January 2, 2024

This is the Commodities, Scrap Metal, Recycling and Economic Report, January 2, 2024.

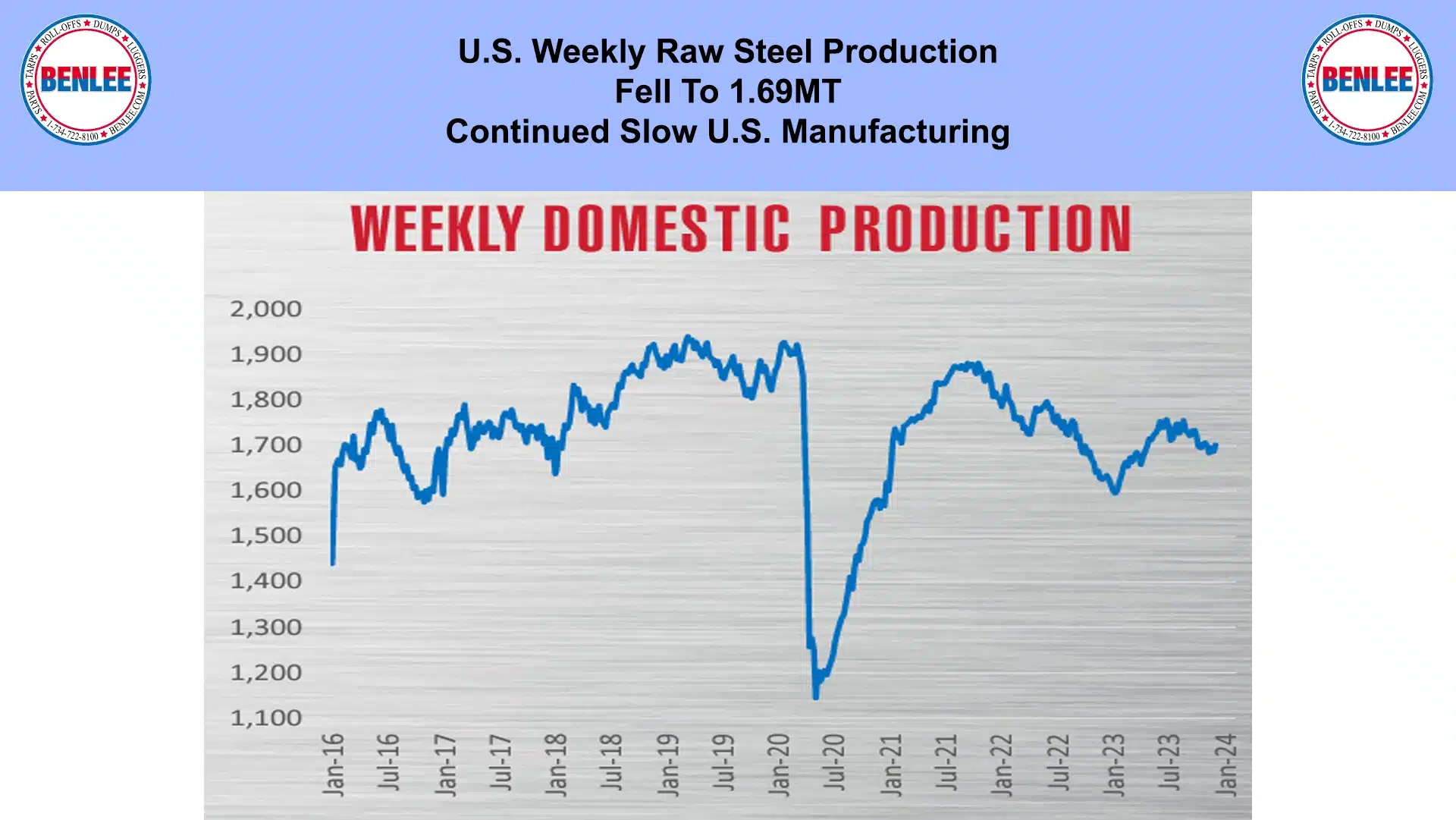

U.S. weekly raw steel production fell to 1.69MT on continued slow U.S. manufacturing.

