November 20, 2023

This is the Commodities, Scrap Metal, Recycling and Economic Report, November 20th, 2023.

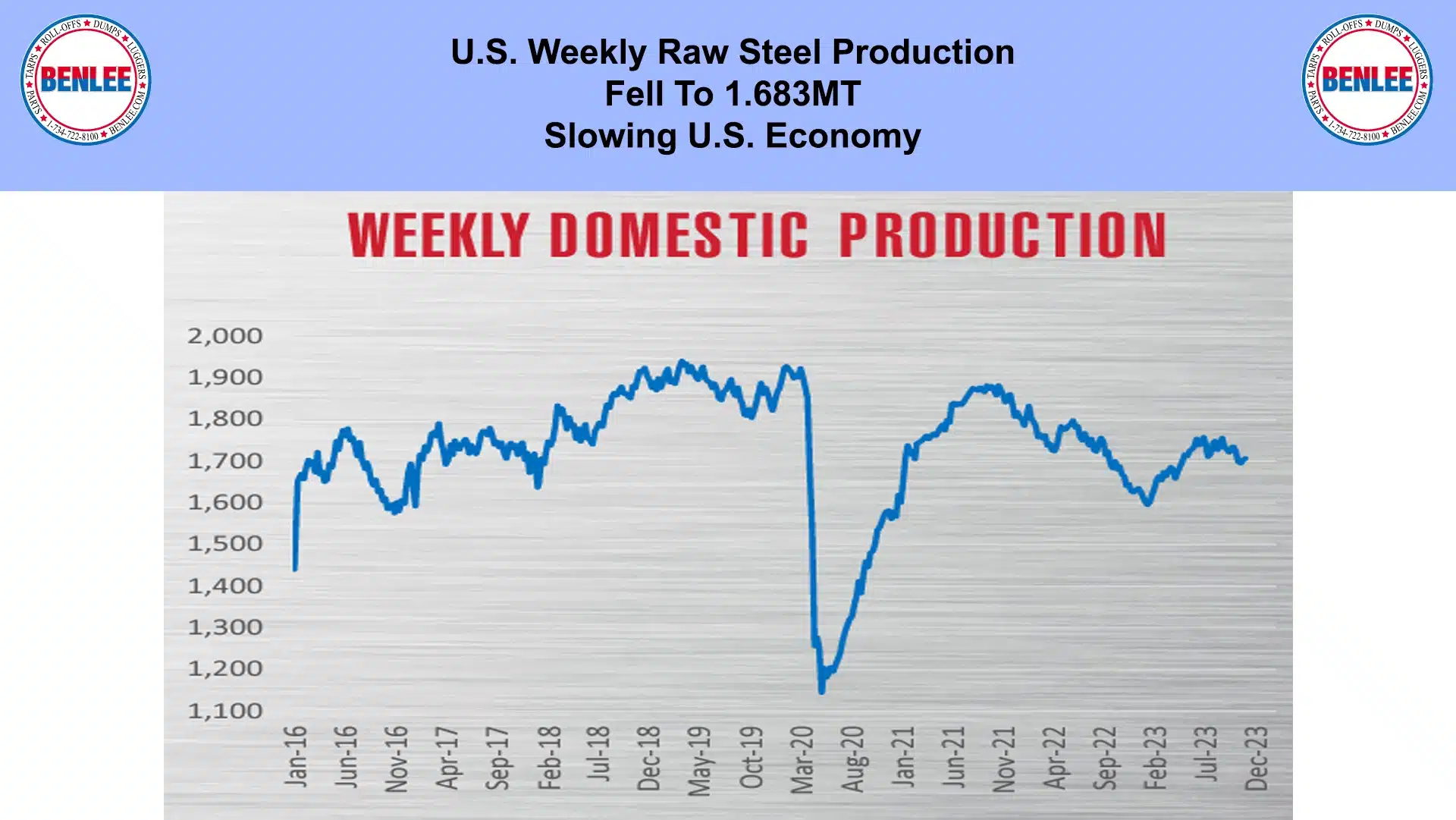

U.S. weekly raw steel production fell to 1.683MT on a slowing U.S. economy.

