January 20, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, January 20th, 2025.

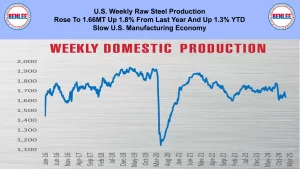

U.S. weekly raw steel production rose to 1.66MT up 1.8% from last year and up 1.3% year to date on the slow U.S. manufacturing economy.

WTI crude oil price rose to $77.89/b., off even higher during the week. The ceasefire in the Middle East helped lower prices, but it was still the 5th week of gains. New sanctions on Russian oil and cold weather both raise prices.

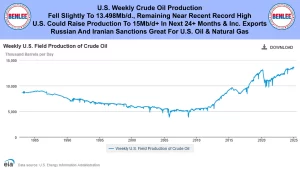

U.S. weekly crude oil production fell slightly to 13.498Mb/d. remaining near the recent record high. The U.S. could raise production to 15Mb/d+ in the next 24 months and increase exports. Russian and Iranian sanctions are great for U.S. Oil and natural gas.

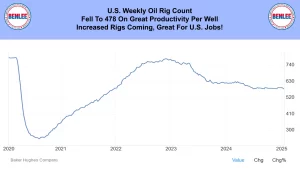

The U.S. weekly oil rig fell slightly to 478 on great productivity per well. Increased rigs are coming, which is great for U.S. jobs.

Scrap steel #1 HMS composite price was steady at $323.33/GT. February pricing is unknown. Lower steel volumes are hurting demand, but bad U.S. weather is hurting scrap supply.

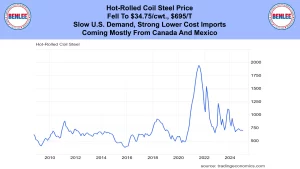

Hot-rolled coil steel price fell slightly to $34.75/cwt. $695/T. This was on slow U.S. demand and strong lower cost imports coming mostly from Canada and Mexico.

Copper price rose to $4.35/lb., a two month high. This was on strong Chinese production data and strong Chinese exports.

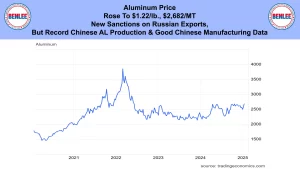

Aluminum price rose to $1.22/lb., $2,682/MT in new sanctions on Russian exports but there was record Chinese aluminum production and good Chinese manufacturing data.

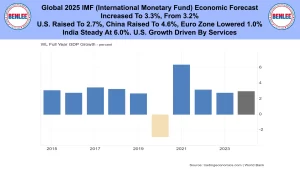

Global 2025 IMF the International Monetary Fund economic forecast increased to 3.3% from 3.2%. This was drive by the U.S. forecast was raised to 2.7%, China raised to 4.6&% and the Euro Zone lowered to 1.0%. India was steady at 6% as the U.S. growth is being driven by services.

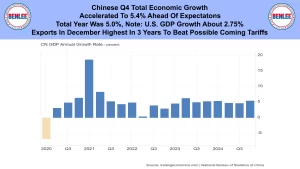

Chinese Q4 total economic growth accelerated to 5.4% ahead of expectations. The total year was 5.4%. As a note the U.S. GDP is about 2.75%. Exports in December were the highest in 3 years to beat possible coming tariffs.

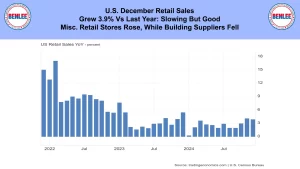

U.S. December retail sales grew at 3.9% vs last year, which was slowing but good. Miscellaneous retail stores rose while building suppliers fell.

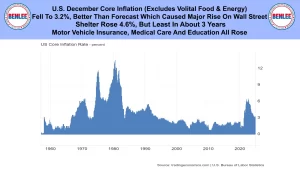

U.S. December core inflation which excludes volatile food and energy. It fell to 3.2%, better than forecast, which caused a major rise on Wall Street. Shelter rose 4.6%, but was the least in about 3 years. Motor vehicle insurance, medical care and education all rose.

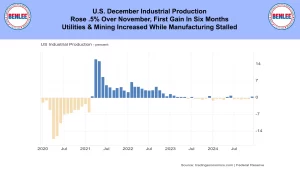

U.S. December Industrial Production rose .5% over November the first gain in six months. Utilities and mining increased while manufacturing stalled.

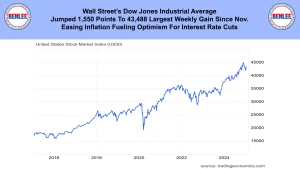

Wall Street’s Dow Jones Industrial Average jumped 1,550 points to 43.488 the largest weekly gain since November. Easing inflation was fueling optimism for interest rate cuts.

This is Greg Brown reporting. As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.