March 31, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, March 31th, 2025.

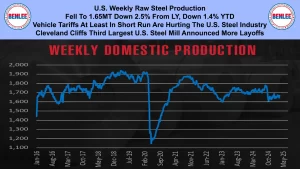

U.S. weekly raw steel production fell slightly to 1.65MT down 2.5% from last year and down 1.4% year to date. Vehicle tariffs at least in the short term are hurting the U.S. steel industry. Cleveland Cliffs, the third largest U.S. steel mill just announced more layoffs on top of the ones from a couple of weeks ago.

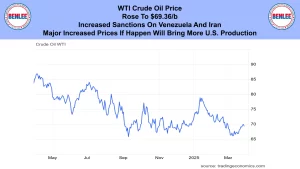

WTI crude oil price rose to $69.36/b. on increased sanctions on Venezuela and Iran. Major increased prices if they happen will bring more U.S. production.

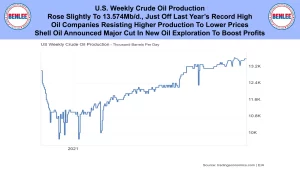

U.S. weekly crude oil production rose slightly to 13.57Mb/d just off last year’s record high. Oil companies are resisting higher production to lower prices. Shell oil announced a major cut in new oil exploration to boost profits.

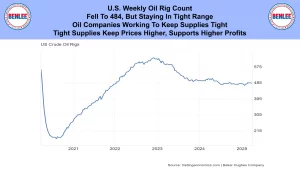

The U.S. weekly oil rig count fell to 484, but is staying in a tight range. Oil companies are working to keep supplies tight. Tight supplies keep prices higher, which supports higher profits.

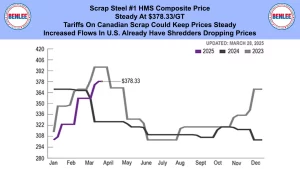

Scrap steel #1 HMS composite price was steady at $378.33/GT. Tariffs on Canadian scrap metal could keep prices steady, but increased flows in the U.S. already have shredders dropping prices.

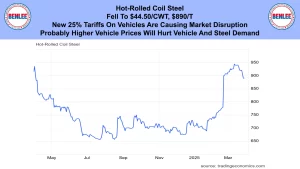

Hot-rolled coil steel price fell to $44.50/cwt, $890/T. The new 25% tariffs on vehicles are causing market disruption. Higher vehicle prices will hurt vehicle and steel demand.

Copper price rose slightly to $5.11 after hitting new highs during the week. There are reports of new copper tariffs by the U.S. Possible tariffs created a surge of copper imports into the U.S. to beat tariffs.

Aluminum price fell to $1.16/lb., $2,551/MT the lowest in 10 weeks. Rising trade tensions are slowing global demand, as increased alumina capacity came on-line.

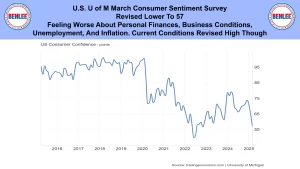

U.S. U of M March consumer sentiment survey was revised lower to 57. People are feeling worse about personal finances, business conditions, unemployment and inflation. Current condition was revised higher though.

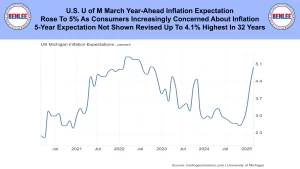

U.S. U of M March year-ahead inflation expectation rose to 5% as consumers are increasingly concerned about inflation. The 5-year inflation expectation not shown here was revised up to 4.1% the highest in 32 years.

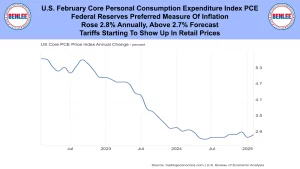

U.S. February Core personal consumption expenditure index called PCE. It is the federal reserve’s preferred measure of inflation. It rose to 2.8% annually, above the 2.7% forecast. Tariffs are starting to show up in retail prices.

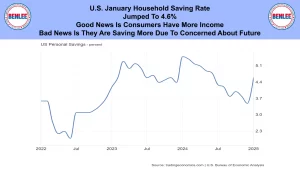

U.S. January household savings rate jumped to 4.6%. The good news is consumers have more income. The bad news is they are saving more due to being concerned about the future.

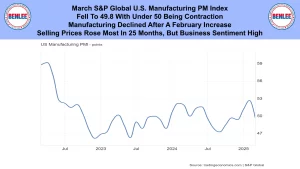

March S&P Global U.S. manufacturing purchasing managers’ index. It fell to 49.8 with under 50 being contraction. Manufacturing declined after a February increase. Selling prices rose the most in 25 months, but business sentiment was high.

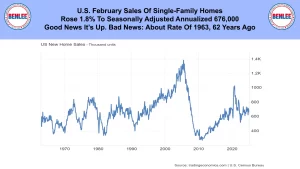

U.S. February sales of single family homes rose 1.8% to a seasonally adjusted annualized rate of 676,000. The good news is that it’s up. The bad news is that this is about the rate of 1963, 62 years ago.

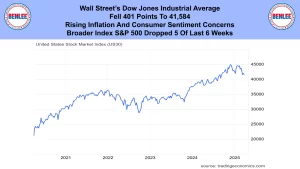

Wall Street’s Dow Jones Industrial average fell 401 points to 41,584. This was on rising inflation and consumer sentiment concerns. The broader index, the S&P 500 has dropped 5 of the last 6 weeks.

This is Greg Brown. As always, feel free to call or email me with any questions, and we hope all have a safe and profitable week.