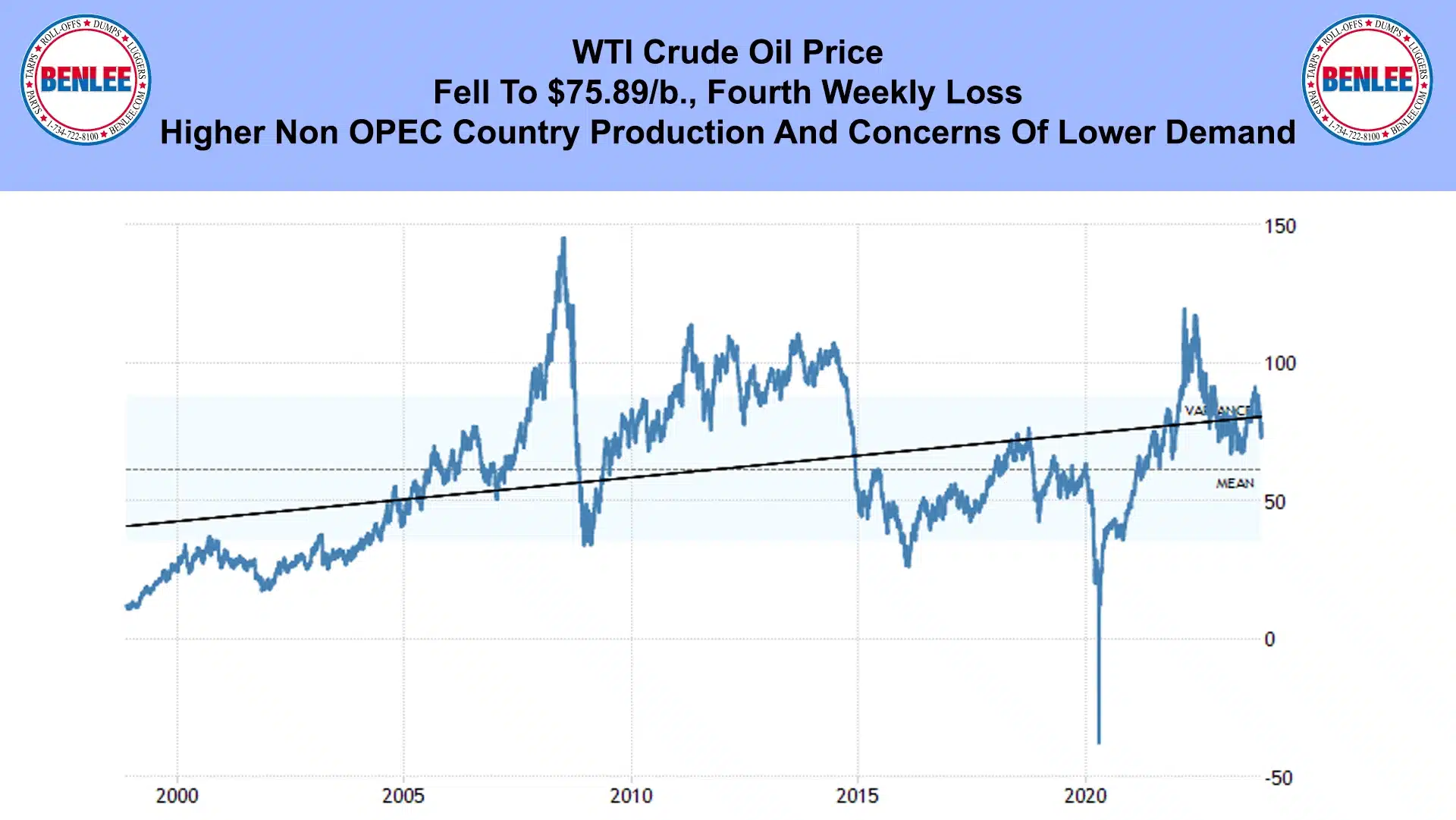

WTI crude oil price fell to $75.89/b., the fourth weekly loss on higher non OPEC country production and on concerns over lower demand.

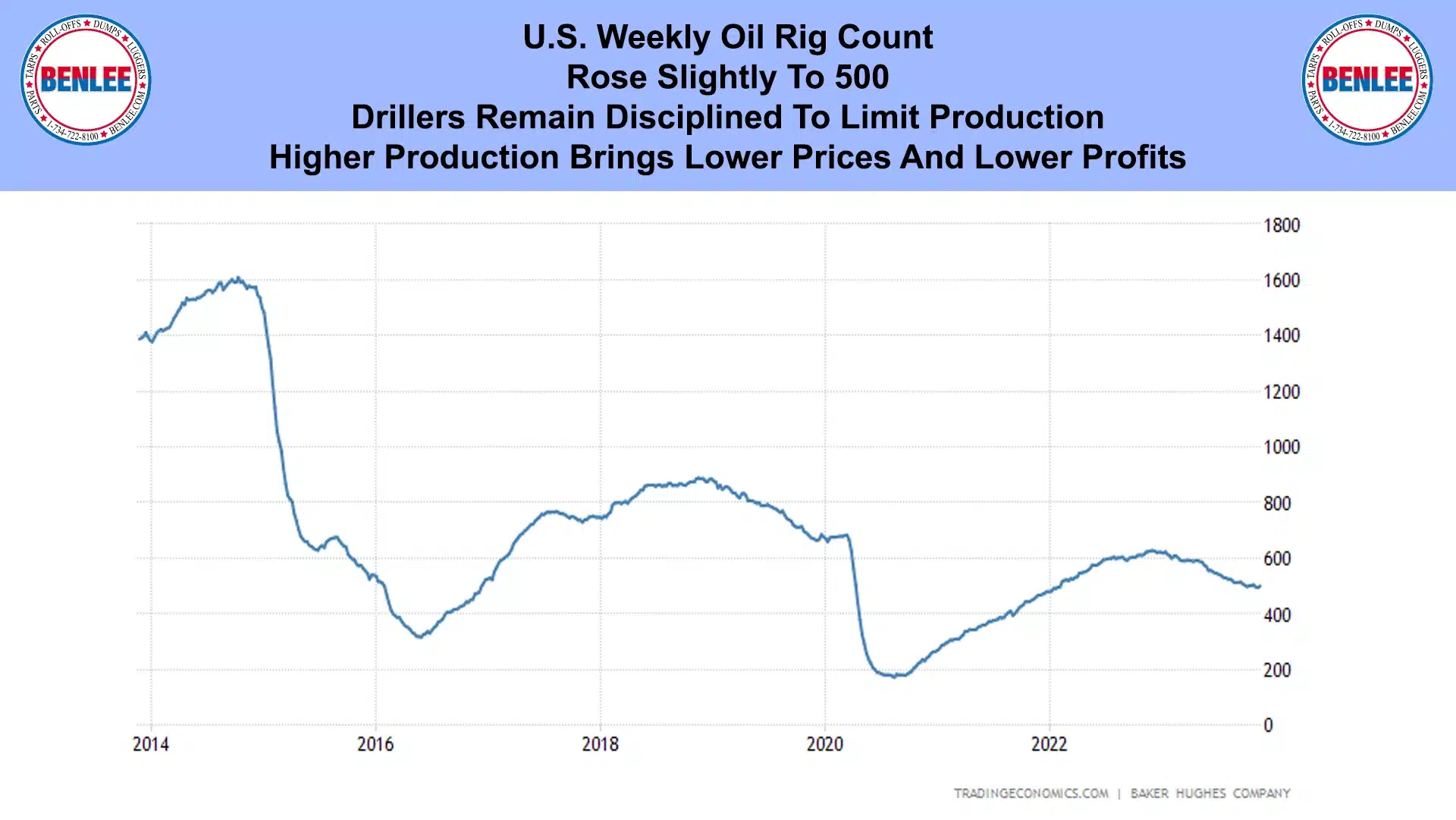

The U.S. weekly oil rig count rose slightly to 500 as drillers remain disciplined to limit production. Higher production brings lower prices and lower profits.

