January 27, 2025

This is the Recycling, Scrap Metal, Commodities and Economic Report, January 27th, 2025.

U.S. weekly raw steel production fell to 1.64MT up .9% from last year and up 1.1% year to date. This was on continued slow U.S. manufacturing.

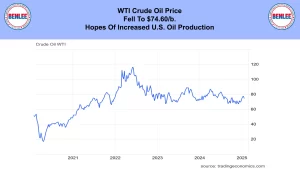

WTI crude oil price fell to $74.60/b., on hopes of increased U.S. oil production.

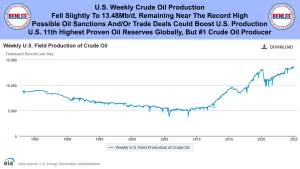

U.S. weekly crude oil production fell slightly to 13.48Mb/d., remaining near the record high. Possible oil sanctions and/or trade deals would boost U.S. production. The U.S. has the 11th highest proven oil reserves globally, but we are the #1 crude oil producer; a huge 50% higher than Saudia Arabia.

The U.S. weekly oil rig fell to 472 on great productivity per well. Oil companies are not ready for major increased production until sanctions and/or trade deals raise prices which will lead to higher U.S. production.

Scrap steel #1 HMS composite price was steady at $323.33/GT. There is upward price pressure for February because cold weather is hurting the supply into recyclers.

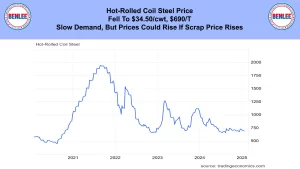

Hot-rolled coil steel price fell to $34.50/cwt, $690/T. This was on slow demand, but prices could rise if scrap price rises.

Copper price fell to $4.31/lb., on constrained supply concerns. But the lack of immediate tariffs supported higher prices.

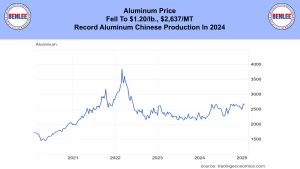

Aluminum price fell to $1.20/lb., $2,637/MT on record aluminum Chinese production in 2024.

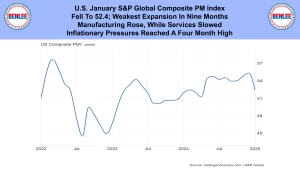

U.S. January S&P Global Composite purchasing managers index fell to 52.4, the weakest expansion in nine months. Manufacturing rose, while Services slowed as inflationary pressures reached a four-month high.

U.S. December existing home sales rose to 4.38M annualized. But high interest rates remained putting downward pressure on sales. 2024 total sales were the lowest in 29 years.

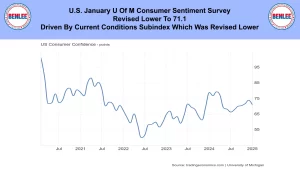

U.S. January U of M consumer sentiment survey was revised lower to 71.1. This was driven by the current conditions subindex was revised lower.

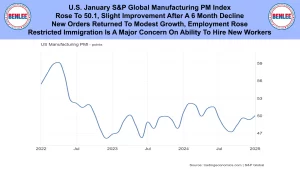

U.S. January S&P Global Manufacturing purchasing managers index rose to 50.1. This was a slight improvement after a 6-month decline. New orders returned to modest growth as employment rose. Restricted immigration is a major concern on the ability to hire new workers.

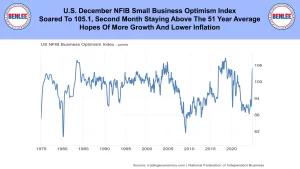

U.S. December NFIB small business optimism index soared to 105.1, the second month staying above the 51-year average. This was on hopes of more growth and lower inflation.

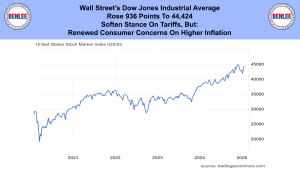

Wall Street’s Dow Jones Industrial average rose 936 points to 44,424. This was on the softened stance on tariffs, but renewed consumer concerns on higher inflation.

This is Greg Brown still reporting from down under at the Australian Open tennis tournament. As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.