February 6, 2023

This is the Commodities, Scrap Metal, Recycling and Economic Report. Brought to you by BENLEE roll off trailers, gondola trailers and roll off truck parts, February 6th, 2023.

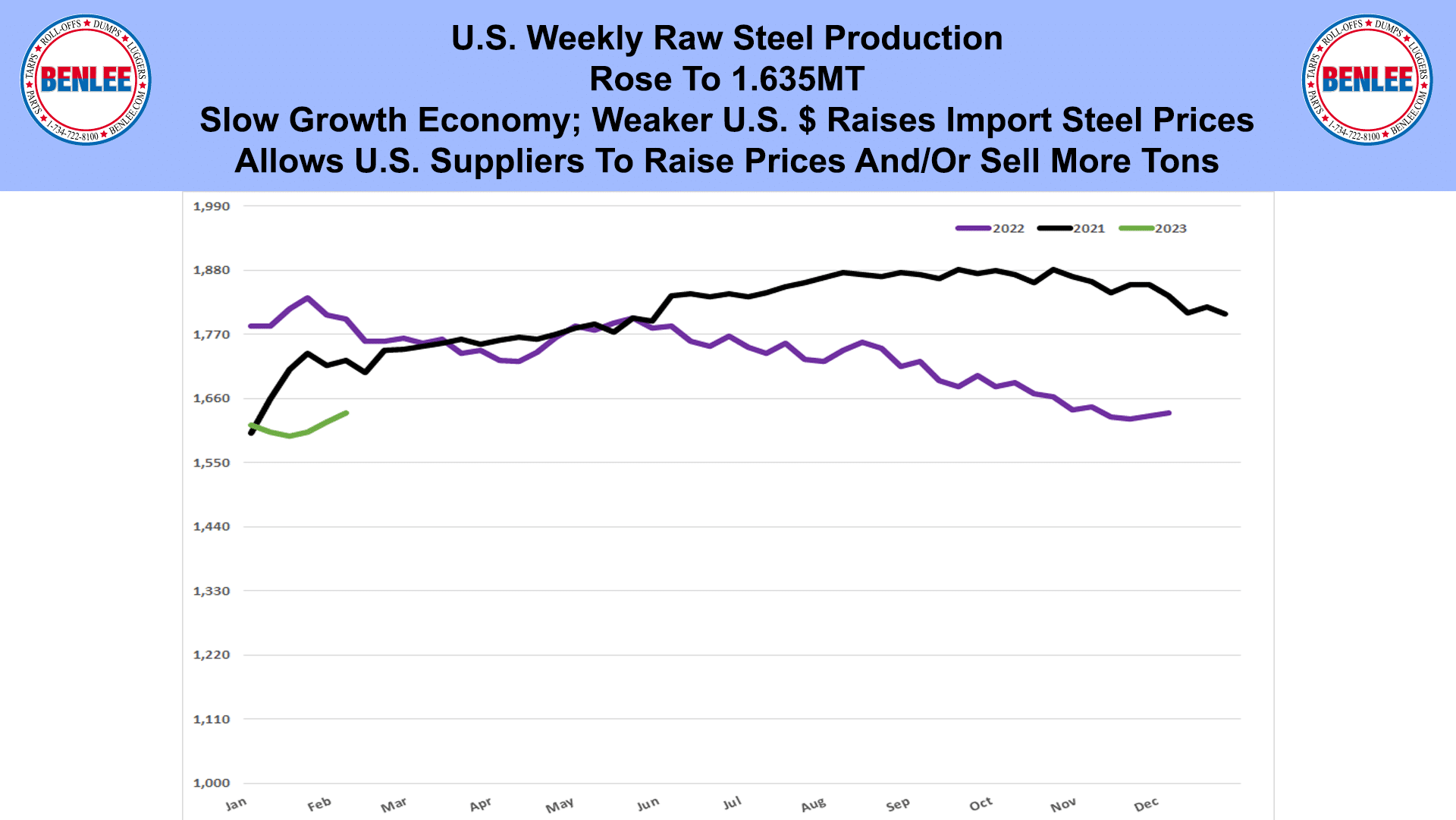

U.S. weekly raw steel production rose to 1.635 MT on a slow growth economy and the weaker U.S. Dollar raised import steel prices. That allows U.S. suppliers to raise prices and/or sell more tons.

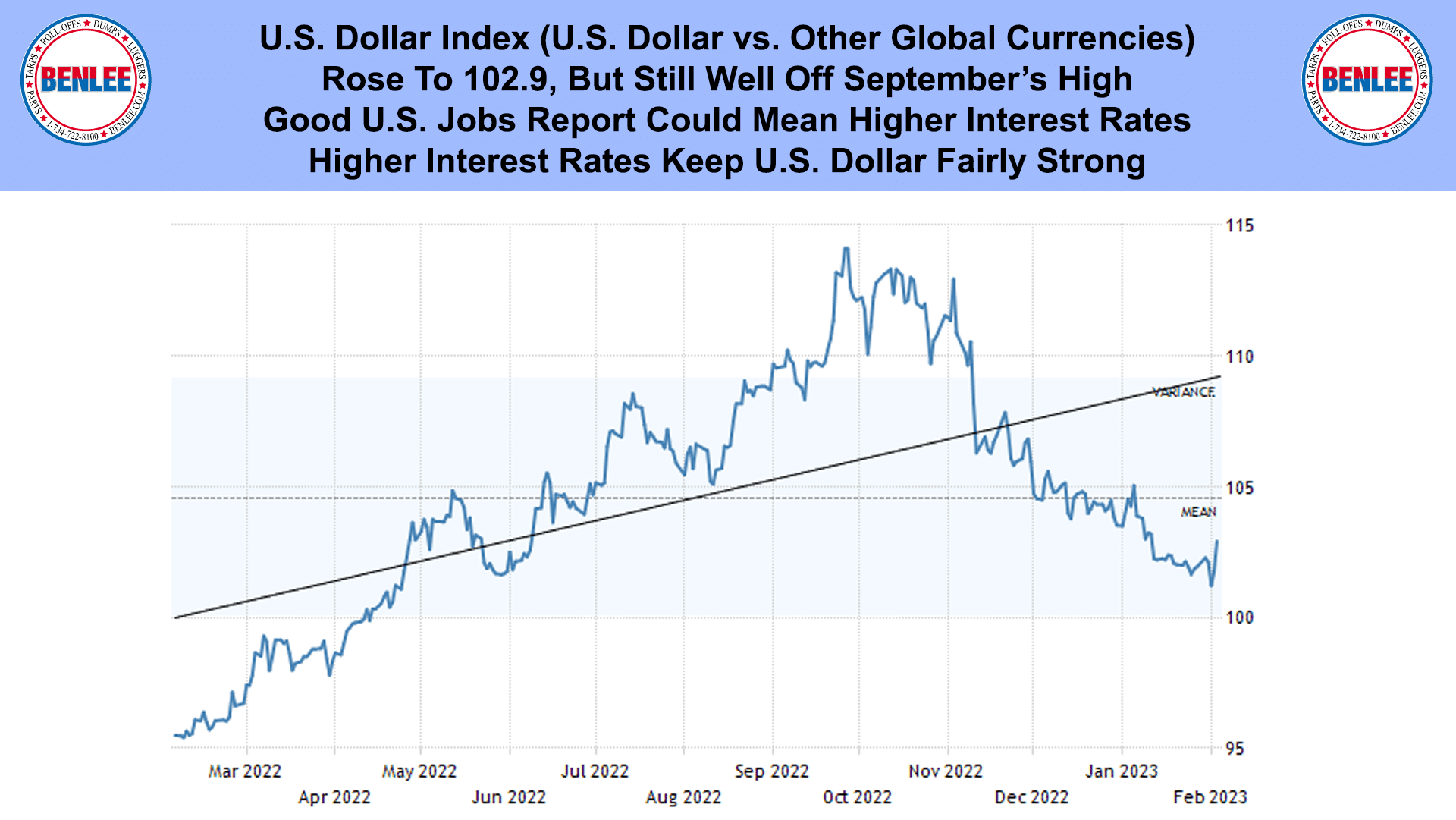

U.S. Dollar index. The U.S. dollar vs. other global currencies. When the U.S. dollar falls, commodities priced in U.S. dollars rises. It rose to 102.9, but still well off the September high. The good U.S. jobs report could mean higher interest rates than planned. That raises the U.S. dollar. Higher interest rates keep U.S. dollar fairly strong.

