May 28, 2024

This is the Recycling, Scrap Metal, Commodities and Economic Report, May 28th, 2024.

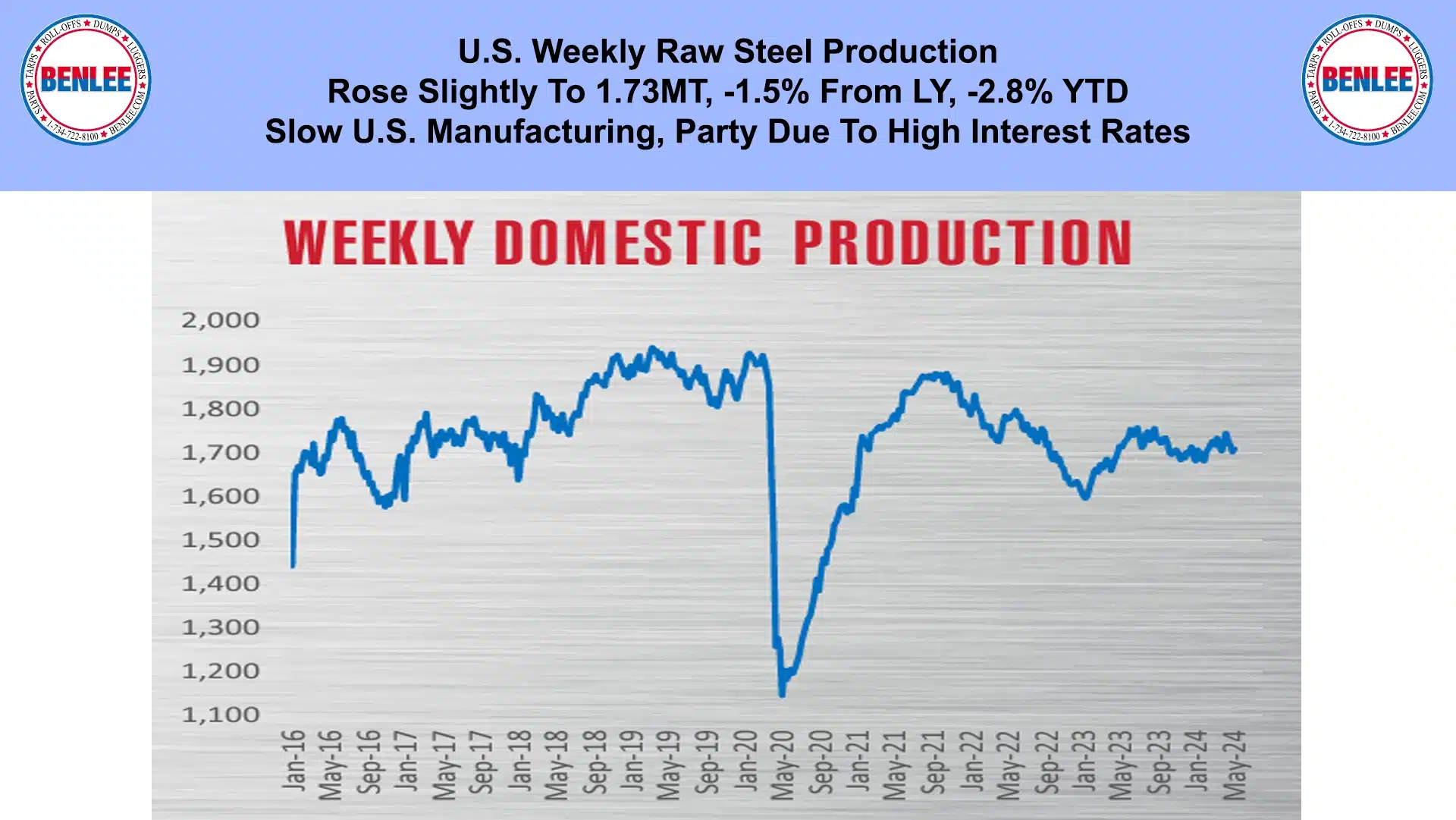

U.S. weekly raw steel production rose slightly to 1.73MT, down 1.5% from last year and down 2.8% year to date on slow U.S. manufacturing partly due to higher interest rates.

