March 24, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, March 24th, 2025.

U.S. weekly raw steel production fell slightly to 1.667MT down 1.7% from last year and down 1.3% year to date. Despite tariffs, steel mills announced layoffs and earnings declines.

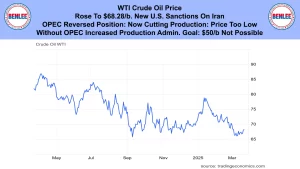

WTI crude oil price rose to $68.28/b. on new U.S. sanctions on Iran. Also, OPEC reversed their position and are now cutting production because oil prices are too low. Without OPEC increasing production in at least the short run, the administration’s goal of $50/b. oil is not possible.

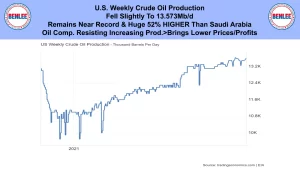

U.S. weekly crude oil production fell slightly to 13.573Mb/d. Production remains near the record and a huge 52% higher than Saudi Arabia. Oil companies are resisting increasing production because it brings lower prices and lower profits.

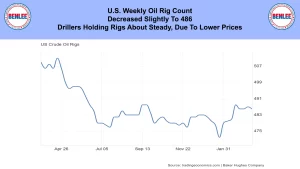

The U.S. weekly oil rig count decreased slightly to 486. Drillers are holding rigs about steady due to lower prices.

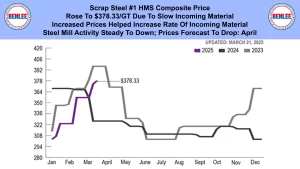

Scrap steel #1 HMS composite price rose to $378.33/GT due to slow incoming material. Increased prices helped increase the rate of incoming material. Steel mill activity is steady to down, so scrap prices are forecast to drop in April.

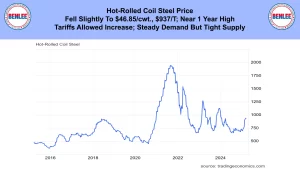

Hot-rolled coil steel price fell slightly to $46.85/cwt. which is $937/T near a 1 year high. Tariffs allowed an increase in recent weeks while there is steady demand, but tight supply.

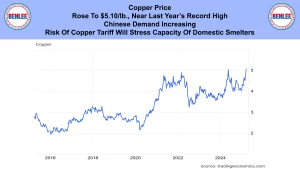

Copper price rose to $5.10/lb. near last year’s record high. Chinese demand is increasing. Also, the risk of a copper tariff will stress the capacity of domestic smelters.

Aluminum price fell to $1.19/lb., $2,626/MT as new global alumina production is coming online.

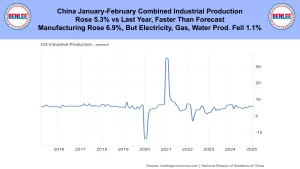

China’s January-February combined industrial production rose 5.3% vs last year, faster than forecast. Manufacturing rose 6.9% but electric, gas, and water production fell 1.1%.

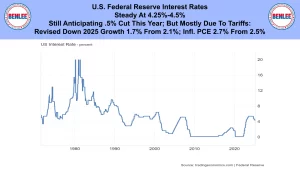

U.S. Federal Reserve Interest rates were kept steady at 4.25% to 4.5%. They announced they were still anticipating a .5% cut this year. They also announced that mostly due to tariffs they revised down growth to 1.7% from 2.1% and revised up inflation as measured by the PCE to 2.7% from 2.5%.

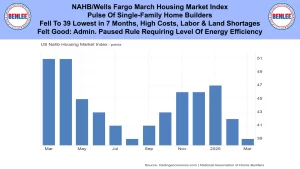

NAHB/Wells Fargo March housing market index, the pulse of single-family home builders. It fell to 39, the lowest in 7 months on high costs and labor and land shortages. They felt good about the Administration pausing the rule requiring a certain level of energy efficiency in buildings

U.S. February retail sales a major driver of the U.S. economy. They increased 3.1% over last year, which was slowing and below forecast. Restaurants, bars, gasoline all fell while online stores rose. Excluding food services, auto dealers, gas and building materials, sales jumped 1%

U.S. February existing home sales rose 4.2% to 4.26M annualized, but near the rate of 1978, 47 years ago. It was above market expectations as buyers were slowly entering the market.

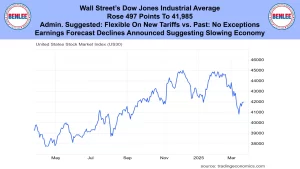

Wall Street’s Dow Jones Industrial average rose 497 points to 41,985. This was as the administration suggested they may be flexible on new tariffs, vs in the past saying no exceptions. Also, as there were earning forecast declines announced with is suggesting a slowing economy.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.