March 17, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, March 17th, 2025.

U.S. weekly raw steel production rose slightly to 1.67MT. New steel tariffs will help U.S. production.

WTI crude oil price rose slightly to $67.18/b., but there was a new lower global oil demand forecast issued. The U.S. Administration is targeting $50/b. oil to offset higher tariff costs. Oil price is down, not on increased U.S. production, but on the lower global oil demand.

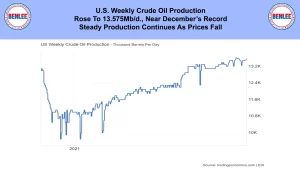

U.S. weekly crude oil production rose to 13.575Mb/d., near December’s record. Steady production continues as prices fall.

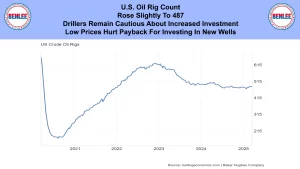

The U.S. weekly oil rig count rose slightly to 487. Drillers remain cautious about increased investment. Low prices hurt the payback for investing in new wells.

Scrap steel #1 HMS composite price is still settling at about $376/GT. Tariffs on Mexico and Canada are causing scrap price instability.

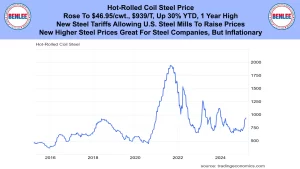

Hot-rolled coil steel price rose to $46.95/cwt., $939/T, up 30% YTD and is a 1 year high. New steel tariffs are allowing U.S. steel mills to raise prices. The new higher prices are great for steel companies, but are inflationary.

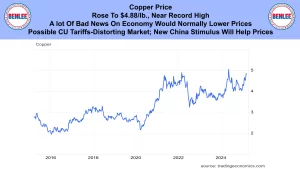

Copper price rose to $4.88/lb., near a record high. A lot of bad news on the economy would normally lower prices. Possible copper tariffs are distorting the market, as new Chinese stimulus will also help prices.

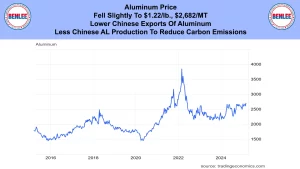

Aluminum price fell slightly to $1.22/lb., $2,682/MT on lower Chinese exports of aluminum. There has been less Chinese aluminum production to reduce carbon emissions.

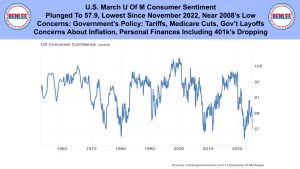

U.S. March U of M Consumer Sentiment plunged to 57.9, the lowest since November 2022, and near 2008’s low. This was on concerns around the government’s policy of tariffs, Medicare cuts and government layoffs. Also, on concerns about continued inflation as well as personal finances including 401k’s that are dropping.

–

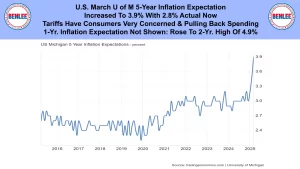

U.S. March U of M 5-year inflation expectation increased to 3.9% with 2.8% actual now. Tariffs have consumers very concerned and they are pulling back spending. One year inflation expectation not shown here rose to a 2 year high of 4.9%.

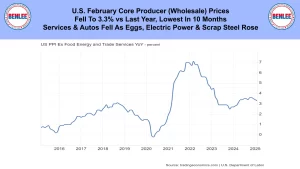

U.S. February core producer wholesale prices fell to 3.3% vs last year, the lowest in 10 months. Services and autos fell as eggs, electric power and scrap steel rose.

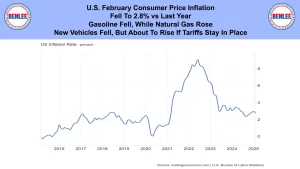

U.S. February consumer price inflation fell to 2.8% vs last year. Gasoline fell while natural gas rose. Also, new vehicles fell but are about to rise if tariffs stay in place.

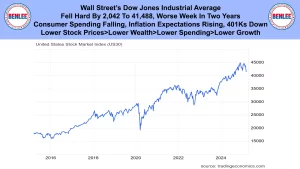

Wall Street’s Dow Jones Industrial average fell a big 2,042 points to 41,488 the worst week in two years. Consumer spending is falling and inflation expectations rising as 401ks are down. Lower stock prices means lower wealth that causes lower spending, which brings lower economic growth.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.