Recycling, Scrap Metal, Commodities and Economic Report

March 18, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, March 18th, 2024.

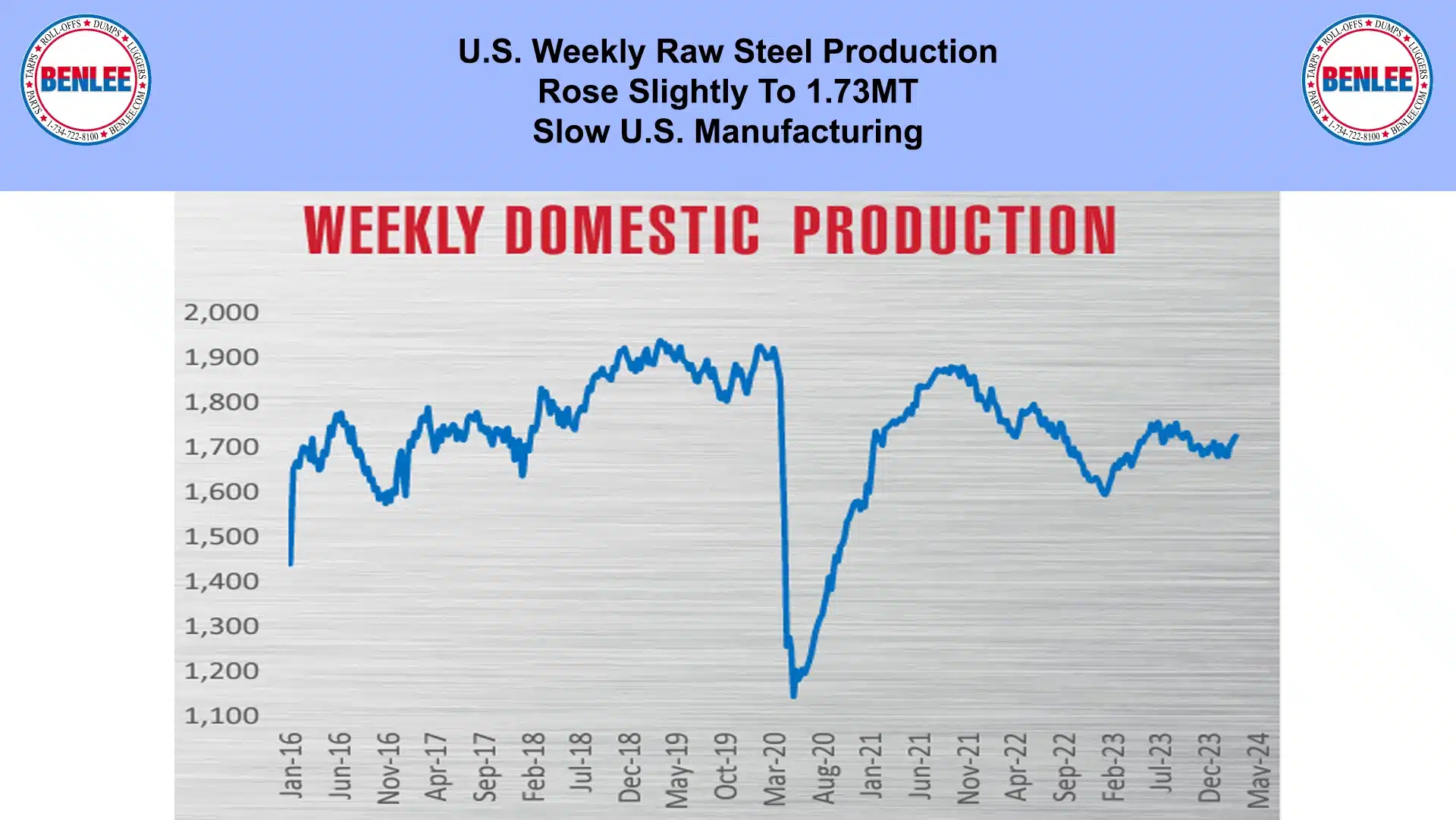

U.S. weekly raw steel production rose slightly to 1.73MT on slow U.S. manufacturing.

