December 9, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, July 29th, 2024.

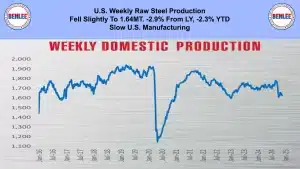

U.S. weekly raw steel production fell slightly to 1.64MT down 2.9% from last year and down 2.3% year to date on slow U.S. manufacturing.

WTI crude oil price fell to $67.20/b. over concerns about a 2025 global oil glut. Also, on weak Chinese demand due to their dramatic increase in electric vehicles and record U.S. crude oil production. Related, OPEC delayed their undoing of production cuts until April 2025.

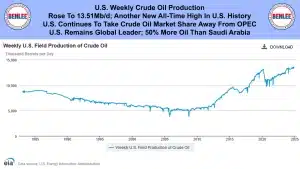

U.S. weekly crude oil production rose to 13.51Mb/d, another new all-time high in U.S. history. The U.S. continues to take crude oil market share away from OPEC. The U.S. also remains the global leader in production, 50% more than Saudi Arabia.

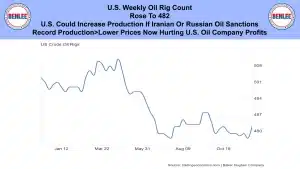

The U.S. weekly oil rig count rose to 482. The U.S. could increase production if there are Iranian or Russian oil sanctions. Record production is bringing lower prices that are now hurting U.S. oil company profits.

Scrap steel #1 HMS composite price was steady at $316.67/GT. There is downward price pressure for December caused by a good supply and lower global demand.

Hot-rolled coil (HRC) steel price fell to $34.45/cwt., $689/T about 1/3 of 2021’s price. 2021 supply chain problems and a burst of purchasing activity, fueled inflation, corporate profits, and Wall Street prices.

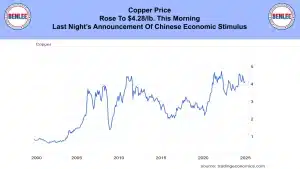

Copper price rose to $4.28/lb. this morning on last night’s announcement of Chinese government economic stimulus.

Aluminum price rose slightly to $1.18/lb., $2,609/mt on uncertain global economic conditions.

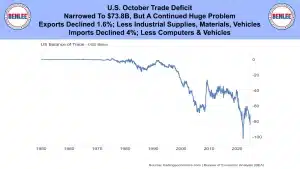

The U.S. October trade deficit narrowed to $73.8B but is a continued huge problem. Exports declined 1.6%, with less industrial supplies, materials, and vehicles. Imports declined 4%, with less computers and vehicles.

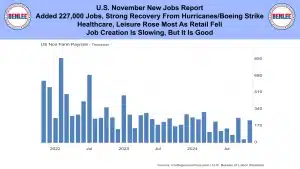

U.S. November new jobs report. The U.S. added 227,000 jobs, with a strong recovery from the hurricanes and the Boeing strike. Healthcare and leisure rose the most, as retail fell. Job creation is slowing but it is good.

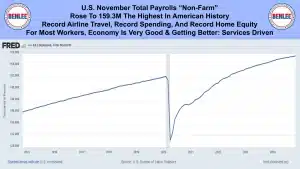

U.S. November total payrolls, which are counted as non-farm. They rose to 159.3M the highest in American history. Record airline travel, record spending, and record home equity means for most workers, the economy is very good and getting better, driven by services.

U.S. November hourly earnings rose 4% over last year, vs 2.6% inflation. Good gains in productivity are allowing for lower inflation. Workers continue to gain wages over inflation, which is fueling spending.

U.S. December U of M consumer sentiment survey rose to 74, the 5th consecutive increase and an 8 month high. Inflation expectations rose for the year ahead to 2.9%, but it is 2.6% now. The current conditions gauge soared as there was a surge in buying conditions.

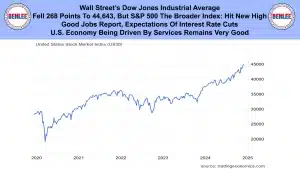

Wall Street’s Dow Jones Industrial Average fell 268 points, to 44,643, but the S&P 500, the broader index hit a new high. This was on expectations of an interest rate cut.

This report by Greg Brown from is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.