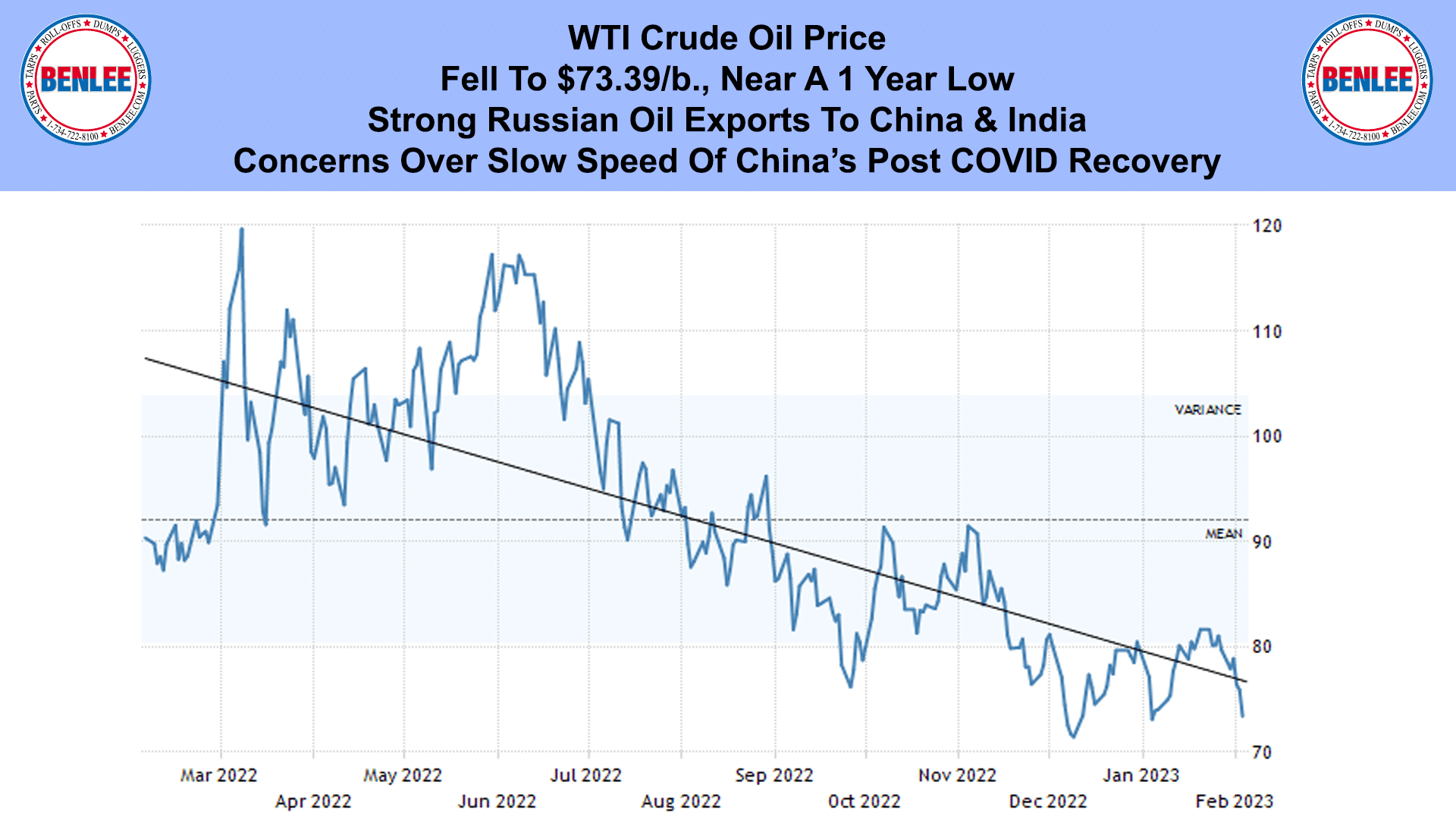

WTI crude oil price fell to $73.39/b, near a one year low. This was on strong Russian exports to China and India and on concerns over the slow speed of China’s post COVID recovery.

