November 18, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, November 18th, 2024.

U.S. weekly raw steel production rose slightly to 1.65MT down 2.3% from last year and down 2.1% year to date on slow U.S. manufacturing.

WTI crude oil price fell to $67.02/b. This was driven by China’s sharp jump in electric vehicle use hurting oil demand. Also, on the strong U.S. dollar and a lower global oil forecast for 2025.

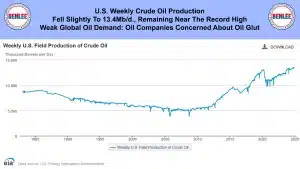

U.S. weekly crude oil production fell slightly to 13.4Mb/d remaining near the record high. Weak global oil demand has oil companies concerned about an oil glut.

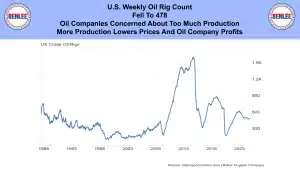

The U.S. weekly oil rig count fell to 478 as oil companies are concerned about too much production as just said. More production lowers oil prices and oil company profits.

Scrap steel #1 HMS price was steady at $305/GT on good supply and weak U.S. and global demand.

Hot-rolled coil steel price fell to $34.55/cwt, $691/T on soft demand and good supply. Note it is about 1/3 of 2021’s high and the price of 2010, 14 years ago.

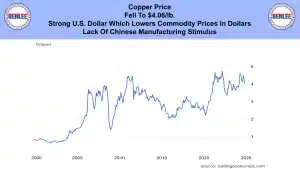

Copper price fell to $4.06/lb., on the strong U.S. dollar which lowers commodities prices in dollars and the lack of Chinese manufacturing stimulus.

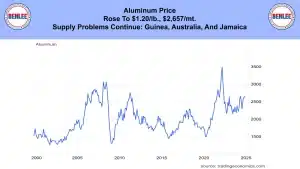

Aluminum price rose to $1.20/lb., which is $2,657/mt as supply problems continue from Guinea, Australia and Jamacia.

U.S. dollar vs other global currencies index. When the US dollar rises, commodity prices in U.S. dollars goes down. This hurts U.S. Exports and makes imports cheaper, which lowers inflation. It rose to 106.7 near a 2 year high on possible higher for longer U.S. interest rates.

U.S. October manufacturing production fell .3% vs last year as the Boeing strike and massive hurricanes hurt output.

U.S. October NFIB small business optimism index increased to 93.7 a three-month high. Companies are hopeful about future business conditions. Concerns about weaker sales and the inability to hire people remain key issues.

U.S. October CPI which is consumer price inflation rose to 2.6%. Most energy fell, but housing rose. The record number of people working making record salaries brings good spending that brings inflation.

U.S. October retail sales rose 2.8% vs last year, which was above forecast with electronics and autos rising the most. Consumers are not happy about high prices, but they continue strong buying.

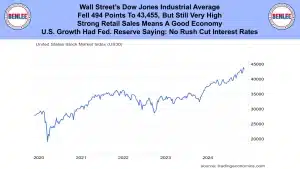

Wall Street’s Dow Jones Industrial Average fell 494 points to 43,454, but it is still very high. Strong retail sales means a good economy. The U.S. growth had the federal reserve say they are in no rush to cut interest rates.

This report by Greg Brown from is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.