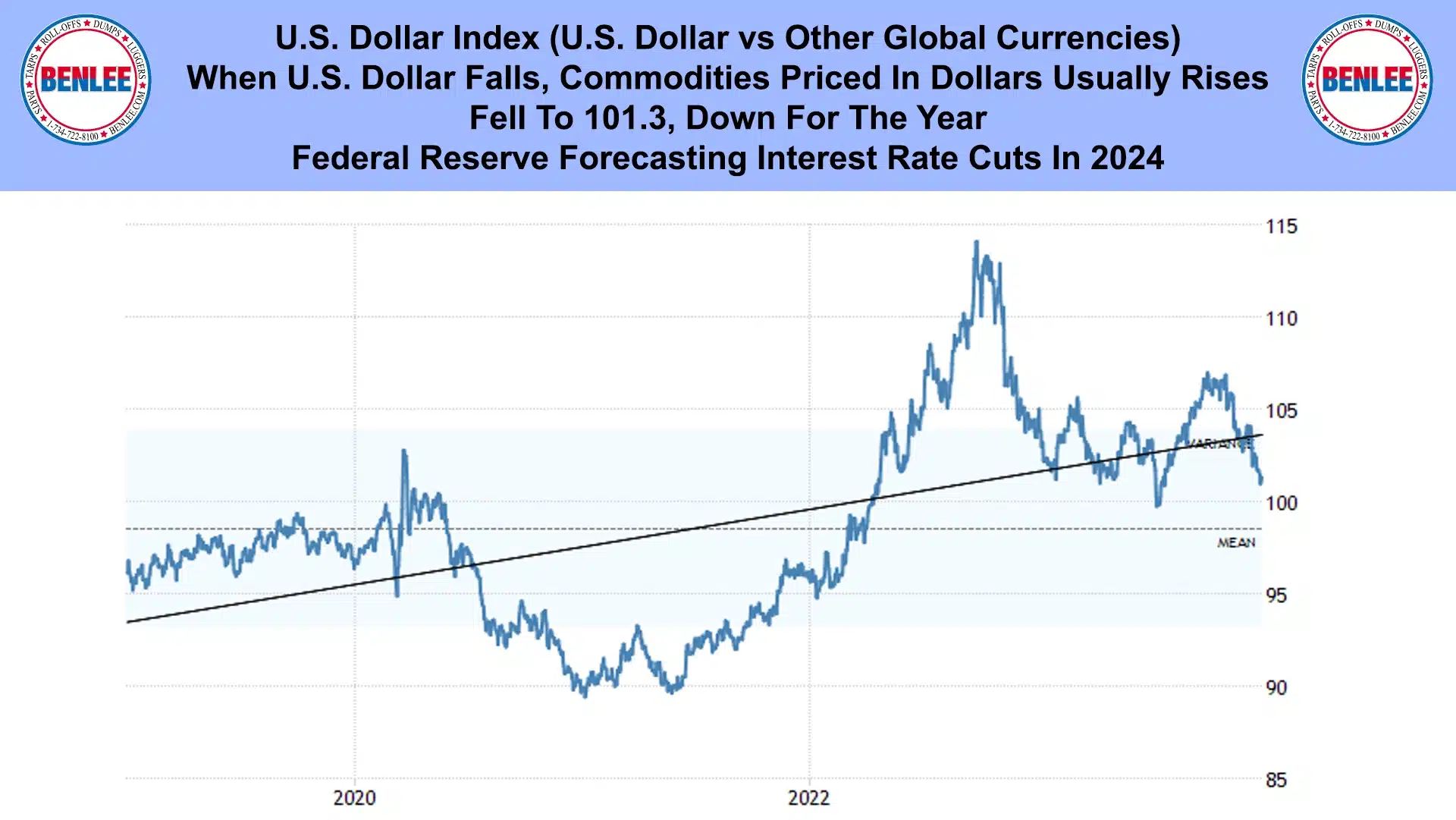

U.S. Dollar index, the U.S. dollar vs other global currencies. When the U.S. dollar index goes down, commodities priced in dollars usually rises. It fell to 101.3, down for the year as the Federal Reserve is forecasting interest rate cuts in 2024.

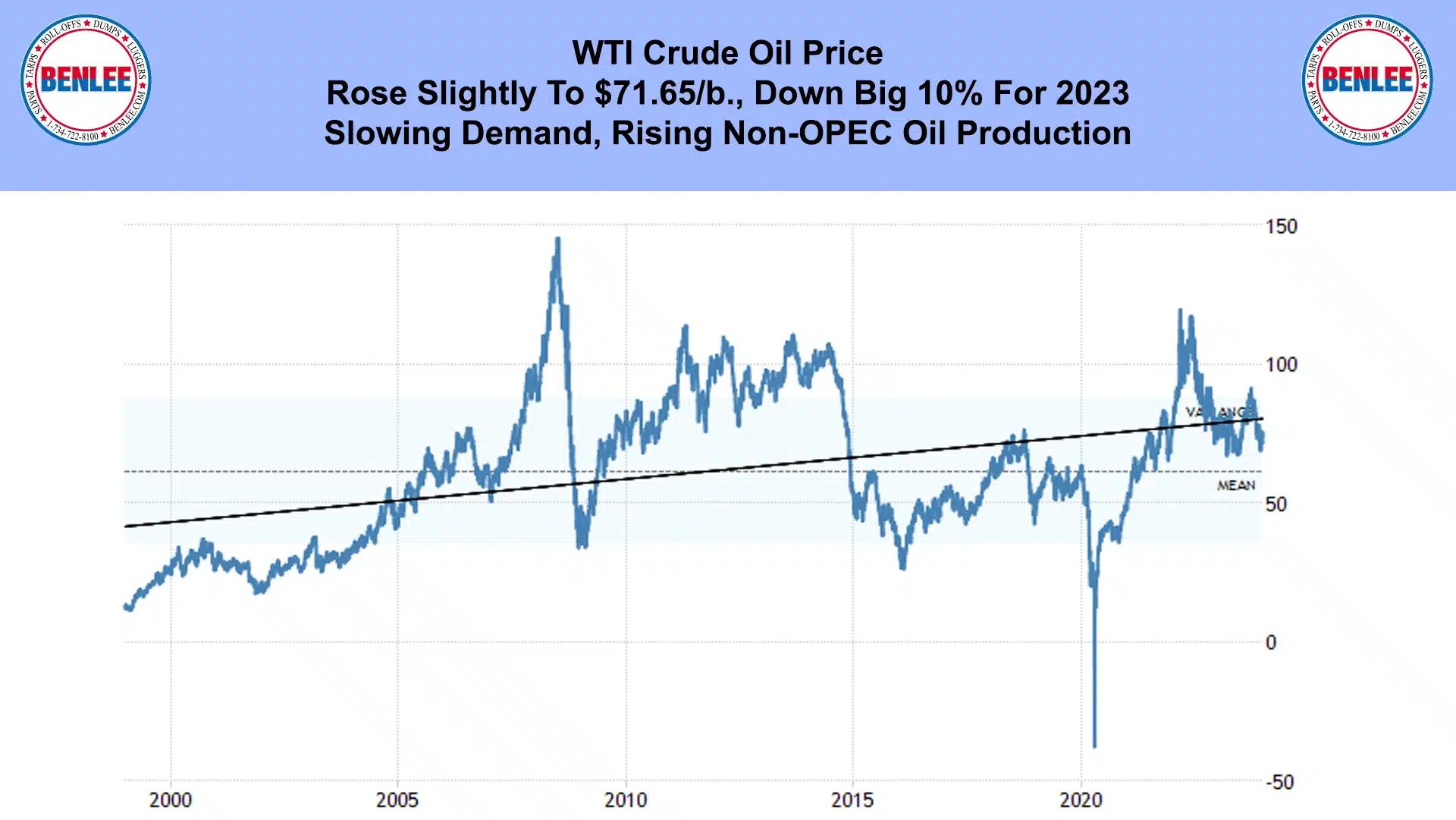

WTI crude oil price rose slightly to $71.65/b., down a big 10% for 2023. This was on slowing demand and rising non-OPEC oil production.

