February 24, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, February 24th, 2025.

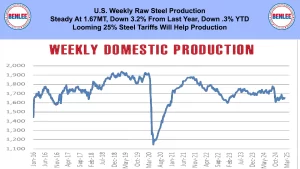

U.S. weekly raw steel production was steady at 1.67MT, down 3.2% from last year and down .3% YTD. Looming 25% steel tariffs will help production.

WTI crude oil price fell to $70.40/b. on a rise in U.S. crude inventories. Lower prices are hurting oil company profits. Cold weather is helping demand though.

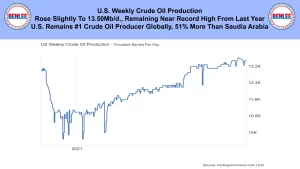

U.S. weekly crude oil production rose slightly to 13.5Mb/d, remaining near the record high from last year. The U.S. remains the #1 crude oil producer globally; 51% more than Saudi Arabia.

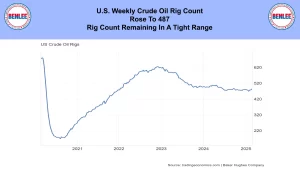

The U.S. weekly oil rig count rose to 487 as the rig count remained in a tight range.

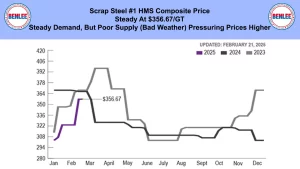

Scrap steel #1 HMS composite price was steady at $356.67/GT. This was on steady demand, but the poor supply due to bad weather is pressuring prices higher.

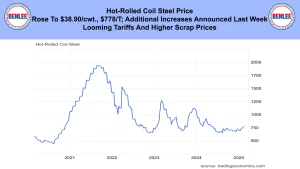

Hot-rolled coil steel price rose to $38.90/cwt, $778/T as additional increases were announced last week. This was on looming tariffs and higher scrap prices.

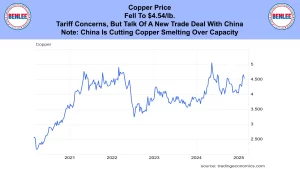

Copper price fell to $4.54/lb., on tariffs concerns, but talk of a new trade deal with China. Also, note that China is cutting copper smelting over capacity.

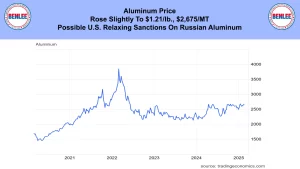

Aluminum price rose slightly to $1.21/lb., $2,675/MT on possible relaxing of sanctions on Russian aluminum.

U.S. January existing home sales fell 4.9% to 4.1M annualized, the sharpest decline in 7 months. This was on high home prices and high mortgage rates. Note that high mortgage rates are caused by high government borrowing. Possible U.S. deficit cuts, would lead to lower borrowing, which lowers the 10 year bond interest rate which leads to lower mortgage rates.

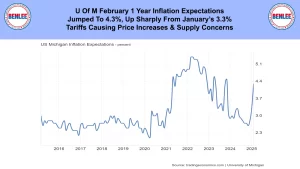

U of M February one year inflation expectations jumped to 4.3%, up sharply from January’s 3.3%. Tariffs are causing price increases and supply concerns.

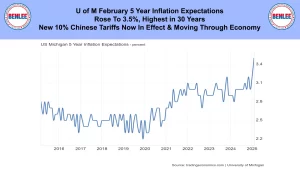

U of M February 5 year inflation expectations rose to 3.5%, the highest in 30 years. New 10% Chinese tariffs are now in effect and moving through the economy.

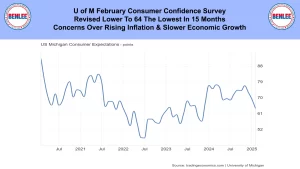

U of M February consumer confidence survey was revised lower to 64, the lowest in 15 months. This was on concerns over rising inflation and slower economic growth.

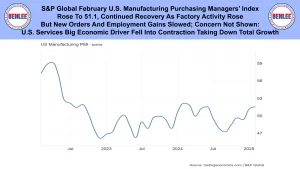

S&P global February U.S. manufacturing purchasing managers’ index rose to 51.1 on the continued recovery as factory activity rose. But new orders and employment gains slowed. A concern not shown is U.S. Services which are a major economic driver fell into contraction taking down total U.S. growth.

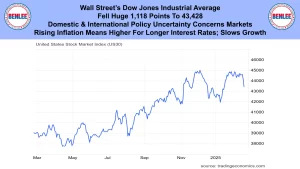

Wall Street’s Dow Jones Industrial average fell 1,118 points to 43,428. This was on domestic and international policy uncertainty that concerns markets. Also, rising inflation means higher for longer interest rates that slows growth

This is Greg Brown. As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.