February 17, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, February 17th, 2025.

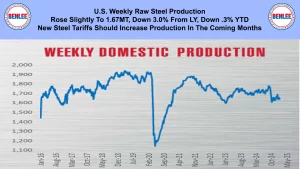

U.S. weekly raw steel production rose slightly to 1.67MT down 3.0% from last year and down .3% YTD. New steel tariffs should increase production in the coming months.

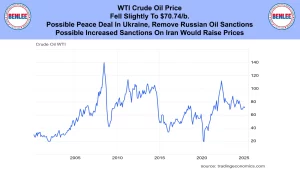

WTI crude oil price fell slightly to $70.74/b., on a possible peace deal in Ukraine that could remove Russian oil sanctions. Possible increased sanctions on Iran would raise prices.

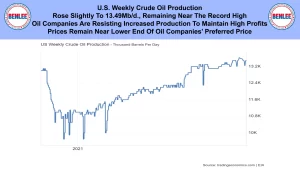

U.S. weekly crude oil production rose slightly to 13.49Mb/d. remaining near the record high. Oil companies are resisting increased production so as to maintain high profits. Prices remain near the lower end of oil companies’ preferred price.

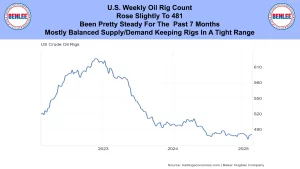

The U.S. weekly oil rig count rose slightly to 481. It has been pretty steady for the past 7 months. Mostly balanced supply and demand keep rigs in a tight range.

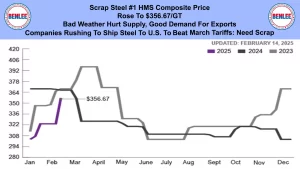

Scrap steel #1 HMS composite price rose to about $356.67/GT. This was as bad weather hurt supply and a good demand for exports. Companies that are rushing to ship steel to the U.S. to beat March tariffs, need scrap.

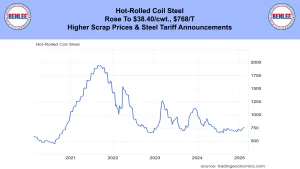

Hot-rolled coil steel price rose to $38.40/cwt., $768/T on higher scrap prices and steel tariff announcement.

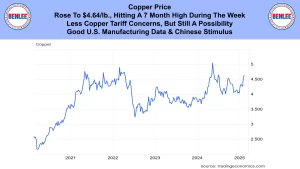

Copper price rose to $4.64/lb., hitting a 7 month high during the week on less copper tariff concerns, but still a possibility. Also, on good U.S. manufacturing data and Chinese stimulus.

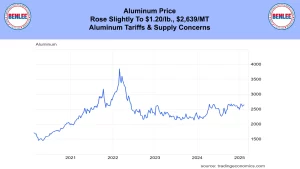

Aluminum price rose slightly to $1.20/lb., $2,639/MT. This was on aluminum tariffs and supply concerns.

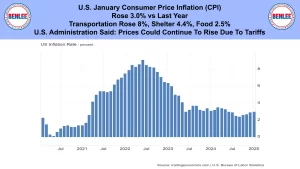

U.S. January Consumer Price Inflation, which is CPI, rose to 3.0% vs last year. Transportation rose 8%, shelter 4.4% and food 2.5%. The U.S. administration said prices could continue to rise due to tariffs.

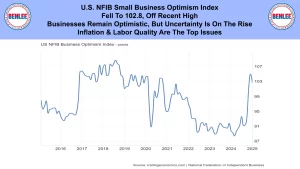

U.S. NFIB small business optimism index fell to 102.8, off the recent high. Businesses remain optimistic, but uncertainty is on the rise. Inflation and labor quality are the top issues.

U.S. January retail sales fell to 4.2% year over year which is good, but dropped a big .9% vs December. Severe weather and the LA fires hurt spending. Sporting goods/hobby/books fell the most. Gasoline rose.

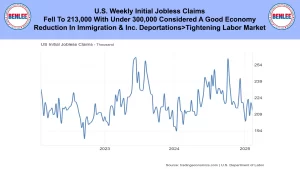

U.S. weekly initial jobless claims fell to 213,000 with under 300,000 considered a good economy. The reduction in immigration and the increase in deportations is bringing a tighter labor market.

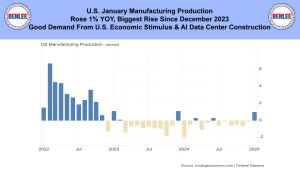

U.S. January manufacturing production rose 1% YOY, the biggest rise since December 2023. This was on good demand from U.S. economic stimulus and new AI data center construction.

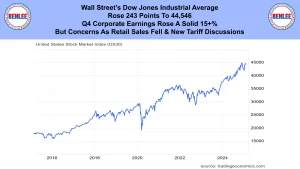

Wall Street’s Dow Jones Industrial average rose 243 points to 44,546. This was as Q4 corporate earnings rose a solid 15%+, but on concerns as retail sales fell and new tariff discussions.

This is Greg Brown. As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.