November 4, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, November 4th, 2024.

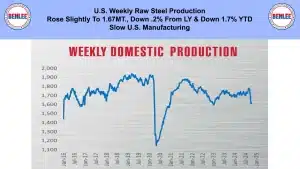

U.S. weekly raw steel production rose slightly to 1.67MT, down .2% from last year and down 1.7% YTD on slow U.S. manufacturing.

WTI crude oil price rose to $69.49/b., on tensions in the Middle East.

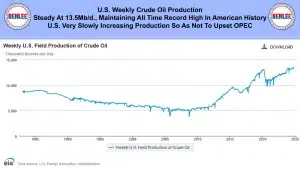

U.S. weekly crude oil production was steady at 13.5mb/d, maintaining the all-time record high in American history. The U.S. is very slowly increasing production so as to not upset OPEC.

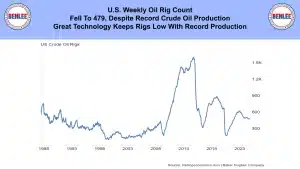

The U.S. weekly oil rig count fell to 479 despite record crude oil production. Great technology keeps rigs low with record production.

Scrap steel #1 HMS price was steady at $305/GT as many steel mills cancelled open orders at month end. This means downward price pressure due to slow manufacturing.

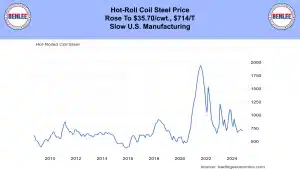

Hot-roll coil steel price rose to $35.70/cwt. $714/T on the same U.S. manufacturing.

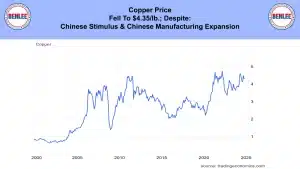

Copper price fell to $4.35/lb., despite Chinese stimulus and Chinese manufacturing expansion.

Aluminum price fell to $1.18/lb., $2,606/mt., despite the same Chinese stimulus but continued slow housing construction.

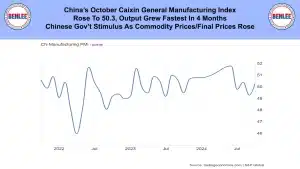

China’s October Caixin general manufacturing index rose to 50.3 as output grew the fastest in 4 months. This was on the Chinese stimulus as commodity prices and final prices rose.

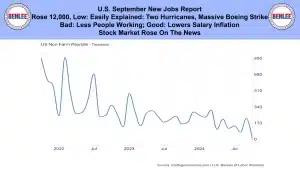

U.S. September new jobs report. The economy added 12,000 jobs, which is low, but easily explained by the two hurricanes and the massive Boeing strike. This is bad due to less people working but good because it lowers salary inflation. The stock market rose on the news.

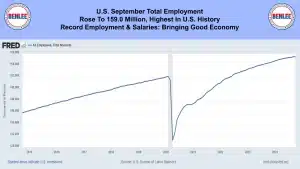

U.S. September total employment rose to 159 million the highest in U.S. history. Record employment and record salaries are bringing a good economy.

U.S. September PCE a key inflation measure fell to 2.1% vs last year despite major worker salary increases. Increased productivity is allowing salary increases with low inflation.

U.S. September hourly earnings rose 4% from last year. Salaries continue increasing faster than inflation. The extreme was April 2020. Salaries spiked 8% year over year, but prices rose a tiny .5%, which was a huge worker gain.

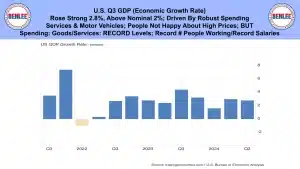

U.S. Q3 GDP, which is economic growth rate, rose a strong 2.8% above the nominal 2%, which was driven by robust spending on services and on motor vehicles. People are not happy about the high prices, but spending on goods and services is at a record level and a record number of people are working making record salaries.

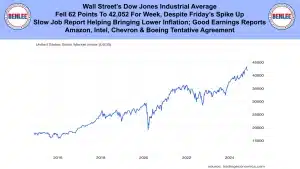

Wall Street’s Dow Jones industrial average fell 62 points to 42,052 for the week despite Friday’s spike up. This was on the slow jobs report, helping bring lower inflation and good earnings reports from Amazon, Intel, Chevron, and the Boeing tentative agreement.

Lugger trucks and lugger trailers by BENLEE. Heil luggers, Huge Haul and Load Lugger are all BENLEE. Call BENLEE for a quote at 734-722-8100 or call Premier Truck Sales and rental at 800-825-1255.

This report by Greg Brown from is brought to you by BENLEE roll off trailers, gondola trailers, crushed car trailers, lugger trucks, roll off trailer parts and of course roll off truck parts for Galbreath, American and more.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.