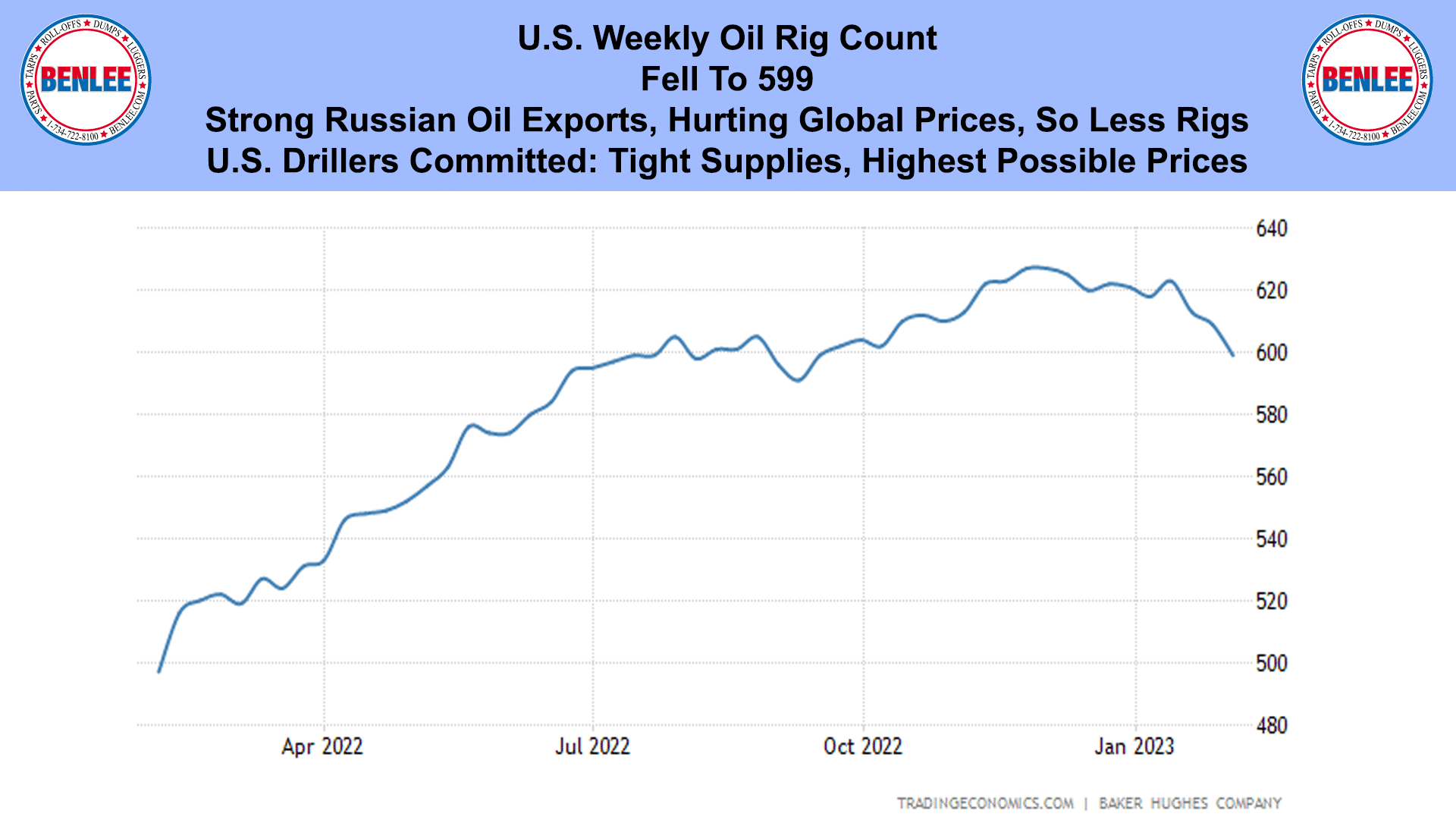

The U.S. weekly oil rig count fell to 599 on strong Russian oil exports hurting global prices. U.S. drillers are committed to tight supplies to get the highest possible prices.

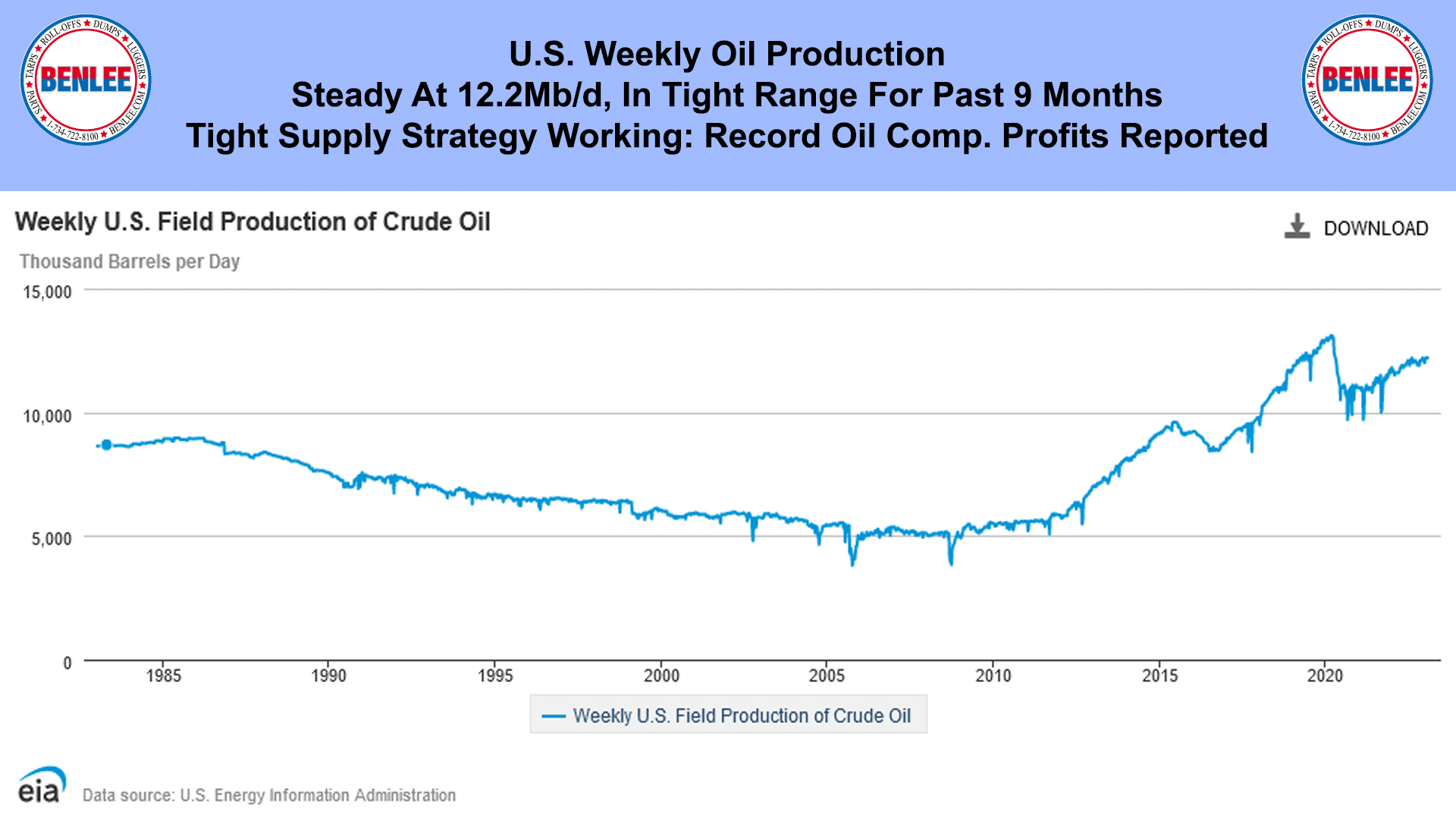

U.S. weekly crude oil production was steady at 12.2Mb/d and in a tight range for the past 9 months. The tight supply strategy is working. This week, oil companies declared record profits.