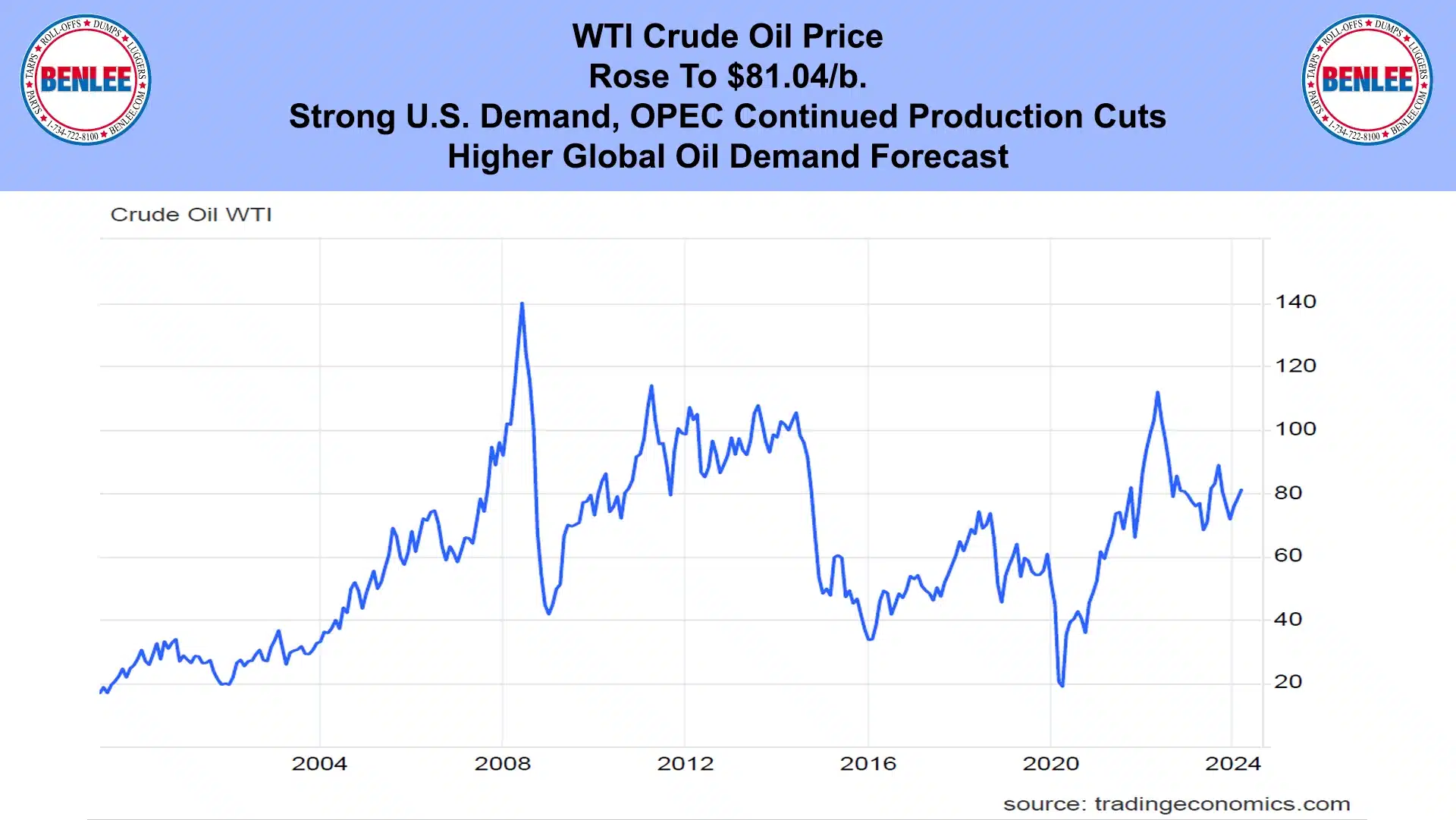

WTI crude oil price rose to $81.04/b. on strong U.S. demand, OPEC continued production cuts and a higher global oil demand forecast.

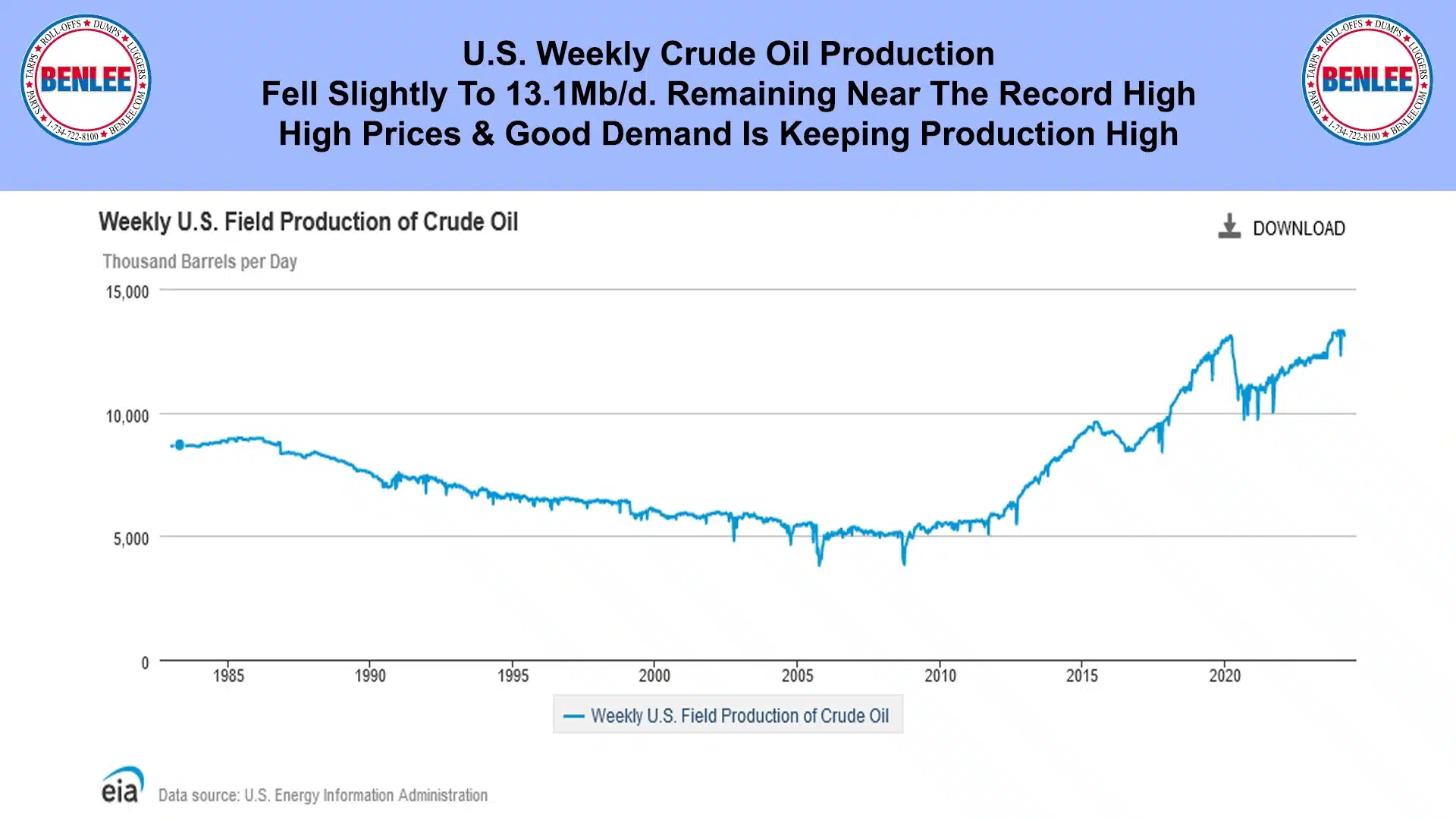

U.S. weekly crude oil production fell slightly to 13.1Mb/d. remaining near the record high. High prices and good demand is keeping production high.

