November 25, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, July 29th, 2024.

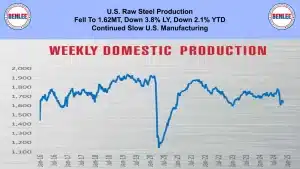

U.S. weekly raw steel production fell to 1.62MT, down 3.8% from last year and down 2.1% YTD on continued slow U.S. manufacturing.

WTI crude oil price rose to $71.08/b. on the intensifying conflict in Ukraine. Also, on good U.S. demand, but poor Eurozone economic data.

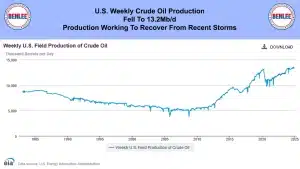

U.S. weekly crude oil production fell to 13.2Mb/d., as production is working to recover from the recent storms.

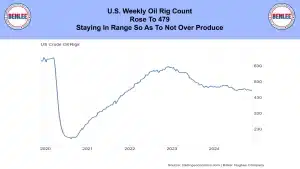

The U.S. weekly oil rig count rose to 479 staying in a range so as to not over produce.

Scrap steel #1 HMS price. Note that we are using a new index. It was steady at $316.67/GT on steady, but slow U.S. and global demand. Also, the strong U.S. dollar is hurting U.S. scrap exports.

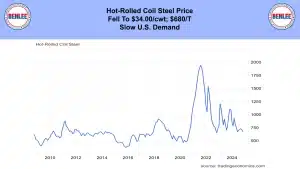

Hot-rolled coil steel price fell to $34.00/cwt., which is $680/T on slow U.S. demand.

Copper price rose slightly to $4.08/lb., but down in recent months. This was on a two year high in the U.S. Dollar and concerns over future higher inflation which could be driven by possible coming tariffs.

Aluminum price fell slightly to $1.19/lb., $2,635/mt on the Chinese ending rebates on aluminum exports. Also, on bauxite near a record high on supply disruptions.

U.S. dollar vs other global currencies index. When the U.S. dollar rises, commodities priced in U.S. dollars is pressured lower. It rose to 107.5 the highest level in over two years. This was on weak Eurozone economic data while there is strong U.S. economic data.

U.S. October housing starts fell to 1.31M annualized, lower than the 1950s, 70+ years ago. Activity fell sharply due to hurricanes. Also, on relatively high interest rates and high home prices, but increasing supply.

U.S. November S&P Manufacturing purchasing managers’ index rose to 48.8, but under 50 is contraction. Production fell faster, but the loss of new orders eased. Longer lead times were linked to purchases before possible tariffs.

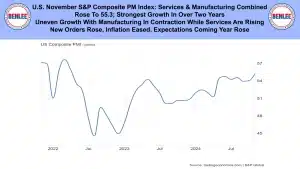

U.S. November S&P composite purchasing managers’ index as in services and manufacturing combined. It rose to 55.3, the strongest growth in over two years. There is uneven growth with manufacturing in contraction while services are rising. New orders rose, inflation eased and expectations in the coming year rose.

University of Michigan November consumer sentiment was revised lower to 71.8, but it is the highest in 7 months. Post election interviews were lower than pre-election on concerns about the coming economic agenda.

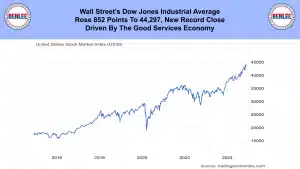

Wall Street’s Dow Jones Industrial Average rose 852 points to 44,297 a new record close driven by the good Services economy.

This report by Greg Brown from is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.