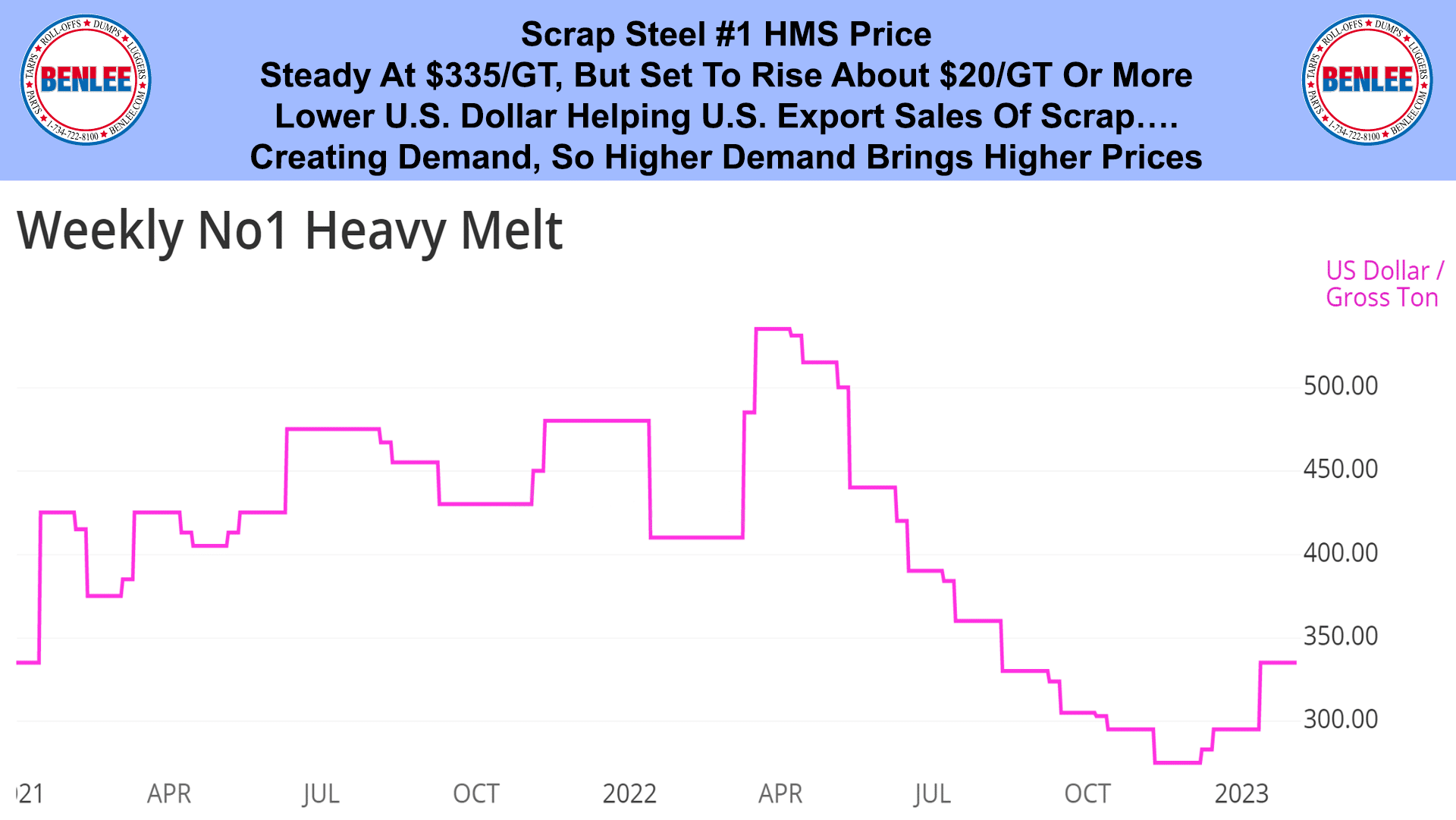

Scrap steel #1 HMS price was steady at $335/GT but set to rise about $20/GT or more. The lower U.S. dollar is helping U.S. export sales of scrap, creating demand for scrap. Higher demand brings higher prices.

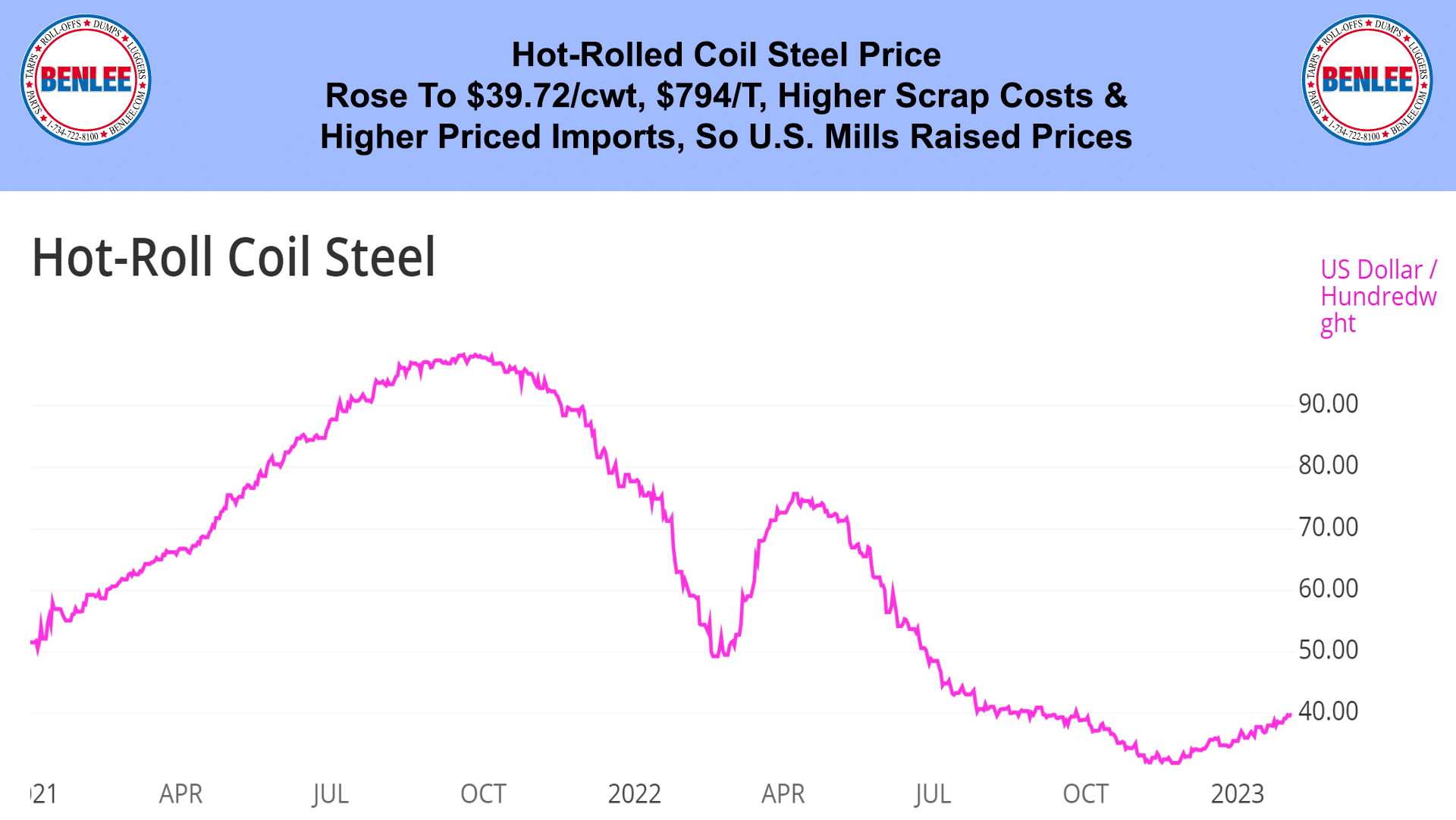

Hot-rolled coil steel price rose to $39.72/cwt., $794/T. This was on higher scrap costs and higher priced imports, so U.S. mills raised prices.