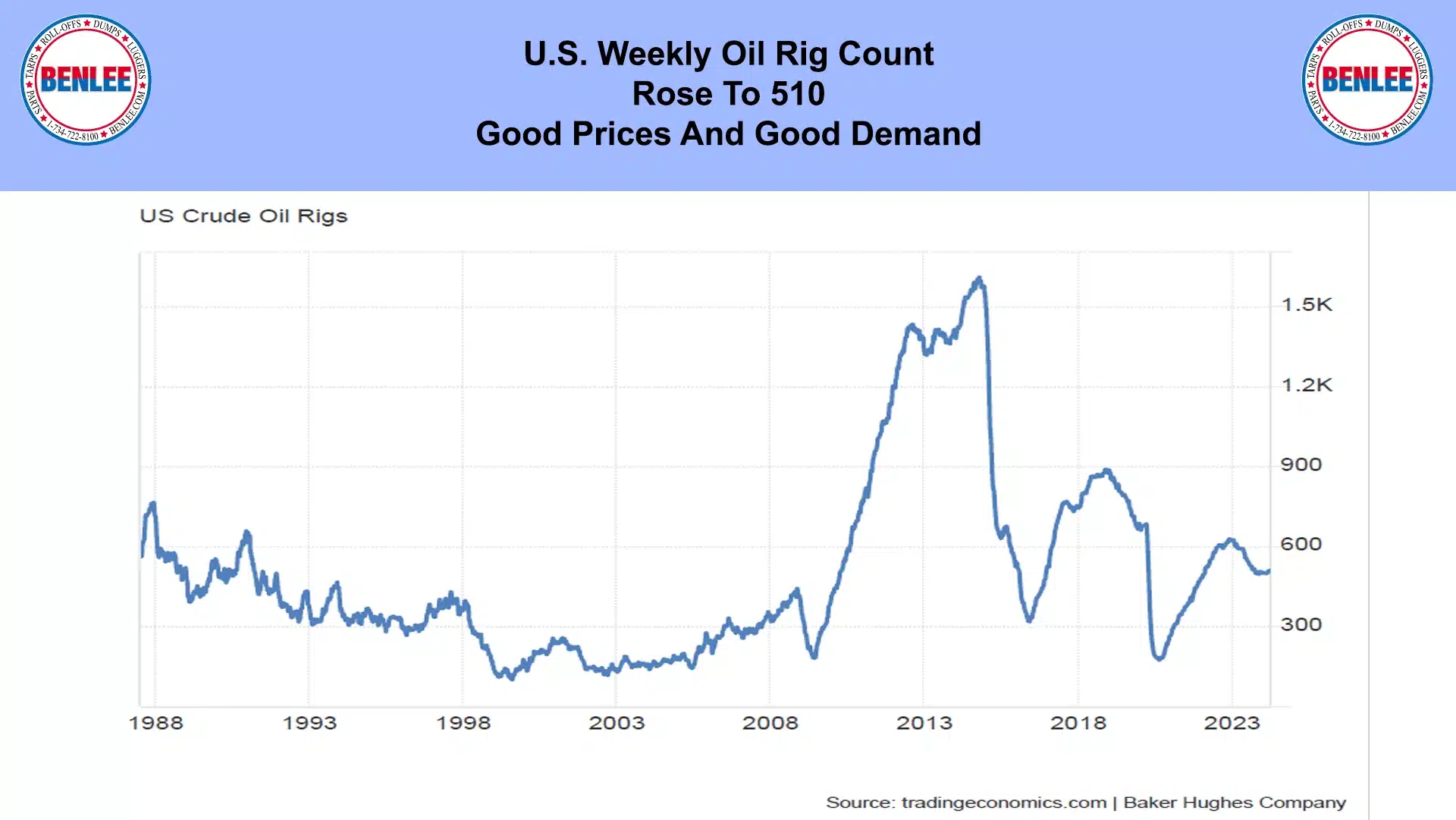

The U.S. weekly oil rig count rose to 510 on good prices and good demand.

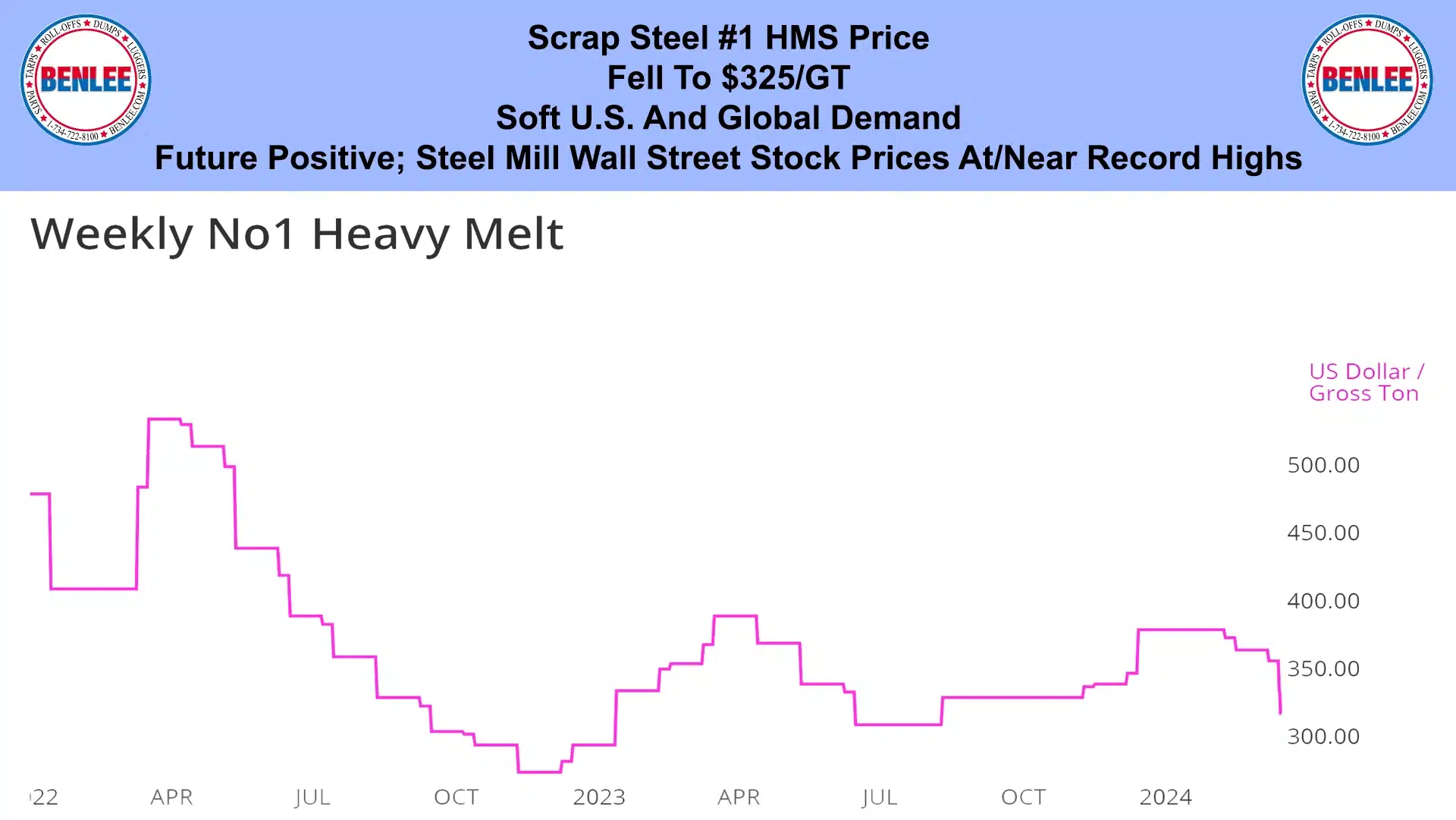

Scrap steel #1 HMS price fell to $325/GT on soft U.S. and global demand. The future is positive though as steel mill Wall Street stock prices are at or near record highs.