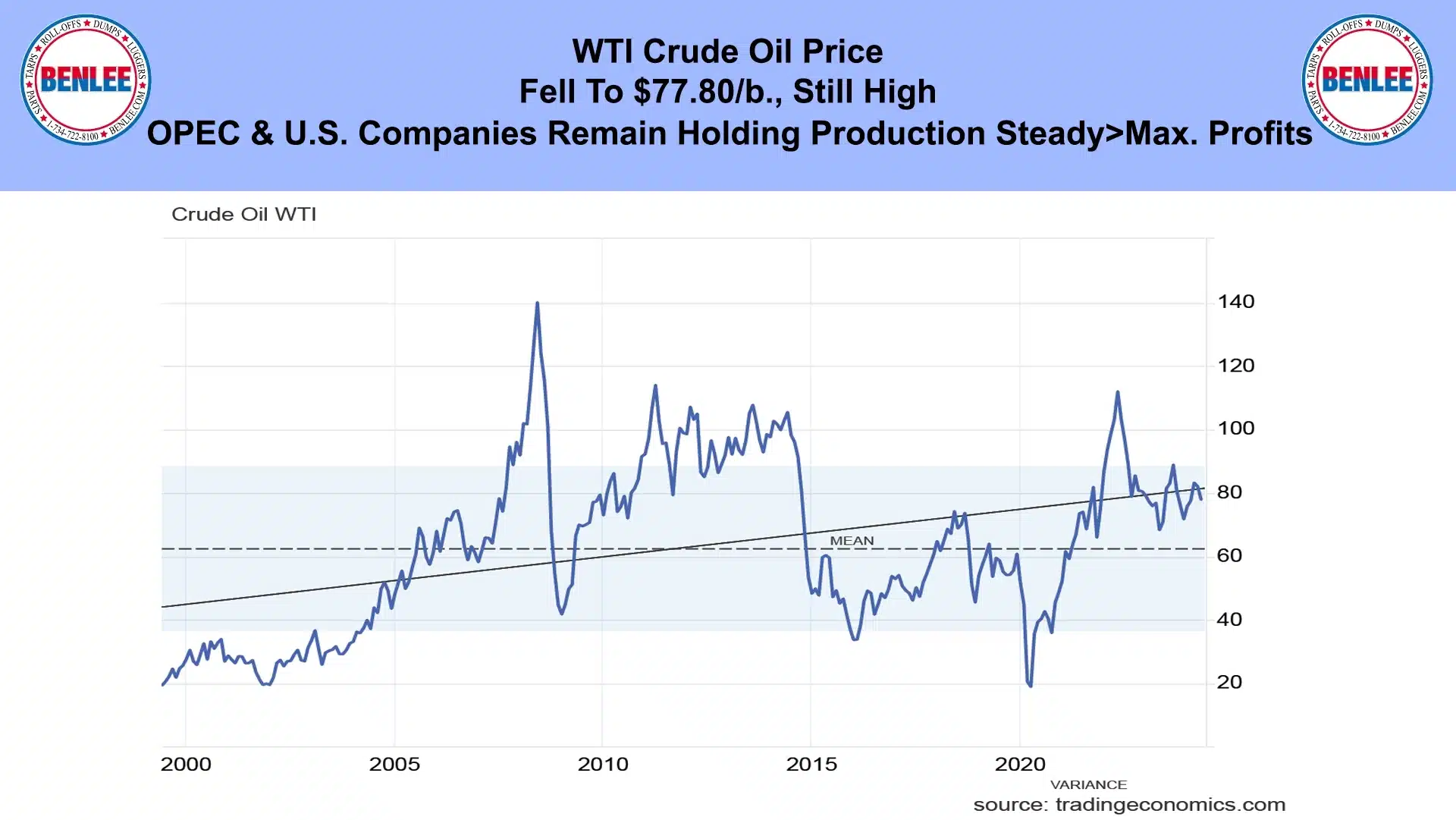

WTI crude oil price fell to $77.80/b, but still high. OPEC and U.S. companies remain holding production steady to maximize profits.

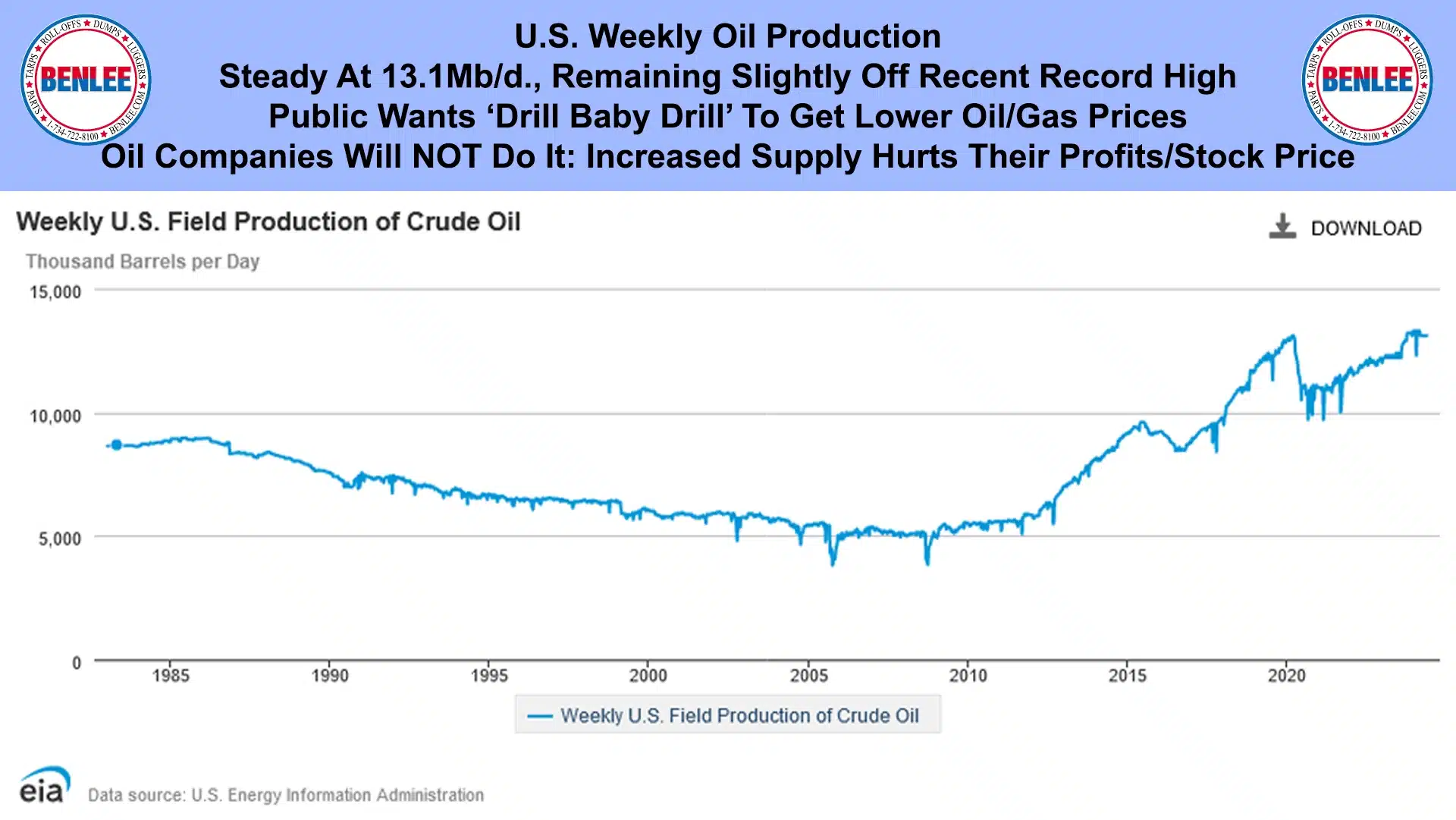

U.S. weekly crude oil production was steady at 13.1Mb/d. remaining slightly off the recent record high. The public wants drill baby drill, to get lower oil and gas prices. The oil companies will simply not do it, because increased supply lowers prices, hurts profits and hurts their Wall street stock prices.