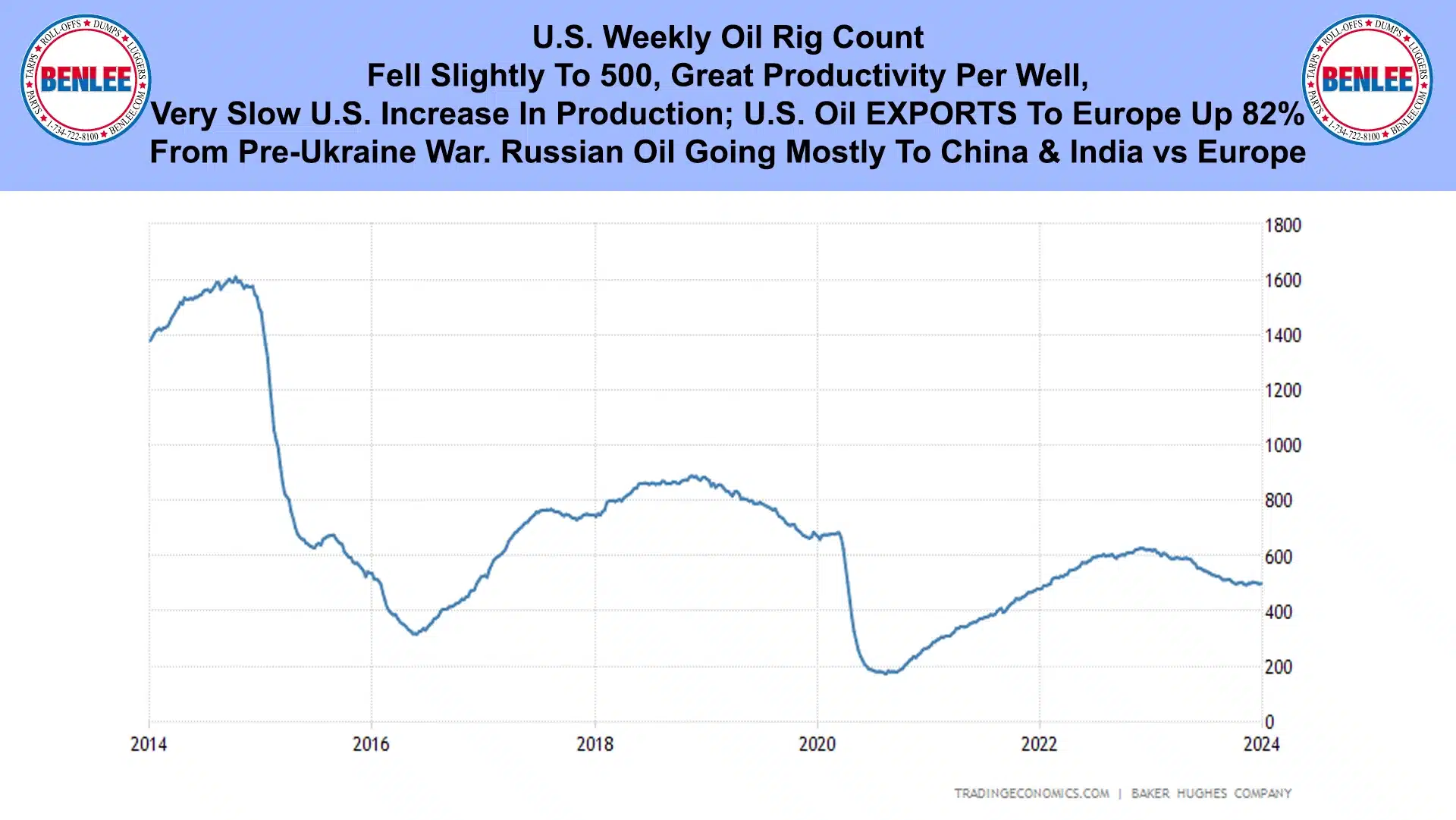

The U.S. oil rig count fell slightly to 500. This was on great productivity per well and a very slow increase in production. U.S. oil exports to Europe are up 82% from pre-Ukraine war. Russian oil now going mostly to China and India, vs Europe.