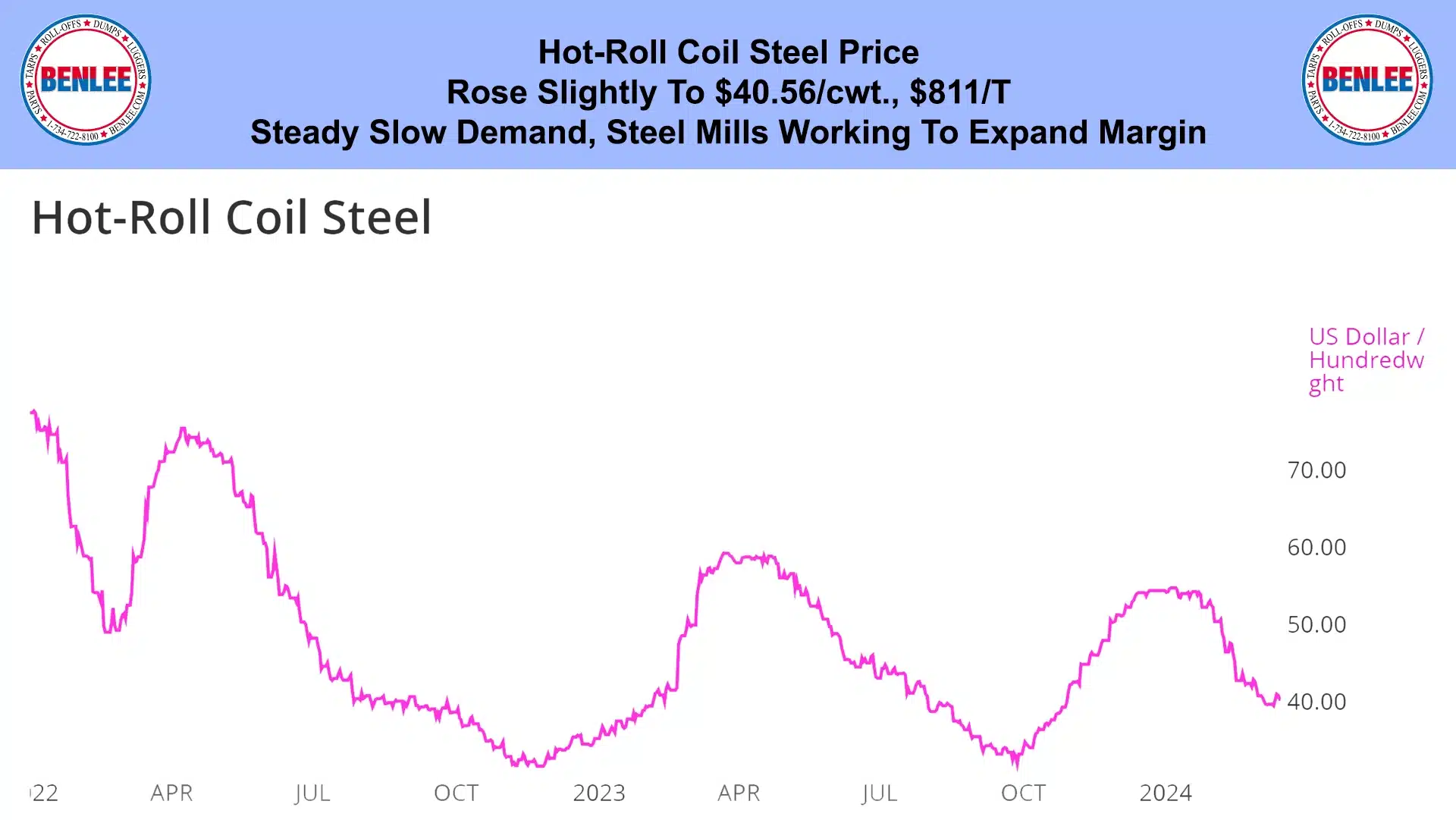

Hot-roll coil steel price rose slightly to $40.56/cwt. $811/T on slow steady demand, as steel mills are working to expand margins.