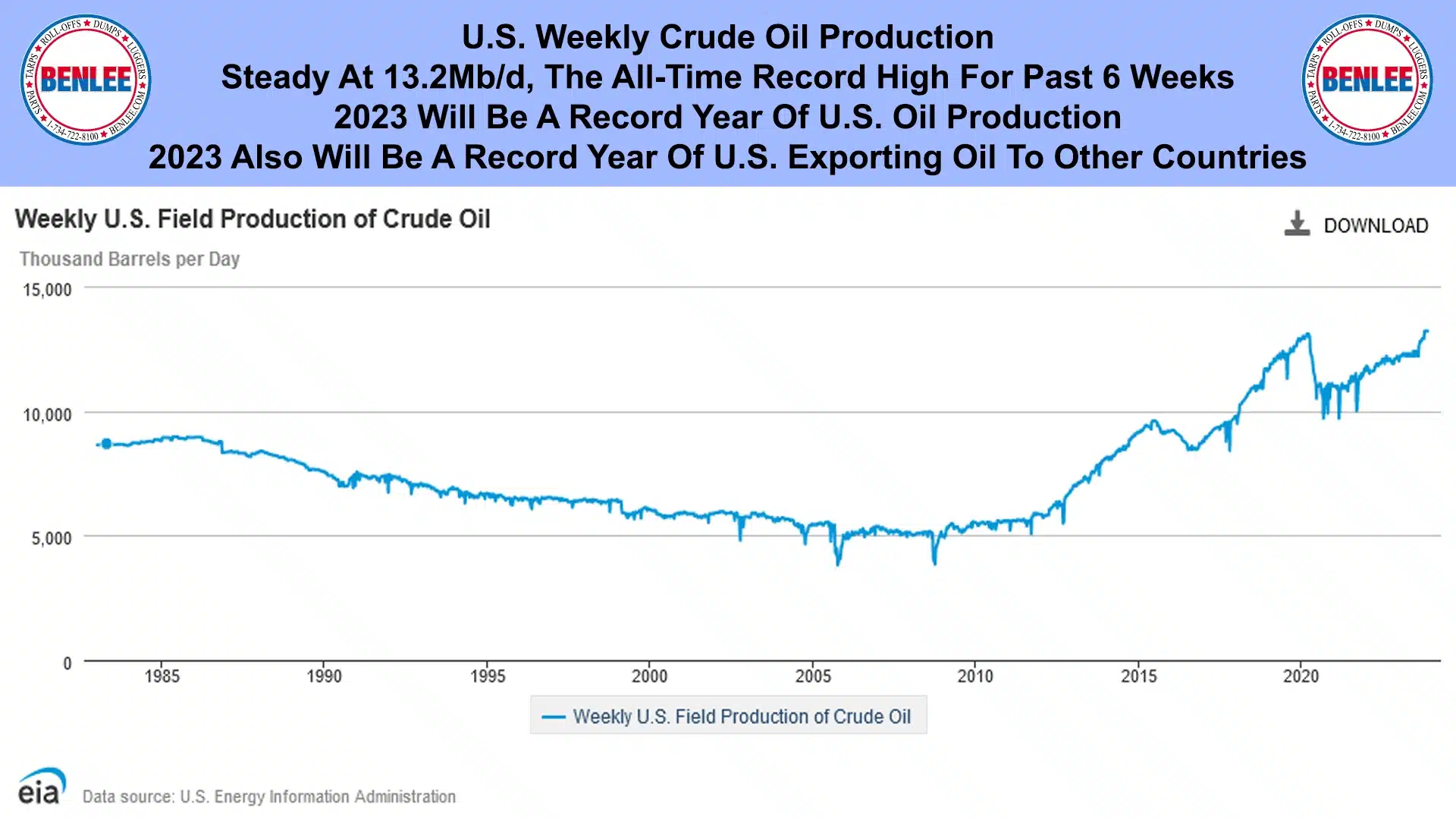

U.S. weekly oil production was steady at 13.2Mb/d., the all-time record high for the past 6 weeks. 2023 will be a record year for U.S. oil production. 2023 will also be a record year of U.S. oil exports to other countries.

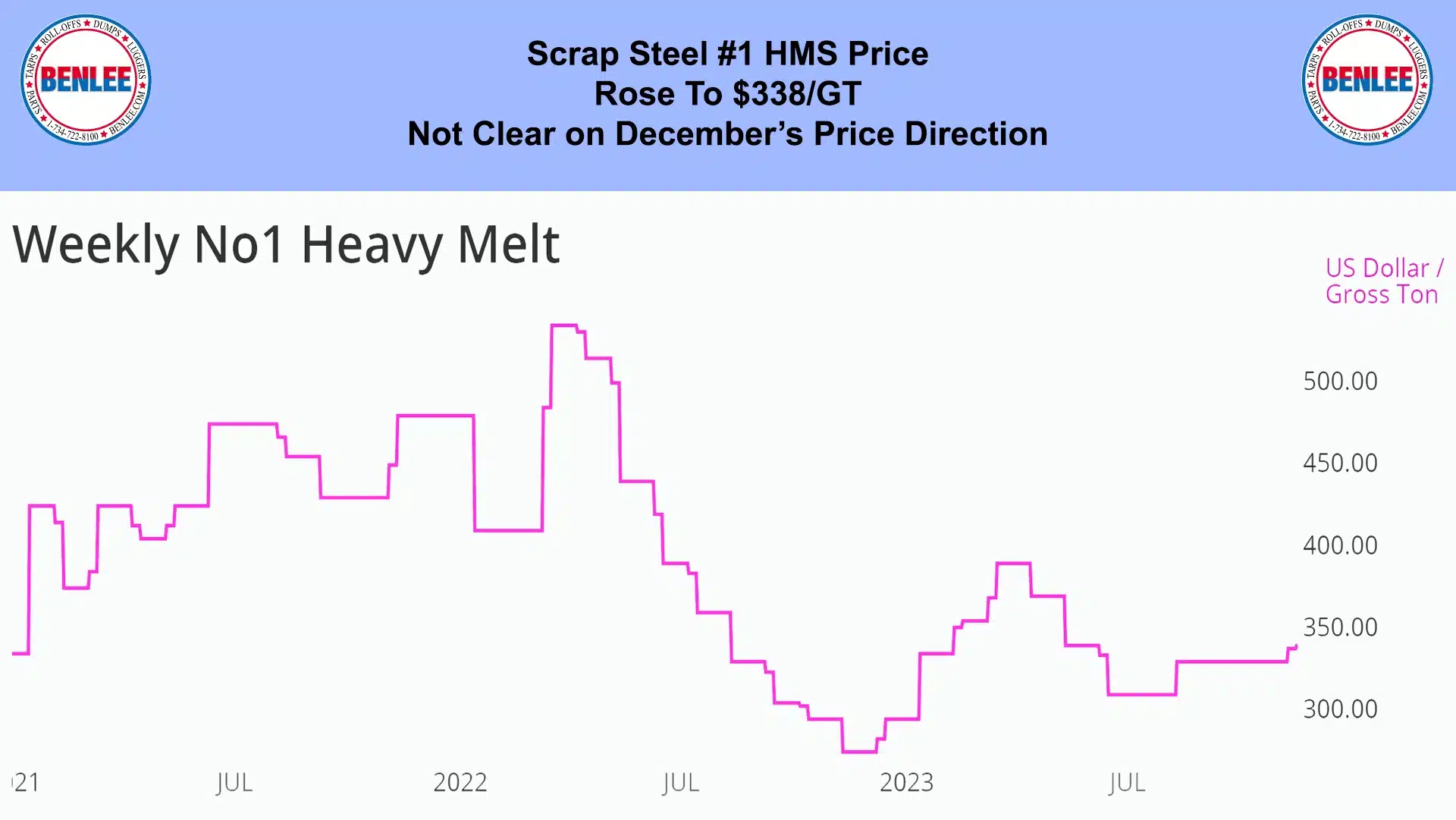

Scrap steel #1HMS price rose to $338/GT. It is not clear on December’s price direction.

