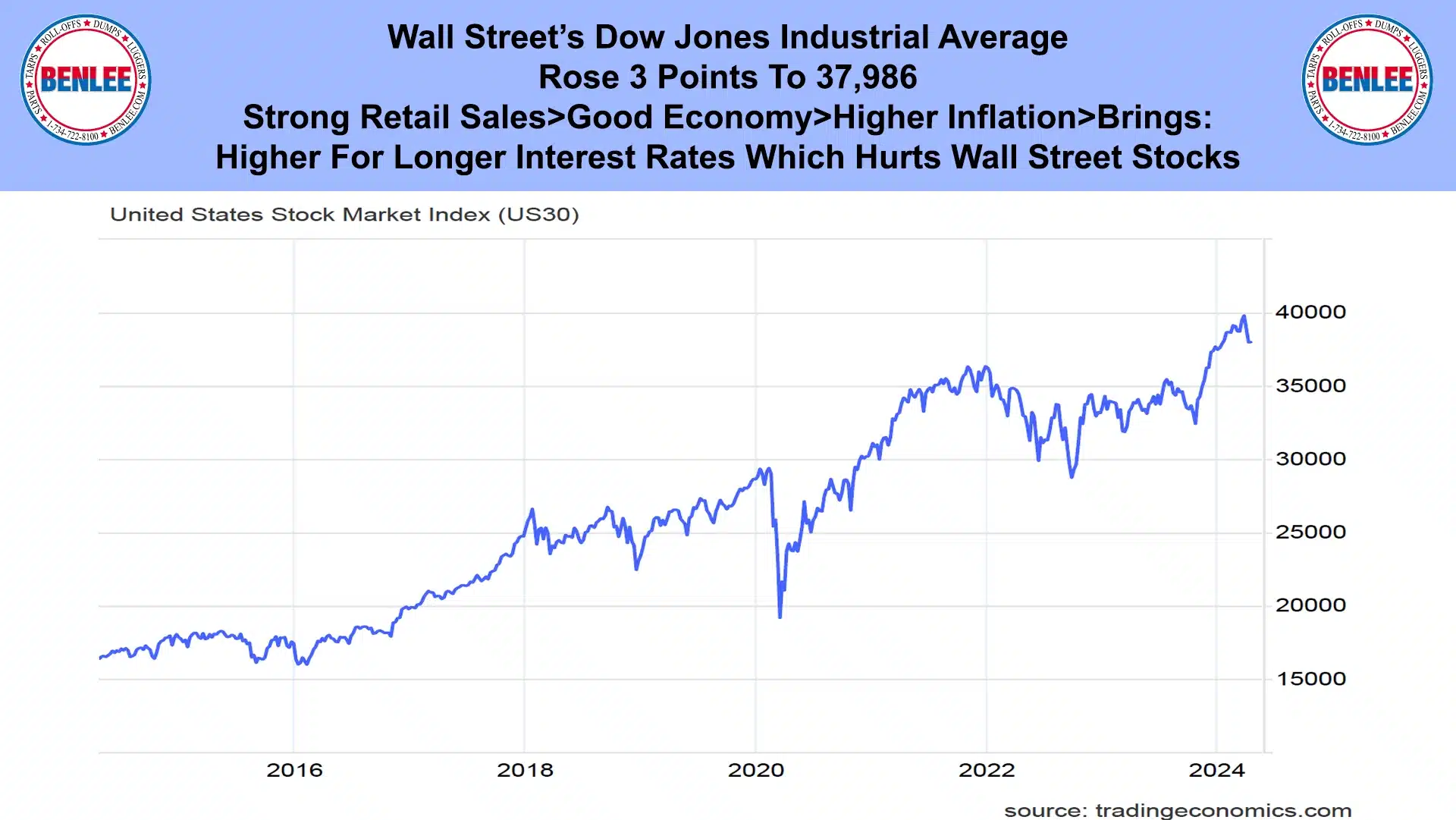

Wall Street’s Dow Jones industrial average rose 3 points to 37,986. Strong retail sales means there is a good economy, which brings higher inflation, which brings higher for longer interest rates, which hurts Wall Street Stocks.

This report by Greg Brown from is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.