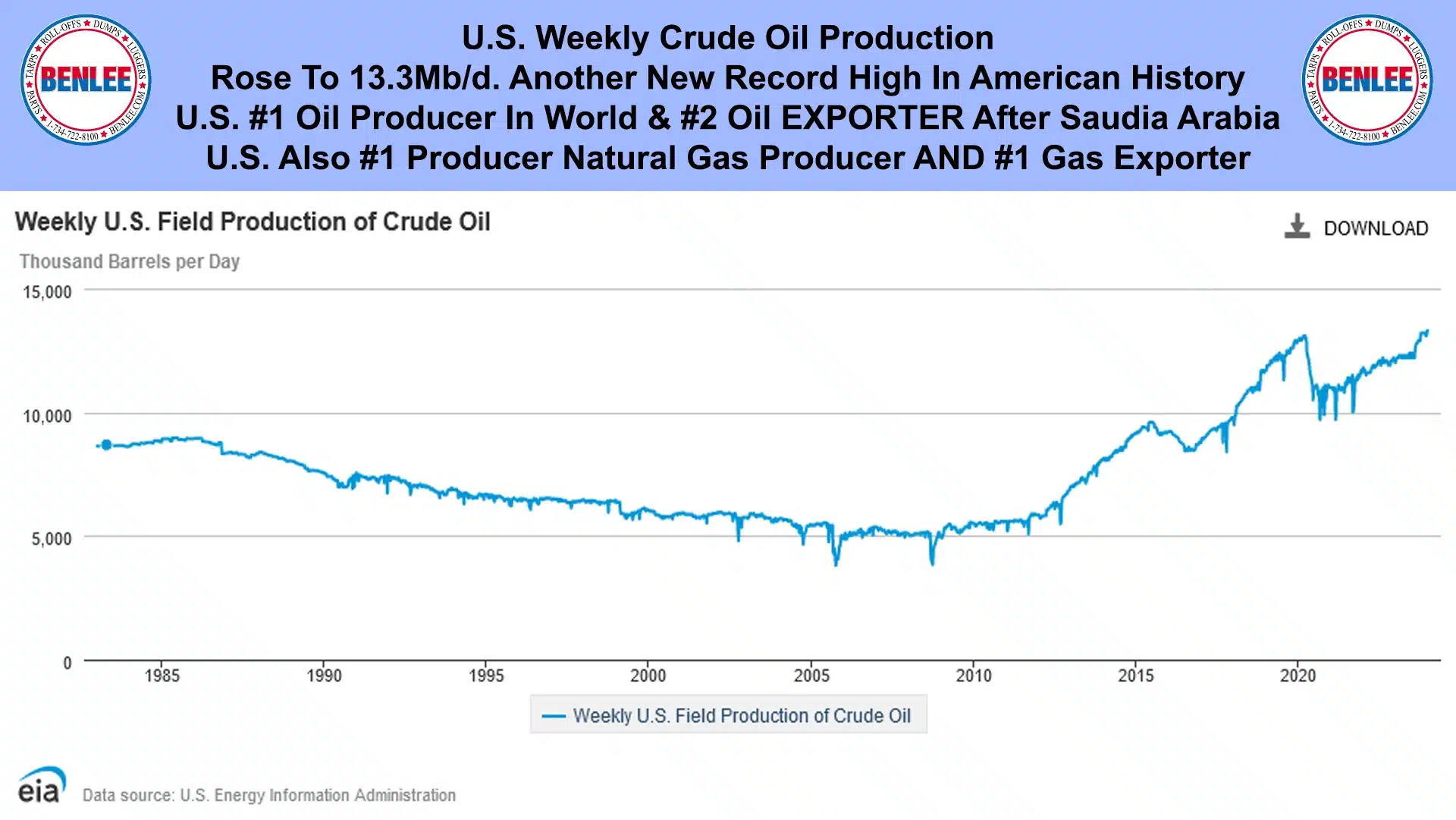

U.S. weekly crude oil production rose to 13.3Mb/d, another new record high in American history. The U.S. is the #1 oil producer in the world and the #2 oil exporter, yes exporter, after Saudia Arabia. The U.S. is also the #1 natural gas producer and #1 exporter.