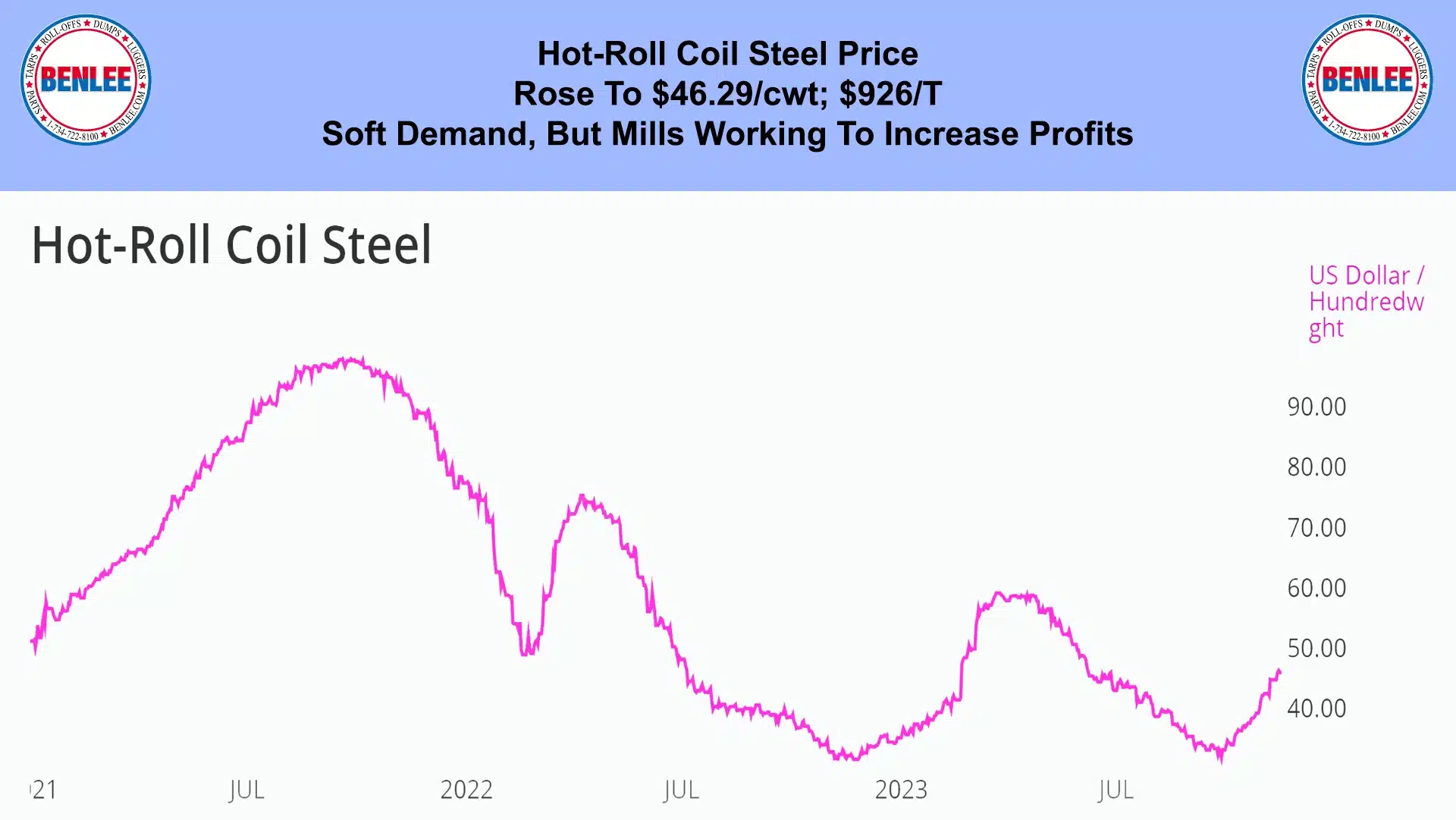

Hot-rolled coil steel price rose to $46.29/cwt., $926/T on soft demand, but mills are working to increase profits.