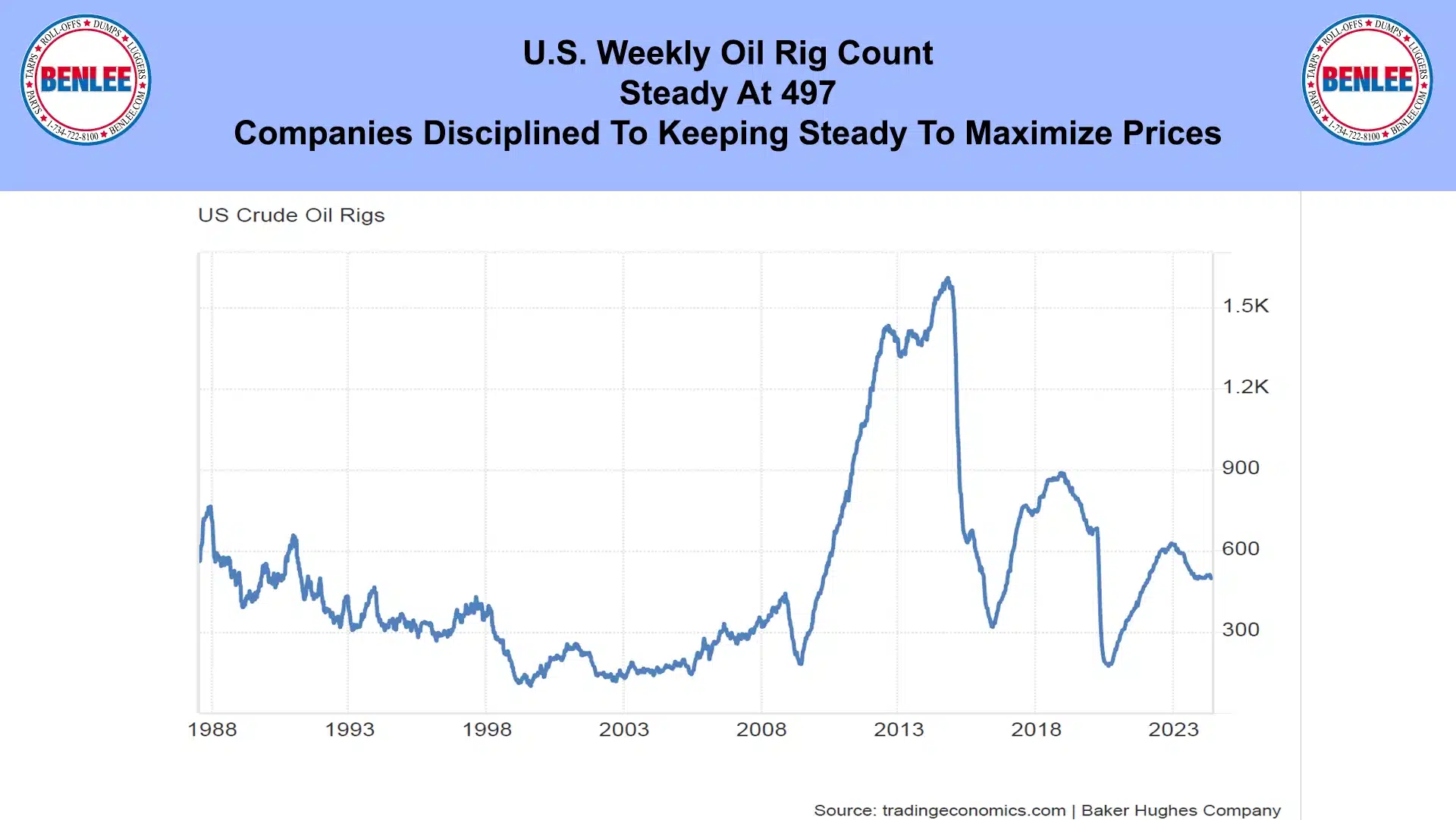

The U.S. weekly oil rig count was steady as companies remain disciplined to keeping the count steady to maximize prices.

