July 1, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, July 1st, 2024.

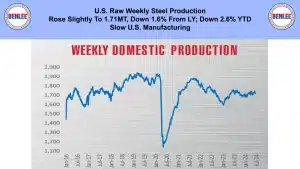

U.S. weekly raw steel production rose slightly to 1.71MT down 1.6% from last year and down 2.6% year to date.

WTI crude oil price rose to $81.54/b. on the major OPEC production cuts and high, but steady U.S. output. Together that keeps supplies tight and prices high.

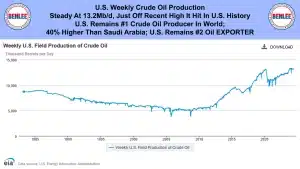

U.S. weekly crude oil production was steady at 13.2Mb/d. just off the recent high it hit in U.S. history. The U.S. remains the #1 crude oil producer in the world, 40% higher than Saudi Arabia. The U.S. also remains the #2 oil exporter in the world.

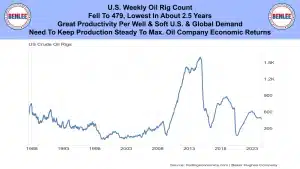

The U.S. weekly oil rig count fell to 479 the lowest in about 2.5 years on great productivity per well and soft U.S. and global demand. Oil companies need to keep production steady to maximize oil company economic returns.

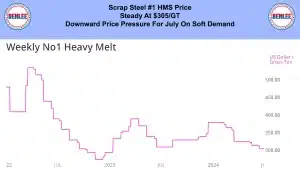

Scrap steel #1 HMS price was steady at $305/GT. There is downward price pressure for July on soft demand

Hot-roll coil steel price fell to $34.17/cwt., $683/T. This is lower than the price of July 2004, about 20 years ago.

Copper price fell to $4.37/lb., a big drop for the month. This was on weak Chinese demand and growing inventories. Also, on a Federal Reserve Governor saying they were open to raising interest rates to slow the economy.

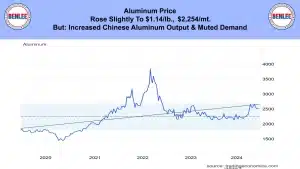

Aluminum price rose slightly to $1.14/lb., $2,254/mt., but with increased Chinese aluminum output and muted demand.

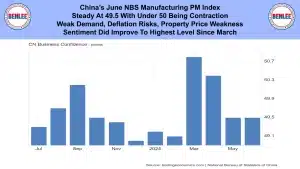

China’s June NBS manufacturing Purchasing Managers’ index was steady at 49.5 with under 50 being contraction. This was on weak demand, deflation risks and property price weakness. Sentiment did improve to the highest level since March.

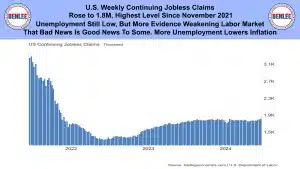

U.S. weekly continuing jobless claims rose to 1.8M the highest level since November 2021. Unemployment is still low, but this is more evidence that there is a weakening labor market. That bad news is good news to some. More unemployment lowers inflation.

U.S. May new orders for U.S. manufactured durable goods rose .1% from April, which was better than forecast. It was the 4th consecutive monthly advance. Defense orders were up 22.6%. Most of the U.S. billions of dollars to Ukraine are U.S. made weapons.

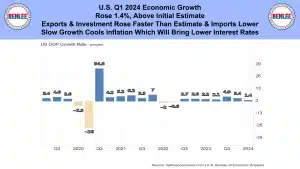

U.S. Q1 2024 economic growth rose 1.4% which was above the initial estimate. Exports and investment rose faster than estimate and imports were lower. Slow growth cools inflation which will bring lower interest rates.

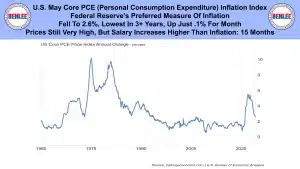

U.S. May core PCE, Personal Consumption expenditures inflation index, the Federal Reserve’s preferred measure of inflation. It fell to 2.6% the lowest level in over 3 years and went up just .1% for the month. Prices are still very high, but salary increases have been higher than inflation for 15 months.

Wall Street’s Dow Jones industrial average fell 31 points to 39,119, remaining near the record high. There has been a massive U.S. wealth build up from 2019-2024 from stocks, home equity and government payments. All hate the high prices, BUT almost all have more money. As an example, there is going to be record airline travel this summer.

This report by Greg Brown is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.