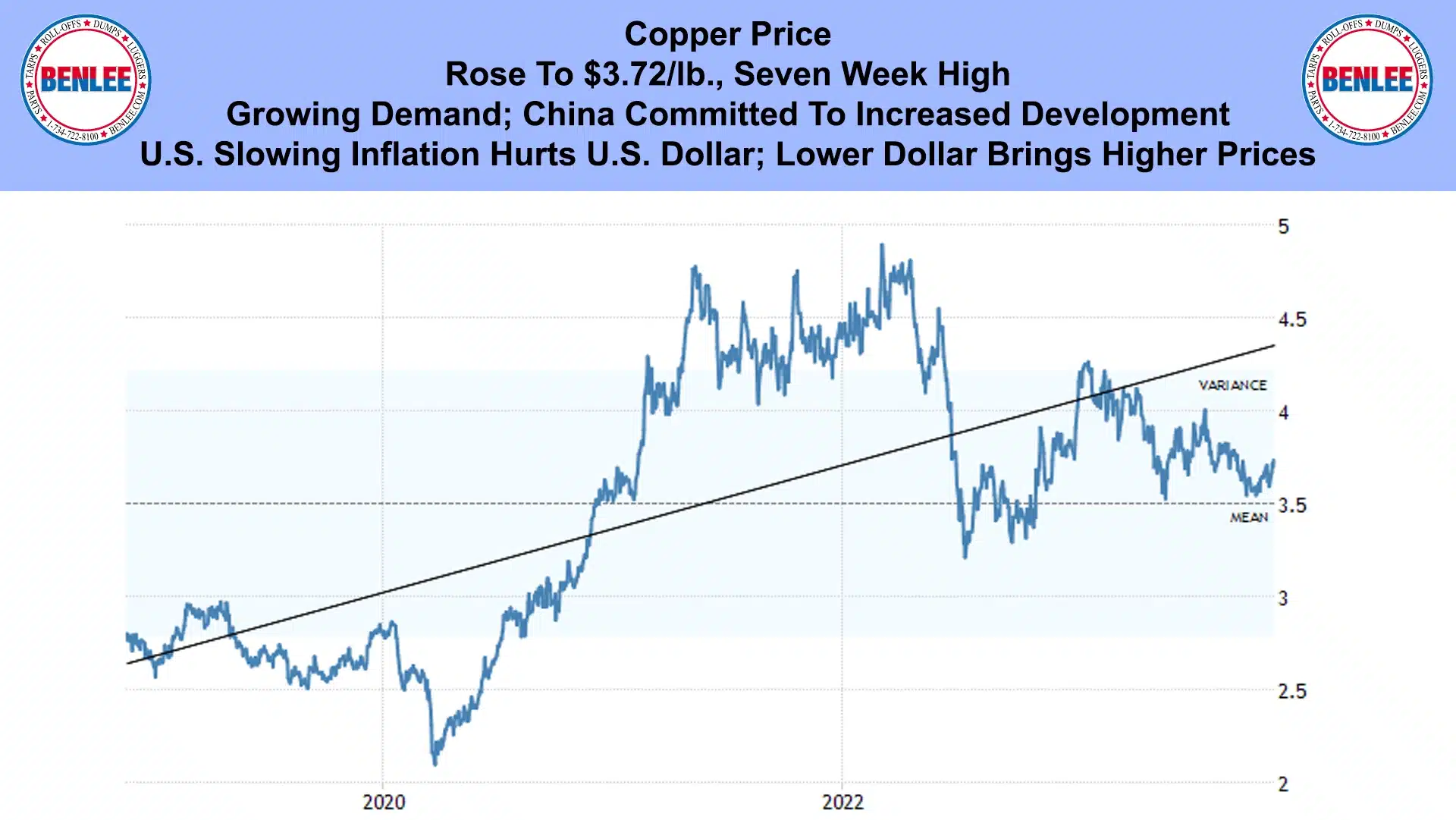

Copper price rose to $3.72 lb., a seven week high. This was on growing demand with China which is committed to increased development. Also, the U.S. slowing inflation hurts the U.S. dollar, and the lower dollar brings higher prices.

Aluminum price dropped slightly to $1.01/lb., which is $2,218/mt on bets for higher demand in China.

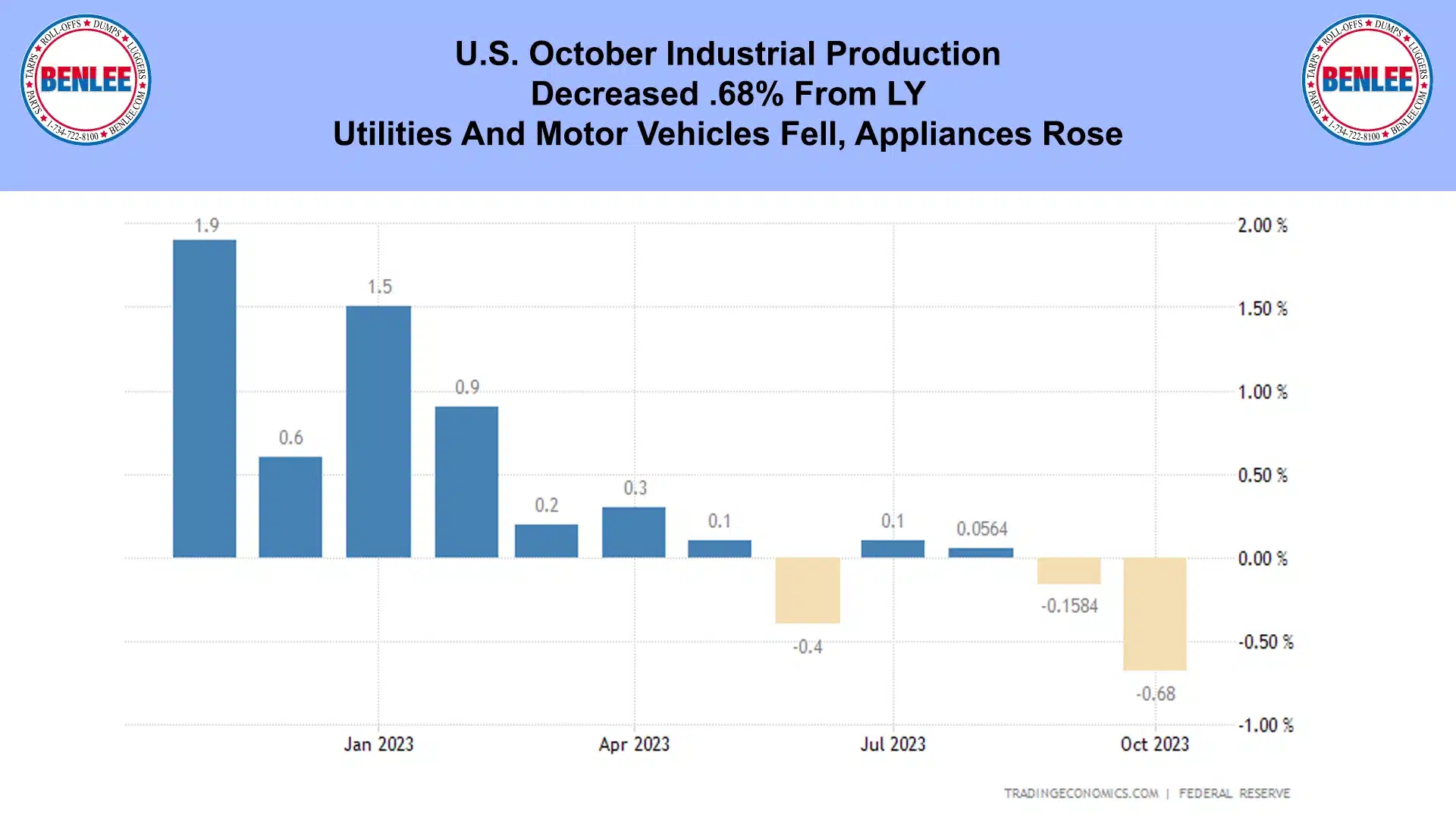

U.S. October Industrial production decreased .68% from last year. Utilities and motor vehicles fell while appliances rose.