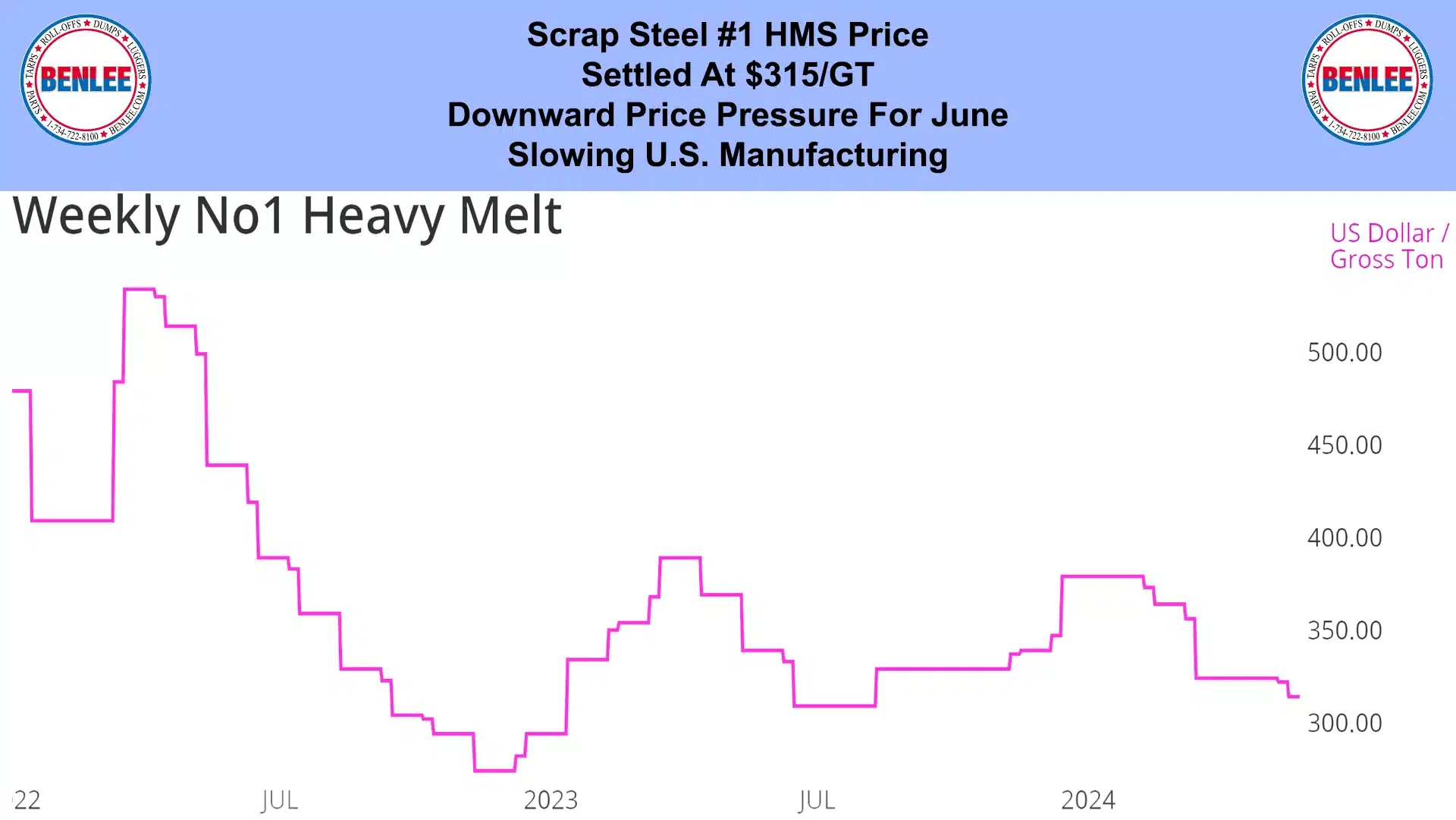

Scrap steel #1 HMS price settled at $315/GT with downward pressure for June on slow U.S. manufacturing.

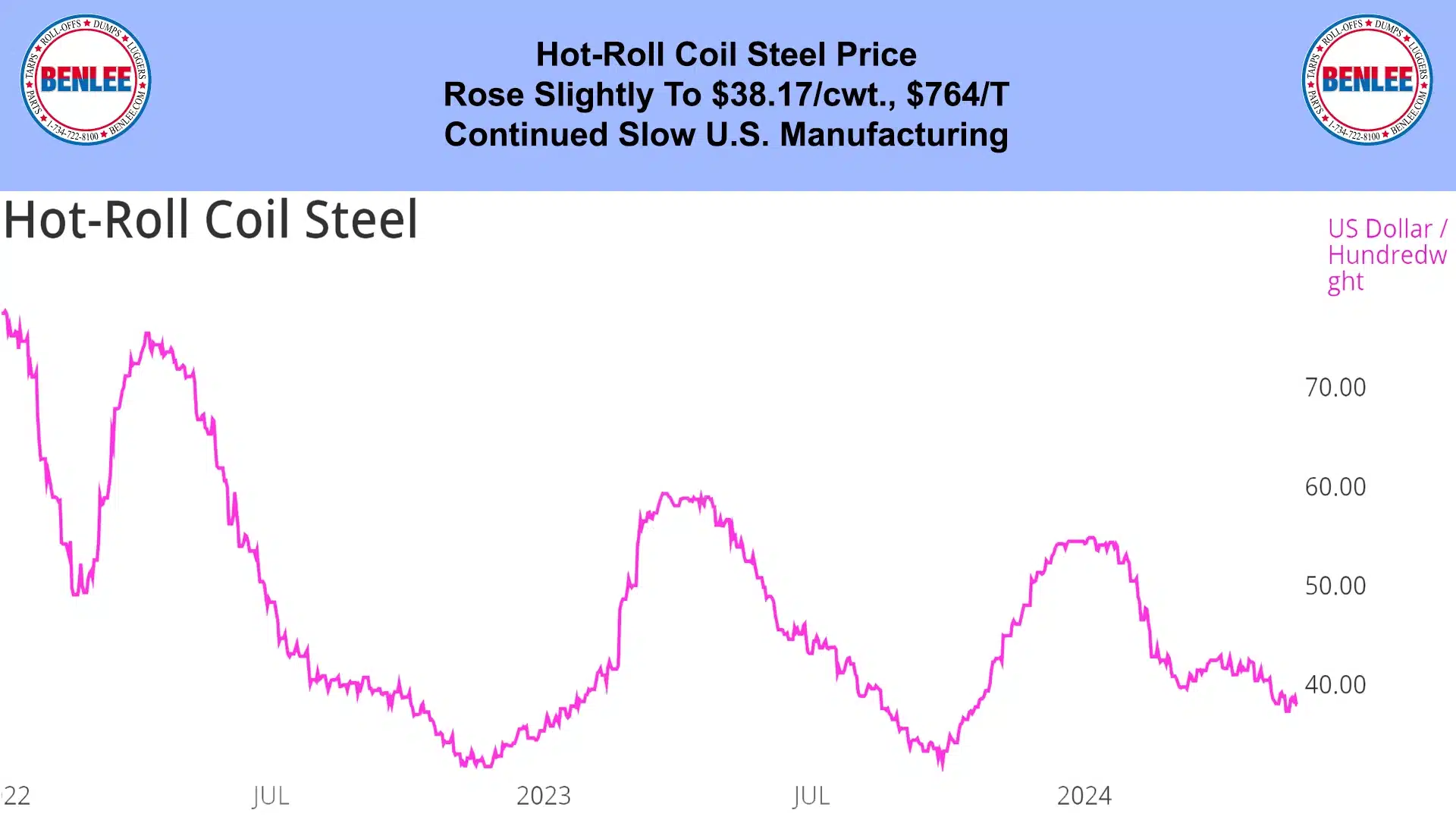

Hot-roll coil steel price rose slightly to $38.17/cwt., $764/T on continued slow U.S. manufacturing.

Copper price fell to $4.76/lb., after hitting a record high during the week. This was on poor near term demand as China consumes about 50% of global copper. This was despite Chinese government stimulus.

Aluminum price rose to $1.21/lb., $2,662/MT, the highest in two years on supply concerns caused by weather and on Russian sanctions.