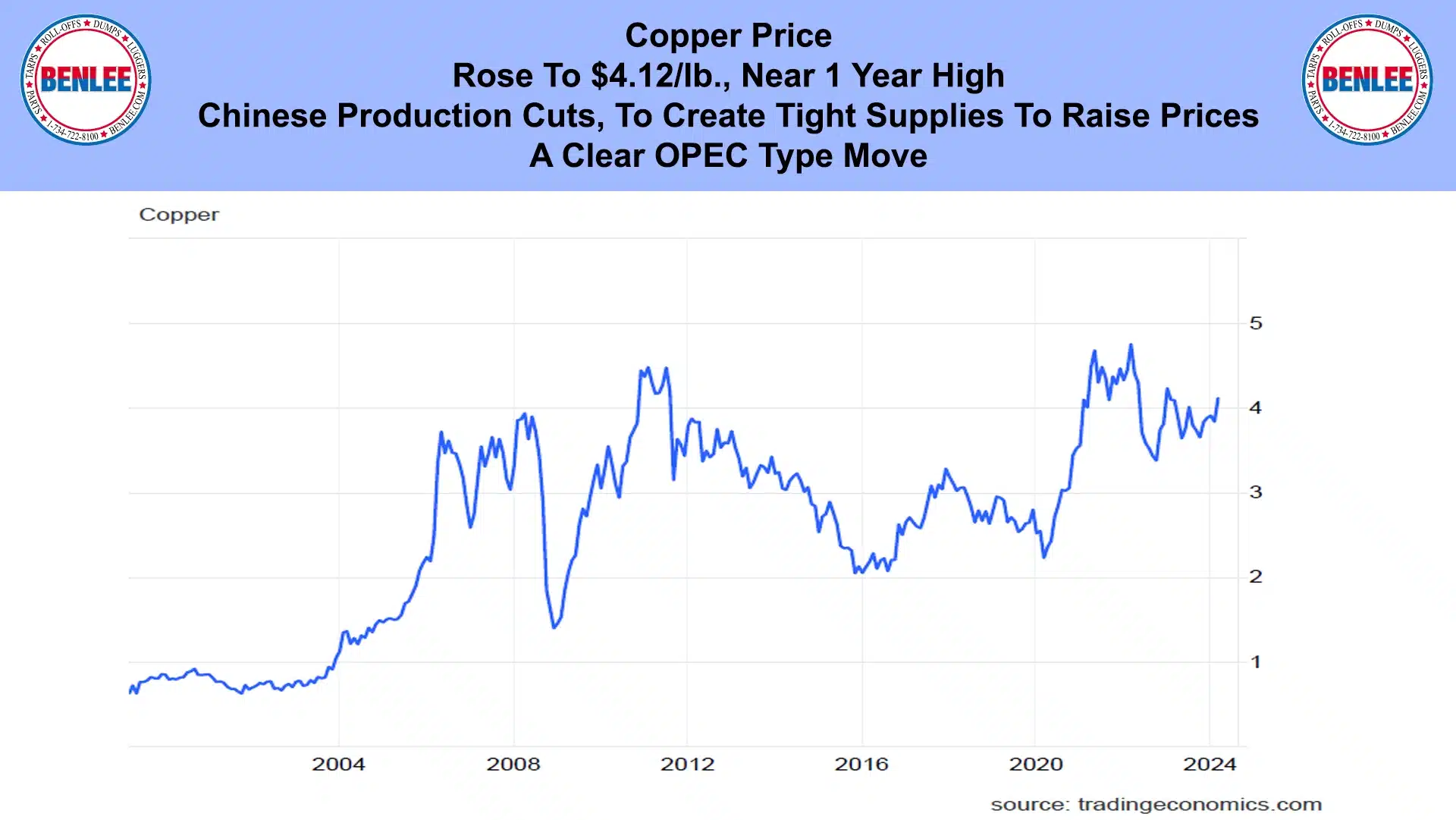

Copper price rose to $4.12/lb., near a one year high. This was on Chinese production cuts to create tight supplies to raise prices. A clear OPEC type move.

Aluminum price rose to $1.03/lb., $2,277/mt on concerns over Middle East supplies. Also, on higher shipping costs of aluminum.

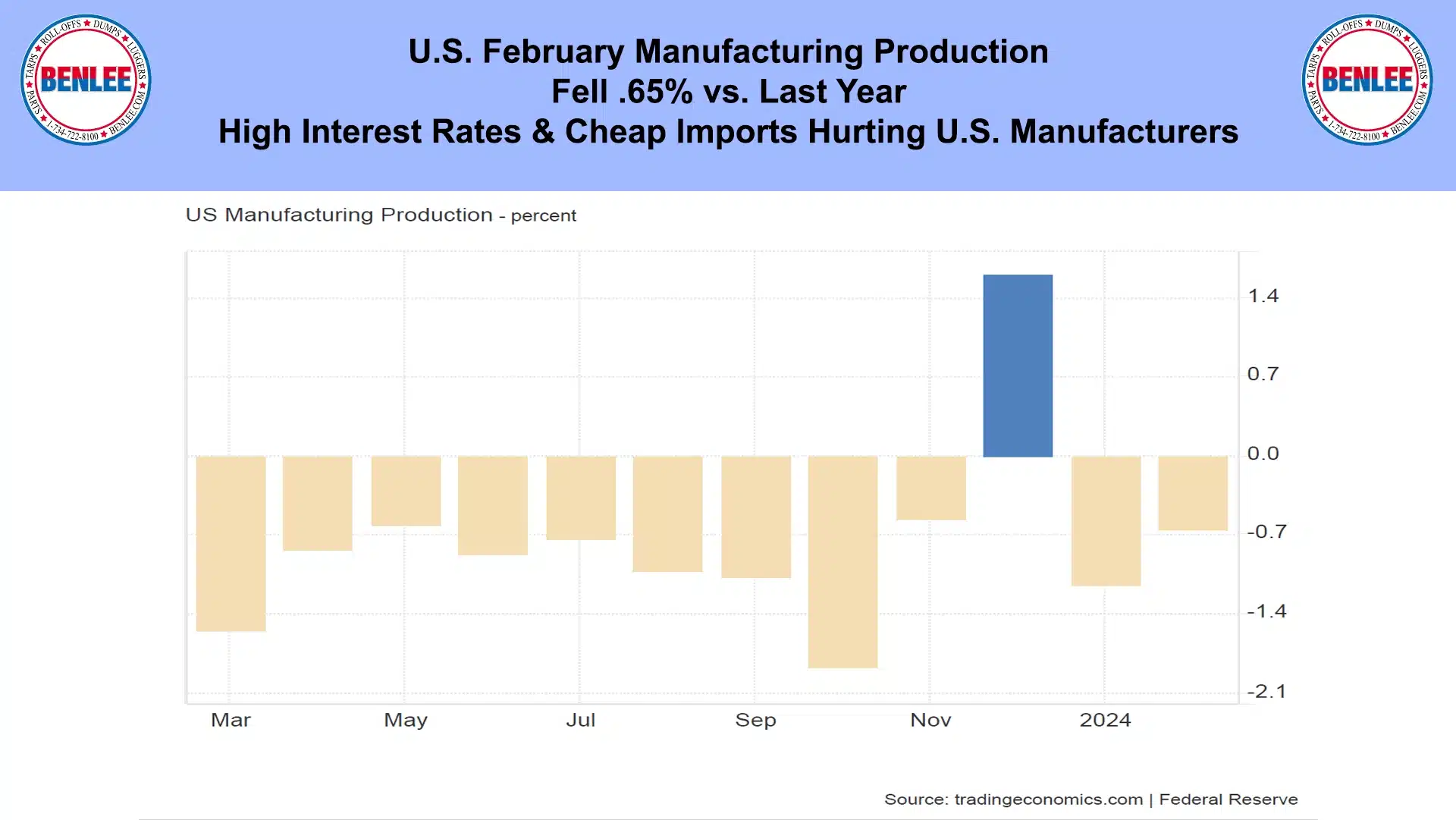

U.S. February Manufacturing production fell .65% from last year. This was on high interest rates and cheap imports hurting U.S. manufacturers.

