December 16, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, December 16th, 2024.

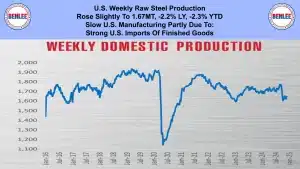

U.S. weekly raw steel production rose slightly to 1.67MT, down 2.2% from last year and down 2.3% year to date on slow U.S. manufacturing partly due to strong U.S. imports of finished goods.

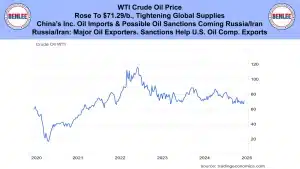

WTI crude oil price rose to $71.29/b. on tightening global supplies, China’s increased oil imports and possible oil sanctions coming on Russia and Iran. Russia and Iran are major oil exporters. Sanctions would help U.S. oil company exports.

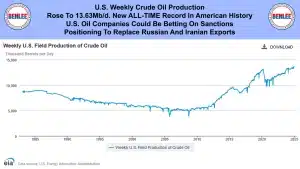

U.S. weekly crude oil production rose to 13.63Mb/d. a new all-time record in American history. U.S. oil companies could be betting on sanctions as they are positioning to replace Russian and Iranian exports.

The U.S. weekly oil rig count was steady at 482 on record U.S. production. There is major room for growth and exports.

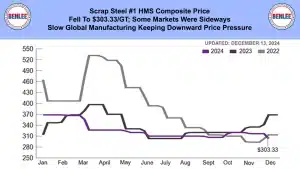

Scrap steel #1 HMS composite price fell to $303.33/GT as some markets were sideways. This was on slow global manufacturing which is keeping downward price pressure.

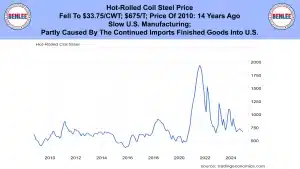

Hot-rolled coil (HRC) steel price fell to $33.75/CWT which is $675/T the price of 2010, 14 years ago. This was on slow U.S. manufacturing partly caused by the continued imports of finished goods into the U.S.

Copper price fell to $4.20/lb., but remained high. There was China manufacturing pessimism despite stimulus. Also, on possible fewer and slower interest rate cuts by the U.S. Federal Reserve.

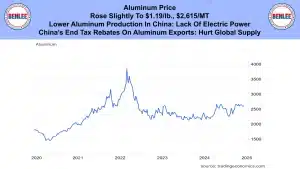

Aluminum price rose slightly to $1.19/lb., $2,615/MT on lower aluminum production in China caused by the lack of electric power. Also, on China’s end of tax rebates on aluminum exports that hurt global supply.

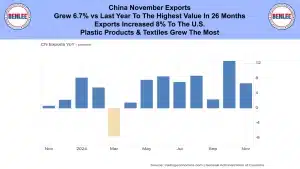

China’s November exports grew 6.7% vs last year to the highest value in 26 months. Exports increased 8% to the U.S. Plastic products and textiles grew the most.

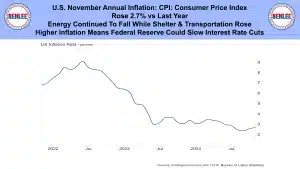

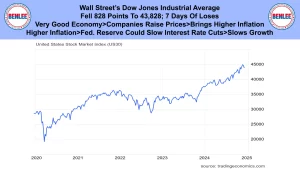

U.S. November annual inflation CPI, consumer price index rose 2.7% vs last year. Energy continued to fall while shelter and transportation rose. Higher inflation means the Federal Reserve could slow interest rate cuts.

U.S. weekly initial jobless claims soared higher to 242,000, which goes against the thoughts of a tightening labor market. But most forecast an interest rate cut this week to undo the current restrictive rates.

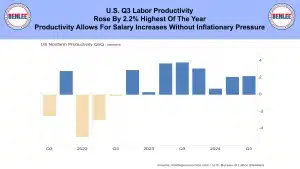

U.S. Q3 labor productivity rose by 2.2% the highest of the year. Productivity allows for salary increases without inflationary pressure.

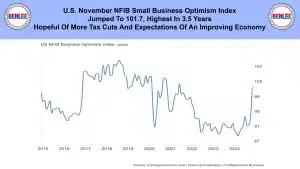

U.S. November NFIB small business optimism index jumped to 101.7, the highest in 3.5 years. Owners are hopeful of more tax cuts and expectations of an improving economy.

Wall Street’s Dow Jones Industrial Average fell 828 points to 43,828 with 7 days of losses. The very good economy allows companies to raise prices, which brings higher inflation. Higher inflation means the Federal Reserve could slow interest rate cuts, which slows growth.

This report by Greg Brown is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.