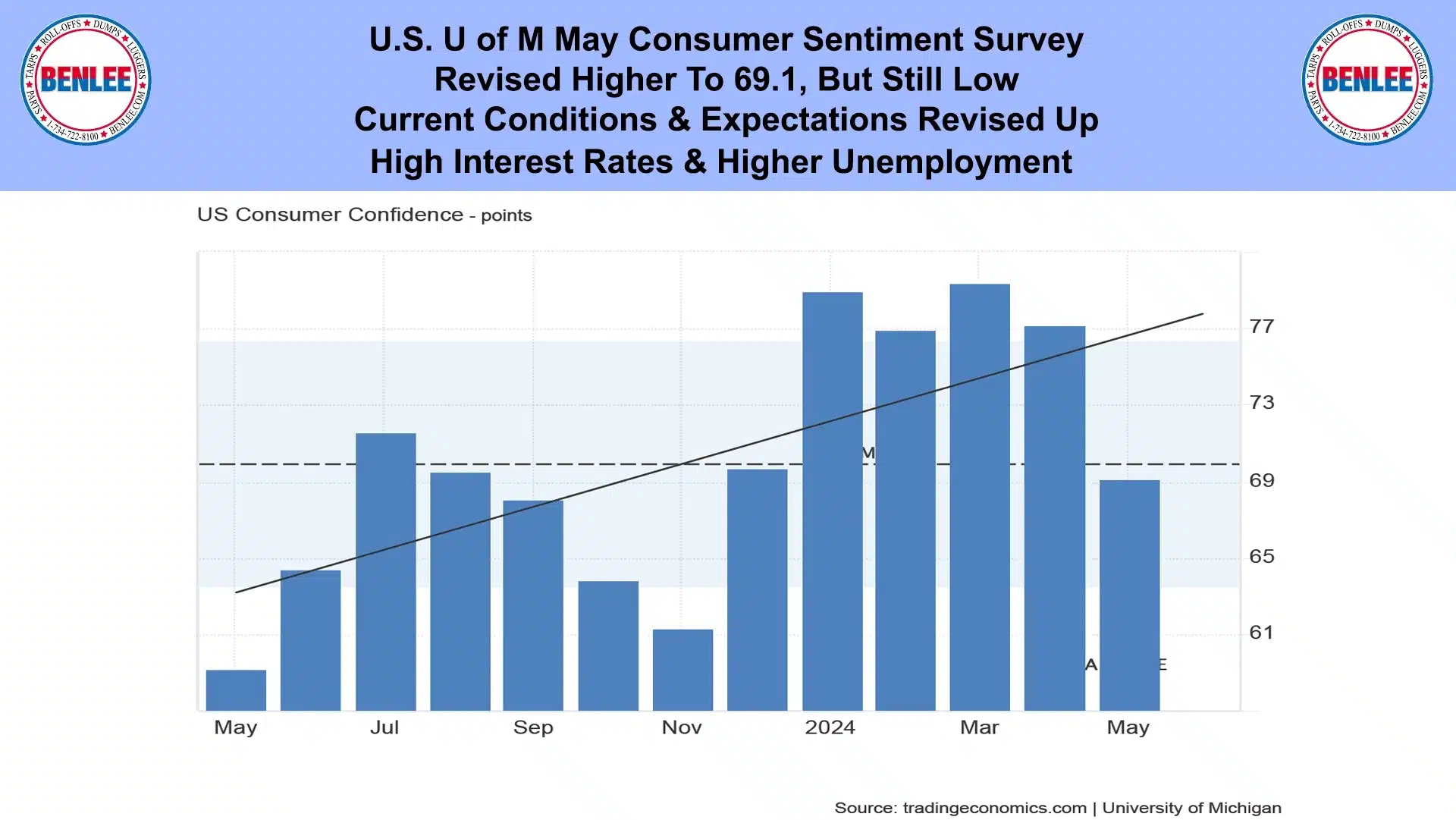

U.S. U of M May consumer sentiment survey was revised higher to 69.1 but is still low. Current conditions and expectations were revised up. Also, people are concerned about high interest rates and future higher unemployment.