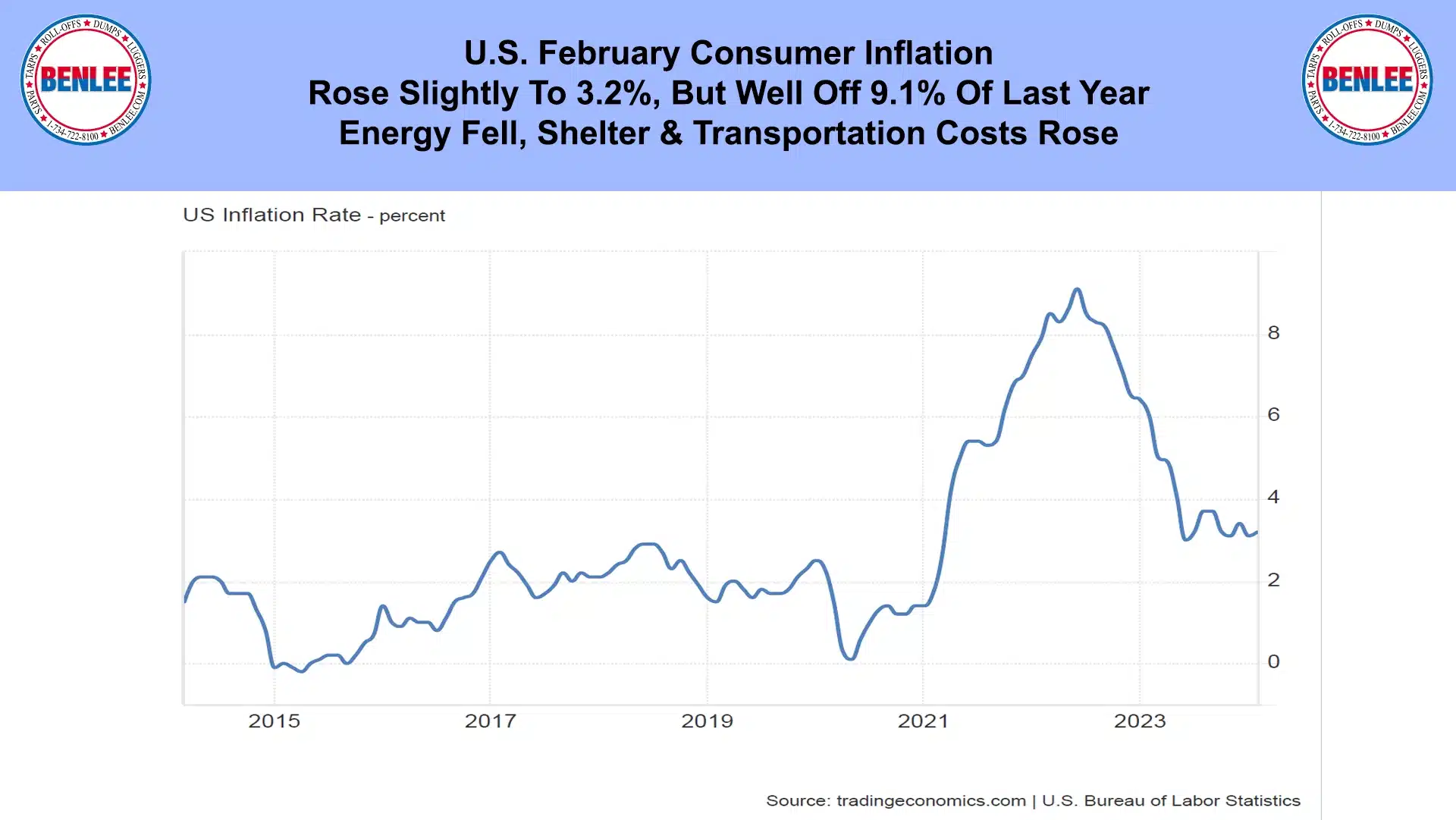

U.S. February Consumer inflation rose slightly to 3.2%, but well off the 9.1% of last year. Energy fell, while shelter and transportation costs rose.