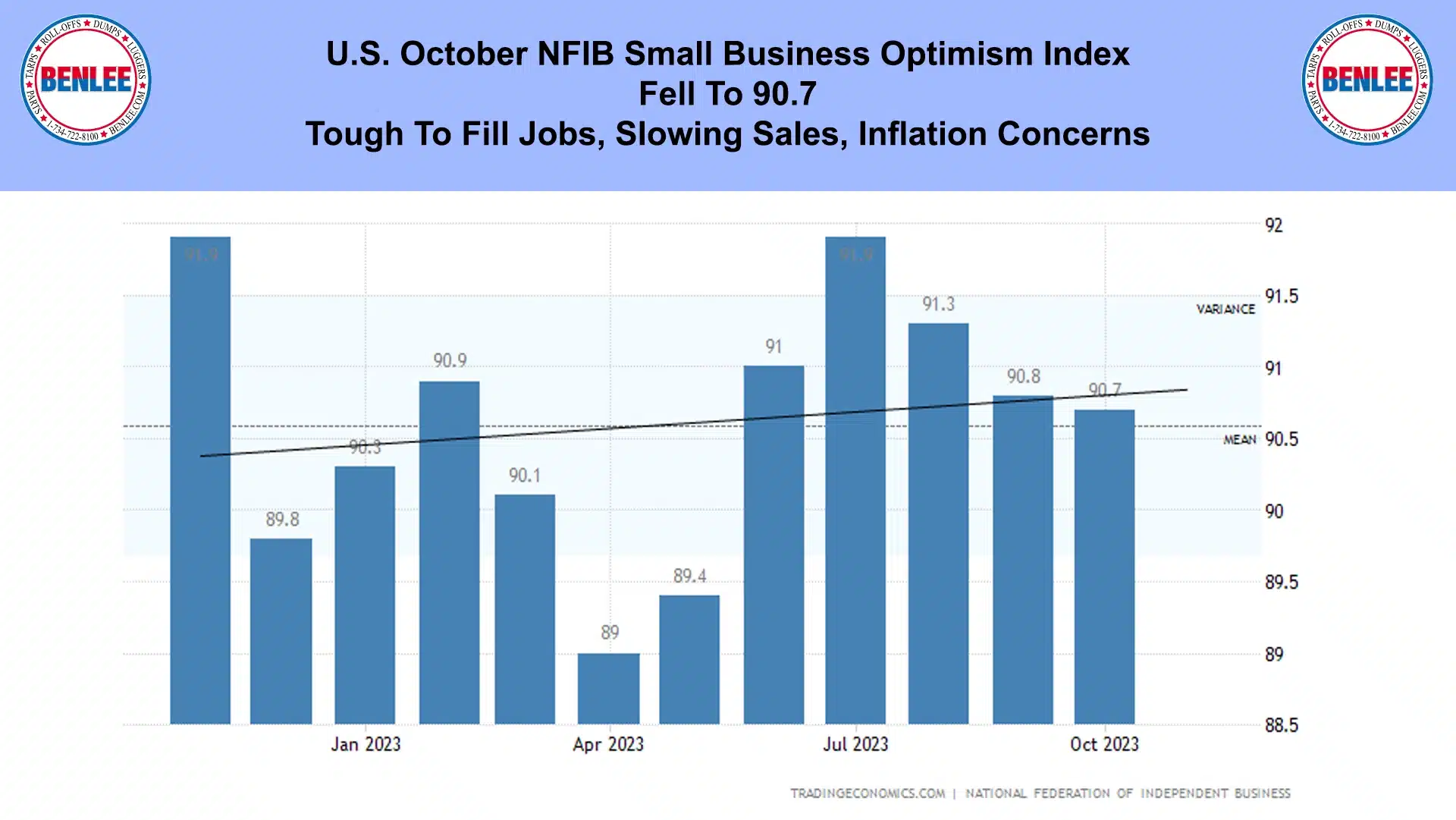

U.S. October NFIB small business optimism index, fell to 90.7. Tough to fill jobs, slowing sales and inflation were the top concerns.

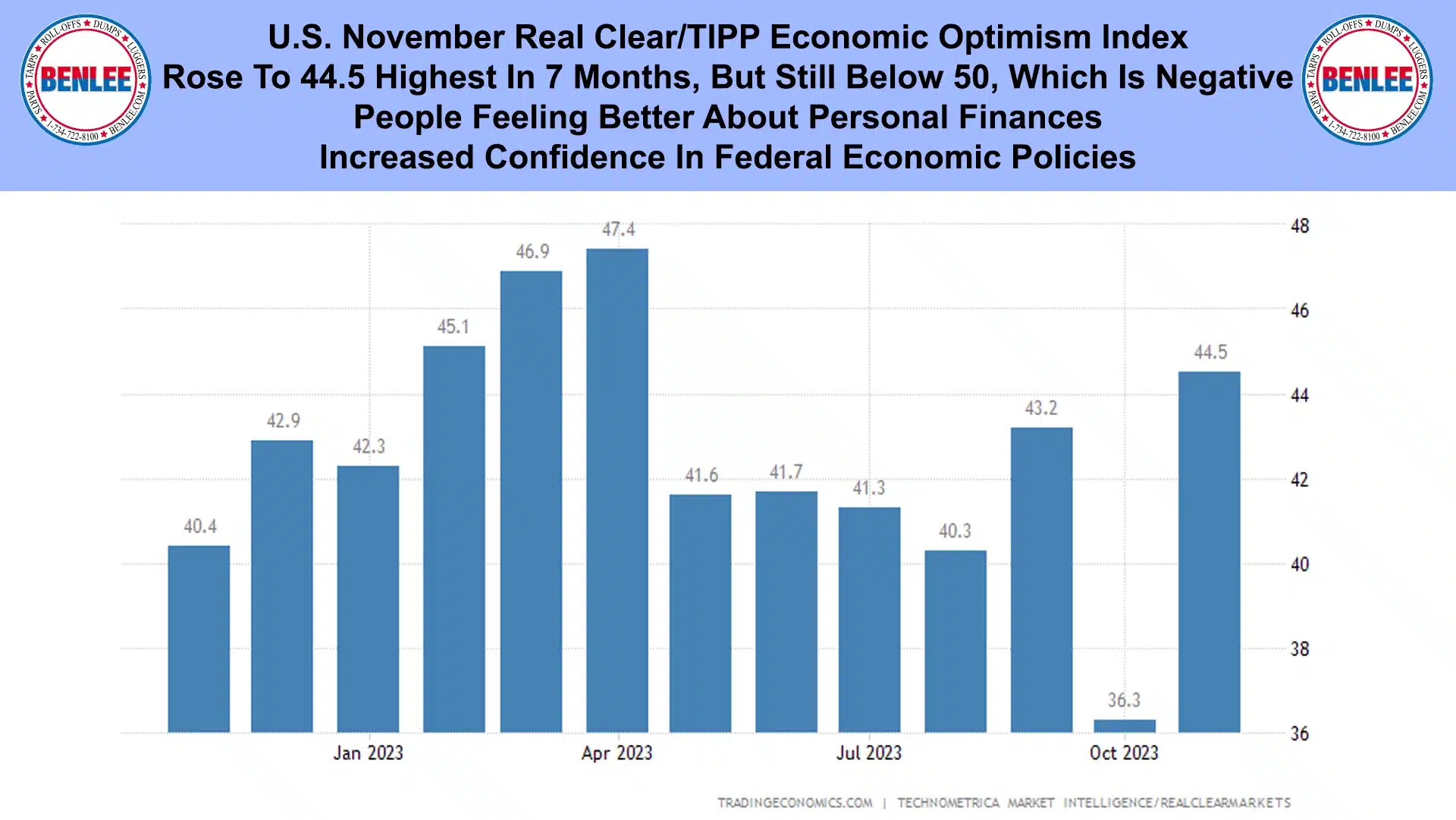

U.S. November Real Clear/TIPP economic optimism index rose to 44.5 the highest in seven months, but still below 50 which is negative. People are feeling better about personal finances and have an increased confidence in federal economic policies.