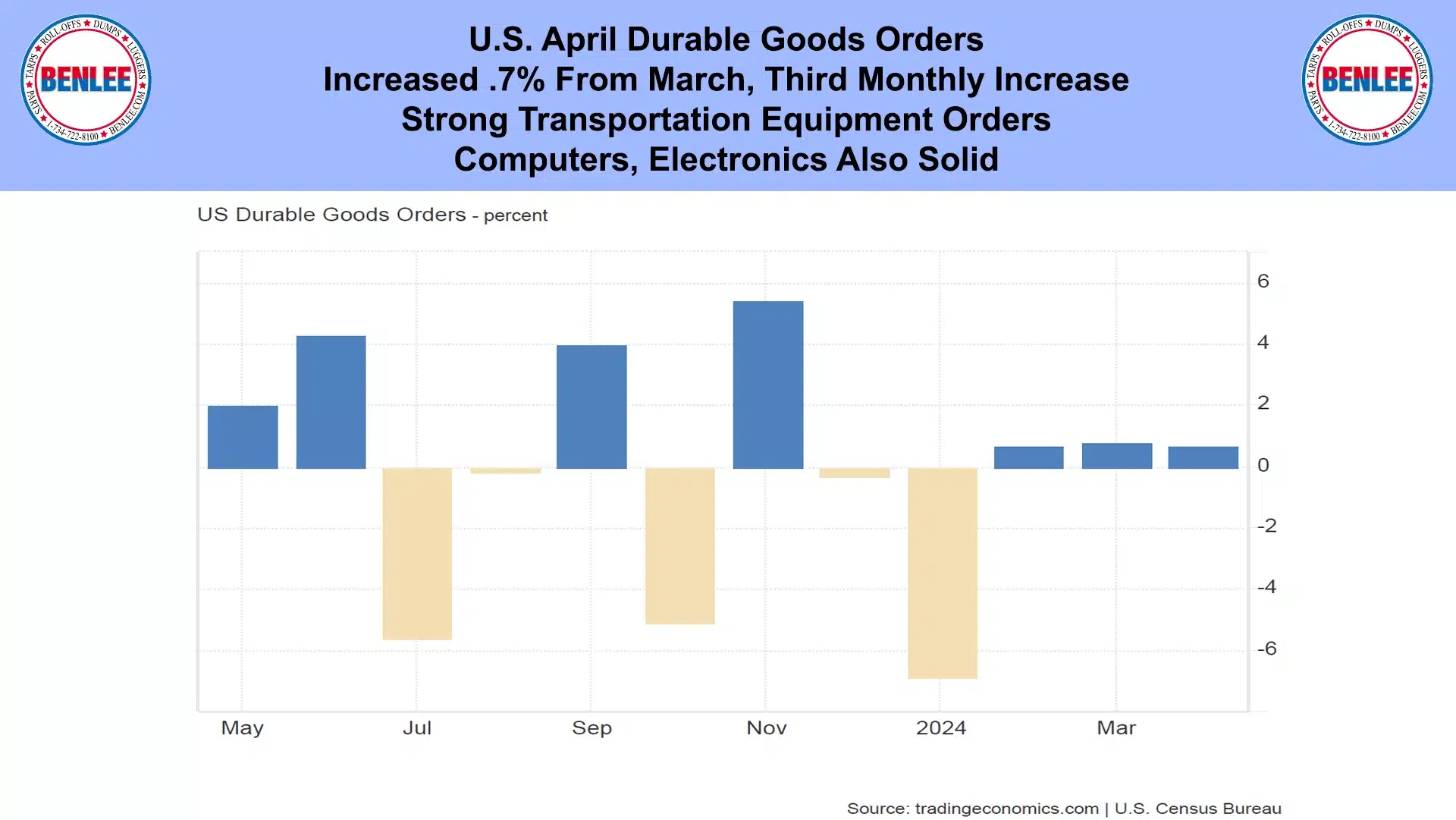

U.S. April durable goods orders increased .7% from March the third monthly increase. This was on strong transportation orders as well as computers and electronics were also solid.

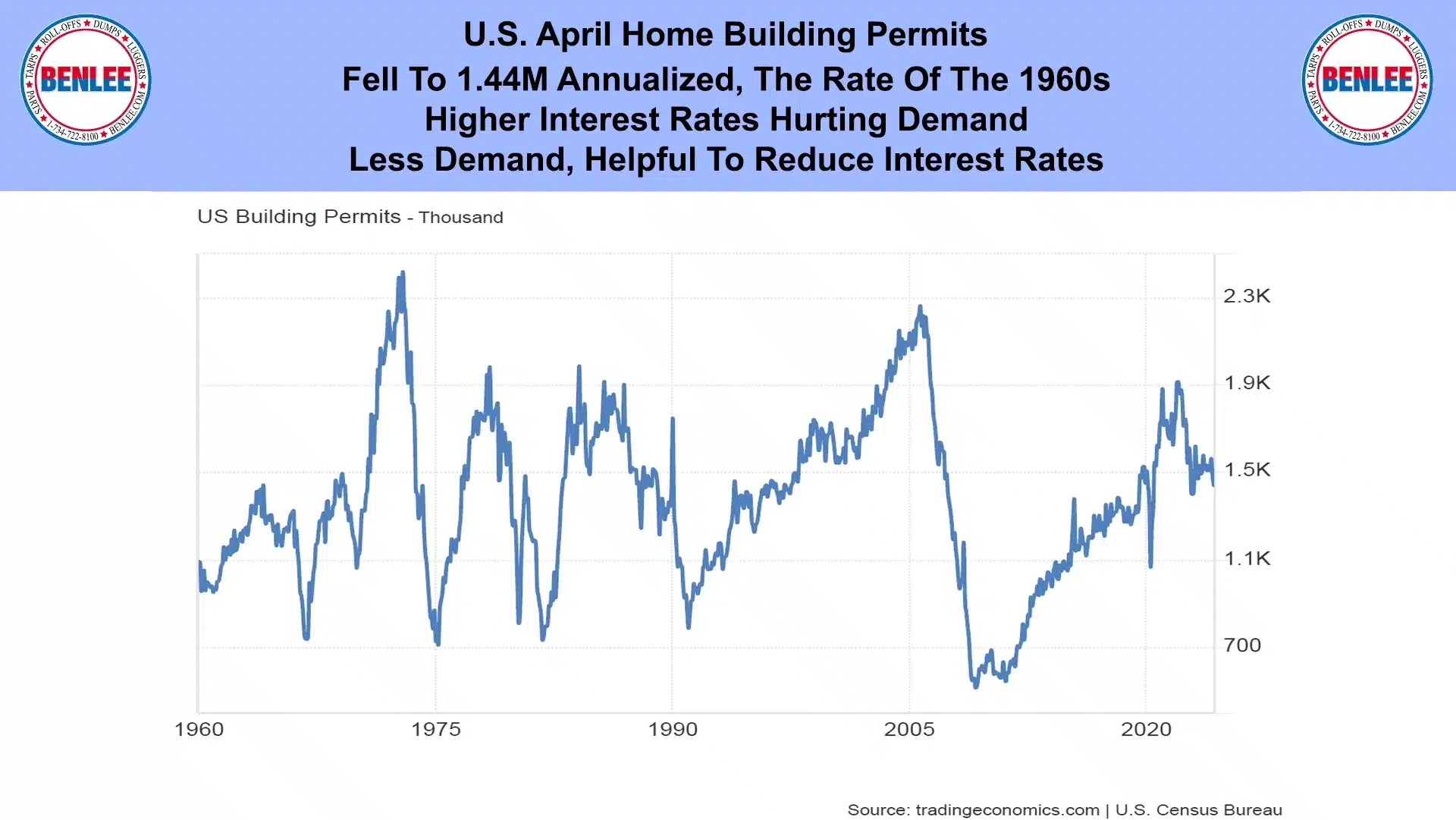

U.S. April home building permits fell to 1.44M annualized the rate of the 1960’s as higher interest rates are hurting demand.

