February 3, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, February 3rd, 2025.

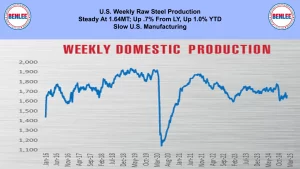

U.S. weekly raw steel production was steady at 1.64MT, up .7% from last year and up 1% YTD on slow U.S. manufacturing.

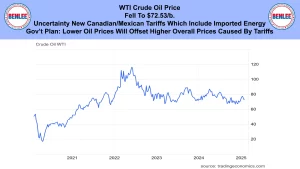

WTI crude oil price fell to $72.53/b., on uncertainty of the new Canadian And Mexican tariffs which include imported energy. The U.S. government plan is that lower oil prices will offset higher overall prices caused by tariffs.

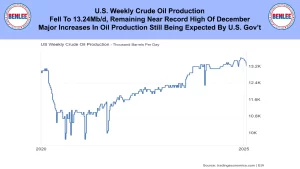

U.S. weekly crude oil production fell to 13.24Mb/d, remaining near the record high of December. Major increases in oil production are still expected by the U.S. Government.

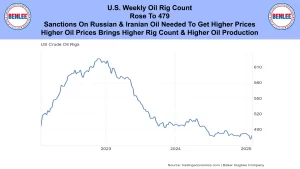

The U.S. weekly oil rig count rose to 479. Sanctions on Russian and Iranian oil are needed to get higher oil prices. Higher oil prices brings a higher rig count and higher oil production

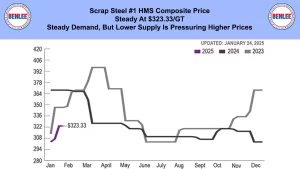

Scrap steel #1 HMS composite price was steady at $323.33/GT. This was on steady demand, but lower supply is pressuring higher prices.

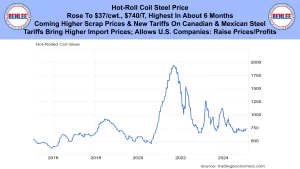

Hot-rolled coil steel price rose to $37/cwt., $740/T. the highest in about 6 months. The coming higher scrap prices and new tariffs on Canadian and Mexican steel allows U.S. steel companies to raise prices and profits.

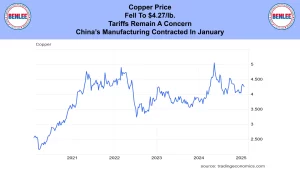

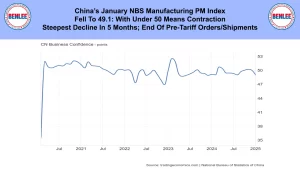

Copper price fell to $4.27/lb. Tariffs remain a concern as China’s manufacturing contracted in January.

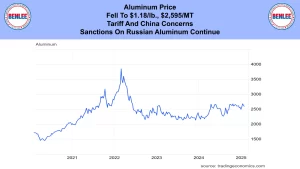

Aluminum price fell to $1.18/lb., 2,595/MT on tariff and China concerns. Also, sanctions on Russia’s Aluminum continue.

China’s January NBS Manufacturing PM index fell to 49.1, with under 50 being contraction. This was the steepest decline in 5 months as there was the end of pre-tariff orders and shipments.

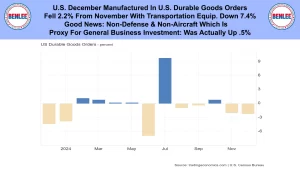

U.S. December manufactured in the U.S., durable goods orders. They fell 2.2% from November with transportation equipment down 7.4%. The good news is, non-defense and non aircraft orders which is a proxy for general business investment was up .5%.

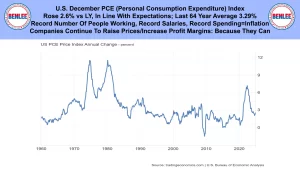

U.S. December PCE, personal consumption expenditure index. This is the Federal Reserve’s preferred measure of inflation. It rose 2.6% vs last year in line with expectations. Note that for the last 64 years the average was 3.29%. A record number of people working, with record salaries, which brings record spending, brings inflation. Companies continue to raise prices and increase profit margins because they can.

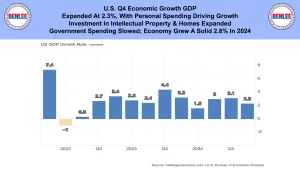

U.S. Q4 Economic Growth, GDP. The economy expanded at 2.3%, with personal spending driving growth. Investment in intellectual property and homes expanded. This was as government spending slowed. The economy grew a solid 2.8% in 2024.

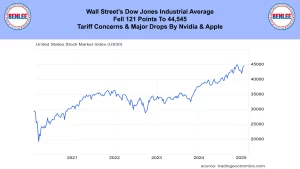

Wall Street’s Dow Jones Industrial average fell 121 points to 44,545. This was on tariff concerns and major drops by Nvidia and Apple.

This is Greg Brown still reporting from down under from New Zealand. As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.