March 10, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, March 10th, 2025.

U.S. weekly raw steel production fell to 1.64MT down 4.6% from last year and down 1.3% year to date. March 12th ‘s steel tariffs already raised steel prices and production increases should follow.

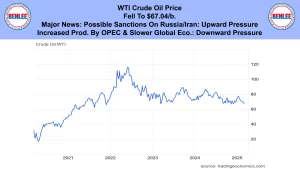

WTI crude oil price fell to $67.04/b. Major news with possible new sanctions on Russia and Iran brings upward price pressure. Increased production by OPEC and slower global economic growth brings downward pressure.

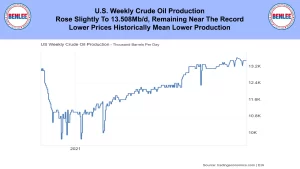

U.S. weekly crude oil production rose slightly to 13.508Mb/d, remaining near the record. Lower prices historically mean lower production.

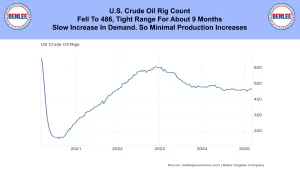

The U.S. weekly oil rig count fell to 486 which has been in a tight range for about 9 months. There has been a slow increase in demand, so there were minimal production increases.

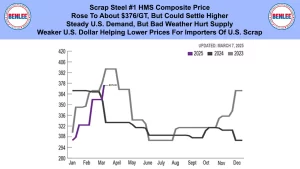

Scrap steel #1 HMS composite price rose to about $376/GT, but could settle higher. There has been steady U.S. demand, but bad weather hurt supply and the weaker U.S dollar is helping lower the prices for importers of U.S. scrap.

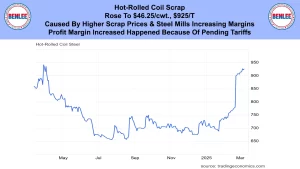

Hot-rolled coil steel price rose to $46.25/cwt., $925/T. This was caused by higher scrap prices and steel mills increasing profit margins. Margin increases happened because of the pending tariffs.

Copper price rose to $4.71/lb. Possible tariffs by the U.S. on copper is causing demand to beat the tariffs.

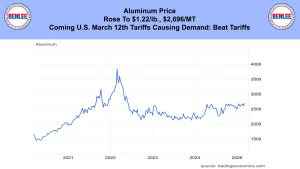

Aluminum price rose to $1.22lb., $2,696/MT. The coming U.S. March 12th tariffs are causing demand to beat the tariffs.

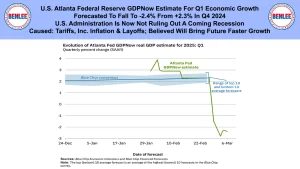

The U.S. Atlanta Federal Reserve GDPNow estimate for Q1 economic growth. It is forecasted to fall to a negative 2.4% growth from a positive 2.3% in Q4 2024. The U.S. Administration is now not ruling out a coming recession. This could be caused by the tariffs that bring increased inflation. Also, by DOGE layoffs. It is believed that this will bring future faster growth.

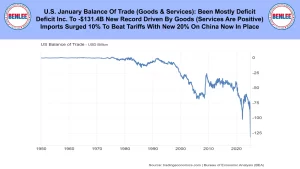

U.S. January balance of trade, which is goods and services and as been mostly a deficit. The deficit increased to a negative $131.4B a new record driven by goods, while services are a positive. Imports surged 10% to beat tariffs with the new 20% tariffs on China now in place.

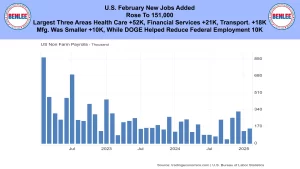

U.S. February new jobs added rose to 151,000. The three largest areas were healthcare 52K, financial services 21,000 and transportation 18,000. Manufacturing was a smaller 10,000 while DOGE helped reduce federal employment by 10,000.

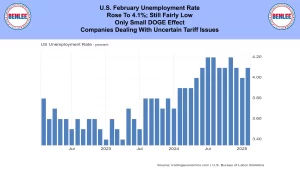

U.S. February unemployment rate rose to 4.1% which is still a fairly low number. There was only a small DOGE effect. Also, companies are dealing with uncertain tariff issues.

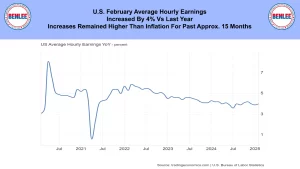

U.S. February average hourly earnings increased by 4% vs last year. Increases remained higher than inflation for the past approximately 15 months.

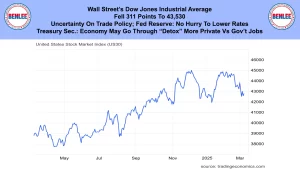

Wall Street’s Dow Jones Industrial average fell 311 points to 43,530. This was on uncertainty on trade policy and the Federal Reserve saying they are in no hurry to lower interest rates. Also, the Treasury secretary said the economy may go through a period of Detox as it moves to more private jobs from government jobs.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.