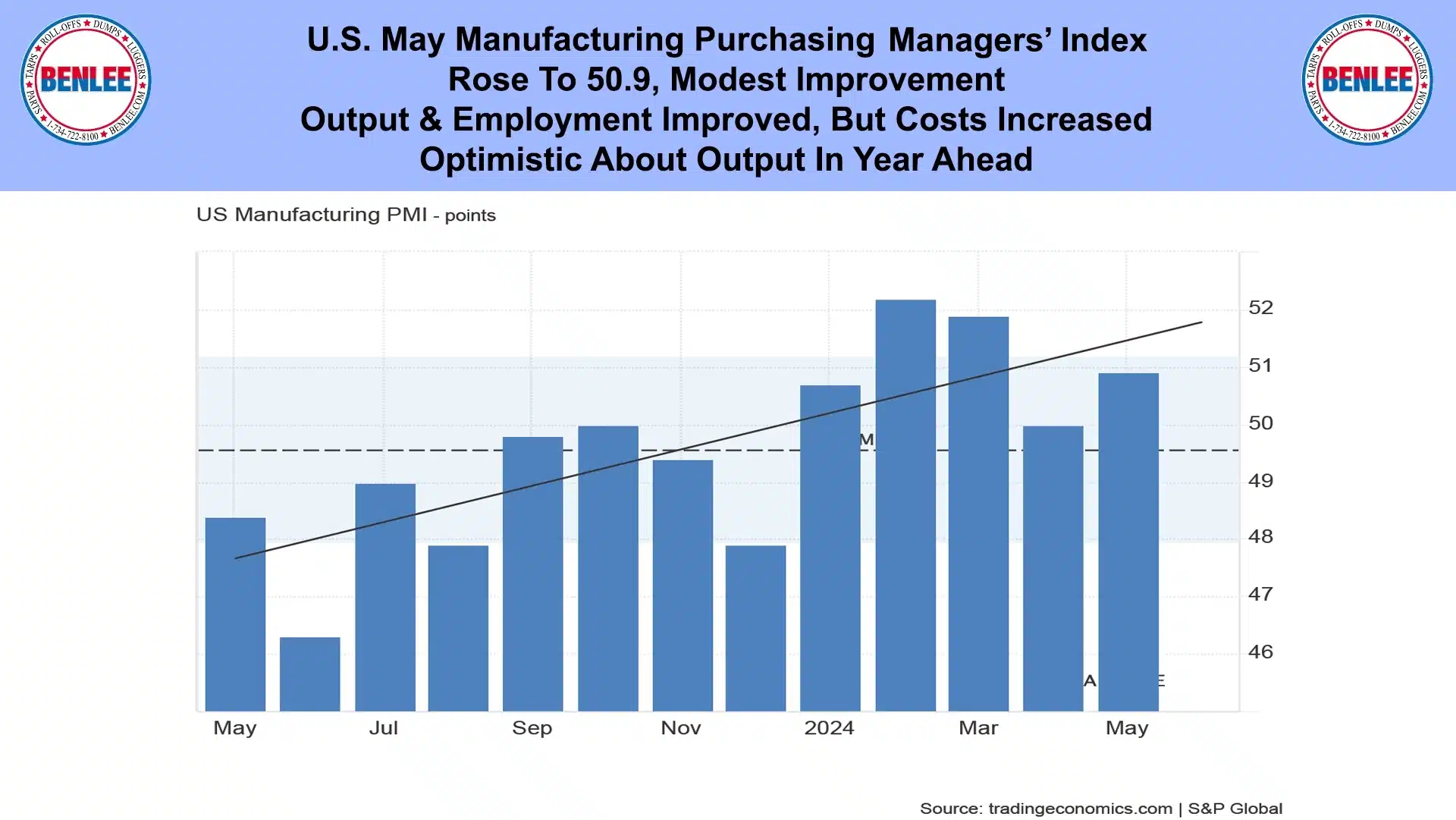

U.S. May manufacturing purchasing managers’ index rose to 50.9, a modest improvement. Output and employment improved, but costs increased. They are optimistic though about the year ahead.