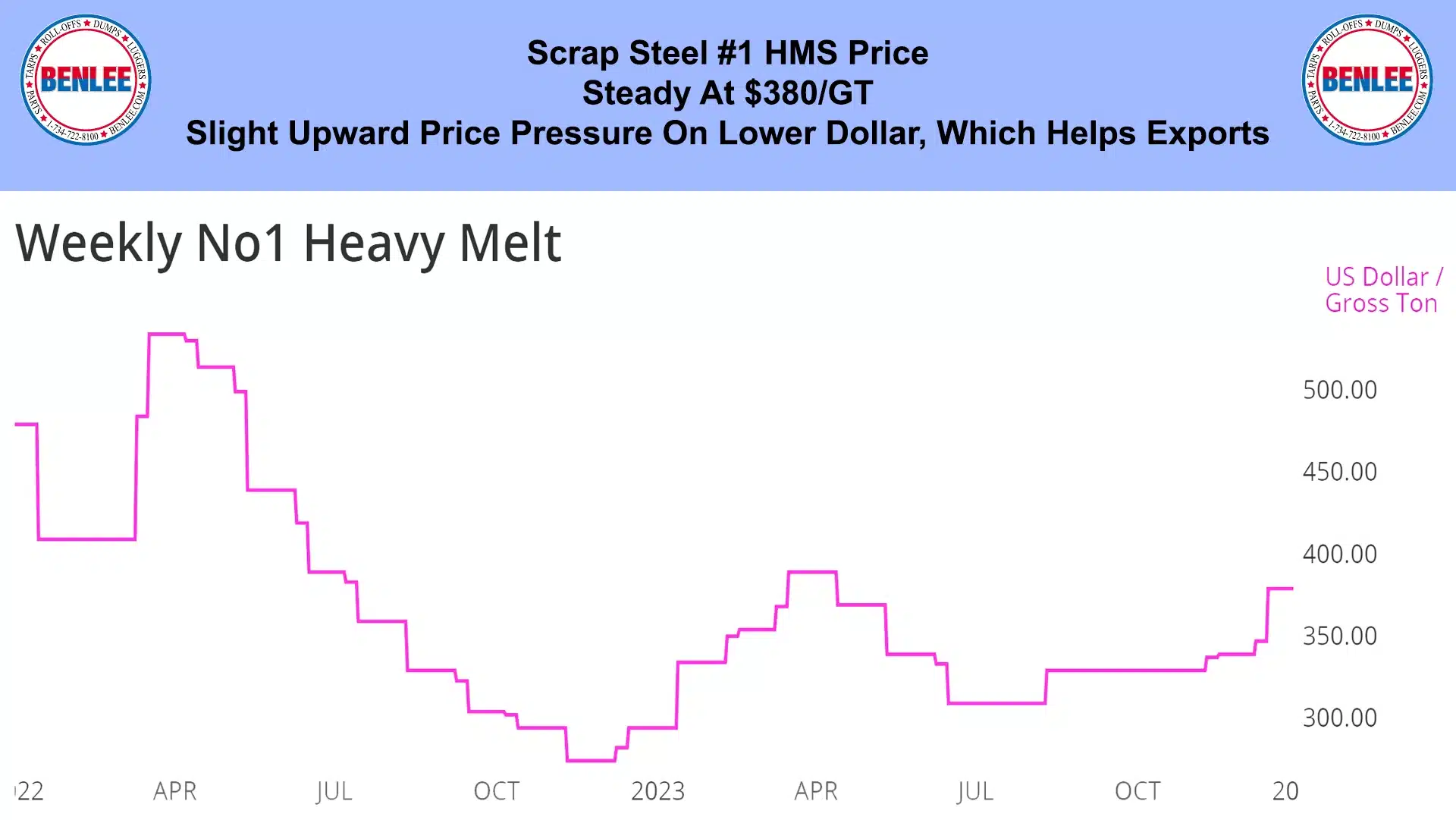

Scrap steel #1 HMS price was steady at $380/GT. There is slight upward price pressure on scrap steel due to the lower U.S. dollar, which helps exports.

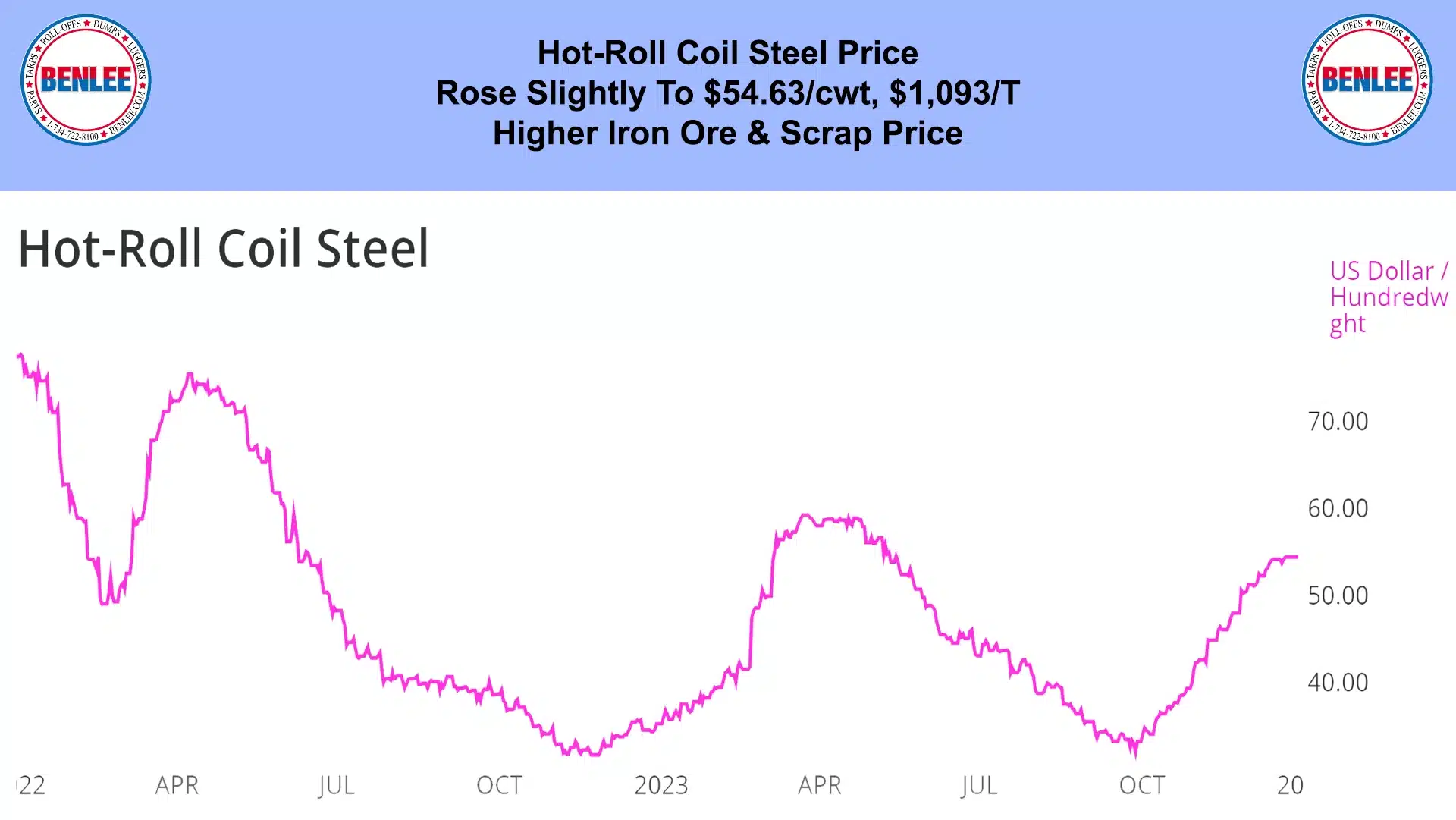

Hot-roll coil steel price rose slightly to $54.63/cwt, $1,093/T on higher iron ore and scrap prices.

