February 10, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, February 10th, 2025.

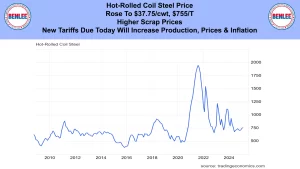

U.S. weekly raw steel production rose slightly to 1.66MT up .8% from last year and up 1.0% year to date. This was on slow U.S. manufacturing, but new tariffs due today will increase production.

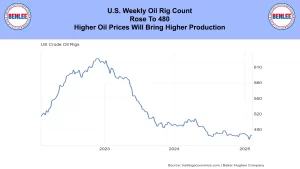

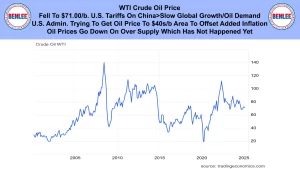

WTI crude oil price fell to $71.00/b., on U.S. tariffs on China expected to slow global growth and oil demand. The U.S. administration is trying to get oil to the $40s/b. area, to offset other added inflation. Oil prices go down on oversupply which has not happened yet.

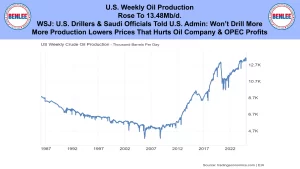

U.S. weekly crude oil production rose to 13.48Mb/d. The Wall Street Journal reported U.S. drillers and Saudi officials told U.S. Administration they will not drill more. More production lowers prices that hurts oil company and OPEC profits.

The U.S. weekly oil rig count rose 480. Higher oil prices will bring higher production.

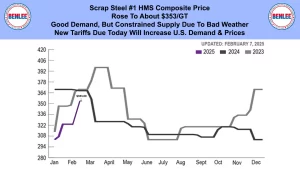

Scrap steel #1 HMS composite price rose to about $353/GT. This was on good demand but constrained supply due to bad weather. New tariffs due today will increase U.S. demand and prices.

Hot-rolled coil steel price rose to $37.75/cwt., $755/T on higher scrap prices. New tariffs due today will increase production, prices, and inflation.

Copper price rose to $4.59lb. on concerns over supply disruptions in Chile, the world’s largest copper producer.

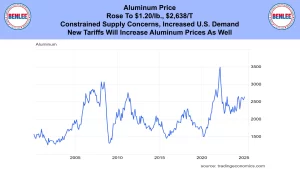

Aluminum price rose to $1.20/lb., $2,638/MT constrained supply concerns and increased U.S. demand. The new tariffs will increase prices on Aluminum as well.

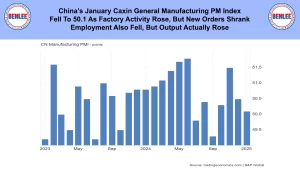

China’s January Caxin general manufacturing purchasing manager’s index fell to 50.1 as factory activity rose, but new orders shrank. Employment also fell, but output activity rose.

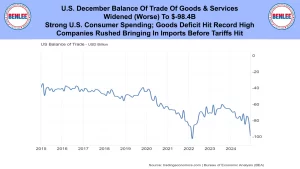

U.S. December Balance of Trade, which is goods and services, widened as in became worse, to -$98.4B. This was on strong U.S. consumer spending as the goods deficit hit a record high. This was as companies rushed to bring in imports before tariffs. New Tariffs will lower the deficit.

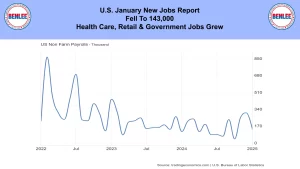

U.S. January new jobs report fell to 143,000 as health care, retail and government jobs grew.

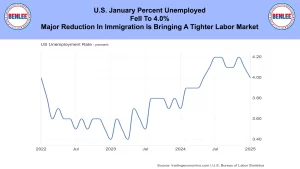

U.S. January percent unemployed fell to 4.0%. The major reduction in immigration is bringing a tighter labor market.

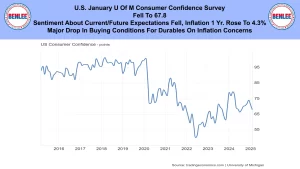

U.S. January U of M long term, 5 year inflation expectation rose to 3.3%, the highest since 2008. Consumers expected the high 2023 inflation would fall, but now consumers are increasingly worried about tariffs increasing inflation.

U.S. January U of M consumer confidence survey fell to 67.8 as sentiment about current and future expectations fell. The inflation one year expectation rose to 4.3%. Also, there was a major drop in buying conditions for durables on inflation concerns.

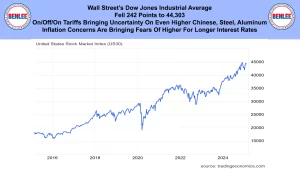

Wall Street’s Dow Jones Industrial average fell 242 points to 44,303. The on/off/on tariffs are bringing uncertainty on even higher Chinese steel and aluminum tariffs. Inflation concerns are bringing higher for longer interest rate concerns.

This is Greg Brown still reporting from down under from New Zealand and took time to watch the Super Bowl. As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.