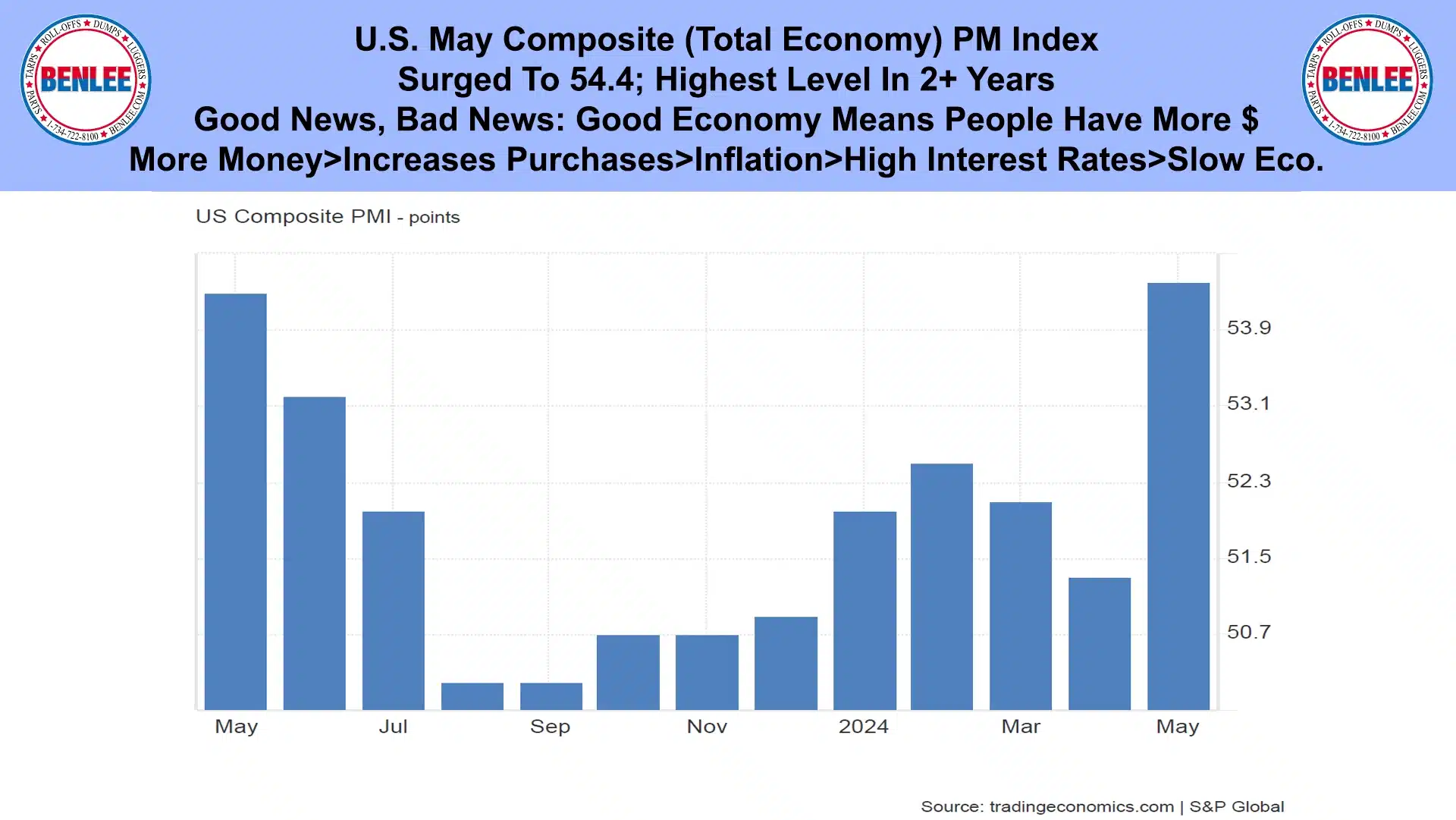

U.S. May composite, total economy, purchasing managers index surged to 54.4 the highest level in 2+ years. This is good news and bad news. The good economy means people have more money. More money increases purchases, which brings inflation, which means higher interest rates to slow the economy.

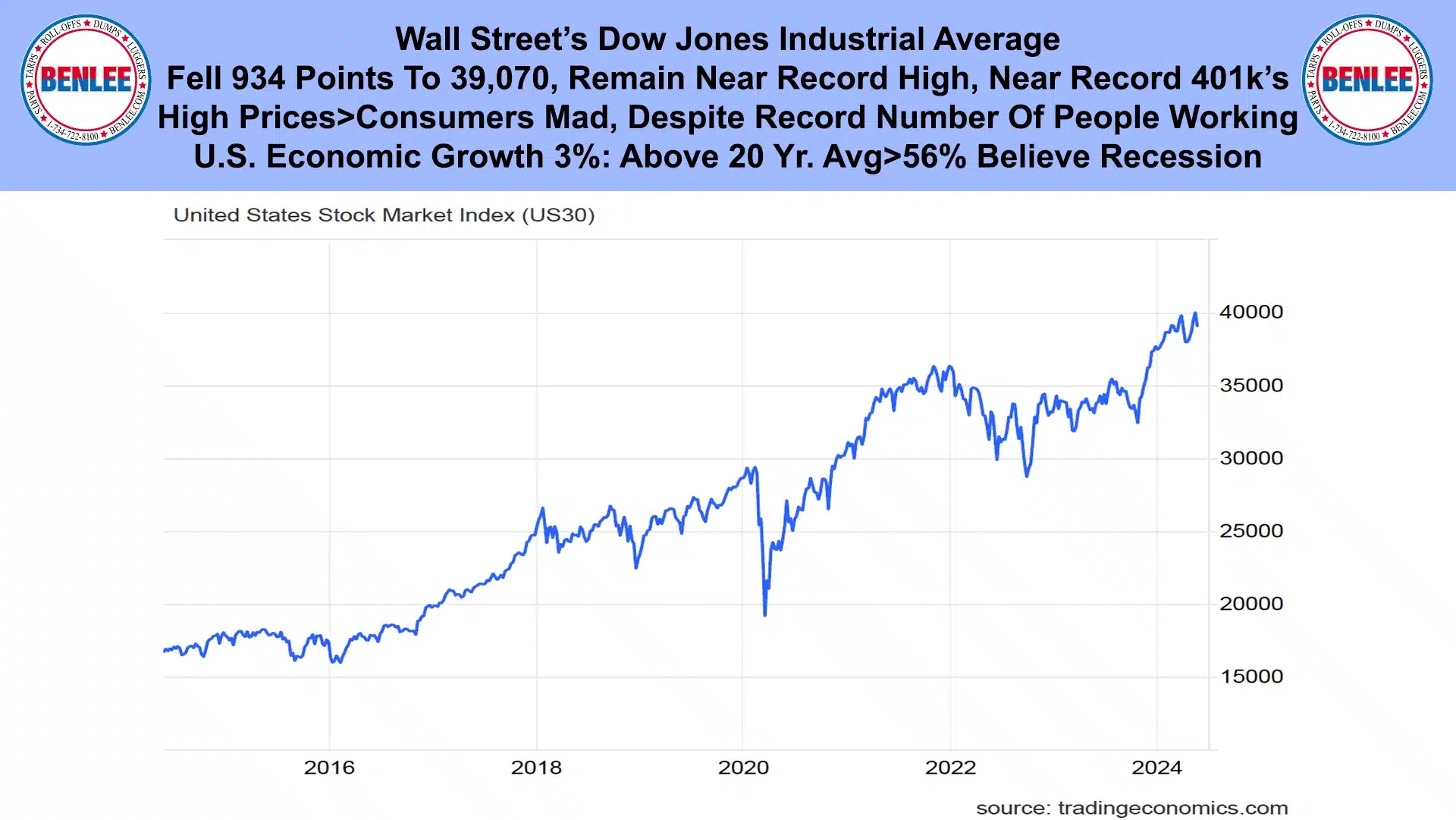

A recent survey had some strange data. Yes prices are high, but 49% thought Wall street’s S&P 500 was down YTD. The S&P is a broad index of 500 stocks, more diverse than the Dow 30. The fact is, it is up a huge 12% YTD. 49% thought unemployment is at a 50 year high. The fact is, it is near a 50 year low. 72% believe inflation is increasing. The fact is, it is down to 3.4% from 9.1% about 2 years ago.

Wall Street’s Dow Jones Industrial average fell 934 points, to 39,070, remaining near the record high and near record 401k’s. High prices have consumers mad despite the record number of people working. The U.S. economy is at about 3% growth, which is above the 20 year average, but 56% of people think we are in a recession, as in negative growth.

This report by Greg Brown from is brought to you by BENLEE.

As always, feel free to call or email me with any questions and we hope all have a safe and profitable week.