Copper price rose slightly to $3.89/lb., on good demand helped by a lower dollar. Copper is called Dr. Metal. Copper price is an indicator of economic health. Many people are not happy, but the economy is pretty good.

Aluminum price rose to $1.08/lb., $2,391/mt., the highest in 8 months. This was on supply concerns, but soft Chinese demand from softer office building construction.

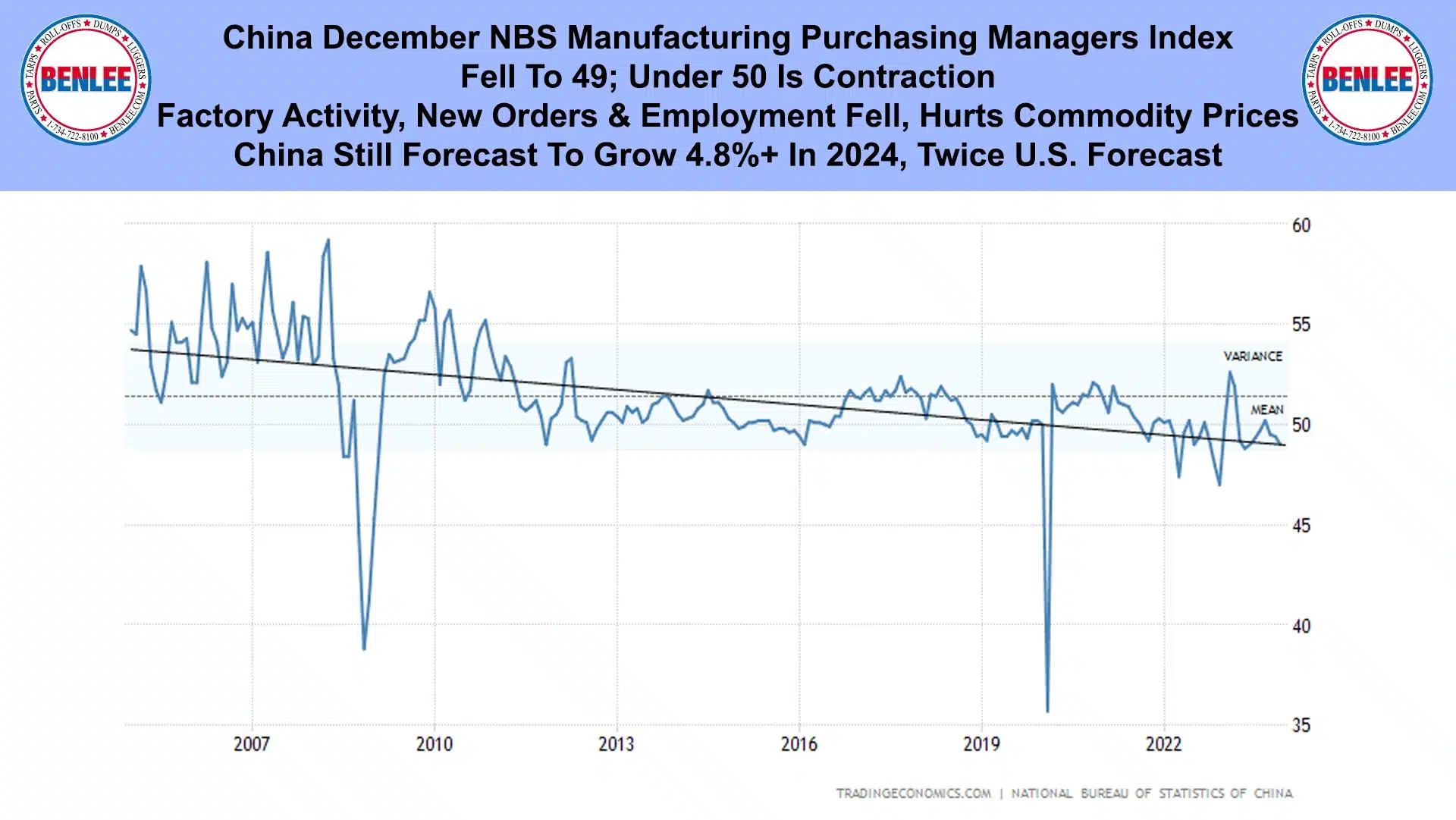

China December NBS Manufacturing Purchasing Managers Index fell to 49, with under 50 being contraction. Factory activity, new orders and employment all fell, which hurts commodity prices. China is still forecast to grow 4.8% in 2024, twice the U.S. forecast.

U.S. November goods trade deficit, widened to $90.3B, as exports of industrial supplies and vehicles declined. BMW and Mercedes are among the largest U.S. exporters, exporting SUVs.

