November 11, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, November 11th, 2024.

U.S. weekly raw steel production fell to 1.63MT down 2.5% from last year and down 2.1% year to date. This was on slow U.S. manufacturing. Americans are spending a record amount on services.

WTI crude oil price rose to $70.38/b., but it is the price of 2005, 19 years ago, on possible future tighter crude oil sanctions on Iran and Venezuela.

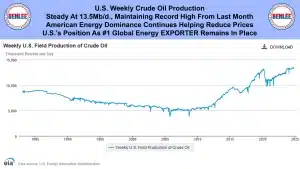

U.S. weekly crude oil production was steady at 13.5mb/d, maintaining the record high from last month. American energy dominance continues helping reduce prices. The U.S.’s position as the #1 global energy exporter remains in place.

The U.S. weekly oil rig count was steady at 479. U.S. technology is keeping the U.S. as the #1 energy supplier to the world.

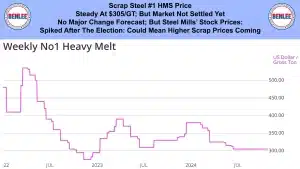

Scrap steel #1 HMS price was steady at $305/GT but the market has not settled yet. No major change is forecast but steel mills’ stock prices spiked after the election which could mean higher scrap prices are coming.

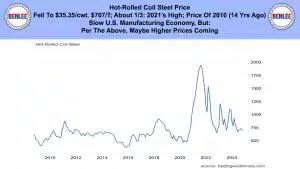

Hot-rolled coil steel price fell to $35.35/cwt, which is $707/T, about 1/3 of 2021’s high and the price of 2010, 14 years ago. This was on the slow U.S. manufacturing economy, but per the above, maybe higher prices are coming.

Copper price fell to $4.31/lb. on a lack of direct Chinese manufacturing stimulus. Also, on possible limited demand from emerging markets based on possible tariff plans.

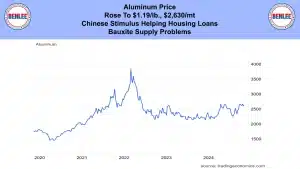

Aluminum price rose to $1.19/lb., $2,630/mt. on Chinese stimulus that is helping housing loans and on bauxite supply problems.

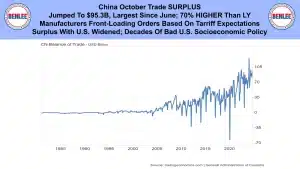

China’s October trade surplus jumped to $95.3B, the largest since June and 70% higher than last year. Manufacturers were front loading orders based on tariff expectations. The surplus with the U.S. widened on decades of bad U.S. socioeconomic policy.

U.S. September trade deficit. Note we were just talking about China’s surplus. Our deficit widened, as in it got worse to $84.4B as exports declined 1.2% after hitting a record in August. Imports hit a record high on strong U.S. consumer spending on imported vehicles and computers.

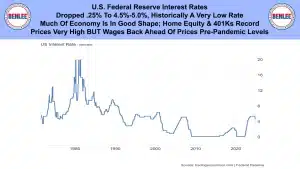

U.S. Federal Reserve interest rates dropped .25% to 4.5% to 5.0%, historical a very low rate. Much of the economy is in good shape as home equity and 401Ks are at record level. Prices are very high, but wages are back ahead of prices pre-pandemic.

U.S. November U of M consumer sentiment survey increased to 73, a 7 month high on Pre-Election data. Future expectations of personal finances soared on the higher incomes people now have. Also, long run business conditions were viewed as the most favorable in almost 4 years

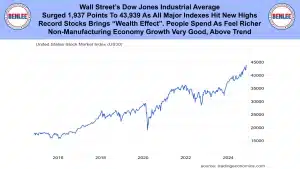

Wall Street’s Dow Jones Industrial average surged 1,937 points to 43,939 as all major indexes hit new highs. Record stocks brings the wealth effect, which is people spend as they feel richer. The non-manufacturing economy growth is very good and above trend.

Roll-off trailer parts, roll-off truck parts for sale. BENLEE, Galbreath, Galfab, Dragon, G&H and more. Rollers, cables, sheaves, cylinders, valves and more. Also, Pioneer, Roll-Rite, Aero, Donovan, U.S. Tarp and more. Order online or call 734-722-8100 to order.

This report by Greg Brown from is brought to you by BENLEE roll off trailers, gondola trailers, crushed car trailers, lugger trucks, roll off trailer parts and of course roll off truck parts for Galbreath, American and more.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.