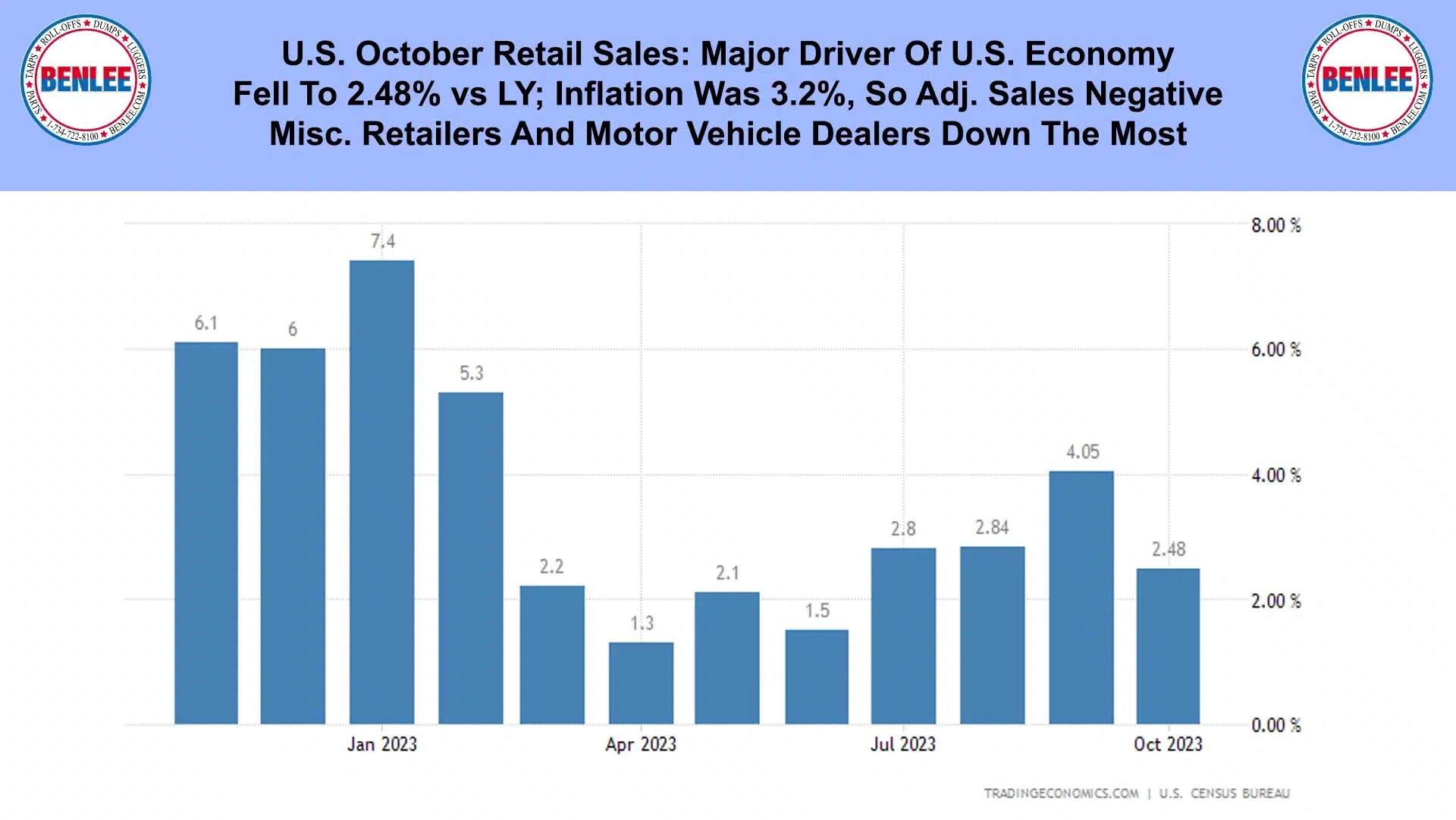

U.S. October retail sales which are a major driver of the U.S. economy, fell to 2.48% vs. last year. Inflation was 3.2%, so adjusted for inflation, sales were negative. Misc. retailers and motor vehicle dealers were down the most.