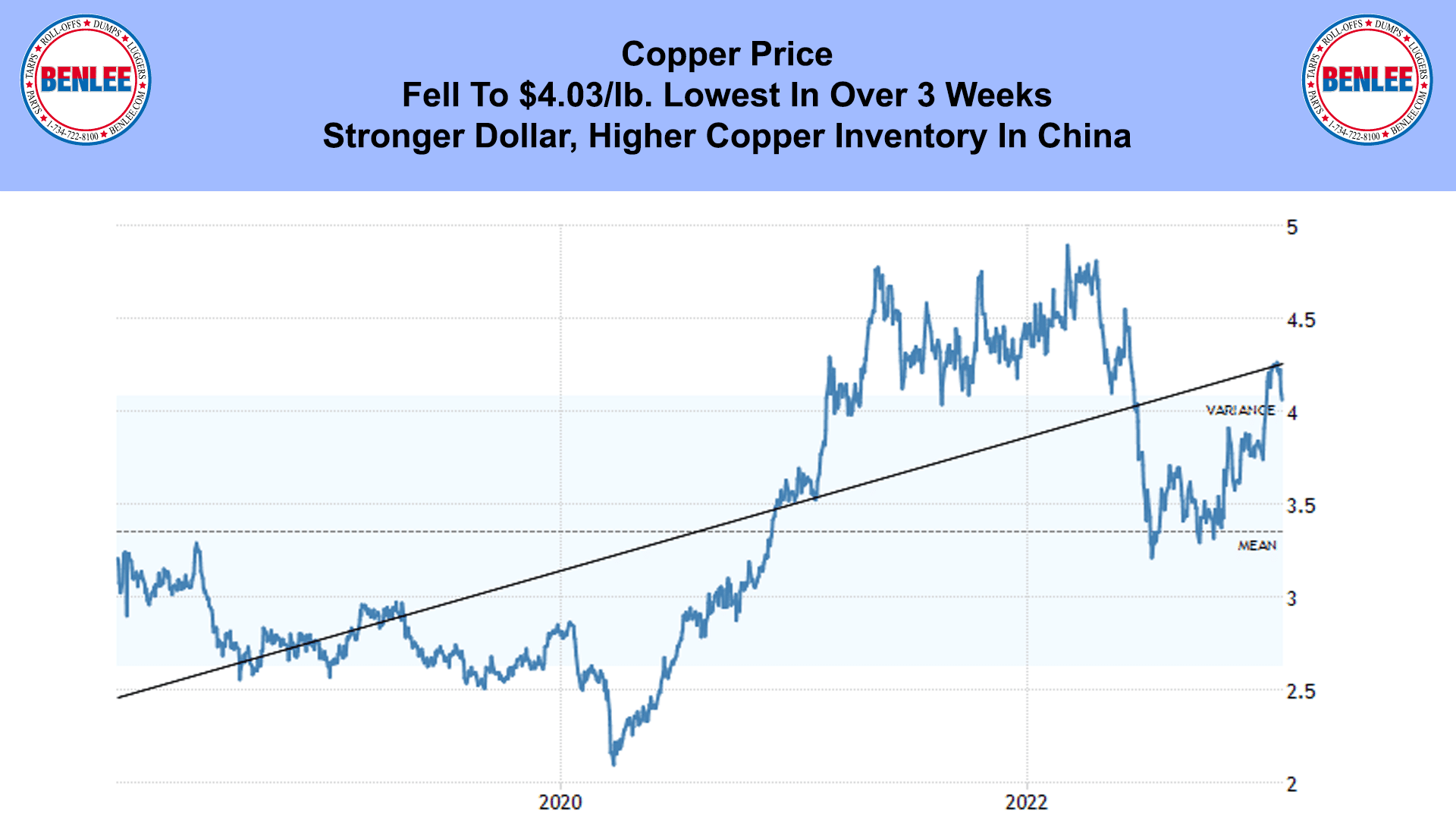

Copper price fell to $4.03/lb., the lowest in over 3 weeks. This was on a stronger dollar and higher copper inventory in China.

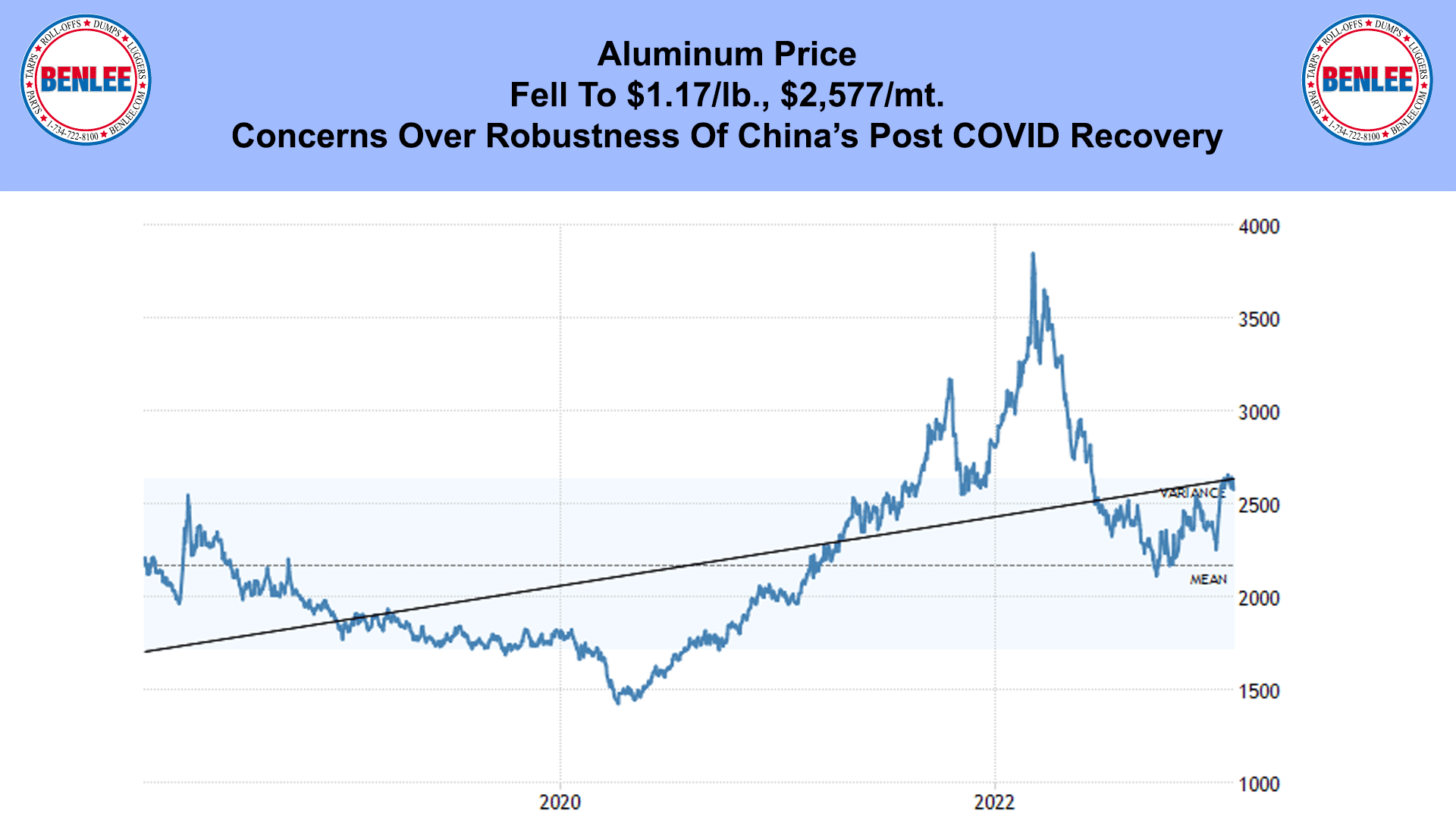

Aluminum price fell to $1.17/lb., $2,577/mt. on concerns over the robustness of China’s post COVID recovery.