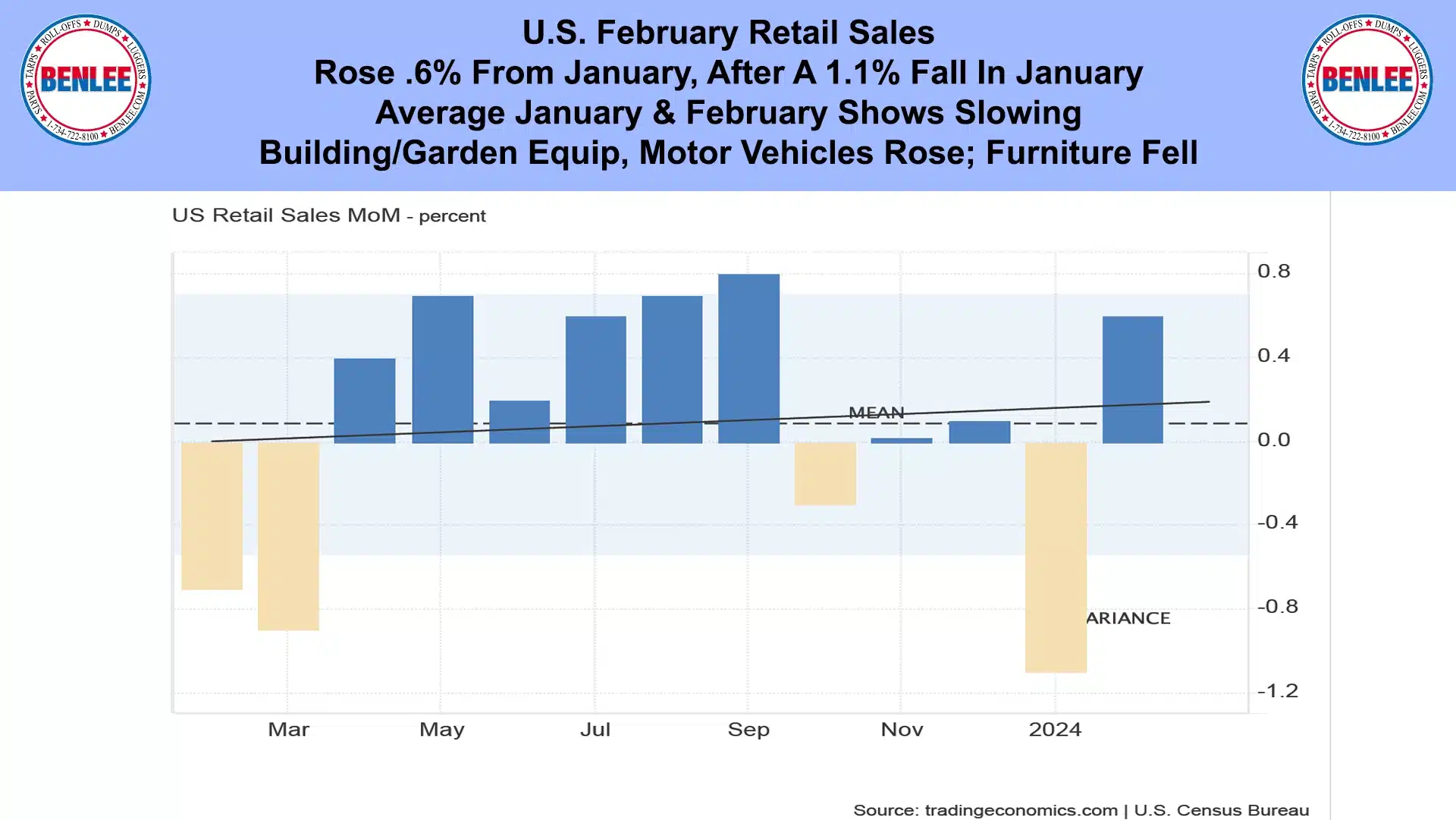

U.S. February retail sales rose .6% from January, after a 1.1% fall in January. Average January February together shows slowing. Building and garden equipment along with motor vehicles rose, while furniture fell.

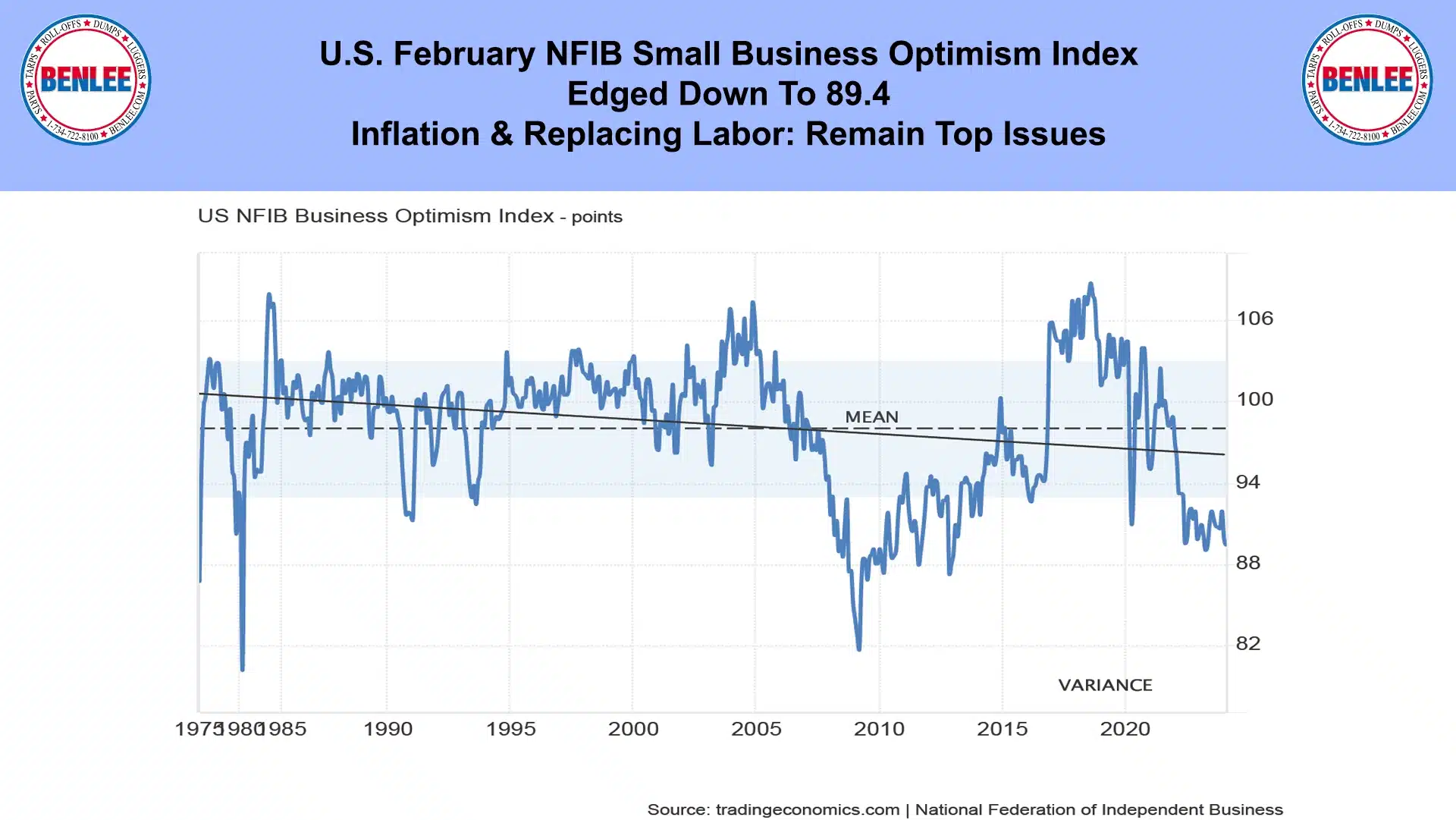

U.S. February NFIB small business optimism index edged down to 89.4. Inflation and replacing labor remain top issues.