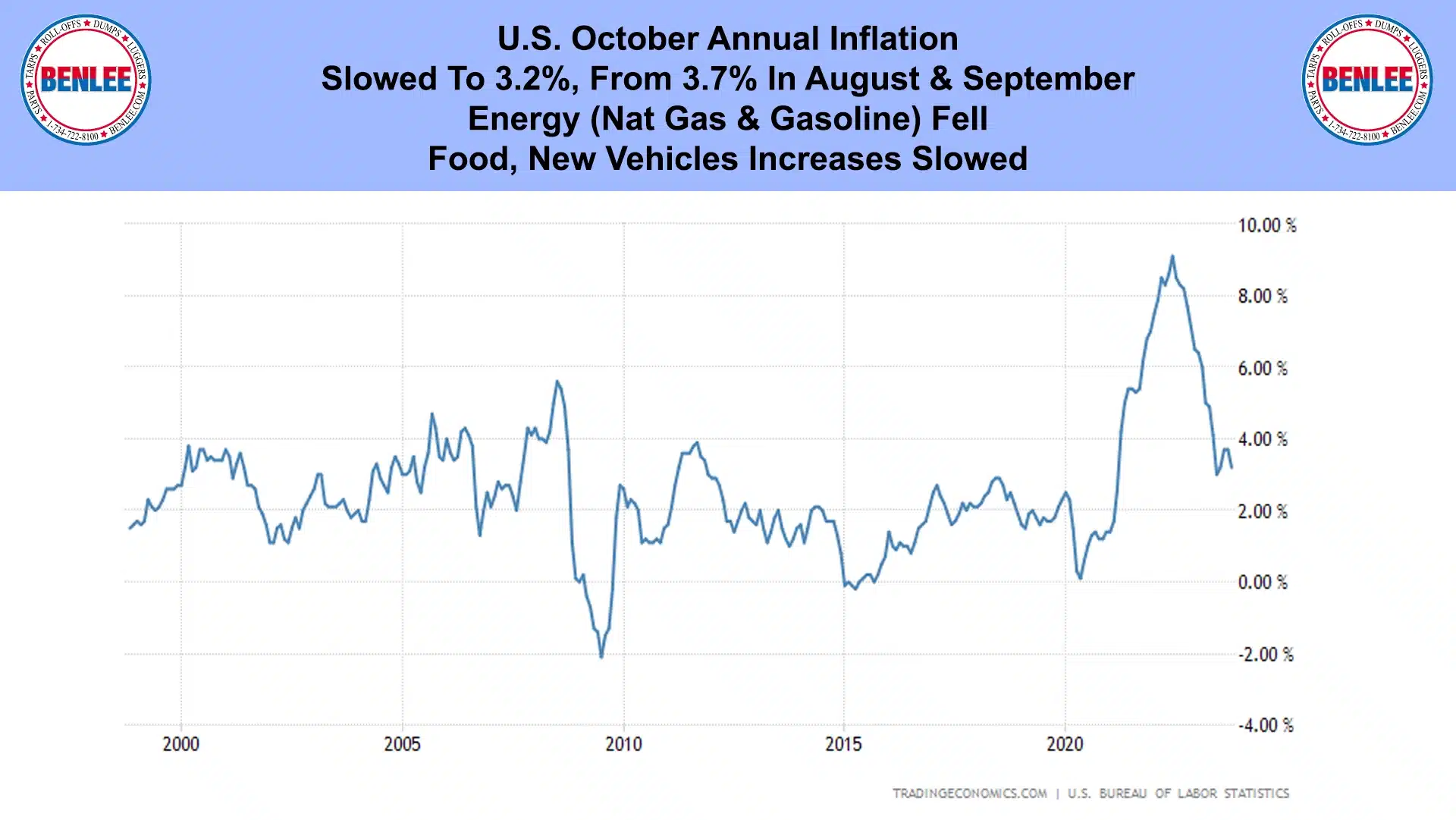

U.S. October annual inflation slowed to 3.2% as just said, from 3.7% in August and September. Energy, as in mostly natural gas and gasoline fell. Food and new vehicle increases slowed.

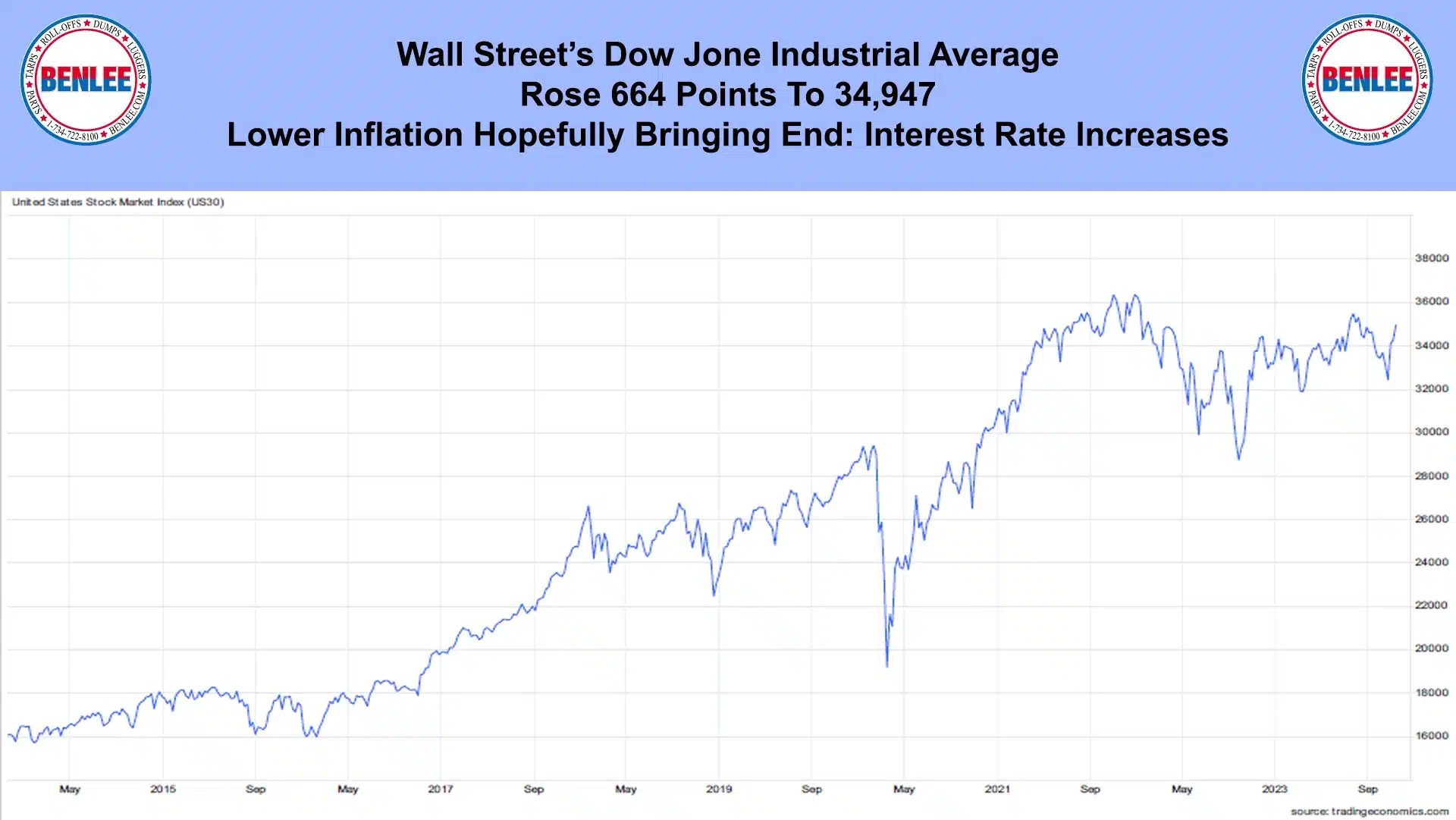

Wall Street’s Dow Jones Industrial average rose 664 points to 34,947 as lower inflation hopefully will be bringing the end to interest rate increases.

This report is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.