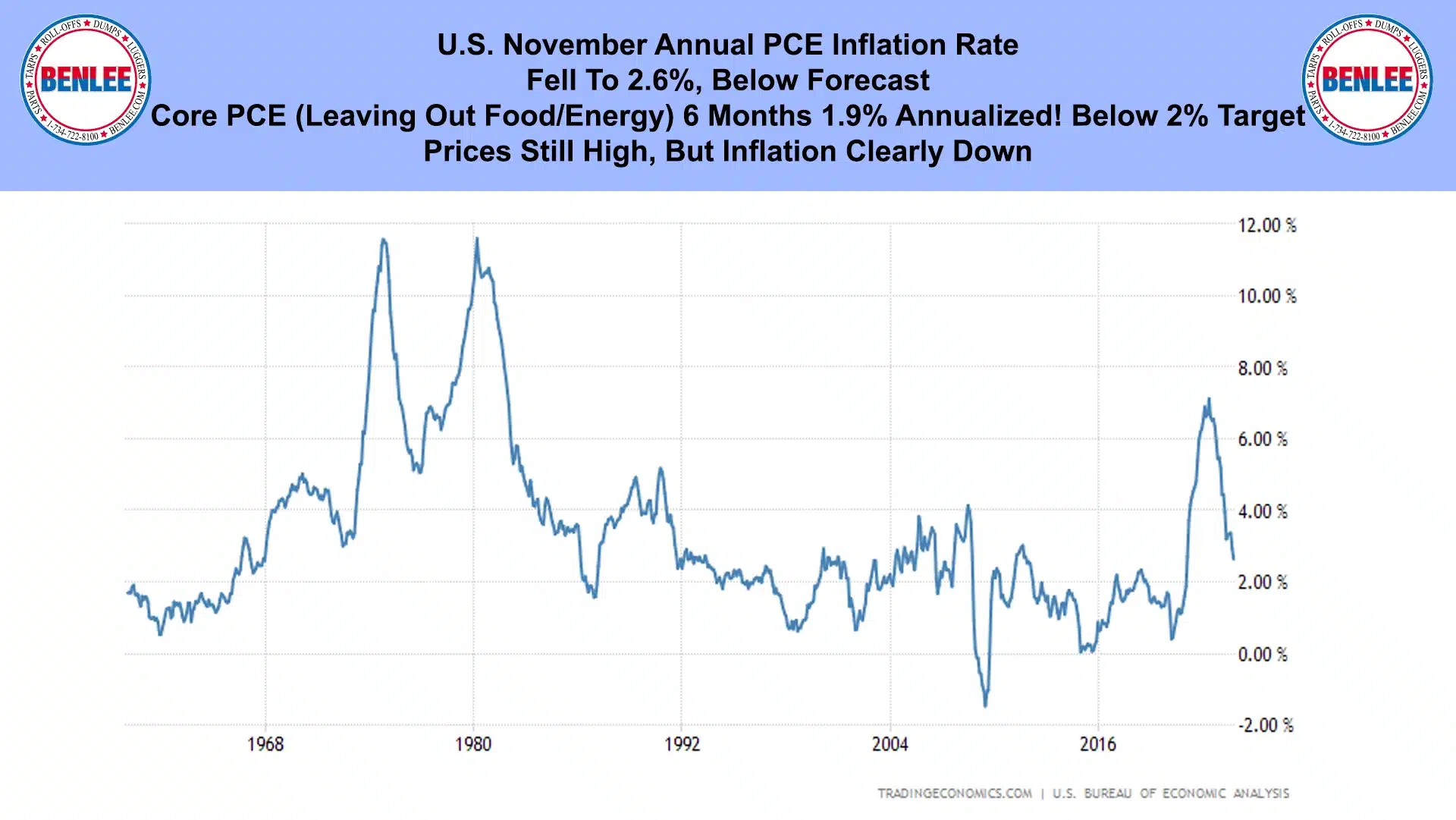

U.S. November Annual PCE Inflation rate fell to 2.6%, below forecast. Core PCE leaving out food and energy was up only 1.9% annualized, below the 2% target. Prices are still high, but inflation is clearly down.

U.S. November new orders for durable goods manufactured in the U.S. surged by 5.4% led by transportation, the largest gain since July 2020.