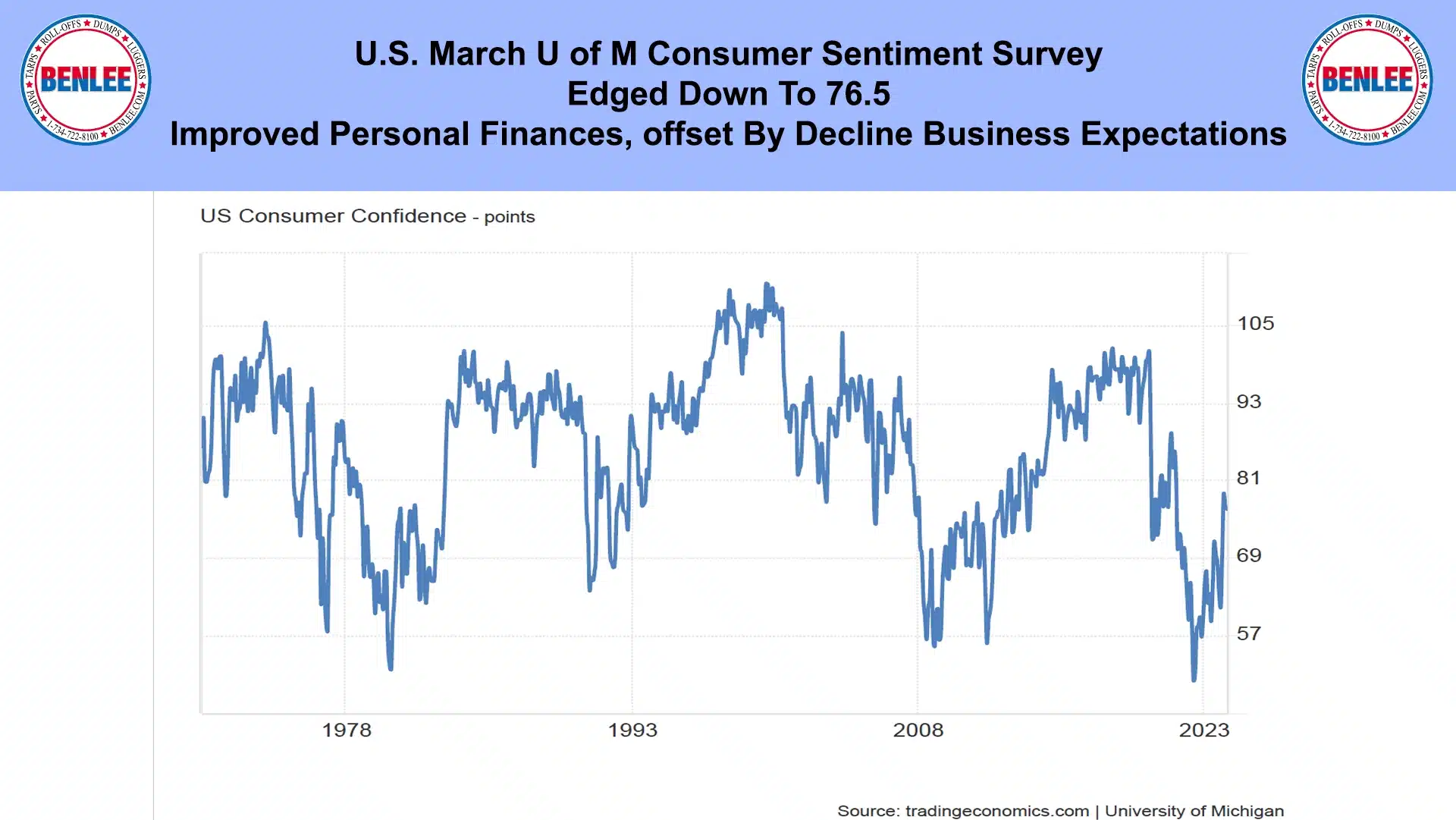

U.S. March U of M consumer sentiment survey edged down to 76.5. Improved personal finances were offset by a decline in business expectations.

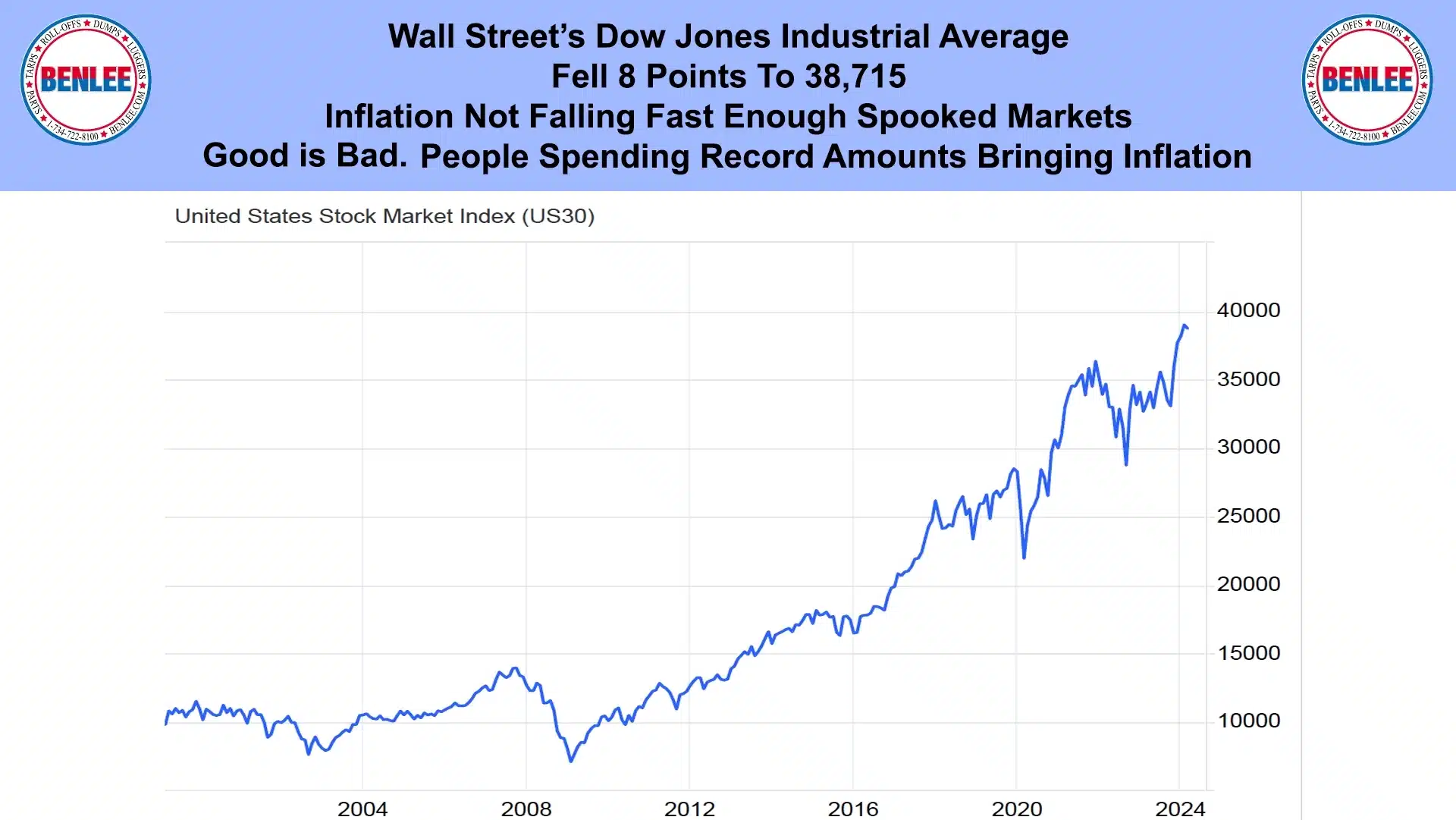

Wall Street’s Dow Jones Industrial Average fell 8 points to 38,715. Inflation not falling fast enough spooked markets. Good news is bad news. People spending record amount of money is bringing the inflation.

This report by Greg Brown is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.