October 21, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, October 21st, 2024.

U.S. weekly raw steel production rose to 1.62MT down 2.6% from last year and down 1.7% year to date on slow U.S. manufacturing.

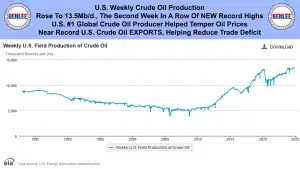

WTI crude oil price fell to $69.22/b., the biggest weekly loss since September on weak demand, especially in China on their record electric vehicle sales. Record U.S. oil production helped get oil prices back to the 2005 level of 19 years ago.

U.S. weekly crude oil production rose to 13.5Mb/d., the second week in a row of new all-time record highs in American history. The U.S., being the #1 global crude oil producer helped temper oil prices. Also, near record U.S. crude oil exports is helping reduce the U.S. trade deficit.

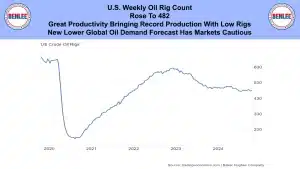

The U.S. weekly oil rig count rose to 482. Great productivity is bringing record production with low rigs. Also, the new lower global oil demand forecast has markets cautious.

Scrap steel #1 HMS price stayed steady nationally weighted at $305/GT. This was on slow U.S. manufacturing and on a good balance of supply and demand.

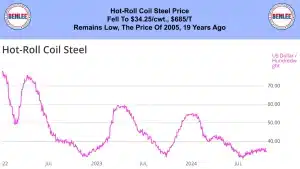

Hot-roll coil steel price fell to $34.25/cwt., $685/T. It remains low and the price of 2005, 20 years ago.

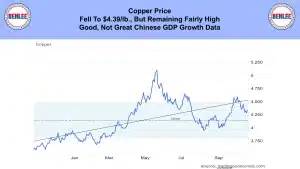

Copper price fell to $4.39/lb., but is remaining fairly high on good, but not great Chinese GDP growth data.

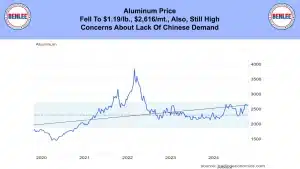

Aluminum price fell to $1.19/lb., $2,616/mt., also still high on concerns about the lack of Chinese demand.

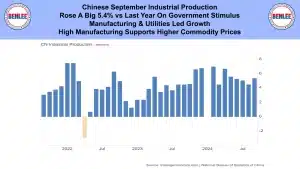

Chinese September industrial production rose a big 5.4% vs last year on government stimulus. Manufacturing and utilities led the growth. High manufacturing supports higher commodity prices.

U.S. September housing starts eased .5% to 1.35 million annualized, below the rate of the 1950’s. High interest rates and high prices have been a problem.

U.S. September industrial production fell .6% vs last year on the hurricanes and the Boeing strike. Manufacturing which is 78% of the total fell about the same, but falling interest rates and U.S. government stimulus is coming.

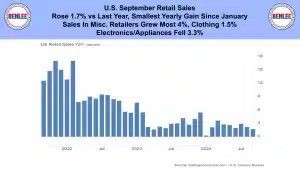

U.S. September retail sales rose 1.7% vs last year, the smallest yearly gain since January. Sales of Miscellaneous retailers grew the most at 4% and clothing at 1.5%. Electronics and appliances fell 3.3%.

U.S. October NAHB/Wells Fargo housing market index. This is how single family home builders feel about conditions. The index rose to 43, the highest since June. Lower interest rates and record U.S. employment will help the future.

Wall Street’s Dow Jones Industrial Average rose 412 points to 43,276 a new record high. But there are problems with high consumer debt and rising debt delinquencies, yet on the positive side strong corporate earnings and record 401Ks are helping the economy.

This report by Greg Brown from is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.