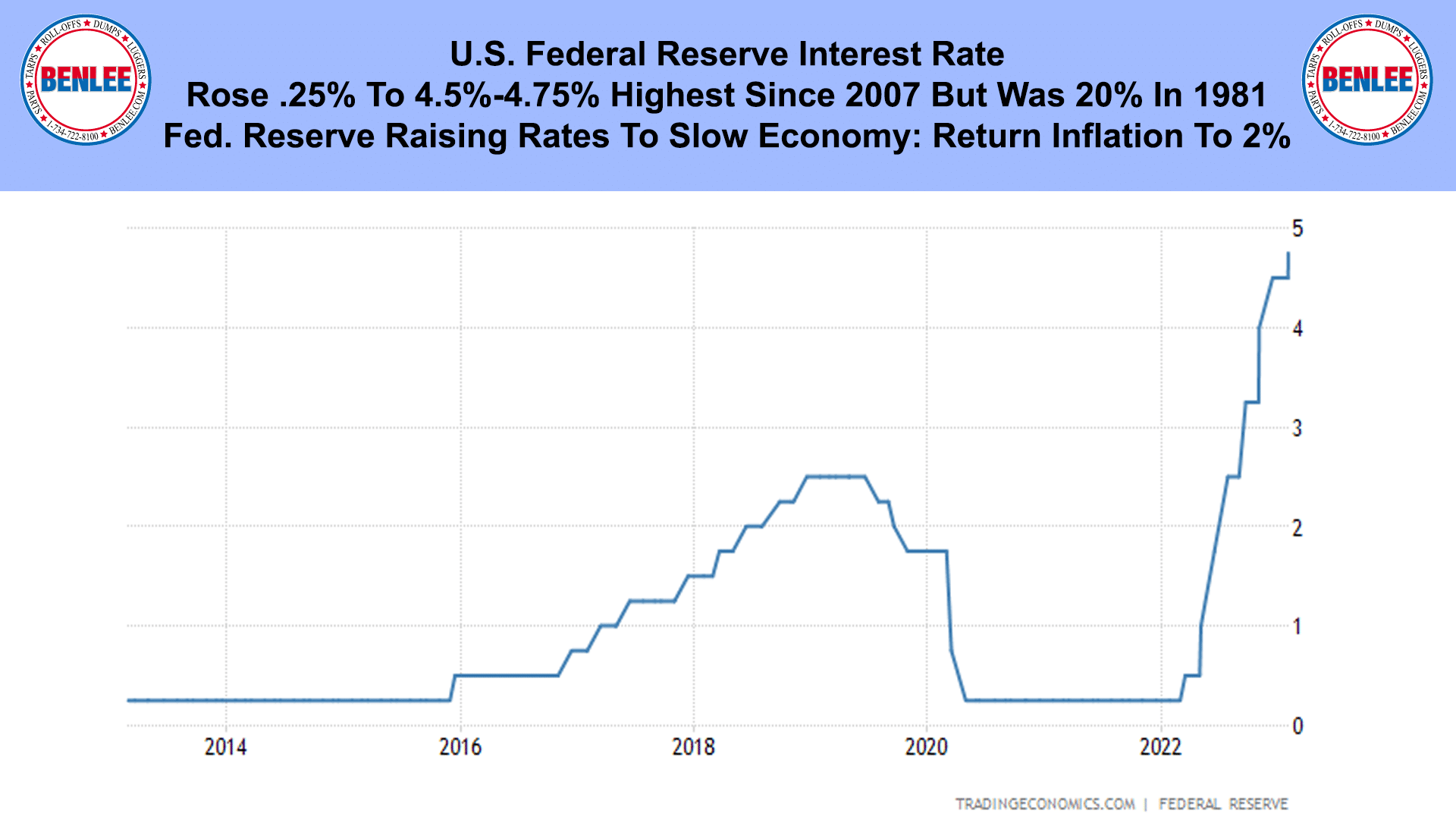

U.S. Federal Reserve Interest Rate It rose .25% to 4.5-4.75%, the highest since 2007, but it was 20% in 1981. The Federal Reserve is raising rates to slow the economy to return inflation to 2%.

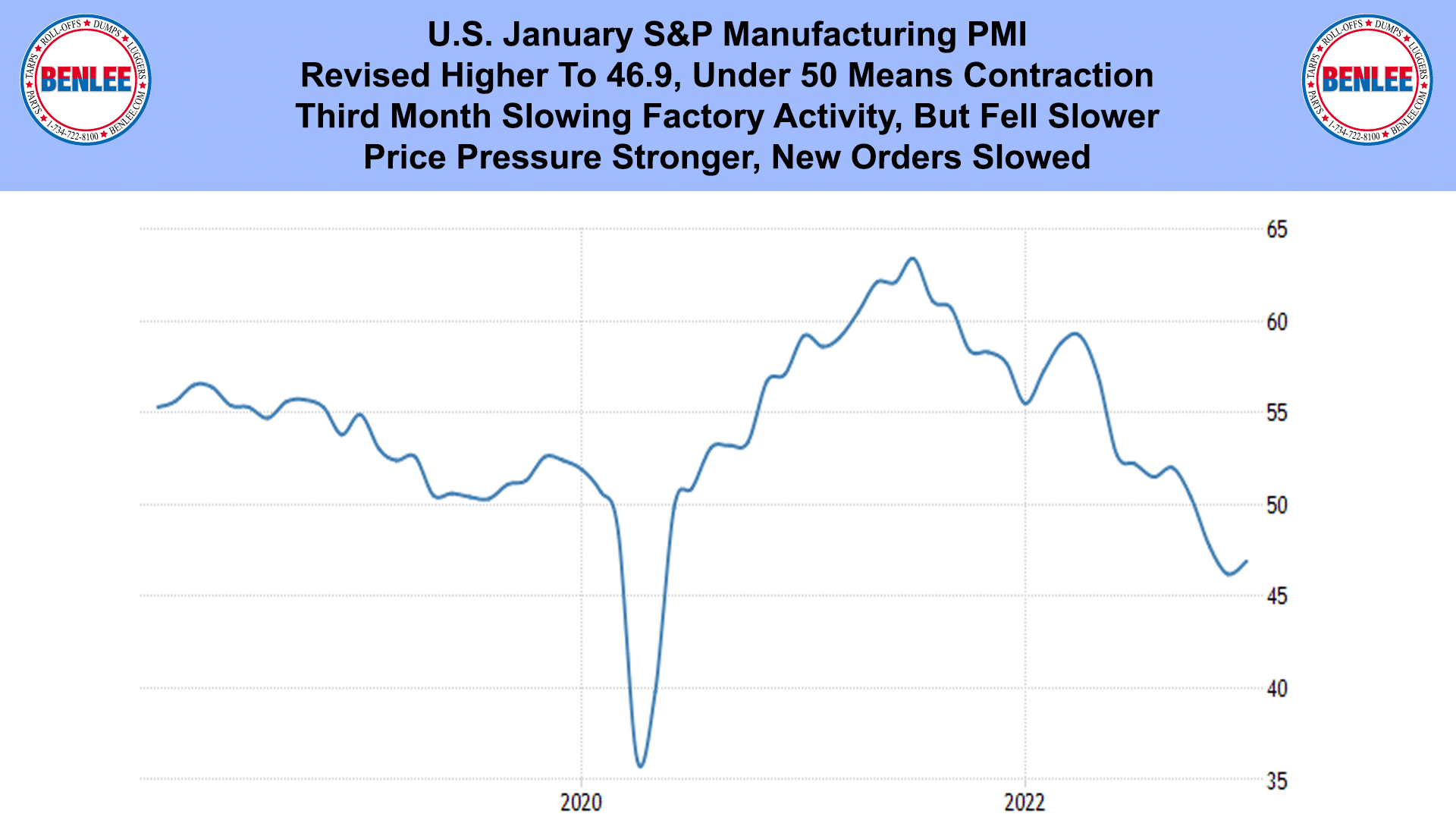

U.S. January S&P Manufacturing PMI was revised higher to 46.9. Under 50 means contraction. It was the third month of slowing factory activity, but it fell slower. Price pressure was stronger and new orders slowed.