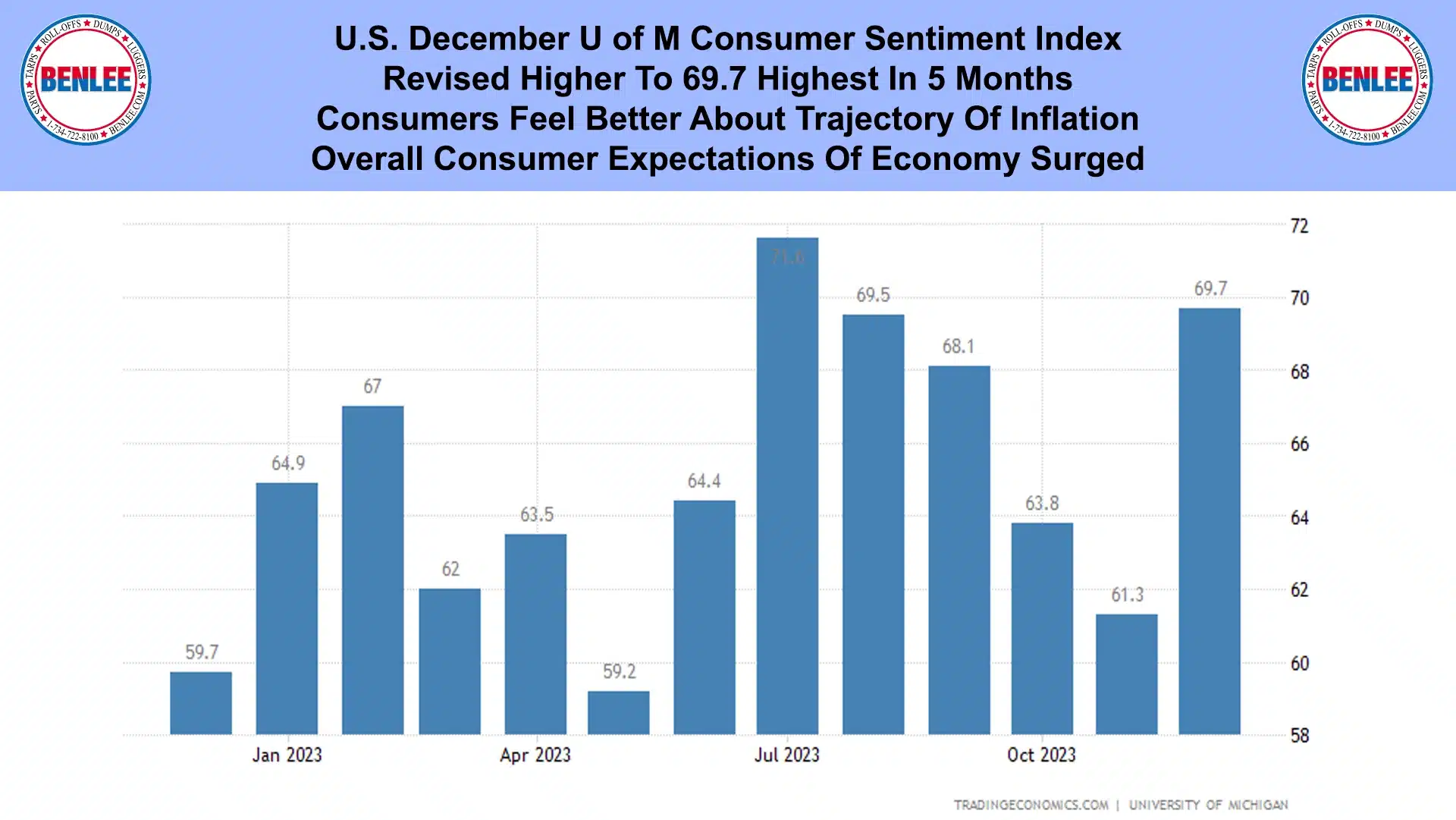

U.S. December U of M Consumer Sentiment index was revised higher to 69.7, the highest in 5 months. Consumers feel better about the trajectory of inflation. Overall consumer expectations of the economy surged.

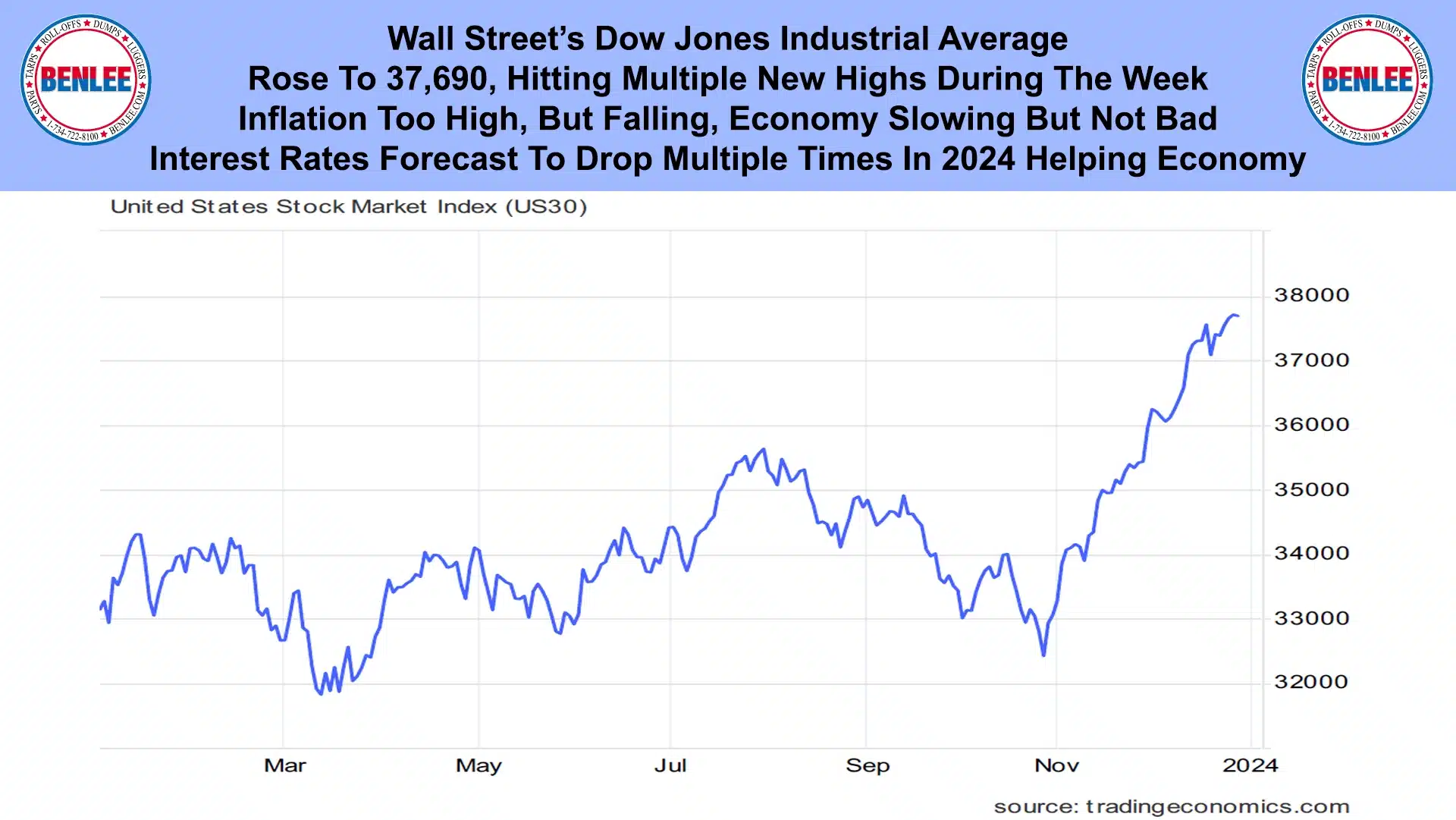

Wall Street’s Dow Jones industrial average rose to 37,690, hitting multiple new highs during the week. Inflation is too high, but is falling and the economy is slowing, but not its bad. Interest rates are forecast to drop multiple times in 2024.

This report is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.