October 7, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, October 7th, 2024.

U.S. weekly raw steel production fell to 1.65MT, down 2.7% from last year and down 1.7% year to date on slow U.S. manufacturing. But it is believed we are near the bottom of the economic cycle.

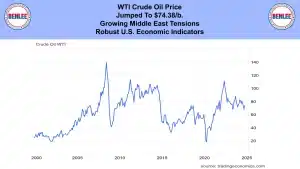

WTI crude oil price jumped to $74.38/b., on growing Middle East tensions and robust U.S. economic indicators.

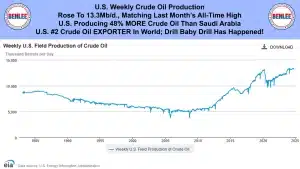

U.S. weekly crude oil production rose to 13.3Mb/d matching last month’s all-time high. The U.S. is producing a huge 48% more crude oil than Saudi Arabia. Also, the U.S. remains the #2 crude oil exporter position in the world. Drill baby drill has happened!

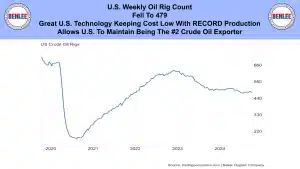

The U.S. weekly oil rig count fell to 479 as great U.S. technology is keeping costs low with record production. This allows the U.S. to maintain the #2 crude oil exporter we just discussed.

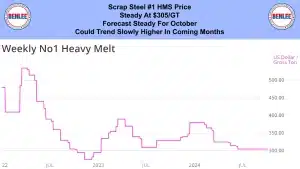

Scrap steel #1 HMS price was steady at $305/GT and is forecast to be steady for October. Scrap steel could trend slowly higher in the coming months.

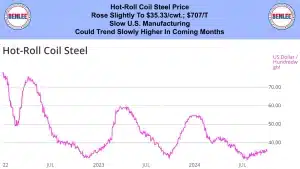

Hot-roll coil steel price rose slightly to $35.33/cwt., $707/T on slow U.S. manufacturing. It could also trend slowly higher in the coming months.

Copper price fell to $4.57/lb., but remains high. Traders took profits, but markets are still positive on copper.

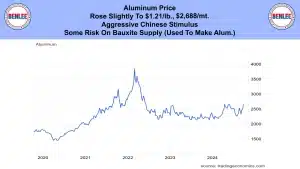

Aluminum price rose slightly to $1.21/lb., $2,668/mt., on the aggressive Chinese stimulus. There remain some risks for the bauxite supply (used to make aluminum) from Guinea and Australia.

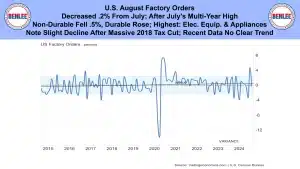

U.S. August Factory Orders decreased .2% from July after July’s multi-year high. Nondurable orders fell .5% as durable orders rose with highest being for electrical equipment and appliances. Note the slight decline after the massive 2018 tax cut with recent data showing no clear trend.

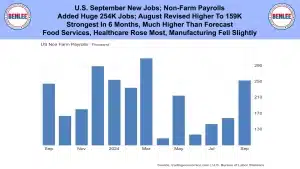

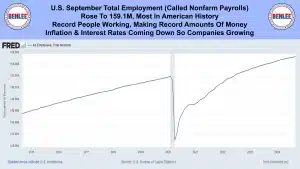

U.S. September new jobs report called nonfarm payrolls. We added a huge 254K jobs and August was revised higher to 159K. This was the strongest in 6 months and much higher than forecast. Food services and healthcare rose the most as manufacturing fell slightly.

The U.S. September unemployment rate fell to 4.1%, the lowest in three months. The number of unemployed fell 281,000 and the number employed rose 430,000. Prices are high but inflation is low, and businesses feel positive, so they are hiring.

U.S. September Average hourly earnings rose a good 4% vs LY, above forecast and above the 2.2% PCE inflation measure. In the 1st year of COVID salaries spiked higher as inflation and the economy crashed. Including the 1st year COVID salaries are higher than inflation so most consumers are strong.

U.S. September total employment called nonfarm payrolls, rose to 159.1 million the most in American history. A record number of people are working, making record amounts of money. Inflation and interest rates are coming down, so companies are growing.

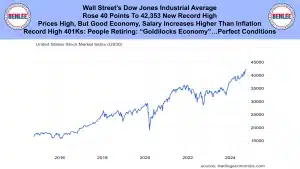

Wall Street’s Dow Jones Industrial Average rose 40 points to 42,353 a new record high. Prices are high as said, but there is a good economy. Salary increases remain higher than inflation and with record high 401Ks, people are retiring. Some call this a Goldilocks economy as in perfect conditions.

This report by Greg Brown from is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.