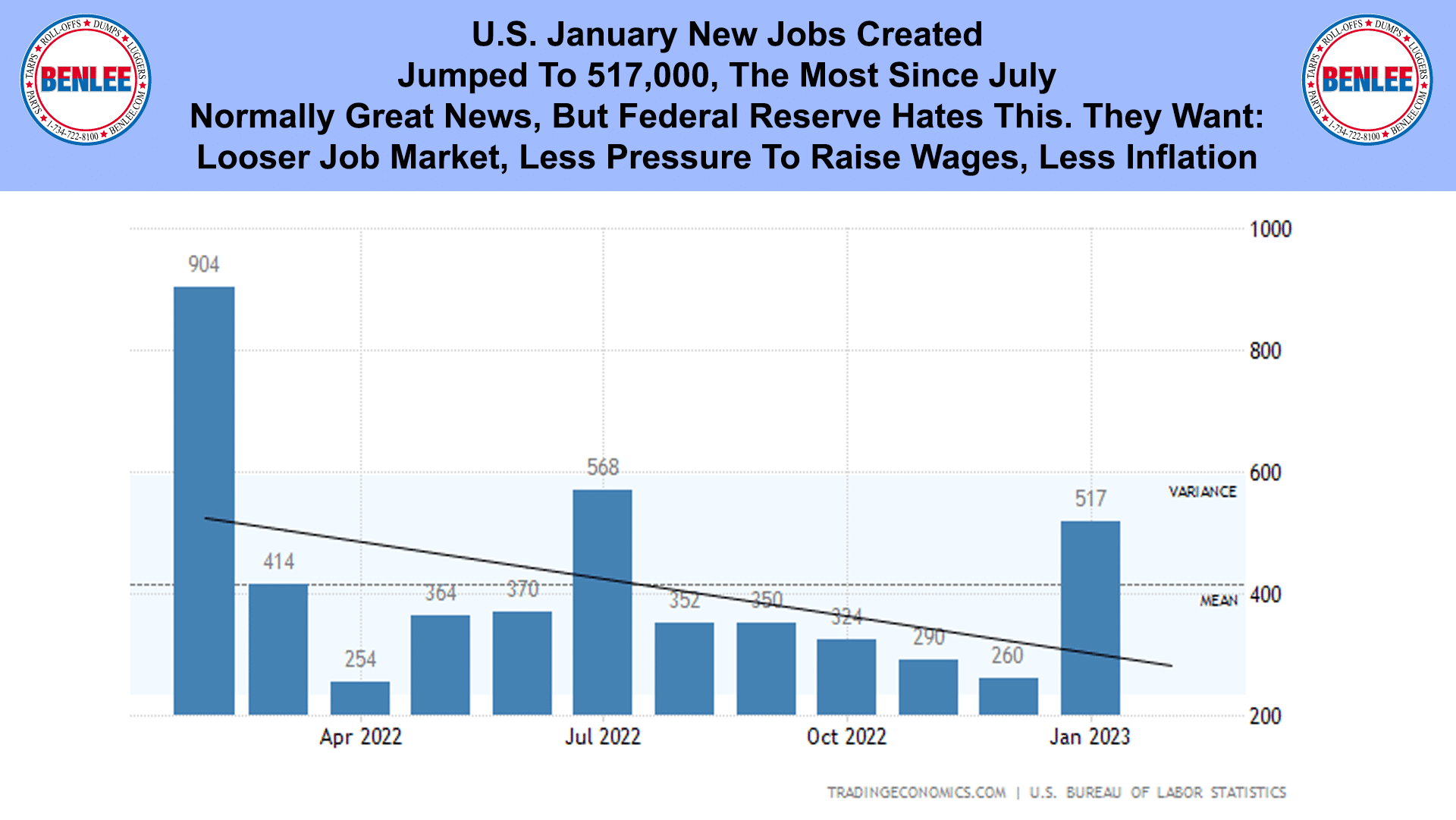

U.S. January new jobs created jumped 517,000 the most since July. This is normally great news, but the Federal Reserve hastes this. They want a loser job market, so less pressure to raise wages and bringing less inflation.

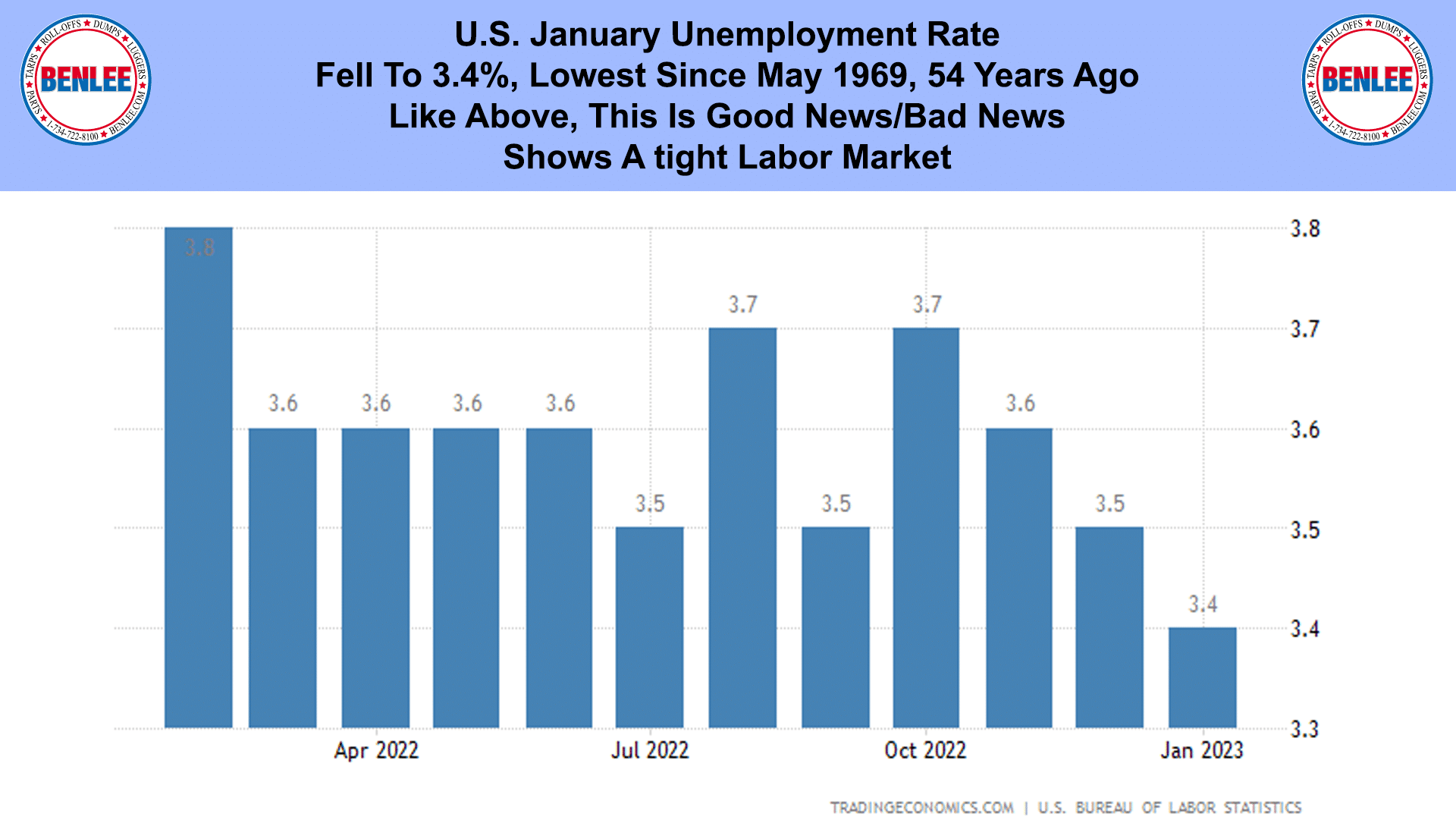

U.S. January unemployment rate fell to 3.4% the lowest since May 1969, 54 years ago. Like above this is good news and bad news. Shows a tight labor market.

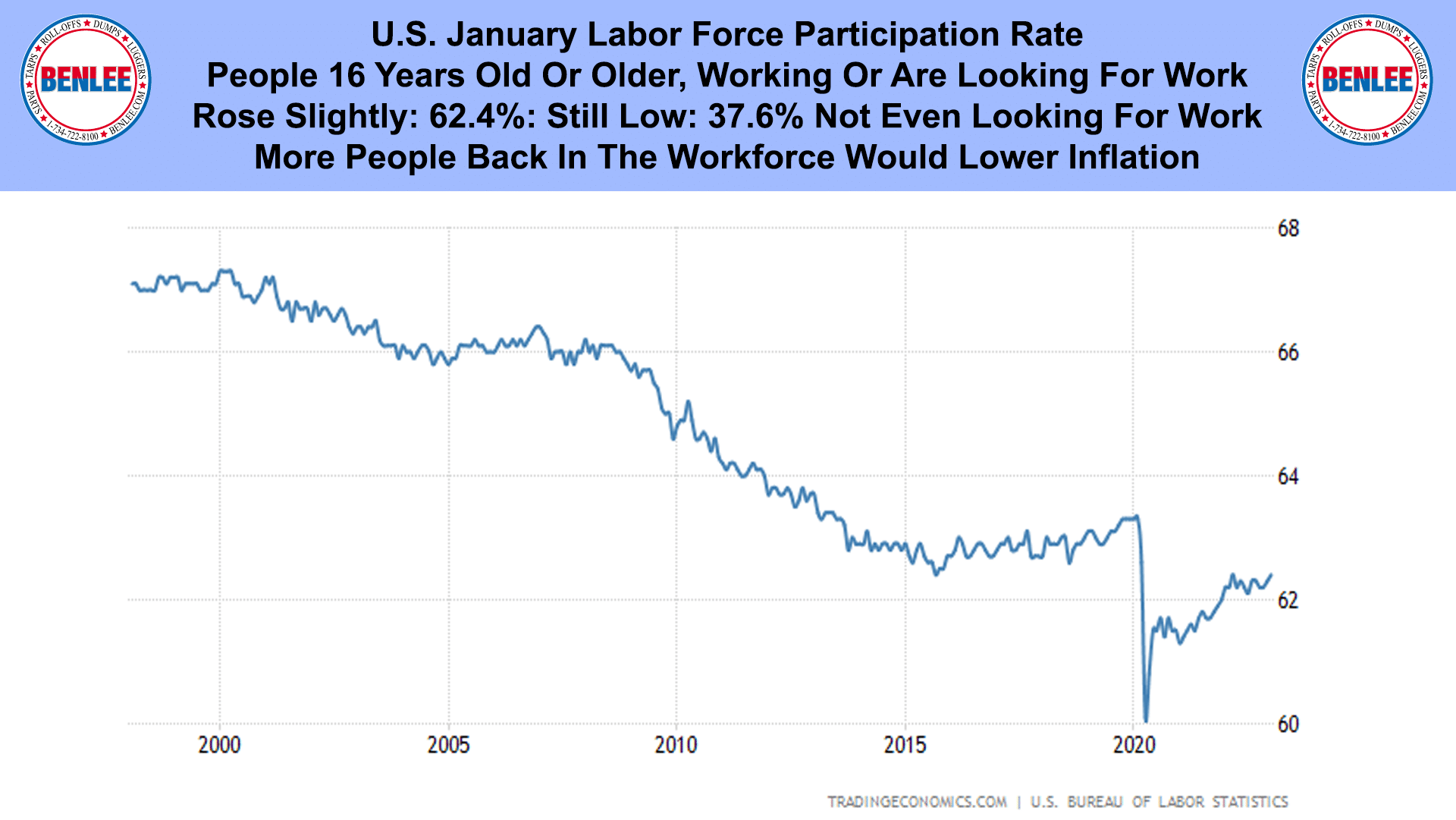

U.S. January labor force participation rate. This is people 16 years of age or older that are working or looking for work. It rose slightly to 62.4%, still low. 37.6% are not even looking for work. More people back in the workforce would lower inflation.

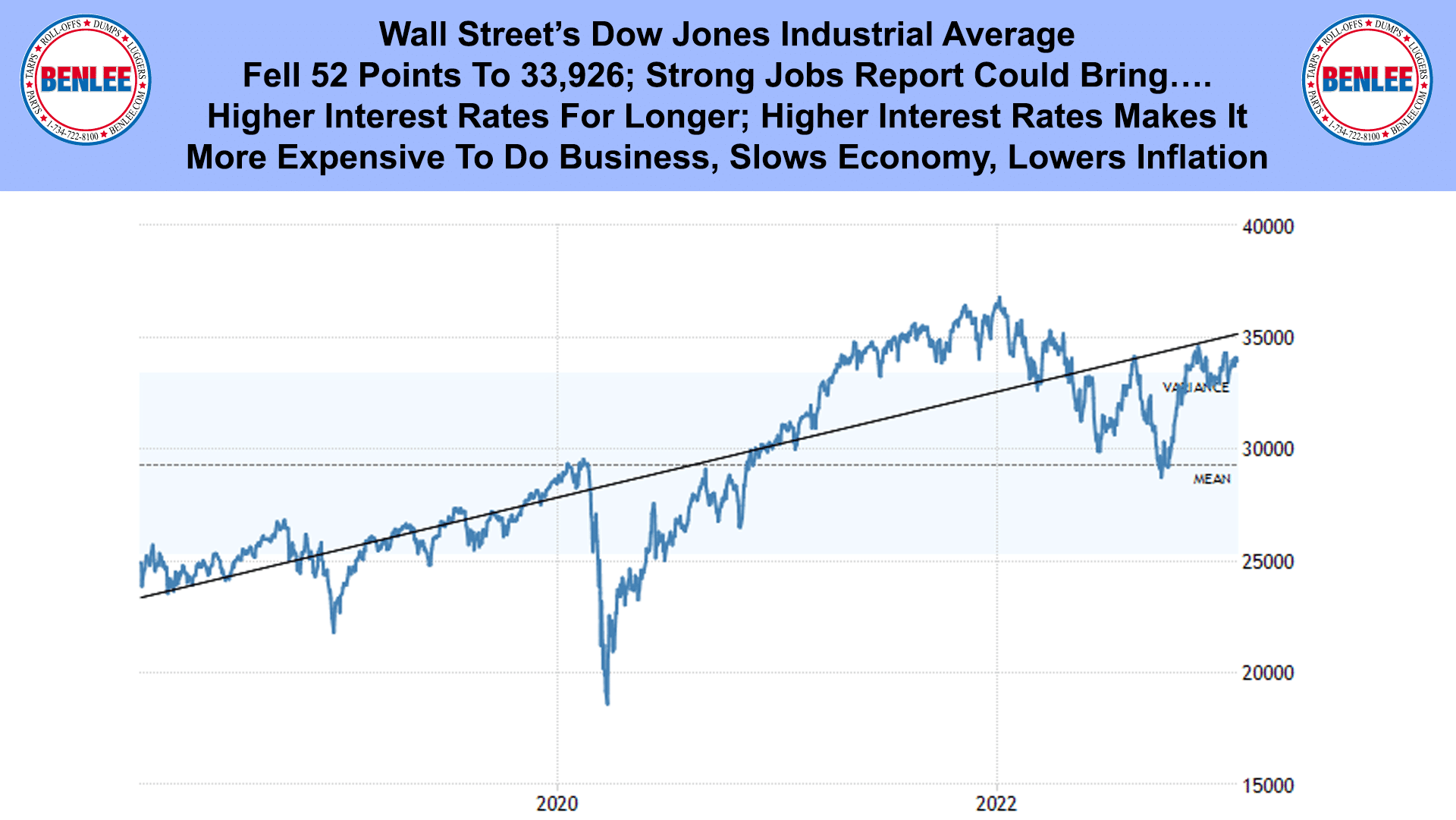

Wall Street’s Dow Jones Industrial Average fell 52 points to 33,926. This was on a concern that the strong jobs report could bring higher interest rates for longer. Higher interest rates make it more expensive to do business, which slows the economy, which lowers inflation.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.